How Much Is One Tonne Of Gold

The glint of gold has captivated humanity for millennia, representing wealth, power, and stability. While we often see gold discussed in terms of grams, ounces, or kilograms, the sheer magnitude of a tonne of gold – and its staggering value – can be difficult to grasp. The price of this precious metal fluctuates constantly, influenced by a complex interplay of economic forces, geopolitical events, and investor sentiment.

Understanding the current value of a tonne of gold is crucial for investors, economists, and anyone seeking insight into the global financial landscape. This article will delve into the factors that determine gold's price, examine the calculation involved in converting that price to a tonne, and explore the implications of this immense wealth.

The Nuances of Gold Pricing

The price of gold is primarily determined in the global spot market, where it is traded continuously. These spot prices are typically quoted in US dollars per troy ounce.

Several factors can influence this ever-shifting price, including interest rates, inflation expectations, currency fluctuations, and perceived economic or political instability. Strong economic data often leads to a decrease in gold prices as investors shift towards assets perceived as riskier but offering higher returns.

Conversely, during times of uncertainty, gold tends to rise in value as investors seek a safe haven for their capital.

Calculating the Value of a Tonne

Converting the price per troy ounce to the value of a tonne requires a few simple conversions. Firstly, it's essential to understand the relationship between troy ounces and kilograms.

