How Fast Does H&r Block Get Your Money

.jpg)

Imagine this: the tax season paperwork is finally behind you. You’ve navigated the forms, wrestled with deductions, and clicked that "submit" button with a sigh of relief. Now, all that's left is the eagerly anticipated refund. The question buzzing in your mind is likely, "How soon until that money hits my account?"

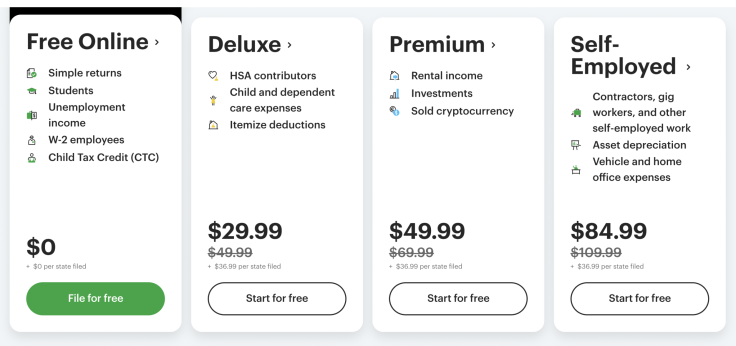

Getting your tax refund quickly is often a priority. The speed at which H&R Block delivers your refund depends on several factors, including the filing method, refund option, and any associated fees.

Understanding the Timeline

The IRS generally issues refunds within 21 days for electronically filed returns. However, this is just an estimate. Several factors can affect the actual timeframe.

Choosing direct deposit is generally the fastest way to receive your refund. This allows the IRS to deposit the money directly into your bank account.

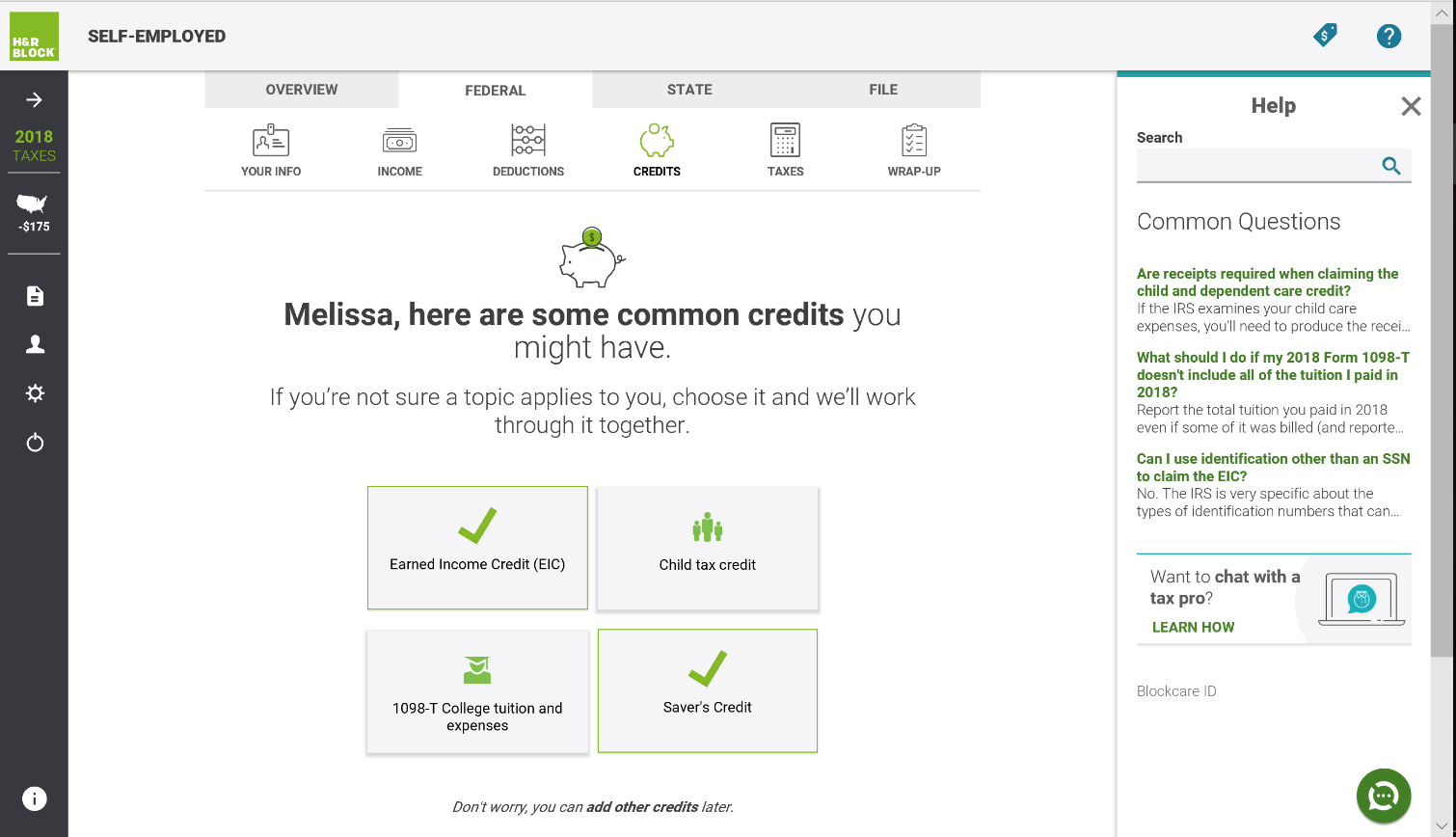

H&R Block offers various refund options. These options include direct deposit, a Spruce Spending Account, or a check in the mail.

H&R Block Refund Options

Direct Deposit: This is often the quickest method, aligning with the IRS timeline of within 21 days for electronically filed returns.

Spruce Spending Account: Spruce is a mobile banking platform offered through a partnership with H&R Block. Getting your refund deposited here may offer additional features, but the processing time will be similar to direct deposit.

Check in the Mail: Receiving a paper check is generally the slowest option. It relies on postal service delivery times.

Factors Affecting Refund Speed

While H&R Block aims to facilitate a smooth process, various external factors can influence the timing of your refund.

IRS Processing Times: The IRS is the primary determinant of refund speed. Any delays on their end will affect the overall timeline.

Errors or Inconsistencies: Errors or inconsistencies on your tax return can trigger manual review, which can significantly delay your refund.

Bank Processing Times: Even with direct deposit, your bank’s processing times can vary slightly.

Fees and Refund Transfers: If you choose to pay your H&R Block fees directly from your refund, this can sometimes add a slight delay. This is because the refund first goes to a third-party bank, which then deducts the fees and sends the remaining amount to you.

H&R Block's Role

H&R Block streamlines the tax filing process. They provide software and services to help you accurately prepare and file your return.

They also offer refund tracking tools, allowing you to monitor the status of your refund once the IRS accepts your return. These tools can provide updates and estimated delivery dates.

Customer support is available to address any questions or concerns throughout the process. Consulting with a tax professional at H&R Block can help ensure your return is accurate and complete, potentially minimizing delays.

"Getting your taxes done right is about more than just filing; it's about peace of mind," shares a long-time H&R Block client.

Conclusion

While H&R Block can assist in preparing and filing your taxes efficiently, the ultimate speed of your refund is largely determined by the IRS and your chosen refund method. Opting for direct deposit and ensuring accuracy are the best ways to expedite the process. Keep track of your refund status online.

Tax season can be stressful. Knowing what to expect regarding refund timing can help ease that burden. By understanding the different factors involved, you can better manage your expectations and plan accordingly.