How Often Are Your Credit Scores Updated

In today's credit-driven world, understanding how frequently your credit scores are updated is crucial for maintaining financial health. Many consumers are unaware of the update cycles, leading to potential surprises when applying for loans, mortgages, or even jobs.

This article explores the factors determining how often your credit scores change, and what you can do to ensure accuracy and a positive financial standing.

The Credit Reporting Ecosystem

The credit scoring system relies on information reported by lenders and creditors to the three major credit bureaus: Equifax, Experian, and TransUnion.

These bureaus compile the data into credit reports, which are then used to generate your credit scores. The most widely used scoring model is FICO, but other models like VantageScore also exist.

Reporting Frequency: It Varies

There is no fixed schedule dictating how often lenders report to credit bureaus. Generally, most creditors report account activity on a monthly basis.

However, the exact timing can vary depending on the lender’s internal processes and reporting cycles. Some lenders might report at the end of the billing cycle, while others might report on a specific date each month.

It is also important to note that not all lenders report to all three credit bureaus. Some might only report to one or two, which can lead to discrepancies in your credit reports and scores across different bureaus.

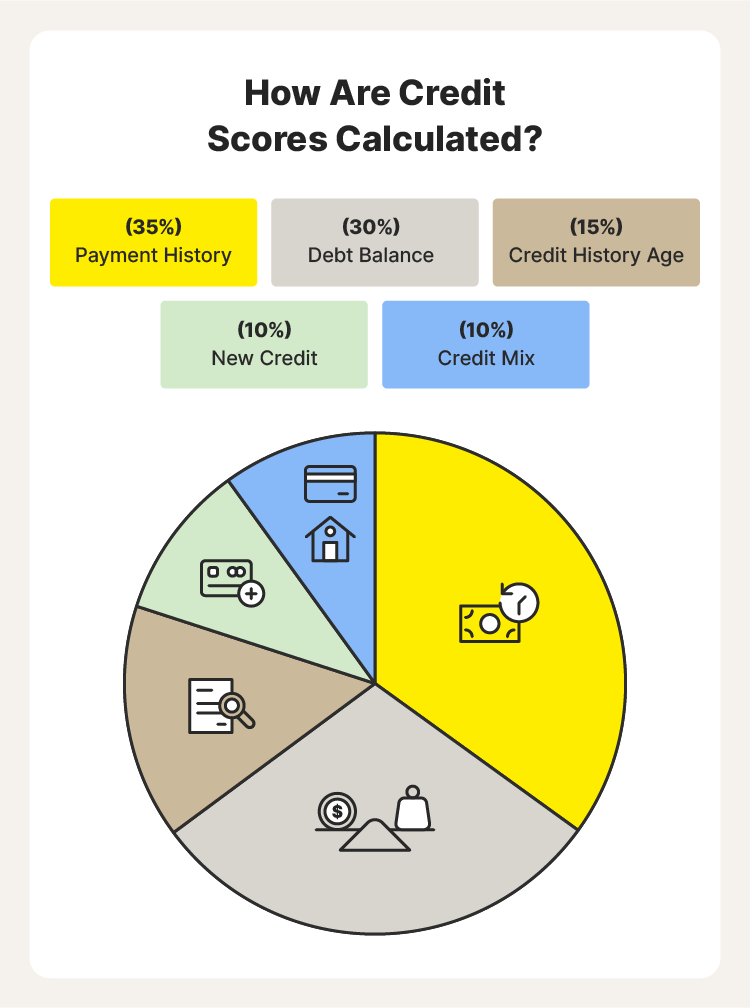

Factors Influencing Update Speed

Several factors can influence how quickly changes appear on your credit report and affect your score. Payment history is a primary driver.

Making on-time payments consistently strengthens your credit score, while late payments can negatively impact it. The amount of debt you owe, also known as your credit utilization ratio, is another crucial element.

Keeping your credit card balances low relative to your credit limits can boost your score. The age of your credit accounts, the mix of credit types you have, and any new credit applications also play a role.

Monitoring for Accuracy and Change

Given the variability in reporting schedules, it's vital to regularly monitor your credit reports for accuracy. You are entitled to a free copy of your credit report from each of the three major credit bureaus annually through AnnualCreditReport.com.

Reviewing these reports allows you to identify and correct any errors, such as incorrect account balances, late payment notations, or fraudulent activity.

Many credit monitoring services offer more frequent updates and alerts, notifying you of changes to your credit reports. These services can be particularly useful for detecting potential identity theft or unauthorized activity.

What if I Find an Error?

If you discover an error on your credit report, you have the right to dispute it with the credit bureau. The bureau is then obligated to investigate the dispute and correct any inaccuracies.

Gather any supporting documentation, such as payment records or account statements, to strengthen your claim. The credit bureau typically has 30 to 45 days to investigate and resolve the dispute.

“Maintaining good credit health is a continuous process, not a one-time event,” advises financial advisor Jane Doe. “Regularly monitoring your credit reports and scores is crucial for identifying potential problems and taking corrective action.”

Impact on Consumers

Understanding credit score update frequency helps consumers make informed financial decisions. For instance, knowing that most lenders report monthly encourages timely payments to boost credit scores.

This can also assist those planning to apply for a loan or mortgage. By monitoring their credit reports in the months leading up to the application, they can identify and address any issues that might negatively impact their chances of approval or interest rates.

Ignoring credit scores, on the other hand, can result in denials and higher interest rate. This can cost consumers significantly in the long run.

Conclusion

While there's no single answer to how often your credit scores are updated, understanding the factors that influence reporting frequency empowers you to take control of your credit health. Consistently monitor your credit reports, address any errors promptly, and maintain responsible credit habits.

By staying informed and proactive, you can build and maintain a strong credit profile, unlocking better financial opportunities and security.