How To Pay Yourself As A Business Owner Llc

Navigating the financial landscape as a small business owner can be complex, especially when it comes to the fundamental question of how to pay yourself. For those operating as a Limited Liability Company (LLC), understanding the proper methods and implications is crucial for both personal financial well-being and the health of the business.

This article delves into the various ways LLC owners can compensate themselves, outlining the key considerations and best practices to ensure compliance and optimize financial outcomes.

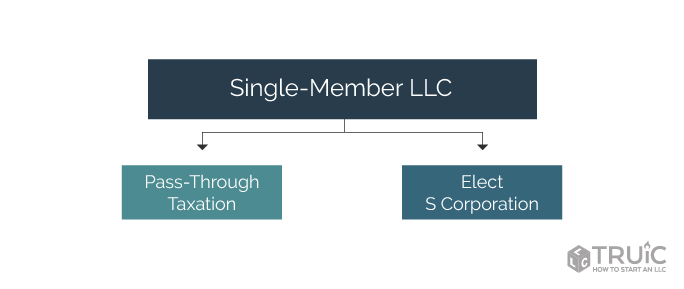

Understanding LLC Taxation and Owner Compensation

The way an LLC is taxed directly impacts how its owners can draw income. Most LLCs are treated as pass-through entities, meaning the business's profits are passed directly to the owners, who then report it on their personal income tax returns.

This avoids double taxation, where profits are taxed at the corporate level and again when distributed to owners.

Methods of Owner Compensation

There are primarily two methods an LLC owner can use to pay themselves: owner's draw and salary.

Owner's Draw: This is the most common method, especially for single-member LLCs. Owners take money out of the business as needed, but it's not considered a salary; rather, it's a distribution of profits.

While draws are not subject to payroll taxes (Social Security and Medicare), the profits are still subject to self-employment taxes.

Salary: For LLCs electing to be taxed as an S corporation (S-corp), owners can be classified as employees and paid a salary. This is often beneficial because only the salary is subject to Social Security and Medicare taxes.

Distributions above the salary are not subject to these taxes. However, the IRS requires that S-corp owners pay themselves a "reasonable salary," commensurate with their skills and experience.

Key Considerations for Determining Owner Compensation

Several factors influence the optimal way to pay yourself as an LLC owner. It is important to consider the following:

Business Profitability: You cannot pay yourself if your business is not making profit. Ensure the business has sufficient funds to cover operational expenses and your compensation.

Tax Implications: Each method of payment has different tax implications. Consulting a tax professional is essential to determine the most advantageous approach for your specific situation.

Legal and Regulatory Compliance: Properly documenting all payments to owners is crucial for maintaining compliance with state and federal regulations.

Failure to adhere to these regulations can result in penalties and legal issues.

Record Keeping and Best Practices

Maintaining meticulous financial records is paramount for LLC owners. Accurate records of all income, expenses, and owner distributions are essential for tax preparation and business management.

Consider using accounting software or hiring a bookkeeper to ensure accurate and organized record keeping. Additionally, it's wise to open a separate business bank account to keep personal and business finances distinct.

Regularly review your financial statements and consult with a financial advisor to ensure your compensation strategy aligns with your overall financial goals.

Potential Impact and Conclusion

Understanding how to pay yourself as an LLC owner is crucial for the long-term sustainability and financial health of both the business and the individual. Choosing the right method, maintaining accurate records, and seeking professional advice are essential steps.

By taking a proactive and informed approach, LLC owners can navigate the complexities of owner compensation and build a thriving business. Properly paying yourself contributes to a more stable business and helps you secure your personal financial future.

![How To Pay Yourself As A Business Owner Llc How to Pay Yourself as an Owner of an LLC [INFOGRAPHIC] - Infographic Plaza](https://infographicplaza.com/wp-content/uploads/llc-paying-yourself-infographic-plaza-thumb.png)