How To Prepare Tds Return In Excel Format

Imagine a spreadsheet, neatly organized rows and columns filled with numbers, dates, and names. It might seem daunting, but it represents something vital: your Tax Deducted at Source (TDS) return. Instead of complex software, this is all done simply in Excel. It can feel empowering, particularly when you understand the process.

This article provides a straightforward guide on preparing your TDS return using Excel. It breaks down the process into manageable steps, ensuring accuracy and compliance. Using Excel for TDS return preparation offers a cost-effective and accessible alternative for many individuals and small businesses.

Understanding TDS and Its Significance

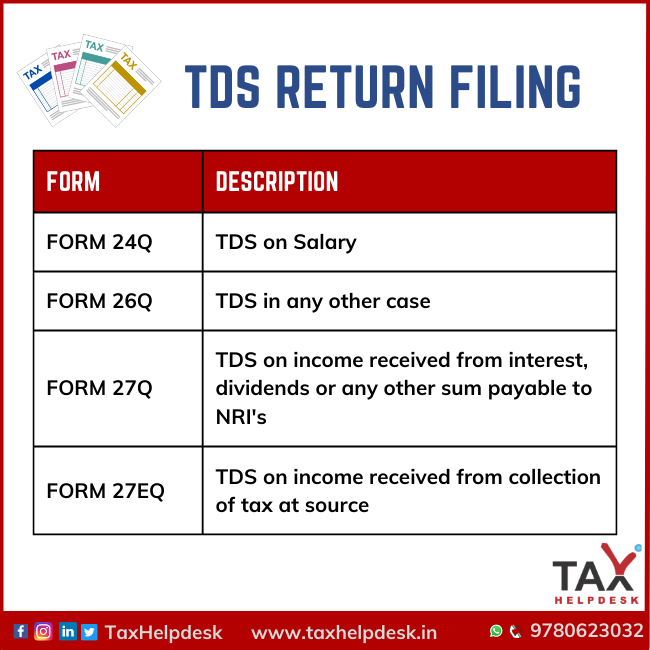

TDS, or Tax Deducted at Source, is a mechanism by which the government collects tax at the point of income generation. It applies to various payments, including salaries, interest, rent, and professional fees.

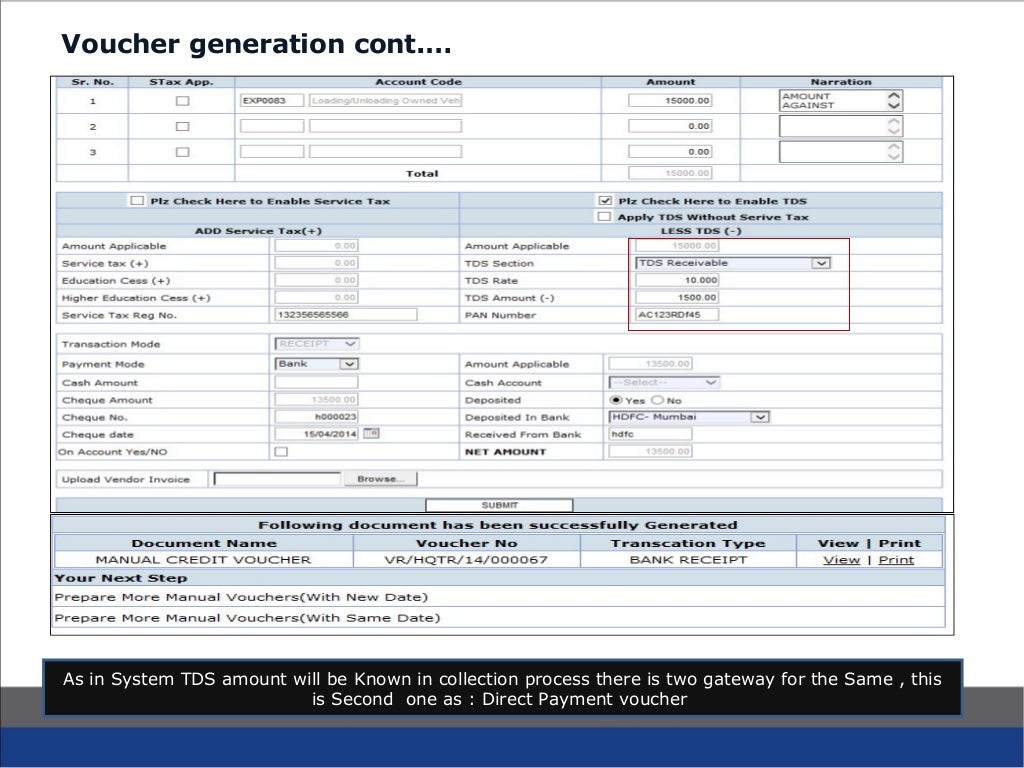

The person or entity making the payment deducts a certain percentage as tax and deposits it with the government. The recipient then claims credit for this TDS amount while filing their income tax return. This ensures regular revenue flow to the government and reduces tax evasion.

