How Much Money Does It Take To Start A Company

Imagine a sun-drenched garage, tools scattered across a workbench, the air thick with the smell of sawdust and ambition. This is the archetypal image of a startup's genesis, a space where dreams are hammered into reality. But beyond the romantic vision lies a practical question: how much money does it really take to transform an idea into a thriving business?

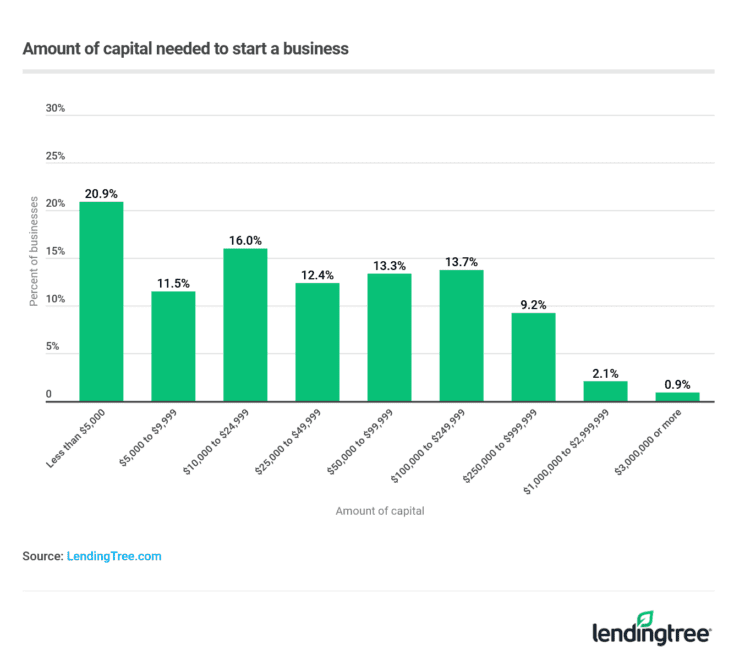

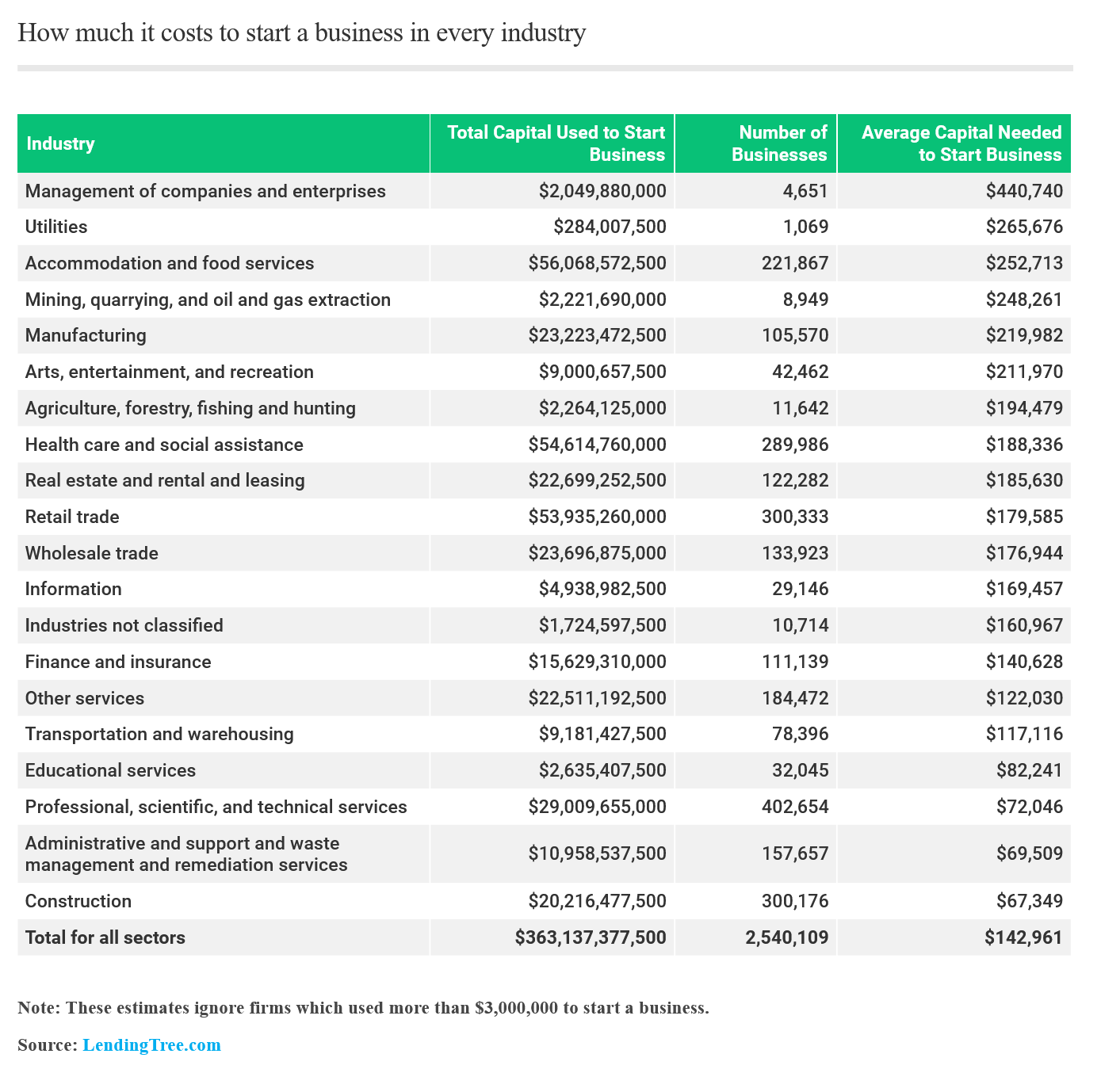

The financial barrier to entry for starting a company is a multifaceted equation with wildly varying answers. It depends heavily on the industry, business model, location, and the founder’s resourcefulness. While some ventures can launch on a shoestring budget, others require significant capital investment from the outset.

The Landscape of Startup Costs

The good news is that launching a business today is often more accessible than ever before. Thanks to technology and the rise of the gig economy, many traditional overhead costs can be minimized. For example, cloud-based software solutions have replaced expensive in-house servers.

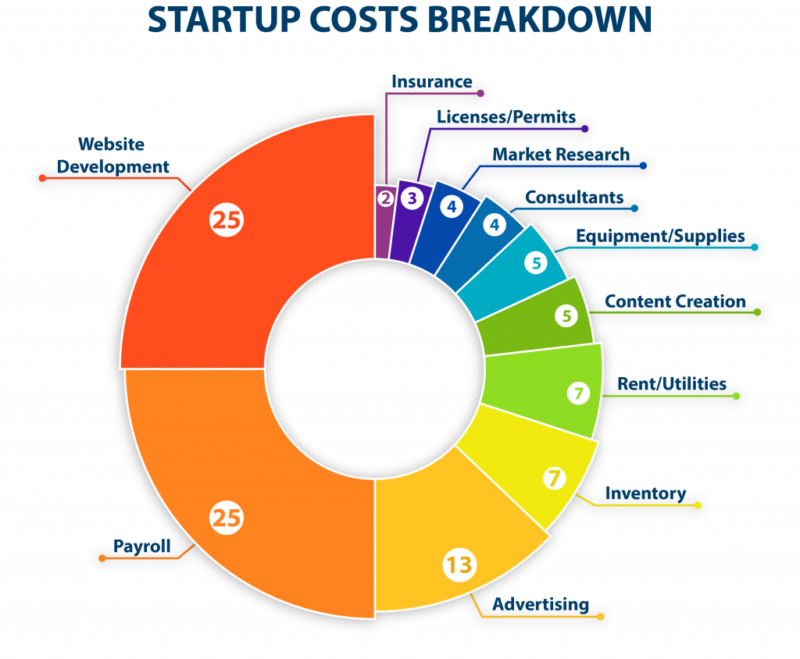

But let's break down the key cost categories that entrepreneurs need to consider:

Defining the Essentials

First and foremost, registration and legal fees are unavoidable. Setting up a legal business entity, like an LLC or corporation, incurs costs. Fees vary by state, but expect to pay several hundred dollars initially.

Next, consider office space. A physical office might be necessary for some businesses, but many startups can operate remotely, significantly reducing costs. Coworking spaces offer a middle ground, providing a professional environment without the commitment of a long-term lease.

Equipment is another factor to consider. A tech startup might need high-powered computers, while a manufacturing business requires specialized machinery. Prioritize essential equipment and explore leasing options to conserve capital.

