How Much Cash Flow Should A Business Have

Imagine you're a skilled sailor, confidently charting a course across the vast ocean. The wind is in your sails, and the horizon promises adventure. But what if you suddenly realize your water reserves are dangerously low? That feeling of uncertainty, that knot in your stomach, is exactly what a business owner experiences when cash flow runs dry.

Understanding how much cash flow a business should have is crucial for survival and growth. It’s not just about making a profit; it’s about having the liquid assets on hand to navigate unexpected storms and capitalize on opportunities. This article delves into the vital considerations for maintaining a healthy cash flow, ensuring your business not only survives but thrives.

Understanding the Basics

Cash flow, simply put, is the movement of money into and out of your business. It encompasses all the money you receive from sales, investments, and loans, as well as all the money you spend on expenses like salaries, rent, and inventory. Positive cash flow means more money is coming in than going out, while negative cash flow indicates the opposite.

The ideal amount of cash flow isn't a one-size-fits-all number. It depends on several factors, including industry, business size, and growth stage. However, a general rule of thumb suggests having enough cash on hand to cover at least 3-6 months of operating expenses, according to many financial advisors.

Why 3-6 Months?

This buffer provides a safety net during slow periods or unexpected events. Think of a local bakery facing a sudden spike in flour prices or a software company experiencing a delay in a major client payment. Having adequate cash reserves allows them to weather these storms without resorting to desperate measures like layoffs or debt.

According to a report by JP Morgan Chase Institute, small businesses typically hold enough cash to cover about 27 days of expenses. This highlights a significant gap between the recommended buffer and the reality for many entrepreneurs.

Factors Influencing Cash Flow Needs

Several factors influence the optimal cash flow level for a business. Understanding these nuances is key to making informed financial decisions. Let's explore some of the most critical aspects:

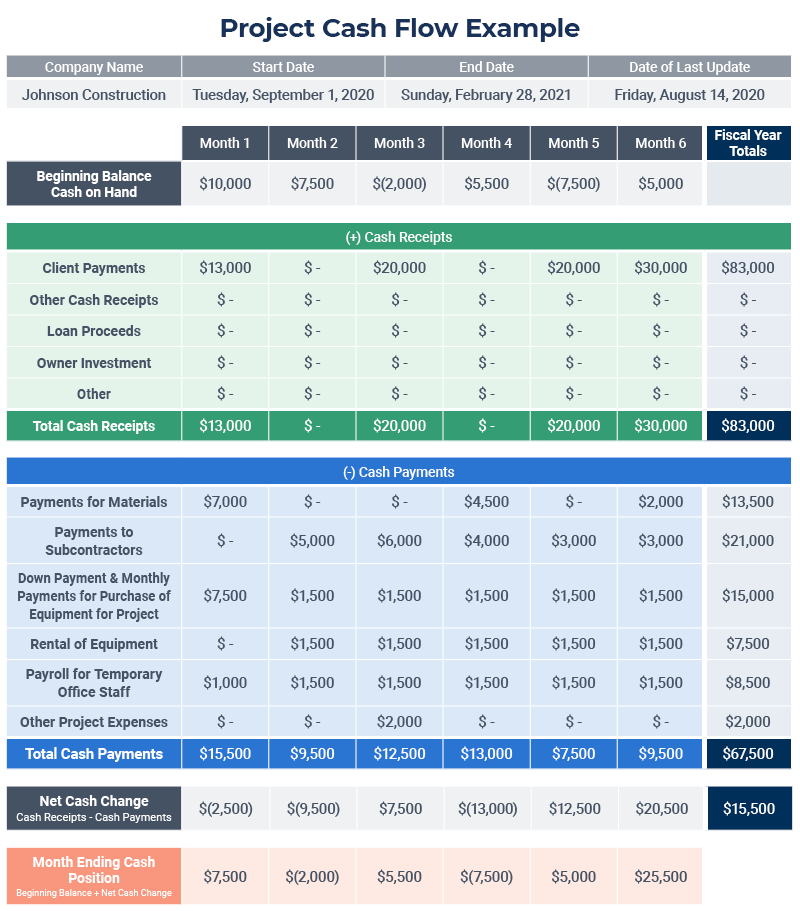

Industry: Some industries, like retail, often have predictable sales cycles and relatively stable cash flow. Others, such as construction, may experience significant fluctuations due to project timelines and payment schedules.

Business Size: Larger companies tend to have more complex financial structures and may require larger cash reserves to manage operations. Smaller businesses, while often more agile, can be more vulnerable to cash flow disruptions.

Growth Stage: A startup rapidly expanding its operations will likely need more cash flow to fund growth initiatives. An established business with a stable customer base may have a more predictable cash flow pattern.

Economic Conditions: External factors like recessions or industry-specific downturns can significantly impact cash flow. Businesses need to be prepared to adjust their financial strategies accordingly.

Strategies for Managing Cash Flow

Maintaining healthy cash flow requires proactive management and strategic planning. Here are a few key strategies to consider:

Accurate Forecasting: Develop a detailed cash flow forecast that projects income and expenses over a specific period. This allows you to anticipate potential shortfalls and take corrective action.

Efficient Inventory Management: Avoid overstocking inventory, which ties up valuable cash. Implement an inventory management system that optimizes stock levels and minimizes waste.

Negotiate Payment Terms: Explore options to extend payment terms with suppliers and shorten payment terms with customers. This can help improve your cash flow cycle.

Expense Control: Regularly review expenses and identify areas where you can cut costs without sacrificing quality or efficiency. Consider negotiating better rates with vendors or exploring alternative suppliers.

Build a Cash Reserve: Prioritize building a cash reserve to cover unexpected expenses and capitalize on opportunities. Even small, consistent contributions can make a big difference over time.

Consider exploring options like a line of credit, but only as a contingency plan. Remember, debt can be a double-edged sword. Used wisely, it can provide a lifeline during temporary cash flow crunches. However, over-reliance on debt can create a cycle of financial instability.

The Ripple Effect of Healthy Cash Flow

Having a healthy cash flow isn’t just about avoiding financial crises; it unlocks numerous benefits for your business. It provides the freedom to invest in growth opportunities, such as expanding your product line or entering new markets. It allows you to attract and retain top talent by offering competitive salaries and benefits.

Furthermore, strong cash flow enhances your business's credibility with lenders and investors. This makes it easier to secure financing for future projects and build long-term relationships with key stakeholders. Ultimately, healthy cash flow empowers you to make strategic decisions that propel your business forward.

Conclusion

Navigating the world of business finance can feel like a complex puzzle. But by prioritizing cash flow management, you can equip your business with the resources it needs to succeed. Remember, it's not just about the numbers on a spreadsheet; it's about the peace of mind that comes from knowing you're prepared for whatever the future holds.

So, take a deep breath, assess your current cash flow situation, and start implementing strategies to build a stronger financial foundation. Your business – and your future – will thank you for it.

/cash-flow-how-it-works-to-keep-your-business-afloat-398180-v3-5b734281c9e77c0057b67a4c.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

![How Much Cash Flow Should A Business Have Best Cash Flow Businesses [Complete Guide] - MoneyReadme.com](https://moneyreadme.com/wp-content/uploads/Best-Cash-Flow-Businesses-Complete-Guide.jpg)