How To Borrow Money In Cash App

Cash App, the popular mobile payment service, offers a feature that allows eligible users to borrow small amounts of money directly within the app. Known as Cash App Borrow, this service provides a short-term loan option for users who need quick access to funds. Understanding the mechanics of this feature is crucial for anyone considering using it.

This article will explore how Cash App Borrow works, the eligibility requirements, associated fees, and potential implications for users. It aims to provide a clear and concise overview of the service, allowing readers to make informed decisions.

Understanding Cash App Borrow

Cash App Borrow is a feature designed to provide eligible users with access to short-term loans. The service allows users to borrow amounts typically ranging from $20 to $500, though the exact amount available can vary based on individual circumstances.

This feature is not universally available to all Cash App users.

Eligibility Requirements

Determining who qualifies for Cash App Borrow is a complex process managed by Cash App's algorithms. According to Cash App's official website, several factors influence eligibility, including the user's Cash App activity, their history of using the app, and their credit score.

Direct deposit activity within Cash App also plays a significant role. Regular and consistent use of Cash App for deposits, particularly payroll deposits, can increase the likelihood of becoming eligible.

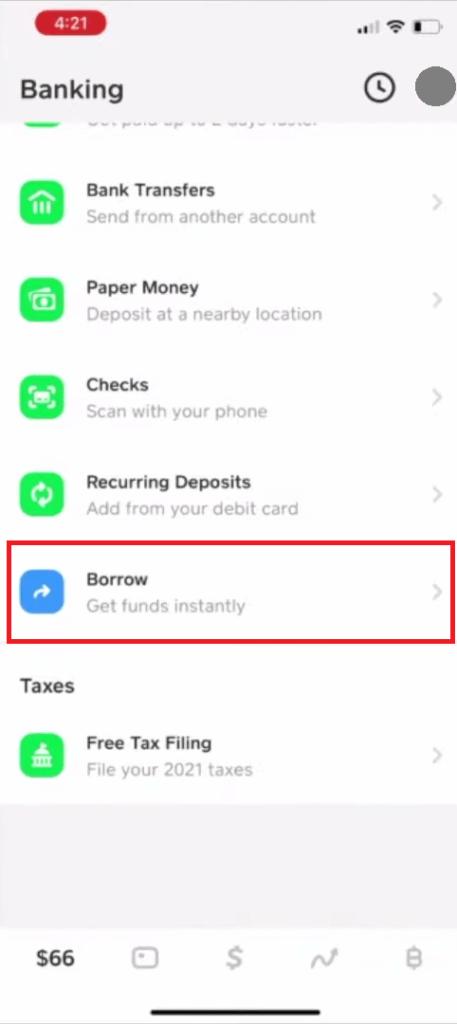

Users can check their eligibility within the app by navigating to the "Borrow" section. If the feature is available, they will see the option to apply; otherwise, a message will indicate that they are not yet eligible.

The Borrowing Process

If eligible, users can apply for a loan by selecting the desired amount and agreeing to the terms and conditions. These terms include the repayment schedule and the associated fees.

Cash App typically offers a repayment period of four weeks. Failure to repay within this timeframe can result in late fees and potential restrictions on future borrowing.

Once the loan is approved, the funds are immediately deposited into the user's Cash App balance, allowing them to use the money as needed. This process is usually quick and seamless.

Fees and Interest

Cash App Borrow is not free; it comes with associated fees. These fees are typically structured as a flat fee rather than a percentage-based interest rate.

For example, a $100 loan might come with a $5 fee, meaning the user would need to repay $105. The specific fee structure can vary depending on the loan amount and the user's creditworthiness.

It's crucial to carefully review the fee structure before accepting the loan. While the fees might seem small, they can translate to a high annualized percentage rate (APR), especially for short-term loans. This is a fact Cash App does not clearly present.

Potential Risks and Considerations

While Cash App Borrow can provide a convenient solution for immediate financial needs, it's essential to consider the potential risks. Over-reliance on short-term loans can lead to a cycle of debt.

Missing a repayment can result in late fees and potentially damage a user's credit score, especially if Cash App reports the default to credit bureaus. According to a 2023 report by the Consumer Financial Protection Bureau (CFPB), short-term loans, while easily accessible, often carry hidden costs and can exacerbate financial instability.

Users should also be aware of the terms and conditions, including the repayment schedule and penalties for late payments. Understanding these details can help avoid unexpected charges and maintain a healthy financial standing.

Alternatives to Cash App Borrow

Before resorting to Cash App Borrow, consider alternative options. These might include borrowing from friends or family, exploring credit card cash advances, or seeking assistance from local community organizations.

Many non-profit organizations offer financial assistance and guidance to individuals facing temporary financial challenges. Exploring these resources can provide a more sustainable solution compared to short-term loans.

Building an emergency fund is another proactive approach. Even a small amount saved regularly can provide a buffer during unexpected expenses, reducing the need for borrowing.

Cash App's Stance

Cash App positions Cash App Borrow as a responsible lending option, emphasizing its transparency and ease of use. The company encourages users to borrow responsibly and only when necessary.

However, it is important for consumers to be diligent in assessing their own financial situations and considering all available options before utilizing this service.

Users should view Cash App Borrow as a tool to be used with caution, not as a long-term financial solution.

Conclusion

Cash App Borrow offers a convenient way to access small loans directly within the Cash App platform. While it can be helpful in certain situations, users must understand the eligibility requirements, fees, and potential risks involved.

By carefully considering these factors and exploring alternative options, users can make informed decisions and avoid the pitfalls of short-term borrowing. Responsible financial management is key to maintaining a healthy financial future.

Ultimately, Cash App Borrow should be approached with caution and used only as a last resort after exploring other available resources.