How Much Should You Pay Yourself First

Imagine a sun-drenched Saturday morning. You're sipping coffee, scrolling through your bank account, and a wave of... something hits. Is it satisfaction? Confusion? Maybe even a little regret? The money is there, but where did it all *really* go? Paying yourself first is a financial strategy that addresses this very feeling, transforming it from a fleeting concern into a consistent, empowering practice.

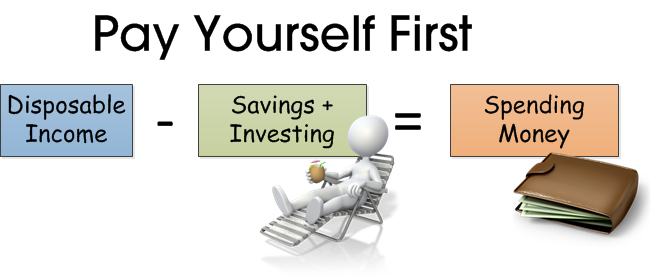

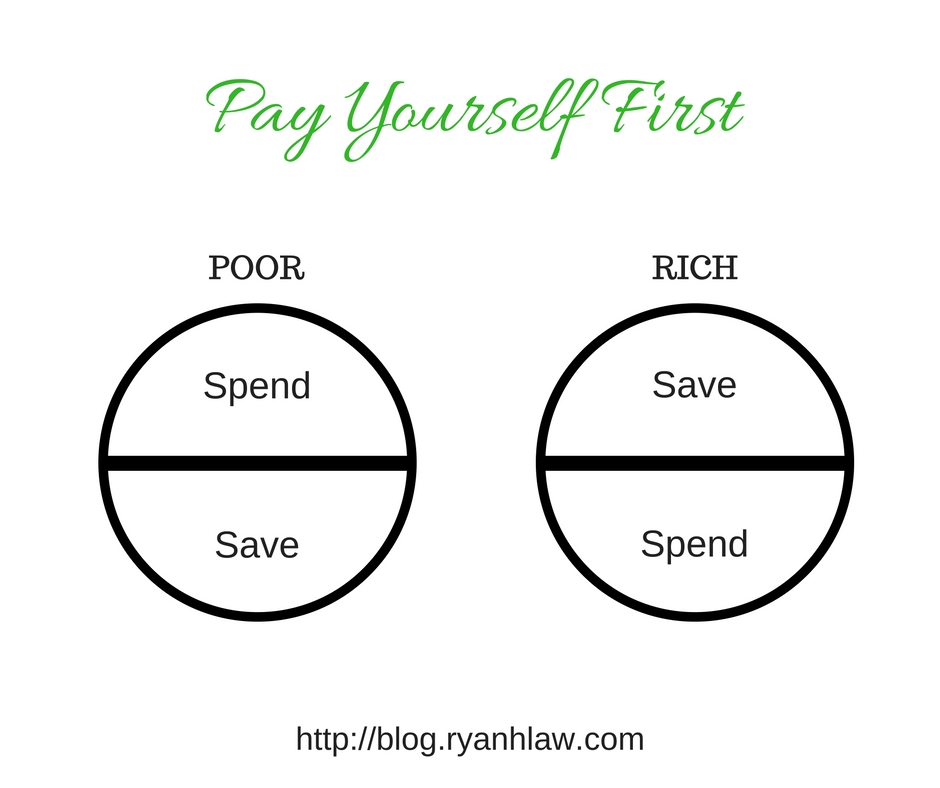

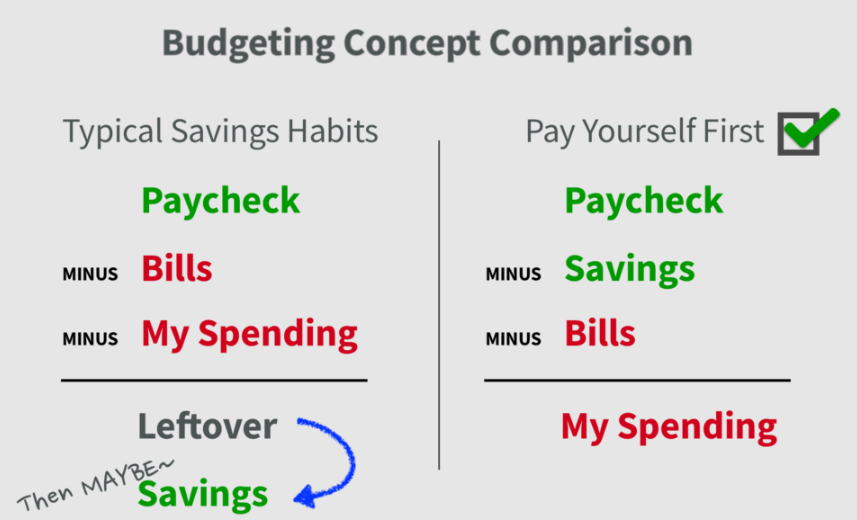

The core idea is simple: before paying bills or indulging in discretionary spending, prioritize setting aside a predetermined amount for your future self. This approach isn't just about saving; it's about consciously building a financially secure future and aligning your spending with your values.

The Foundation: Understanding the "Why"

The concept of paying yourself first isn't new. It gained popularity through books like "The Richest Man in Babylon", which emphasizes saving a portion of your earnings consistently. This isn't about depriving yourself; it's about ensuring your future needs are met, reducing financial stress, and creating opportunities for long-term growth.

Behavioral economics plays a significant role here. We often prioritize immediate gratification over future rewards. Paying yourself first flips this script, making saving an automatic habit rather than a discretionary afterthought.

According to a recent report by the U.S. Bureau of Economic Analysis, the personal saving rate has fluctuated significantly in recent years, highlighting the importance of conscious saving strategies. The report emphasizes the need for individuals to proactively manage their finances to achieve long-term financial stability.

Finding Your Number: How Much is Enough?

There's no one-size-fits-all answer. Financial experts often recommend starting with at least 10-15% of your income. However, the ideal percentage depends on several factors: your income, expenses, debt obligations, and long-term financial goals.

Consider the 50/30/20 rule: 50% of your income goes to needs, 30% to wants, and 20% to savings and debt repayment. This rule offers a helpful framework, but can be adjusted to fit individual circumstances.

If you’re carrying significant debt, allocate a portion of your "pay yourself first" funds to aggressive debt repayment. This can free up cash flow in the long run and reduce the psychological burden of owing money.