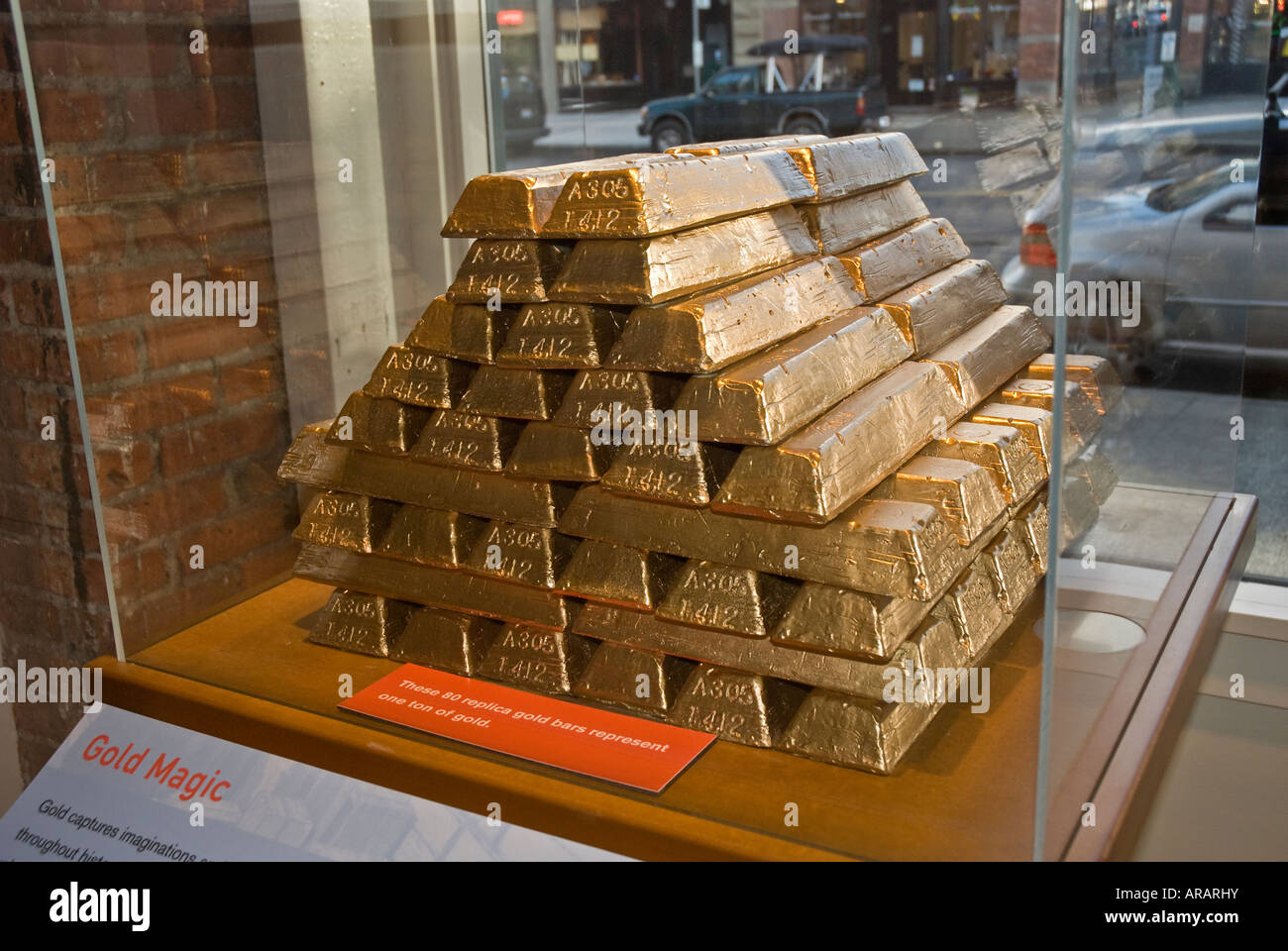

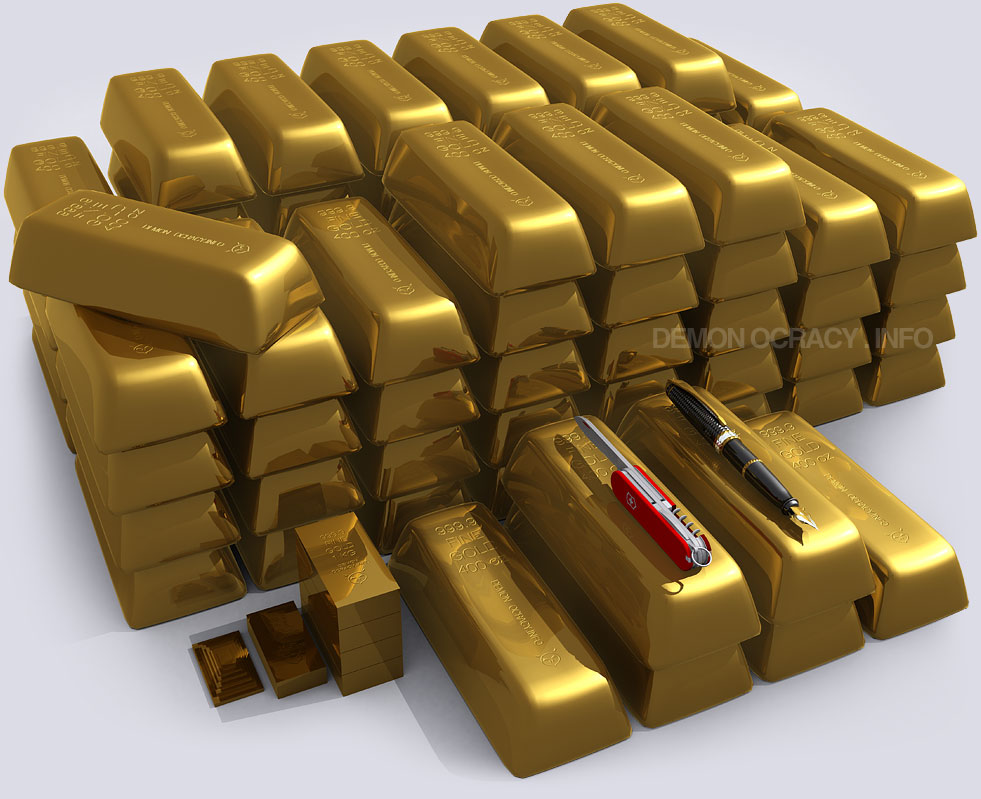

One troy ounce is equivalent to approximately 31.1035 grams, and one tonne equals 1,000,000 grams. Therefore, one tonne contains approximately 32,150.7465 troy ounces.

