H&r Block State Estimated Tax Payments

Imagine a crisp autumn afternoon, sunlight filtering through the changing leaves. You're settling in with a warm cup of tea, ready to tackle those end-of-year financial to-dos. But wait, there's that looming question: have you adequately addressed your state estimated tax payments? The peace of mind knowing you've navigated this often-overlooked aspect of tax planning can make all the difference.

State estimated tax payments are how individuals and businesses pay state income tax throughout the year, instead of waiting until tax season. Understanding this process, particularly with guidance from resources like H&R Block, is crucial for avoiding potential penalties and ensuring a smoother tax filing experience. Let's explore this topic further, focusing on how H&R Block assists taxpayers in managing this critical financial responsibility.

The Significance of State Estimated Tax Payments

State estimated tax payments are generally required if you expect to owe at least a certain amount in state income taxes. This threshold varies by state, so understanding your specific state's requirements is essential. The purpose is to align your tax payments with your income earned throughout the year, much like how federal taxes are withheld from paychecks.

Who typically needs to make these payments? Self-employed individuals, freelancers, small business owners, and those with significant investment income are common candidates. Even individuals who receive income from sources not subject to regular withholding, such as rental properties, may be required to make estimated tax payments.

H&R Block's Role in Simplifying the Process

Navigating state estimated tax payments can feel daunting, but H&R Block offers a range of services to simplify the process. Their expertise provides individuals and businesses with the tools and support needed to accurately calculate and submit these payments on time.

Calculation Assistance

Determining the correct amount to pay can be complex. H&R Block provides resources to help taxpayers estimate their state income tax liability. This involves considering factors like income, deductions, and credits specific to each state.

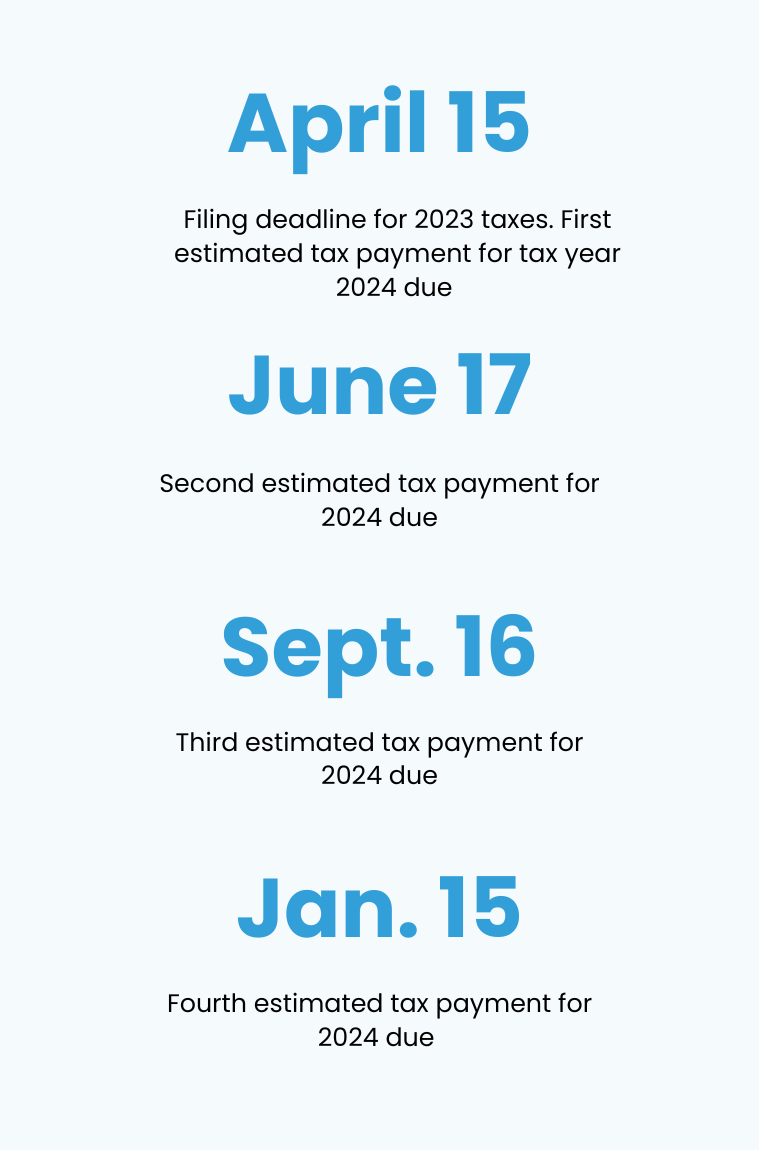

Payment Reminders and Scheduling

Missing a payment deadline can result in penalties. H&R Block offers features like payment reminders to help taxpayers stay on track. They also provide tools to schedule payments electronically, ensuring timely submission.

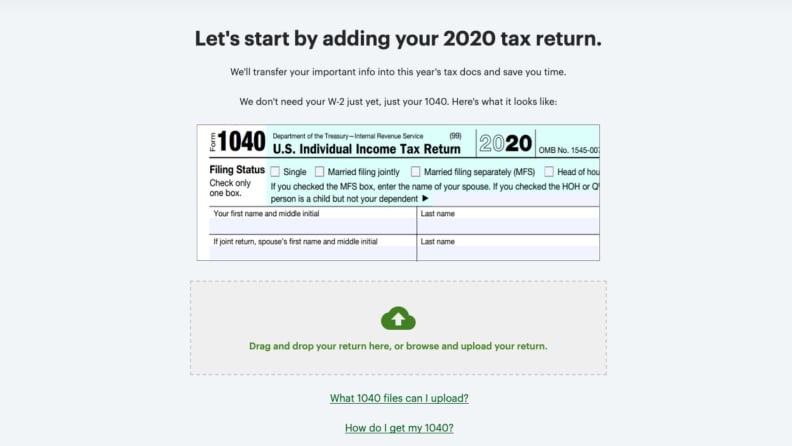

Tax Preparation and Filing

When it's time to file your state income tax return, H&R Block seamlessly integrates your estimated tax payment information. This ensures accurate reporting and minimizes the risk of discrepancies or errors.

Avoiding Penalties and Ensuring Compliance

The consequences of underpaying or not paying state estimated taxes can include penalties and interest charges. These penalties vary by state but can significantly impact your overall tax burden. By utilizing H&R Block's services, taxpayers can mitigate these risks and maintain compliance with state tax laws.

It's important to consult with a tax professional at H&R Block or refer to your state's official tax website for the most up-to-date information and guidance. Each state has unique rules and regulations regarding estimated tax payments, and staying informed is crucial.

Understanding State Requirements is paramount. Each state has unique rules and deadlines for estimated tax payments. Researching your specific state's guidelines ensures you are fulfilling your tax obligations correctly.

As you reflect on your financial planning for the year, remember the importance of addressing state estimated tax payments proactively. With the right tools and resources, such as those offered by H&R Block, you can confidently navigate this aspect of tax planning and enjoy greater peace of mind.