Accurate and timely filing of TDS returns is crucial. Late filing or incorrect information can attract penalties and legal consequences.

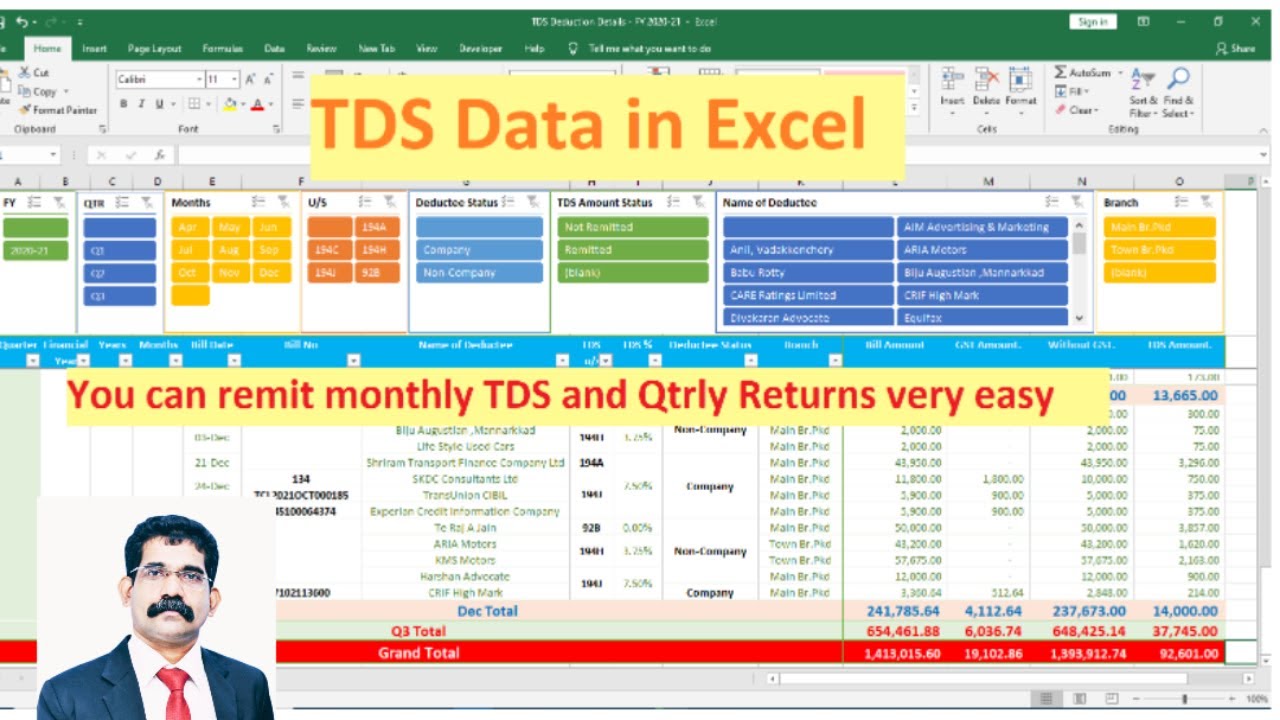

