How Do You Prepare For A Recession

The ominous whispers of a potential recession are growing louder. Inflation remains stubbornly high, interest rates continue their ascent, and geopolitical uncertainties cast long shadows. For individuals and businesses alike, the question isn't *if* a recession will occur, but rather *when* and, more importantly, how to weather the storm.

This article delves into actionable strategies for preparing for a recession, drawing on expert opinions and financial data. It provides a comprehensive guide to safeguarding your financial well-being, whether you're an individual investor, a small business owner, or simply seeking to protect your livelihood.

Understanding the Economic Landscape

Understanding the current economic climate is the first step in preparing for a potential downturn. The Federal Reserve has been aggressively raising interest rates to combat inflation, a move that, while intended to stabilize prices, also increases borrowing costs and can slow economic growth.

According to the Bureau of Labor Statistics, the Consumer Price Index (CPI), a key measure of inflation, remains elevated. This persistent inflation is putting pressure on household budgets and business profitability.

Economic indicators, such as the yield curve inversion (when short-term interest rates are higher than long-term rates), have historically preceded recessions. While not a guaranteed predictor, it is a signal that investors are concerned about future economic prospects.

Personal Finance Strategies

For individuals, the key to recession preparedness lies in strengthening their personal finances. Building an emergency fund is paramount. Aim to have 3-6 months' worth of living expenses saved in a readily accessible account.

Consider paying down high-interest debt, such as credit card balances. This will free up cash flow and reduce your financial burden during uncertain times. Refinancing options should be explored carefully, considering current interest rate trends.

Review your budget and identify areas where you can cut back on unnecessary spending. Small changes can add up over time and create a larger buffer in your finances.

Diversifying Income Streams

Relying solely on a single source of income can be risky during a recession. Explore opportunities to diversify your income streams, such as freelancing, starting a side hustle, or investing in dividend-paying stocks.

The gig economy offers a range of flexible work options that can supplement your primary income. Skill development and continuous learning are essential for staying competitive in the job market.

Business Strategies for Navigating a Downturn

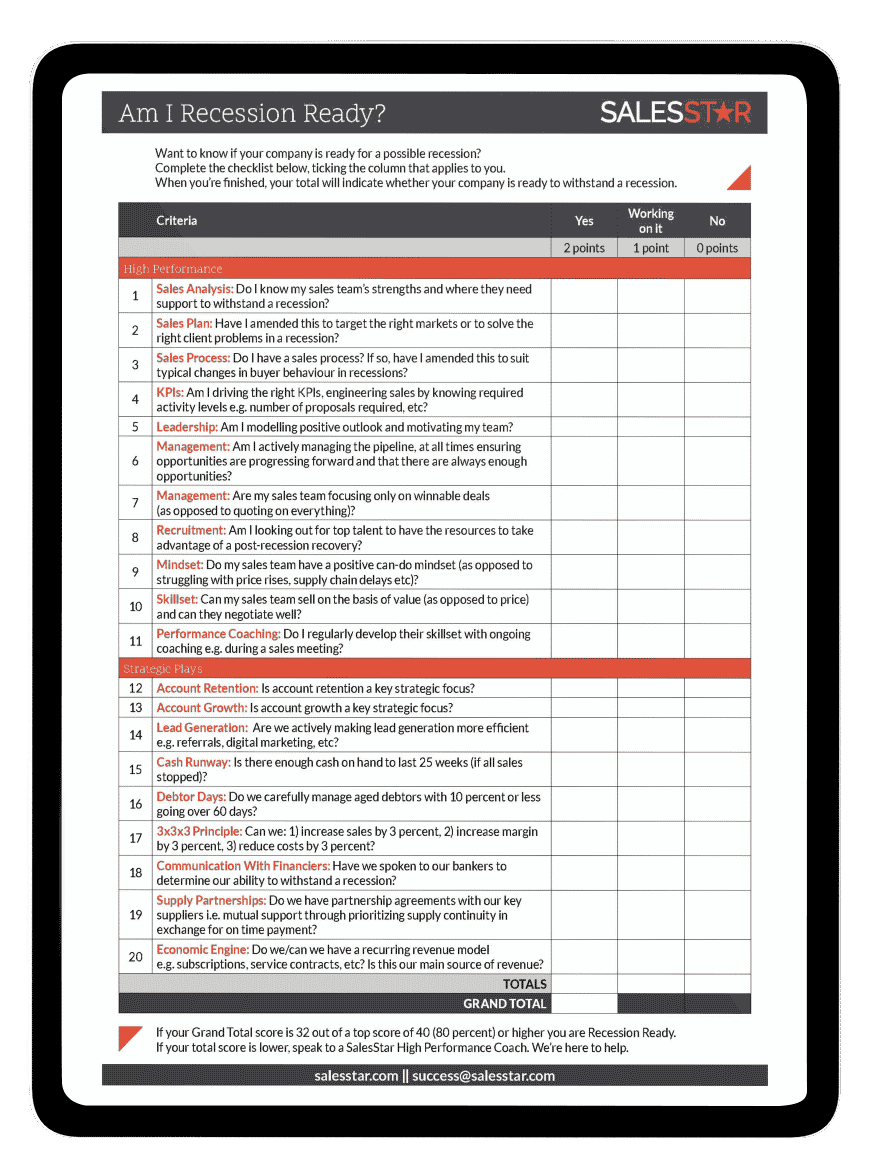

Businesses also need to take proactive steps to prepare for a potential recession. A critical step is to review their financial health and identify areas of vulnerability.

Building a cash reserve is crucial for weathering economic storms. Businesses should aim to have enough cash on hand to cover several months of operating expenses.

Careful management of inventory is also essential. Avoid overstocking products that may become difficult to sell during a downturn. Negotiate favorable terms with suppliers to improve cash flow.

Optimizing Operational Efficiency

Recessions often force businesses to become more efficient. Streamline operations, reduce waste, and implement cost-saving measures. Invest in technology and automation to improve productivity.

Explore opportunities to expand your customer base and diversify your product offerings. Focusing on customer retention is more cost-effective than acquiring new customers.

Investing Strategies for a Recession

Recessions can present both challenges and opportunities for investors. Diversifying your investment portfolio is crucial. Avoid putting all your eggs in one basket. Consider investing in a mix of stocks, bonds, and other assets.

Defensive stocks, such as those in the consumer staples and healthcare sectors, tend to perform relatively well during recessions. Value investing, which involves buying undervalued stocks, can also be a successful strategy.

Dollar-cost averaging, investing a fixed amount of money at regular intervals, can help mitigate the risk of investing during a volatile market. Consult with a financial advisor to develop a personalized investment strategy.

Conclusion: Preparing for Uncertainty

Preparing for a recession is not about predicting the future, but rather about mitigating risk and building resilience. By strengthening your personal finances, optimizing business operations, and adopting a prudent investment strategy, you can position yourself to weather the storm.

Staying informed about economic trends and seeking professional advice are also essential. While the future is uncertain, proactive preparation can significantly improve your ability to navigate a recession successfully.