Is Capital One Good To Build Credit

In today's economy, establishing a good credit score is crucial for accessing loans, securing favorable interest rates, and even renting an apartment. Millions are searching for reliable methods to build or repair their credit, turning to financial institutions like Capital One for assistance. But is Capital One truly a good option for building credit, and what factors should consumers consider before choosing their products?

The question of whether Capital One is a suitable choice for building credit hinges on a variety of factors, including their product offerings, approval rates, reporting practices, and the financial habits of the individual. This article will delve into the specifics of Capital One's credit-building options, weigh the pros and cons, and analyze the experiences of consumers who have used their services. By examining these aspects, we aim to provide a comprehensive perspective on whether Capital One can be a valuable tool in your credit-building journey.

Capital One's Credit-Building Product Suite

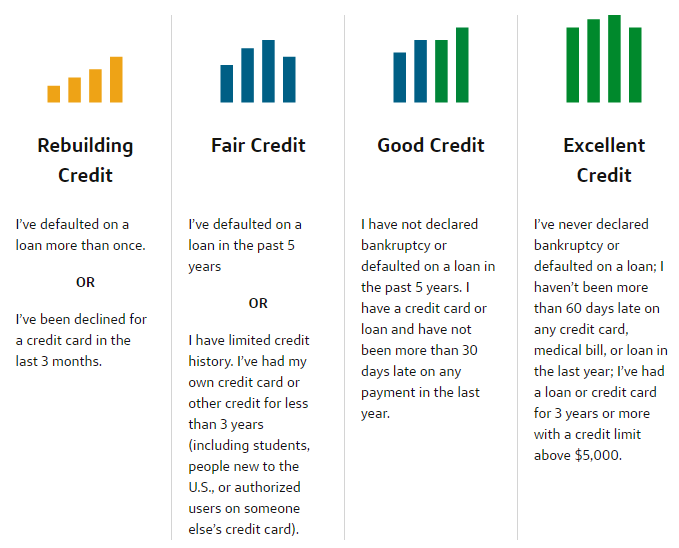

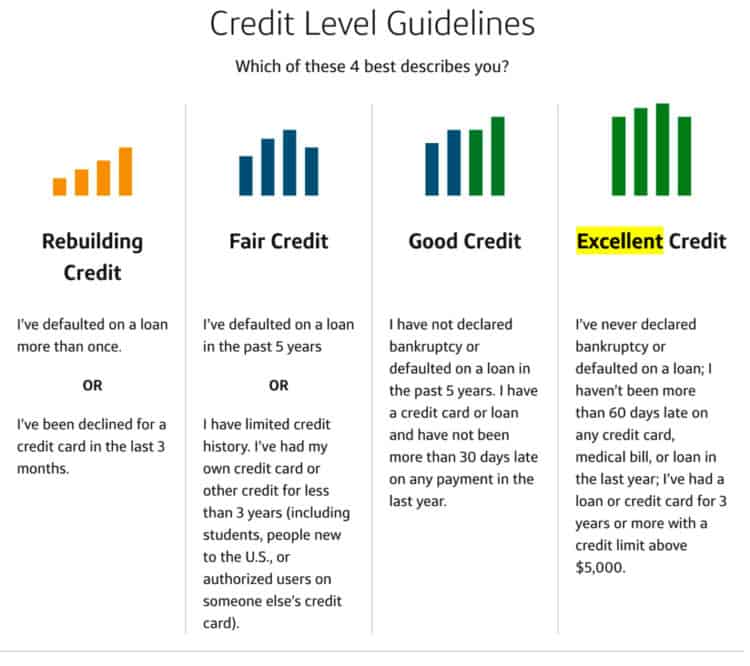

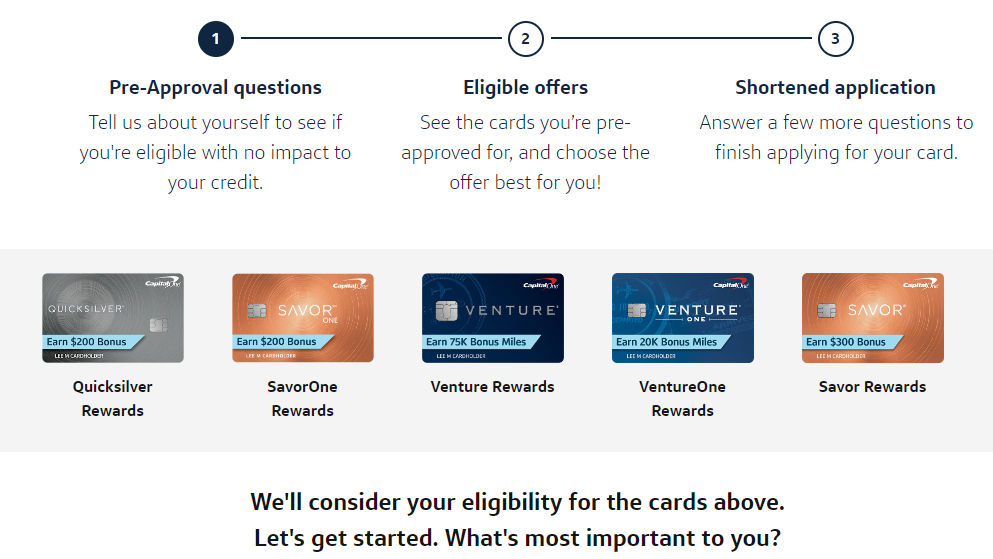

Capital One offers a range of credit cards specifically designed for individuals with limited or no credit history. These include secured credit cards, such as the Capital One Secured Mastercard, and unsecured options targeted towards students or those with fair credit. The availability of these products makes Capital One accessible to a broader spectrum of individuals seeking to establish credit.

Secured credit cards require a security deposit, which typically acts as the credit limit. This deposit mitigates the risk for the lender, making it easier for individuals with poor or no credit to get approved. Unsecured options, while potentially offering higher credit limits without a deposit, usually require a higher credit score or a demonstrated ability to manage credit responsibly.

Key Features and Benefits

One of the main benefits of using Capital One for credit building is their reporting practices. They regularly report credit card activity to the three major credit bureaus: Equifax, Experian, and TransUnion. This consistent reporting is essential for building a positive credit history over time.

Many Capital One credit cards also offer features such as zero fraud liability and access to credit monitoring tools. These tools can help users track their credit score and identify potential issues early on. Some cards offer rewards programs, allowing users to earn cashback or other benefits while building credit.

Potential Drawbacks and Considerations