Preparing Your Excel Sheet

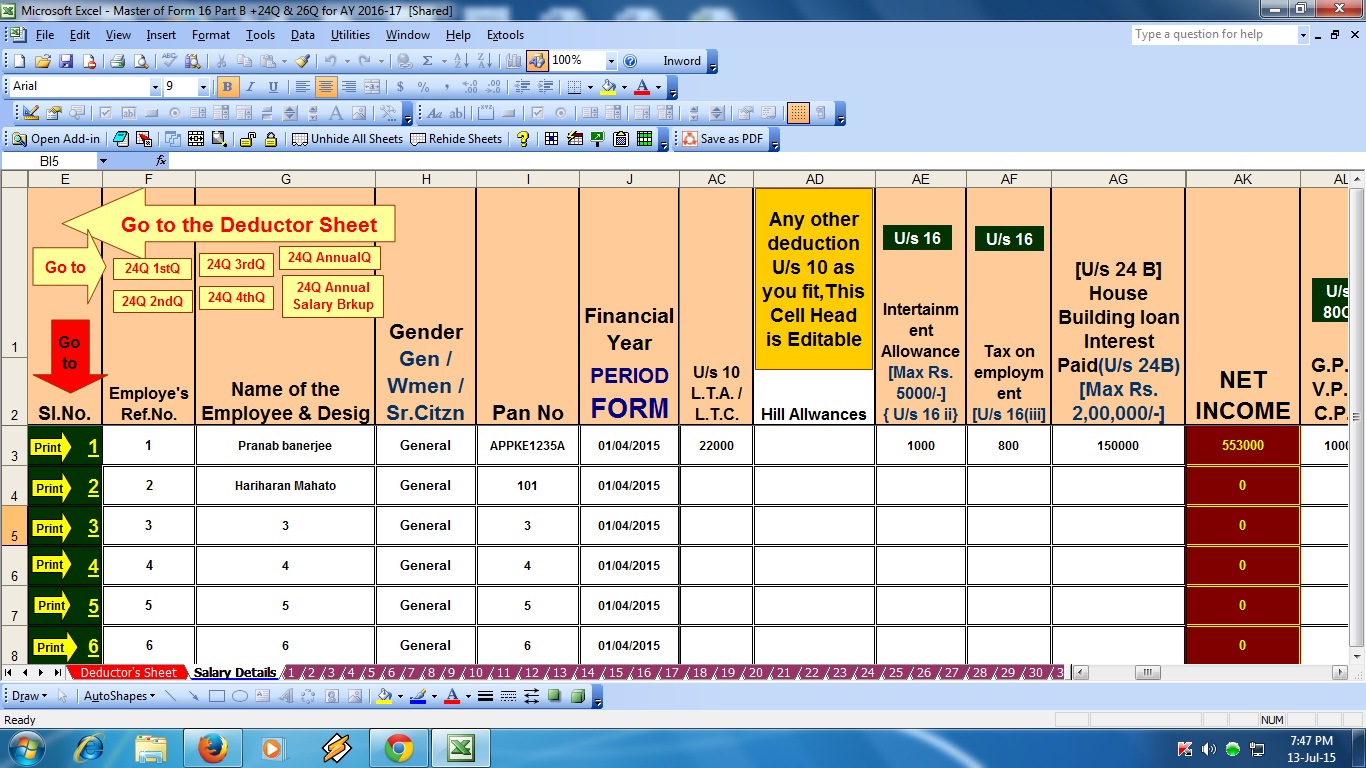

First, create a new Excel workbook. Name it something descriptive, like "TDS Return FY2023-24".

