How Much Is It To Buy Apple Stock Right Now

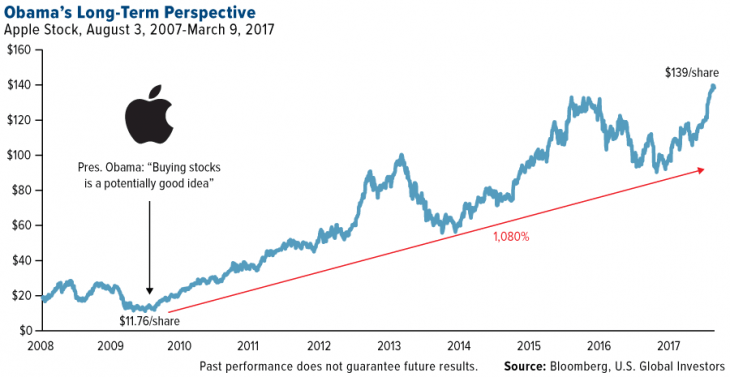

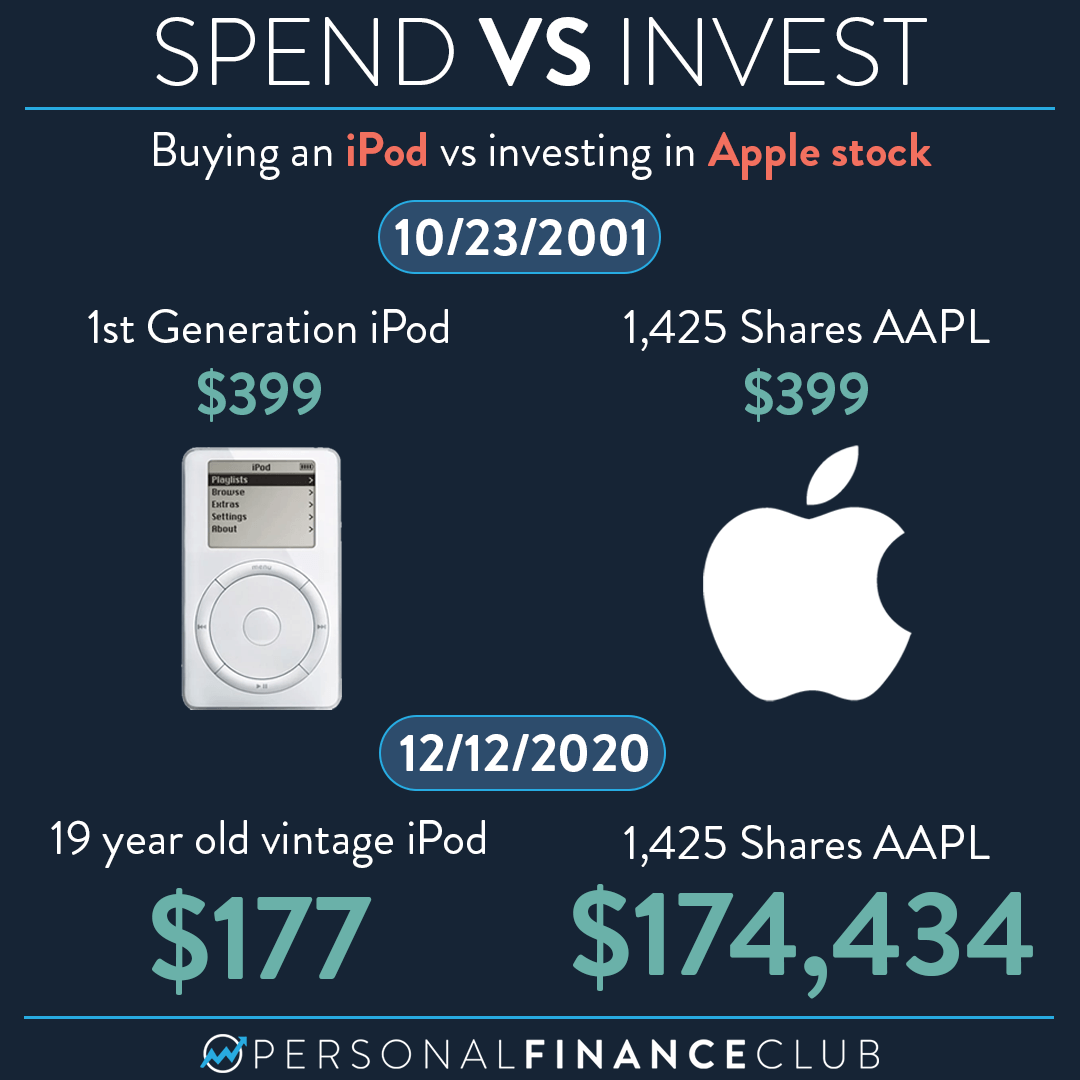

The allure of owning a piece of Apple, one of the world's most valuable companies, continues to captivate investors of all levels. But before jumping in, the crucial question remains: How much will a share of Apple (AAPL) set you back today? The answer, like the stock market itself, is dynamic and depends on real-time market fluctuations.

This article provides a comprehensive overview of the current price of Apple stock, the factors influencing its value, and expert perspectives on its potential future performance. Understanding these nuances is crucial for anyone considering adding AAPL to their investment portfolio. We will delve into recent market data and provide insights to inform your investment decisions.