While Capital One offers numerous advantages, it's crucial to be aware of potential drawbacks. Some of their credit-building cards may have relatively high interest rates, particularly for those with fair credit. High interest rates can lead to debt accumulation if balances are not paid in full each month.

Another consideration is the potential for limited credit limits on some cards, especially secured options. A low credit limit can restrict spending and may make it more difficult to keep credit utilization low, which is an important factor in credit score calculation. Responsible use is paramount, regardless of the card's features.

Alternative Credit-Building Strategies

It's important to remember that Capital One is not the only option for building credit. Other strategies include becoming an authorized user on someone else's credit card account or taking out a credit-builder loan. Credit-builder loans are specifically designed to help individuals establish credit by requiring them to make regular payments on a small loan.

Secured loans, like auto loans or mortgages, can also help build credit, provided payments are made on time. Exploring a variety of options can help individuals find the strategy that best suits their financial situation and goals. A diversified approach may be more effective for some.

Consumer Experiences and Reviews

Consumer experiences with Capital One for credit building are varied. Some users report positive outcomes, noting improvements in their credit scores after consistent on-time payments. Others have faced challenges, such as difficulty getting approved for higher credit limits or dissatisfaction with customer service.

Online reviews and testimonials provide valuable insights into the real-world experiences of Capital One customers. It's beneficial to research and consider multiple perspectives before making a decision. Reading both positive and negative reviews offers a balanced view.

Looking Ahead: The Future of Credit Building

The landscape of credit building is constantly evolving, with new tools and resources emerging regularly. Fintech companies are offering innovative solutions, such as credit-building apps and alternative credit scoring models. Capital One, along with other major financial institutions, will likely continue to adapt to these changes.

Ultimately, whether Capital One is a good choice for building credit depends on the individual's financial circumstances and responsible usage. By carefully evaluating their product offerings, considering the potential drawbacks, and comparing them with other options, consumers can make an informed decision that aligns with their credit-building goals. Diligence and financial literacy are essential to achieving and maintaining a healthy credit profile.