Instant $100 Cash Advance No Credit Check

Desperate for cash? A new wave of instant $100 cash advances, promising no credit checks, is flooding the market, raising concerns and offering a tempting lifeline for those in immediate financial need.

These advances bypass traditional lending institutions, often operating through mobile apps and online platforms. They offer quick access to small sums of money but come with hidden fees and potential risks for unsuspecting borrowers.

Instant Cash: A Lifeline or a Trap?

The premise is simple: download an app, verify your income (often through bank account linking), and receive up to $100 almost instantly. Companies like Earnin, Dave, and MoneyLion dominate this burgeoning sector.

But the convenience comes at a cost. While advertised as having "no interest," these apps often rely on tips or subscription fees, which can translate to an APR far exceeding traditional loan rates.

According to a 2019 report by the Financial Health Network, these products, while potentially helpful for managing short-term liquidity, can lead to a cycle of dependency if not used responsibly.

The Appeal of No Credit Checks

The primary draw for many users is the absence of a credit check. This opens doors for individuals with poor or no credit history who are often excluded from conventional financial services.

This lack of scrutiny, however, also removes a critical safeguard. It allows individuals who are already financially vulnerable to take on additional debt, potentially exacerbating their situation.

A 2021 study by Pew Charitable Trusts found that repeat users of these services are more likely to experience financial distress, including difficulty paying bills and increased reliance on other forms of high-cost credit.

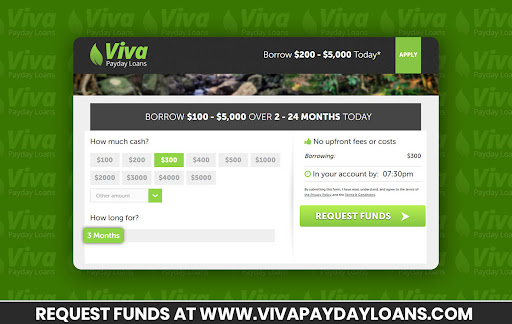

How It Works: A Closer Look

The process typically involves downloading the app and connecting your bank account. The app then analyzes your income and spending patterns to determine your eligibility and maximum advance amount.

Repayment is usually automated, with the borrowed amount and any associated fees deducted from your next paycheck. Some apps also offer the option to repay manually.

Many of these platforms employ a "tipping" system, encouraging users to leave a voluntary tip for the service. While optional, the social pressure to tip can effectively function as an interest rate.

The Risks and Hidden Costs

While seemingly straightforward, the cost structure can be complex and difficult to understand. The absence of a clearly stated APR makes it challenging to compare these advances with other financial products.

Late fees, overdraft charges, and subscription costs can quickly accumulate, turning a small $100 advance into a significant financial burden. Furthermore, some apps may report delinquent payments to credit bureaus, negatively impacting your credit score.

The National Consumer Law Center (NCLC) warns that these products, while marketed as alternatives to payday loans, can often be just as predatory, trapping borrowers in a cycle of debt.

Regulatory Scrutiny and Future Developments

The rapid growth of the instant cash advance industry has attracted regulatory attention. State and federal agencies are beginning to scrutinize the practices of these companies, focusing on transparency and consumer protection.

The Consumer Financial Protection Bureau (CFPB) is actively investigating the industry, examining issues such as hidden fees, automated repayment practices, and the potential for unfair or deceptive practices.

It is anticipated that stricter regulations will be implemented in the coming years, requiring greater transparency and protecting consumers from predatory lending practices.

What's Next?

If you are considering using an instant cash advance, carefully review the terms and conditions, including all fees and repayment schedules. Compare the costs with other financial options, such as a personal loan or a credit card.

Seek advice from a financial advisor or credit counselor to understand the potential risks and benefits. Explore alternative solutions, such as budgeting, negotiating payment plans with creditors, or seeking assistance from community resources.

Stay informed about regulatory developments and consumer alerts related to instant cash advance apps. The landscape is constantly evolving, and it's crucial to protect yourself from potential scams and predatory practices.