Current Price of Apple Stock

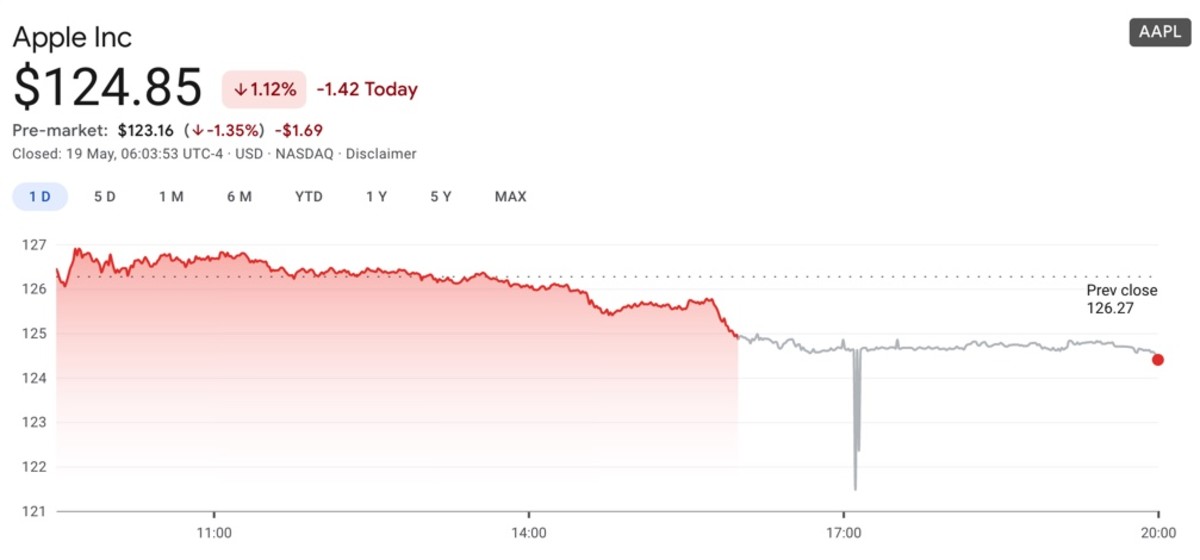

As of today, October 26, 2023, the price of a single share of Apple stock (AAPL) is hovering around $170.43. This price is not static and fluctuates throughout the trading day, influenced by various market forces. To get the most up-to-the-minute price, it's recommended to consult a reputable financial news website or brokerage platform.

Major sources like the New York Stock Exchange (NYSE) or Nasdaq provide real-time stock quotes. These platforms show the current bid and ask prices, along with historical data and other key metrics. Remember, the price you see is the last price at which a share was traded, and it can change quickly.

