If Accounts Payable Have Increased During A Period

The financial health of a company hinges on a delicate balance, a symphony of cash inflows and outflows. Recently, a growing number of businesses have reported a significant increase in their accounts payable (AP). This trend, while seemingly innocuous, warrants careful scrutiny as it can signal underlying challenges, opportunities, or shifts in strategic financial management.

At its core, a rise in accounts payable represents a company's increasing reliance on credit from its suppliers. Understanding the reasons behind this increase – whether it's a strategic decision, a symptom of financial strain, or a reflection of changing market dynamics – is crucial for investors, creditors, and the companies themselves. This article delves into the complexities of rising accounts payable, exploring the factors driving this trend, potential implications for business stability, and forward-looking strategies for navigating this evolving financial landscape.

Understanding the Surge in Accounts Payable

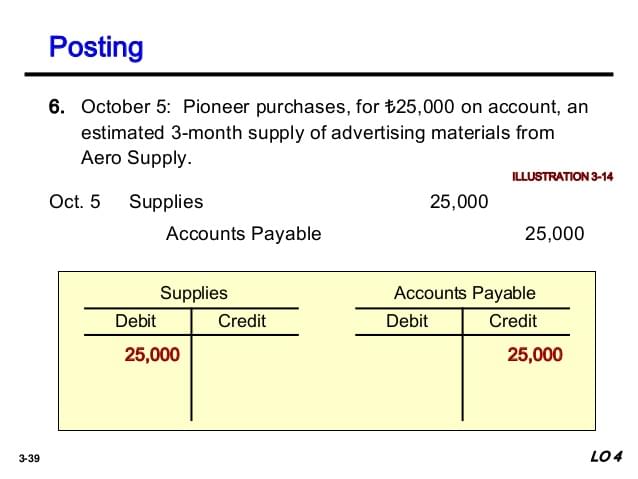

Accounts payable represent the short-term liabilities a company owes to its suppliers for goods and services purchased on credit. An increase in this figure suggests the company is delaying payments to its vendors. Several factors can contribute to this phenomenon.

One primary driver is strategic cash management. Companies may intentionally extend payment terms to conserve cash for other investments, such as research and development or expansion projects. This allows them to optimize working capital and improve their liquidity position.

However, an increase in accounts payable can also signal underlying financial difficulties. A company struggling with cash flow may be forced to delay payments to suppliers simply because it lacks the funds to pay them on time. This can be a red flag for investors and creditors alike.

Furthermore, changes in supply chain dynamics can also influence accounts payable. If a company is experiencing increased demand for its products or services, it may need to purchase more raw materials and inventory, leading to a corresponding increase in its accounts payable. Shifts in supplier relationships, such as negotiating more favorable payment terms, can also impact AP balances.

Differentiating Between Strategic and Distress-Driven Increases

Distinguishing between a strategic increase in accounts payable and one driven by financial distress is paramount. Several key indicators can help differentiate between the two.