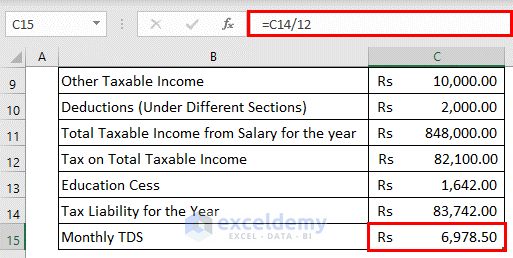

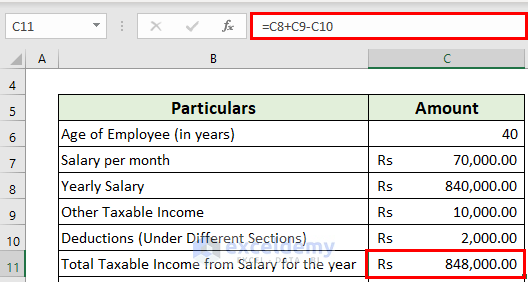

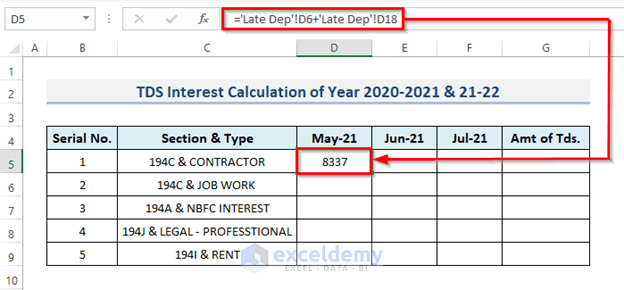

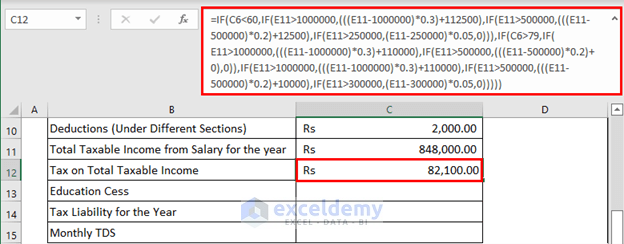

Next, design your worksheet with clear column headers. Key columns should include: Section Code (e.g., 194C for contractors), Payee Name, Payee PAN, Payment Date, Payment Amount, TDS Amount Deducted, Date of Deduction, Challan Number, and Bank Branch Code.

Ensure data accuracy by double-checking all entries, especially PAN numbers. Incorrect PANs are a common cause of TDS return rejection.

Data Entry and Formatting

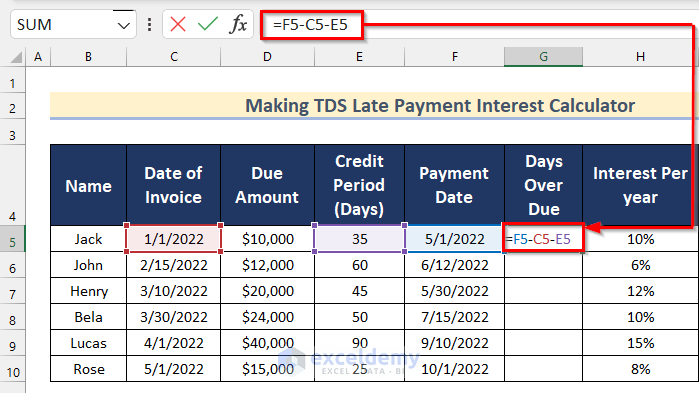

Enter all relevant data into the respective columns, keeping the information detailed and specific. For example, the payee name should match the PAN card records.

Use Excel's formatting tools to improve readability. Format dates correctly (e.g., DD/MM/YYYY), and use number formatting for currency values. This ensures clarity when generating reports.

For larger datasets, consider using Excel's sorting and filtering features. This helps identify any errors or inconsistencies in the data.

Generating the .txt File

The Income Tax Department requires TDS returns to be submitted in a specific text format (usually a .txt file). Preparing that using Excel requires caution.

Download the relevant TDS return template from the NSDL website (nsdl.co.in). This template provides the exact structure required for the text file.

Copy the data from your Excel sheet into the corresponding fields in the template. Save the template as a .txt file, using the naming convention specified by the Income Tax Department.

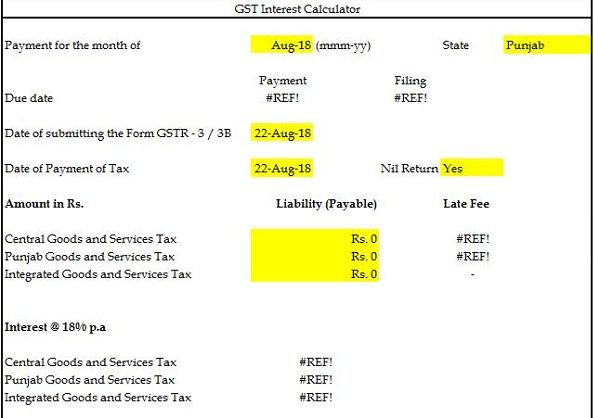

Verification and Submission

Before submitting, validate your .txt file using the File Validation Utility (FVU) provided by NSDL. This utility checks for errors in the file format and data.

The FVU will highlight any discrepancies or errors. Correct the Excel data and regenerate the .txt file until the FVU reports no errors. This step is critical to ensure successful submission.

Finally, log in to the Income Tax Department's e-filing portal and upload the validated .txt file. Follow the instructions on the portal to complete the submission process.

Staying Updated and Compliant

TDS rules and regulations are subject to change. Stay informed about any updates issued by the Income Tax Department.

Regularly visit the Income Tax Department's website and reputable tax portals. This will ensure you're using the correct procedures and forms.

Consider attending workshops or webinars on TDS compliance. This will allow you to stay up-to-date on the latest requirements.

Preparing your TDS return in Excel may seem like a technical task, but with careful attention to detail, it's quite manageable. It empowers you to take control of your tax obligations. Using Excel, you can efficiently manage and file your returns.