Factors Influencing Apple's Stock Price

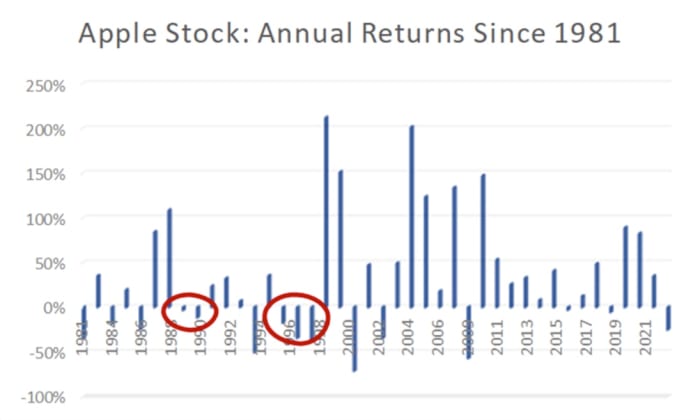

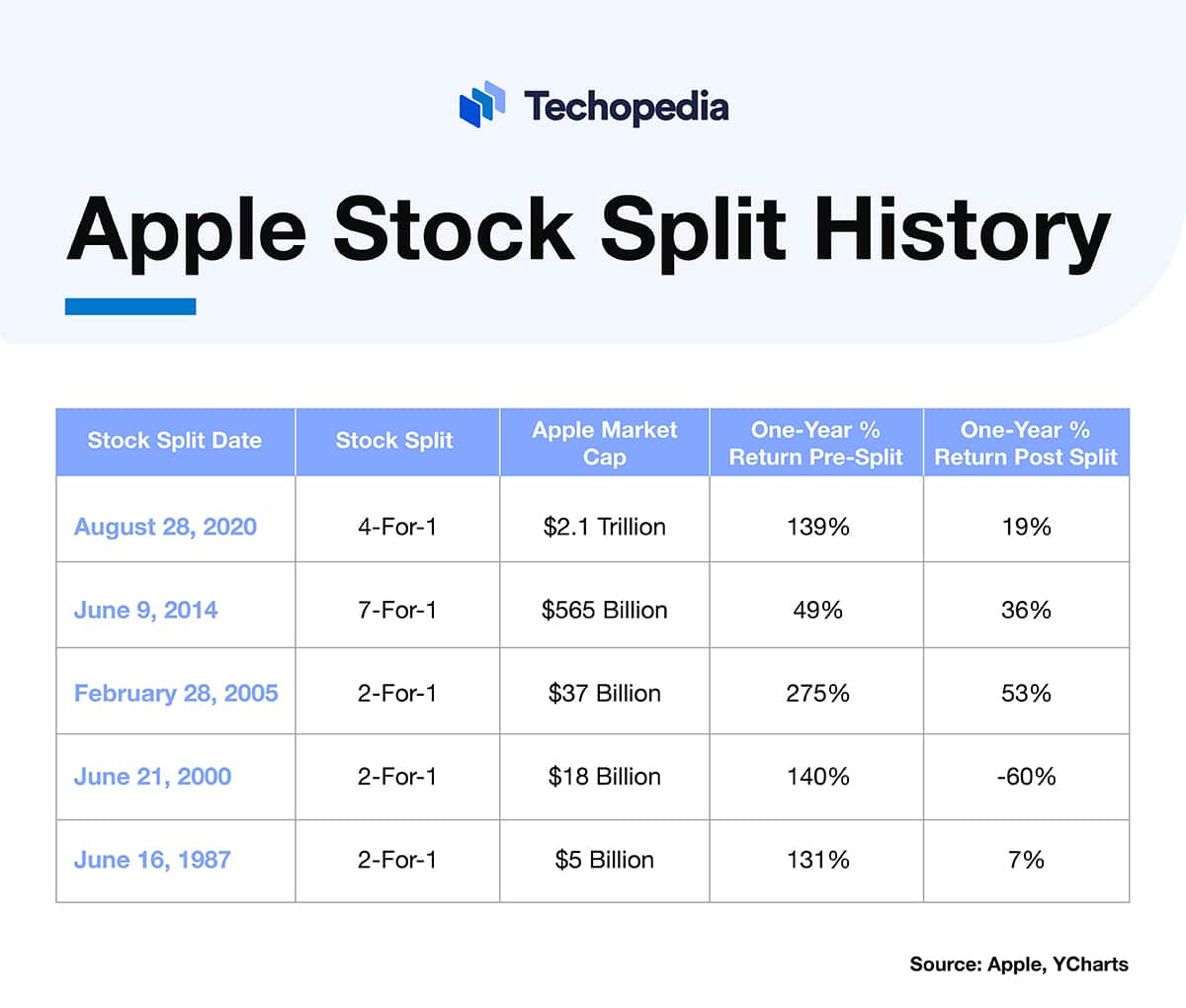

Several factors contribute to the movement of Apple's stock price. These include the company's financial performance, new product launches, and overall market conditions. Macroeconomic trends, such as interest rate changes and inflation, also play a significant role.