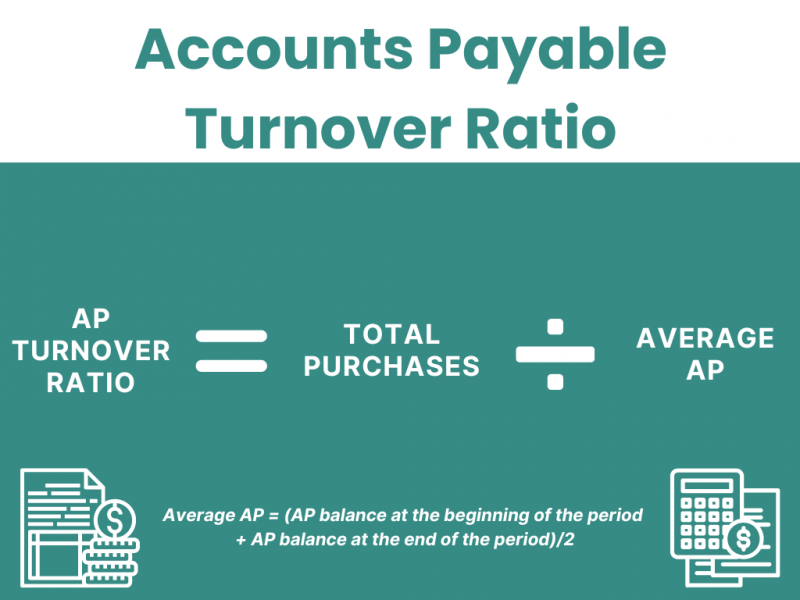

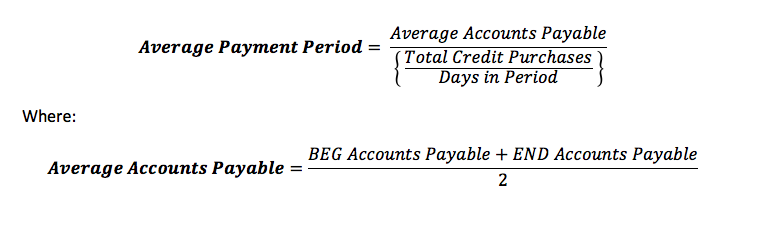

Analyzing financial ratios, such as the current ratio and quick ratio, can provide valuable insights into a company's short-term liquidity. A declining current ratio coupled with a significant increase in accounts payable may suggest the company is facing liquidity challenges. Examining the aging of accounts payable is also crucial; if a large portion of the AP is past due, it's a strong indication of financial stress.

Another key indicator is the company's overall financial performance. Is the company experiencing revenue growth and profitability? If so, an increase in accounts payable may be a strategic decision to optimize working capital. However, if the company is struggling with declining revenues and profits, the increase in accounts payable is more likely a sign of financial distress.

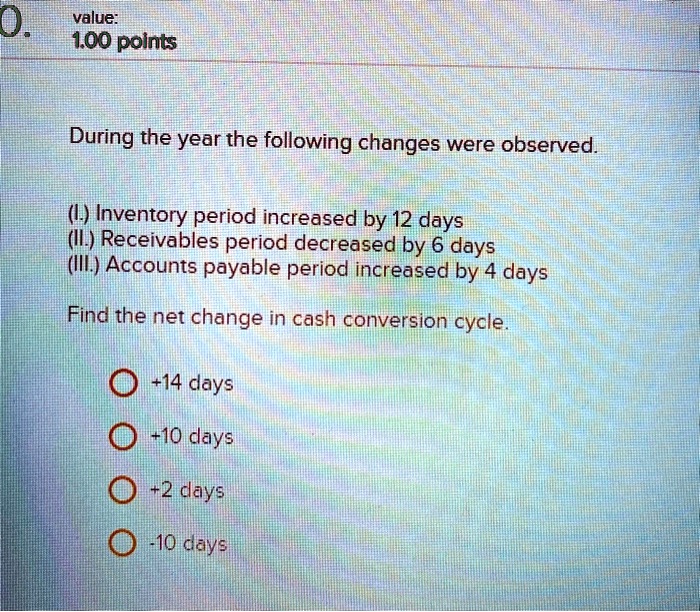

Industry benchmarks also provide context. Comparing a company's accounts payable days (the average number of days it takes to pay suppliers) to the industry average can reveal whether the company is extending payments significantly beyond its peers. A substantial deviation from the industry average may warrant further investigation.

Potential Implications and Risks

Regardless of the underlying cause, a sustained increase in accounts payable carries potential implications and risks for a company. One major concern is the potential for strained supplier relationships. If a company consistently delays payments, suppliers may become reluctant to extend credit or may demand stricter payment terms, which can increase the cost of goods sold.

Furthermore, a build-up of accounts payable can negatively impact a company's credit rating. Credit rating agencies often view a high level of accounts payable as a sign of financial weakness, potentially leading to a downgrade. This can increase the company's borrowing costs and make it more difficult to access capital.

In extreme cases, a company's inability to pay its suppliers can lead to legal action. Suppliers may file lawsuits to recover unpaid debts, which can further damage the company's reputation and financial standing. The domino effect of supplier disputes can escalate quickly, creating significant operational disruptions and jeopardizing the company's solvency.

Managing Rising Accounts Payable Effectively

To effectively manage rising accounts payable, companies need to adopt a proactive and transparent approach. This includes implementing robust cash flow forecasting and management systems to anticipate and address potential liquidity challenges. Establishing open communication channels with suppliers is also crucial.

