How To Get Money From Capital One Credit Card

Imagine this: you’re at a bustling farmer’s market, the scent of fresh lavender and ripe peaches filling the air. You spot the perfect hand-crafted gift for a friend, but your wallet is a little light. That's when you remember your Capital One credit card – a tool that can offer more than just purchasing power, but also access to funds when you need them most.

This article will serve as your friendly guide to understanding how to access cash from your Capital One credit card, covering everything from cash advances and balance transfers to using your card for everyday spending and leveraging rewards programs. We’ll explore the various avenues available, equipping you with the knowledge to make informed decisions that align with your financial goals.

Understanding Your Options

One of the most direct ways to get cash is through a cash advance. This allows you to withdraw money from an ATM using your credit card, similar to using a debit card. However, it’s important to note that cash advances typically come with higher interest rates and fees compared to regular purchases, as stated by Capital One in their cardholder agreements.

Before opting for a cash advance, carefully consider the associated costs. Interest accrues immediately on cash advances, and there's often a transaction fee involved, usually a percentage of the amount withdrawn. Always refer to your card's terms and conditions for the exact details.

Balance Transfers: A Strategic Move

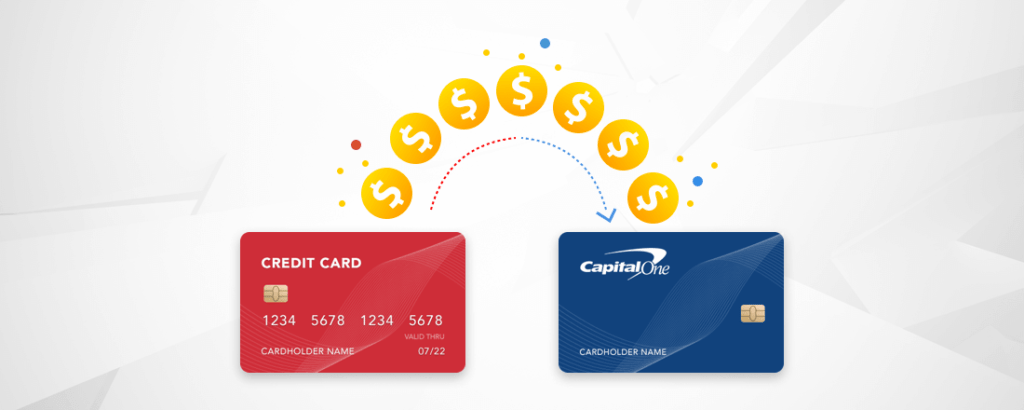

A balance transfer can be a clever way to essentially free up cash, though indirectly. This involves transferring high-interest debt from other credit cards to your Capital One card, ideally one with a lower interest rate or a promotional period featuring 0% APR.

By transferring your balance, you free up the funds you would have used to pay off that higher-interest debt. That extra cash can be used for other needs. Keep in mind that balance transfers often involve a fee, usually a percentage of the amount transferred.

Maximizing Everyday Spending and Rewards

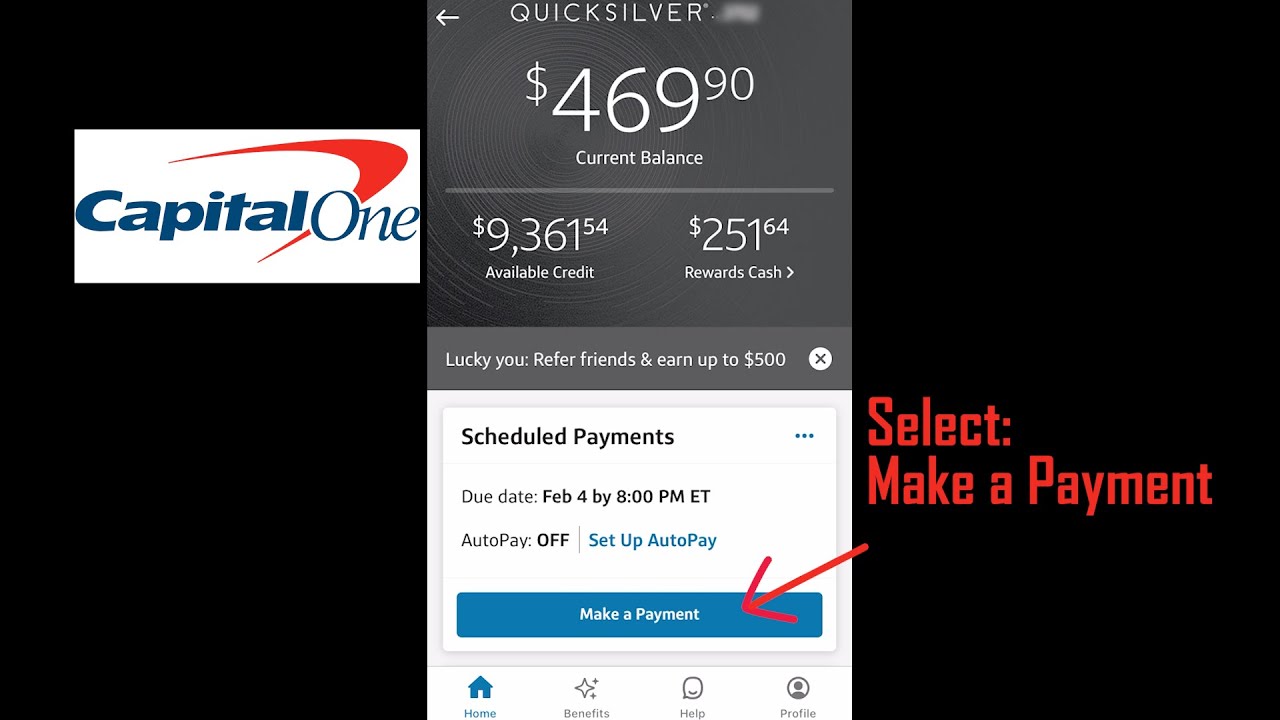

Beyond cash advances and balance transfers, your Capital One card can be a source of financial flexibility through responsible spending and rewards. Use your card for everyday purchases that you would normally make with cash or your debit card, and pay off the balance in full each month.

This allows you to earn rewards, such as cashback, miles, or points, depending on your card type. These rewards can then be redeemed for cash, statement credits, or gift cards, providing a practical way to recoup value from your spending.

Exploring Capital One’s Rewards Programs

Capital One offers a variety of rewards programs tailored to different spending habits. Some cards offer bonus rewards on specific categories, like dining or travel, while others provide a flat rate on all purchases.

Research and choose a card that aligns with your lifestyle. Make the most out of your card's features to maximize your rewards earnings. Check the official Capital One website for detailed information about each card and its specific benefits.

Responsible Credit Card Usage

It's essential to use your Capital One credit card responsibly. Avoid overspending, as carrying a high balance can negatively impact your credit score and lead to accumulating substantial interest charges.

Always make your payments on time and, if possible, pay more than the minimum amount due. Managing your credit card wisely ensures that you maintain a healthy financial profile and avoid unnecessary debt.

Accessing funds through your Capital One credit card can be a helpful tool, but it's crucial to understand the various options available and their associated costs. By making informed decisions, leveraging rewards programs, and prioritizing responsible credit card usage, you can unlock the financial flexibility your card offers, empowering you to achieve your financial aspirations with confidence.