Apple's quarterly earnings reports are closely watched by investors. Positive reports, indicating strong revenue and profit growth, typically lead to a stock price increase. Conversely, disappointing results can trigger a decline.

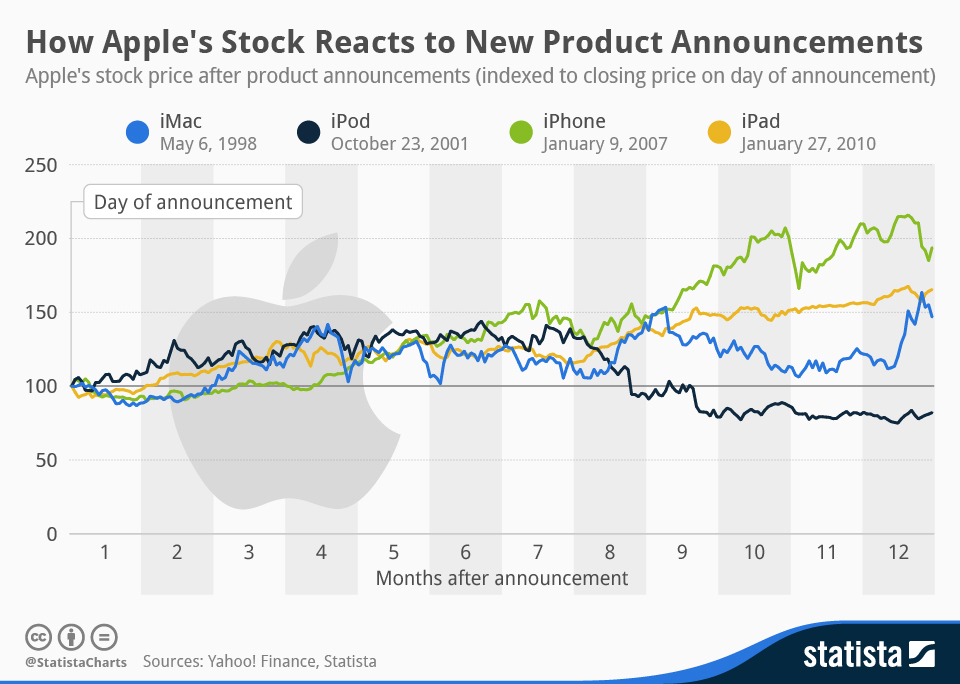

New product announcements and technological innovations can also impact the stock. The success of the iPhone, iPad, and other products directly influences investor sentiment. Anticipation for future innovations, such as augmented reality devices, also plays a part.

Furthermore, general market sentiment and broader economic conditions can affect Apple's stock. A bull market, characterized by rising prices, tends to lift most stocks, including Apple. A bear market, on the other hand, can put downward pressure on even the strongest companies.