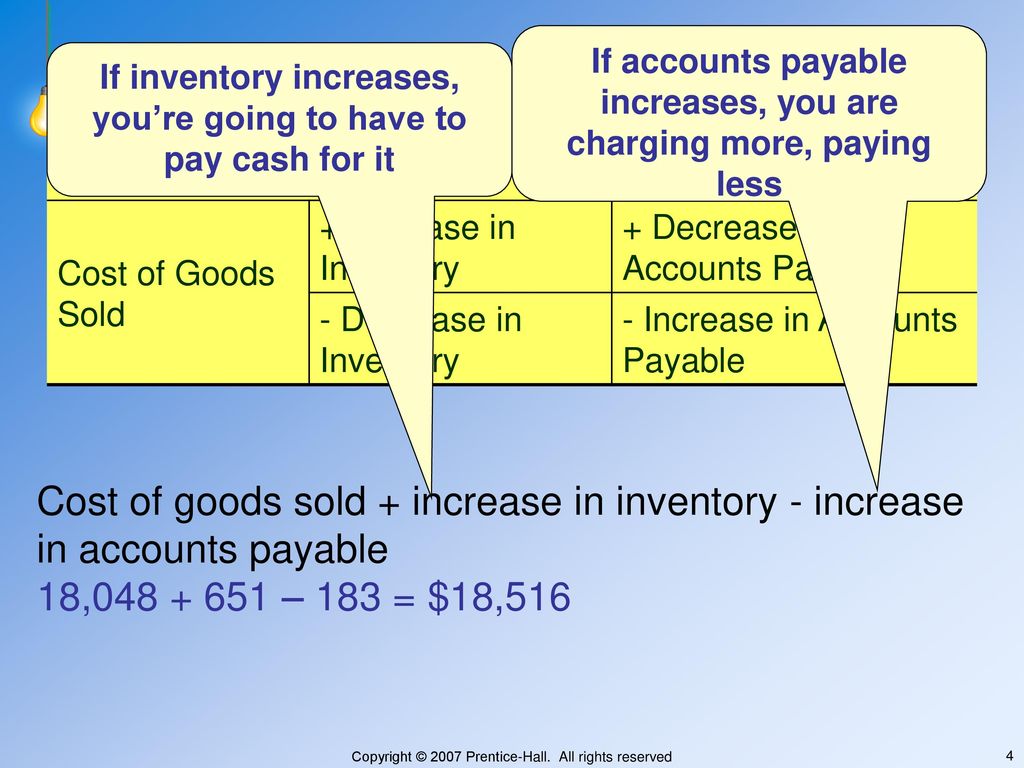

Negotiating favorable payment terms with suppliers is another important strategy. This may involve extending payment deadlines, securing discounts for early payments, or exploring alternative financing options, such as supply chain finance. Companies should also consider implementing automated accounts payable systems to improve efficiency and accuracy.

A well-defined accounts payable policy, clearly outlining payment procedures and timelines, can help prevent misunderstandings and maintain positive supplier relationships. Regularly reviewing and updating this policy is essential to ensure it remains aligned with the company's financial goals and market conditions. Transparency and honesty in communications with suppliers are paramount to fostering trust and long-term partnerships.

Looking Ahead: The Future of Accounts Payable Management

The rise in accounts payable is a trend that's likely to persist in the foreseeable future, driven by factors such as economic uncertainty, globalization, and evolving supply chain dynamics. Companies need to embrace technology and adopt innovative approaches to accounts payable management to stay competitive and mitigate risks. The adoption of blockchain technology, for instance, promises to improve transparency and efficiency in supply chain finance.

Increased automation, driven by artificial intelligence (AI) and machine learning, will further streamline accounts payable processes, reducing errors and improving payment accuracy. Predictive analytics will enable companies to forecast cash flow more accurately and proactively manage their working capital.

Ultimately, the key to navigating the complexities of rising accounts payable lies in a holistic approach that combines strategic financial planning, proactive risk management, and strong supplier relationships. By embracing technology and adopting best practices, companies can transform accounts payable from a potential liability into a strategic asset, driving efficiency, profitability, and long-term sustainability.