Practical Implementation: Making it Automatic

Automation is your best friend. Set up automatic transfers from your checking account to a savings or investment account immediately after you receive your paycheck.

Many employers offer direct deposit options that allow you to split your paycheck between multiple accounts, making saving even easier.

Consider using budgeting apps or tools to track your spending and identify areas where you can cut back and redirect funds to savings.

Choosing the Right Vehicles: Where Should You Save?

The answer depends on your timeline and risk tolerance. For short-term goals (e.g., emergency fund), a high-yield savings account is a safe and liquid option.

For long-term goals (e.g., retirement), consider investing in tax-advantaged accounts like 401(k)s or IRAs. Diversifying your investments across different asset classes is crucial for mitigating risk and maximizing returns.

Consulting with a financial advisor can help you determine the most appropriate investment strategy for your individual needs and goals. They can provide personalized guidance and ensure you're on track to achieve your financial objectives.

Beyond the Numbers: The Psychological Benefits

Paying yourself first isn't just about accumulating wealth; it's about cultivating a mindset of financial empowerment. It fosters a sense of control and reduces anxiety about the future.

Knowing that you're consistently saving for your future provides a sense of security and allows you to enjoy your present spending without guilt or worry.

It encourages mindful spending habits and helps you prioritize your financial well-being.

It's not about restriction; it's about intentionality.

A Final Reflection

Paying yourself first is more than just a financial strategy; it's a commitment to your future self. It’s a conscious decision to prioritize your financial well-being and build a life of security and opportunity.

Start small, be consistent, and celebrate your progress. The journey to financial freedom is a marathon, not a sprint. And every step you take, no matter how small, brings you closer to your goals.

So, take a moment to reflect on your own financial habits. Where can you adjust your spending to prioritize your future? The power to transform your financial life is in your hands.