Marketing and advertising are critical for reaching potential customers. A website, social media presence, and targeted advertising campaigns are essential. Allocate a portion of your budget to these activities.

Finally, salaries and wages are a significant expense, particularly if you're hiring employees. Consider bootstrapping and outsourcing tasks initially to minimize payroll costs. According to the Small Business Administration (SBA), labor costs are a leading expense for many businesses.

The Power of Bootstrapping

Bootstrapping, or self-funding, is a common approach for startups with limited resources. This involves using personal savings, revenue from early sales, and sweat equity to finance the business. It demands discipline and frugality but allows founders to maintain complete control.

Inc. Magazine often features stories of successful companies that started with minimal funding, emphasizing the importance of resourcefulness and creativity. One can often find founders turning to personal networks and friends to get the startup off the ground.

Seeking External Funding

For startups requiring significant capital, external funding options exist. Angel investors and venture capitalists provide capital in exchange for equity in the company. However, securing funding from these sources is highly competitive.

Small business loans are another option. These loans typically require a detailed business plan and collateral. The U.S. Small Business Administration (SBA) offers various loan programs to support small businesses.

Finding the Right Balance

Ultimately, the amount of money needed to start a company is a moving target. It's a delicate balance between ambition and practicality, vision and resourcefulness.

The key is to start small, validate your business idea, and prioritize essential expenses. Embrace the spirit of innovation and find creative solutions to minimize costs. Don't be afraid to pivot and adapt as you learn and grow.

Starting a company is a journey, not a destination. It's about turning a dream into a reality, one step at a time.