Expert Analysis and Future Outlook

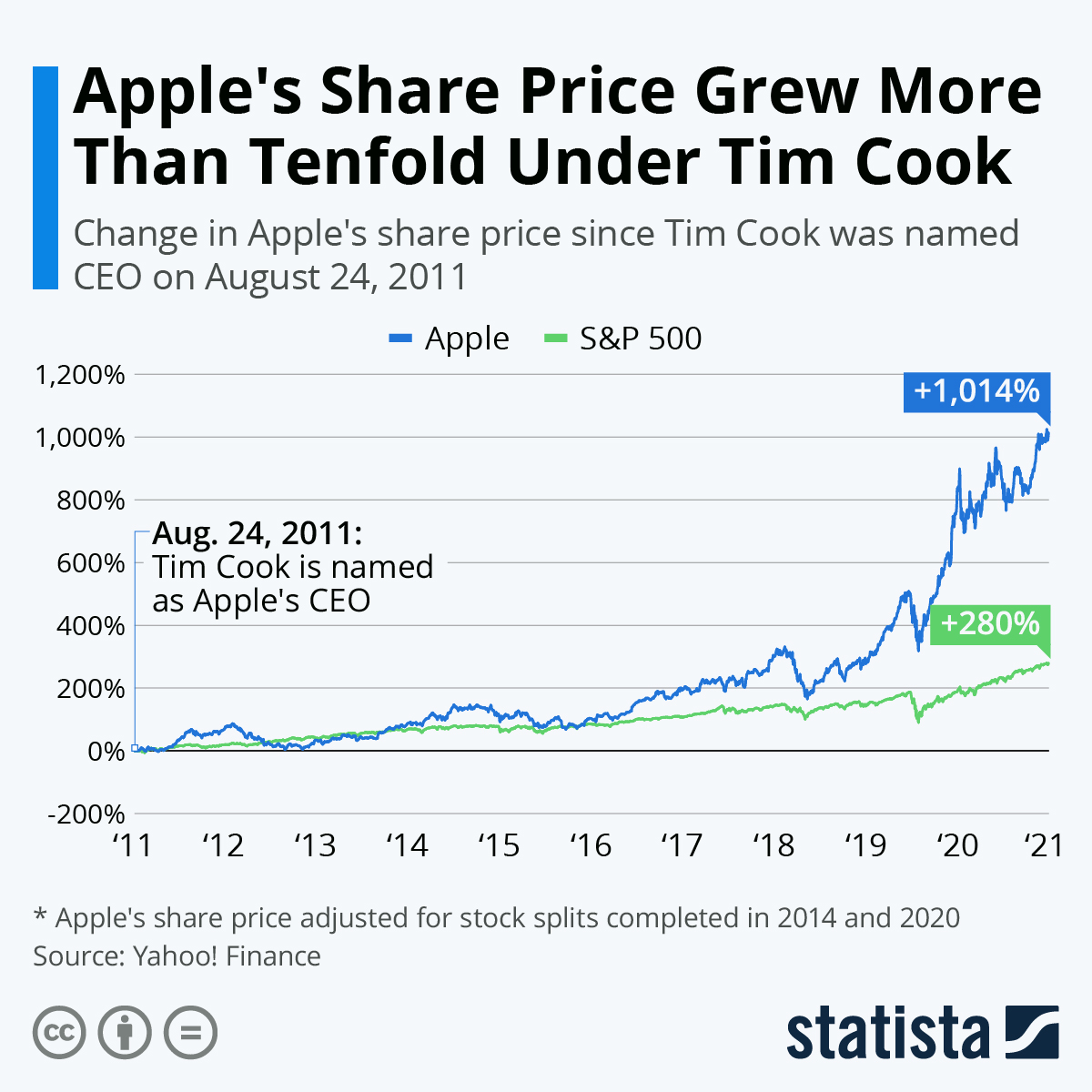

Investment analysts offer a range of perspectives on Apple's future stock performance. Some analysts remain highly optimistic, citing Apple's strong brand, loyal customer base, and ongoing innovation. They predict continued growth and a rising stock price.

Other analysts are more cautious, pointing to potential challenges such as increasing competition and slower economic growth. They suggest that Apple's growth may be more moderate in the coming years. These forecasts consider Apple's dependence on the Chinese market and global supply chain vulnerabilities.

According to a recent report by Goldman Sachs, Apple's stock price could reach $200 within the next year, based on the expected success of new product launches. However, other firms, such as Morgan Stanley, have a more conservative target price of $185.

How to Buy Apple Stock

Buying Apple stock is relatively straightforward. You can purchase shares through a brokerage account, either online or through a traditional broker. Numerous online brokerage platforms offer commission-free trading, making it easier and more affordable than ever to invest in Apple.

Popular platforms include Robinhood, TD Ameritrade, and Fidelity. Each platform offers different features and benefits, so it's important to compare them before making a decision. Consider factors such as fees, account minimums, and research tools.

Before investing, it's crucial to conduct your own research and understand the risks involved. Investing in the stock market always carries the potential for losses. Don't invest money you can't afford to lose.

Conclusion

The price of Apple stock is a constantly moving target, influenced by a complex interplay of factors. While the current price provides a snapshot of its value, understanding the underlying drivers and expert forecasts is essential for making informed investment decisions. Before investing in Apple or any other stock, remember to conduct thorough research and consult with a financial advisor if needed. Diversifying your portfolio is also a good strategy to mitigate risk.