To calculate the value of a tonne of gold, simply multiply the current spot price per troy ounce by this conversion factor.

For example, if the spot price of gold is $2,300 per troy ounce, then one tonne of gold would be worth approximately $73,946,717. This is calculated as $2,300/ounce * 32,150.7465 ounces/tonne.

It is crucial to use real-time, up-to-date pricing information from reputable sources to ensure accuracy. Websites like Bloomberg, Reuters, and gold trading platforms provide current spot prices.

The Impact of Geopolitics and Economic Indicators

Geopolitical events often have a significant impact on the price of gold. Events such as wars, political instability, and international trade disputes can create uncertainty, driving investors towards gold as a safe haven asset.

For instance, periods of heightened tension between nations or significant changes in trade policies often correlate with increases in gold prices. Similarly, economic indicators like inflation rates and employment figures also play a role.

High inflation can erode the purchasing power of traditional currencies, making gold more attractive as a store of value. Conversely, strong employment numbers might signal a healthy economy, potentially reducing demand for gold.

Central Bank Influence

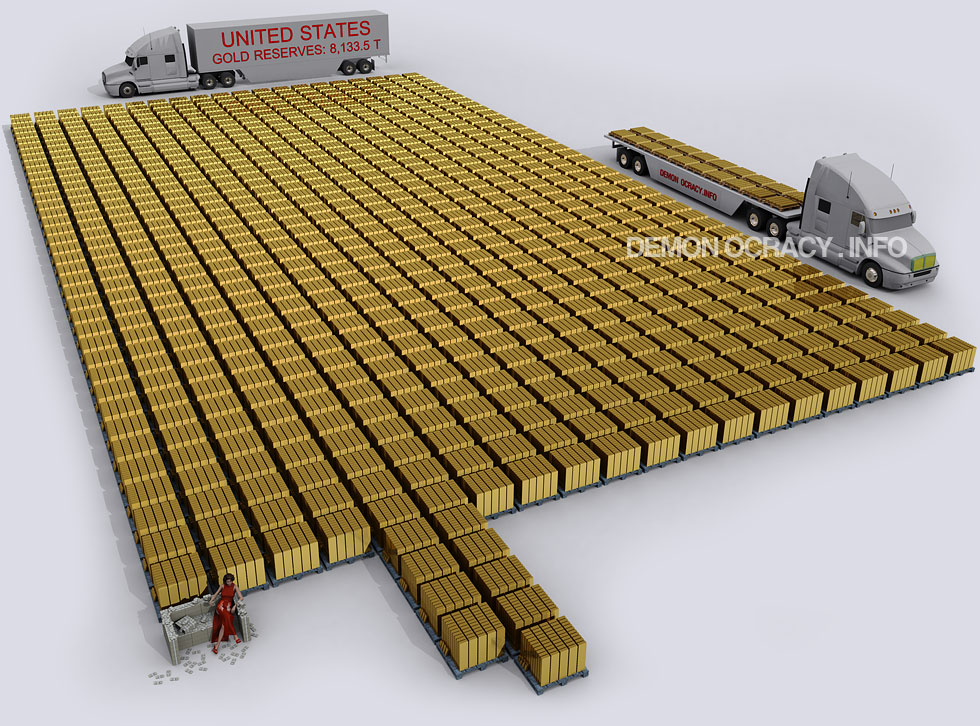

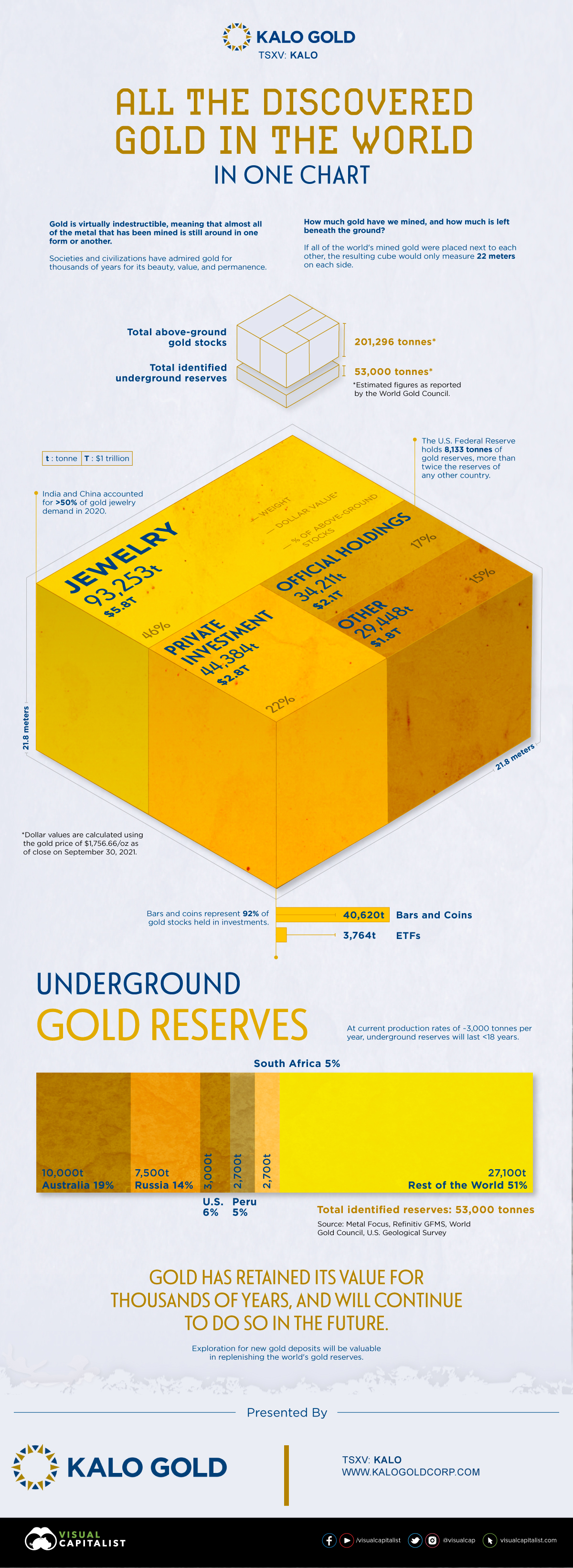

Central banks play a significant role in the gold market. They hold substantial gold reserves and can influence prices through their buying and selling activities.

Some countries accumulate gold to diversify their reserves and reduce reliance on the US dollar. This buying activity can support gold prices. On the other hand, central bank sales can exert downward pressure.

The World Gold Council provides detailed information and analysis on central bank gold reserves and activities, offering valuable insights into this aspect of the market.

Perspectives on Gold's Value

Different market participants hold varied views on the inherent value of gold. Some consider it a purely speculative asset, with its price driven by sentiment and not by fundamental economic factors. These critics argue that gold offers no yield and its value is solely based on the willingness of others to pay more for it in the future.

Others view gold as a crucial store of value and a hedge against inflation and currency devaluation. They believe that its limited supply and historical significance make it a reliable asset to hold during times of economic turmoil.

Many investors adopt a balanced approach, including gold as a part of a diversified portfolio to mitigate risk and provide potential long-term appreciation.

Looking Ahead

Predicting the future price of gold is notoriously difficult due to the multitude of factors at play. However, understanding the key drivers of gold prices can provide a framework for assessing potential future movements.

Factors such as global economic growth, inflation expectations, geopolitical stability, and central bank policies will continue to shape the demand for and supply of gold. Monitoring these trends closely is crucial for investors seeking to make informed decisions.

Regardless of its short-term price fluctuations, gold is likely to remain a significant asset in the global financial system. Its historical role as a store of value and a safe haven ensures its enduring appeal, even in an increasingly complex and volatile world.