Is Sharekhan A Depository Participant

Imagine a bustling marketplace, not one filled with fruits and vegetables, but with shares and stocks. The air is thick with anticipation, and every transaction, every trade, represents a piece of someone's financial future. In this digital arena, entities like Sharekhan play a vital role, facilitating the smooth flow of investments. But what exactly is their function, and how do they contribute to this intricate ecosystem?

At the heart of the matter: Yes, Sharekhan is indeed a Depository Participant (DP). This essentially means they act as an intermediary between investors and the depositories (like NSDL and CDSL) that hold securities in electronic form. Understanding this role is crucial for anyone navigating the complexities of the Indian stock market.

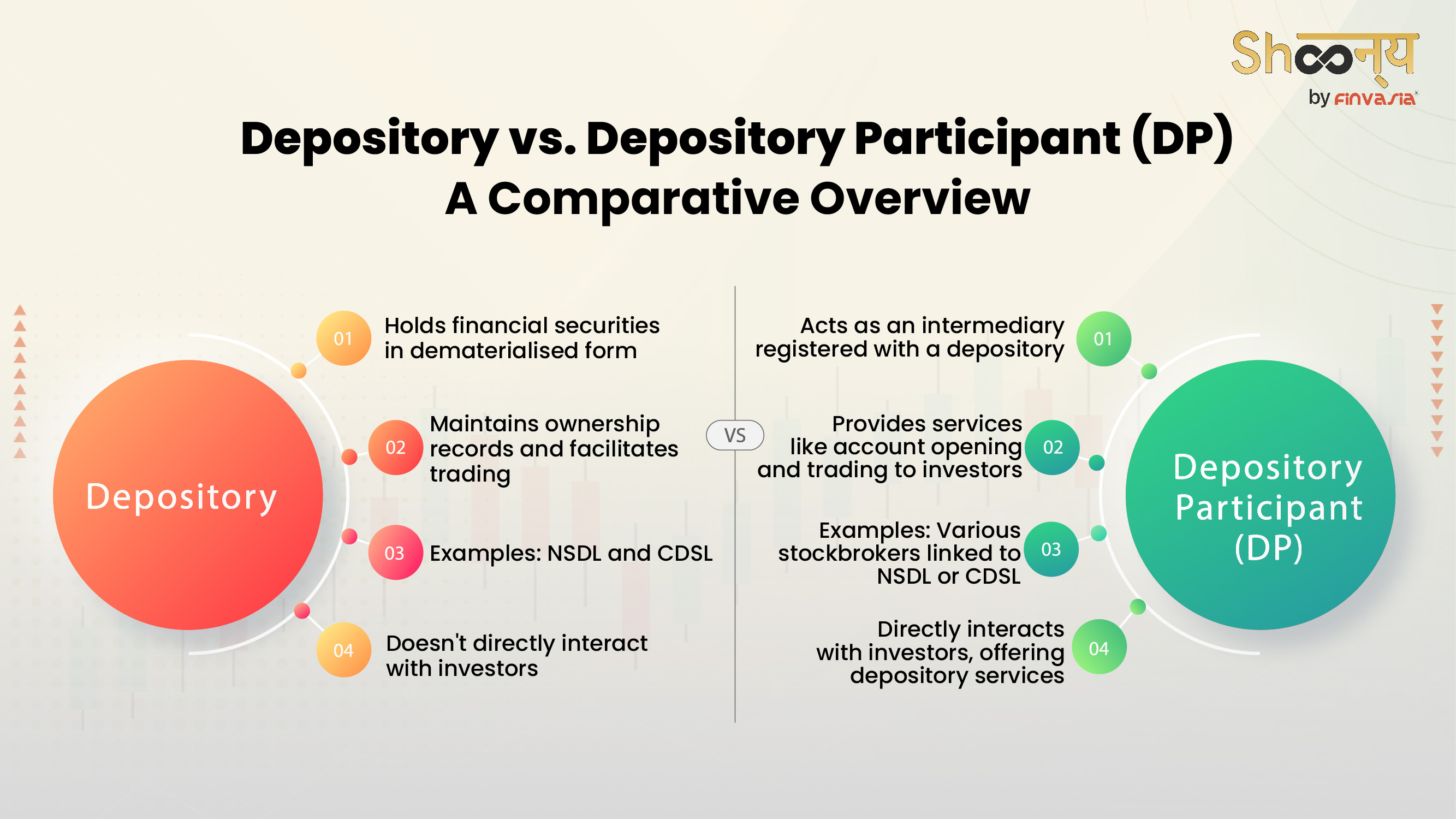

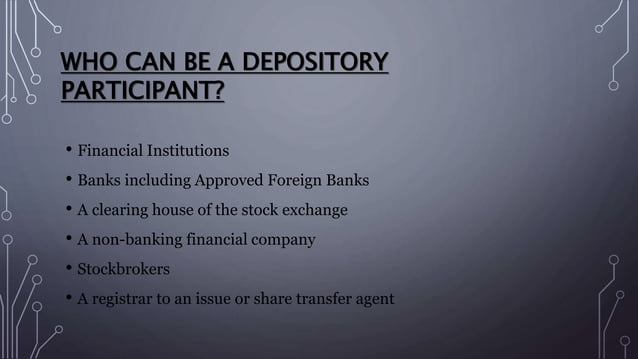

Understanding the Role of a Depository Participant

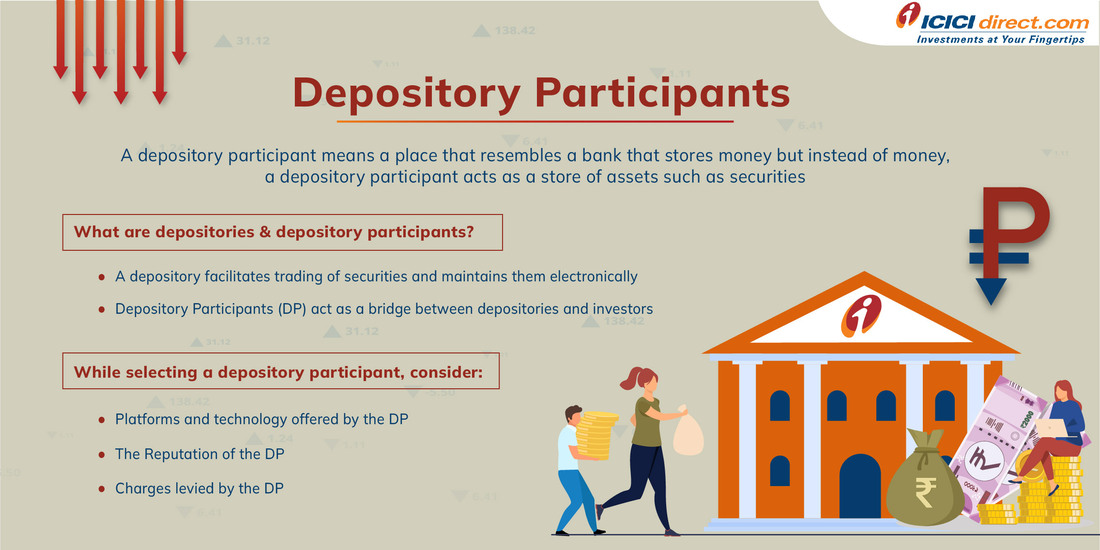

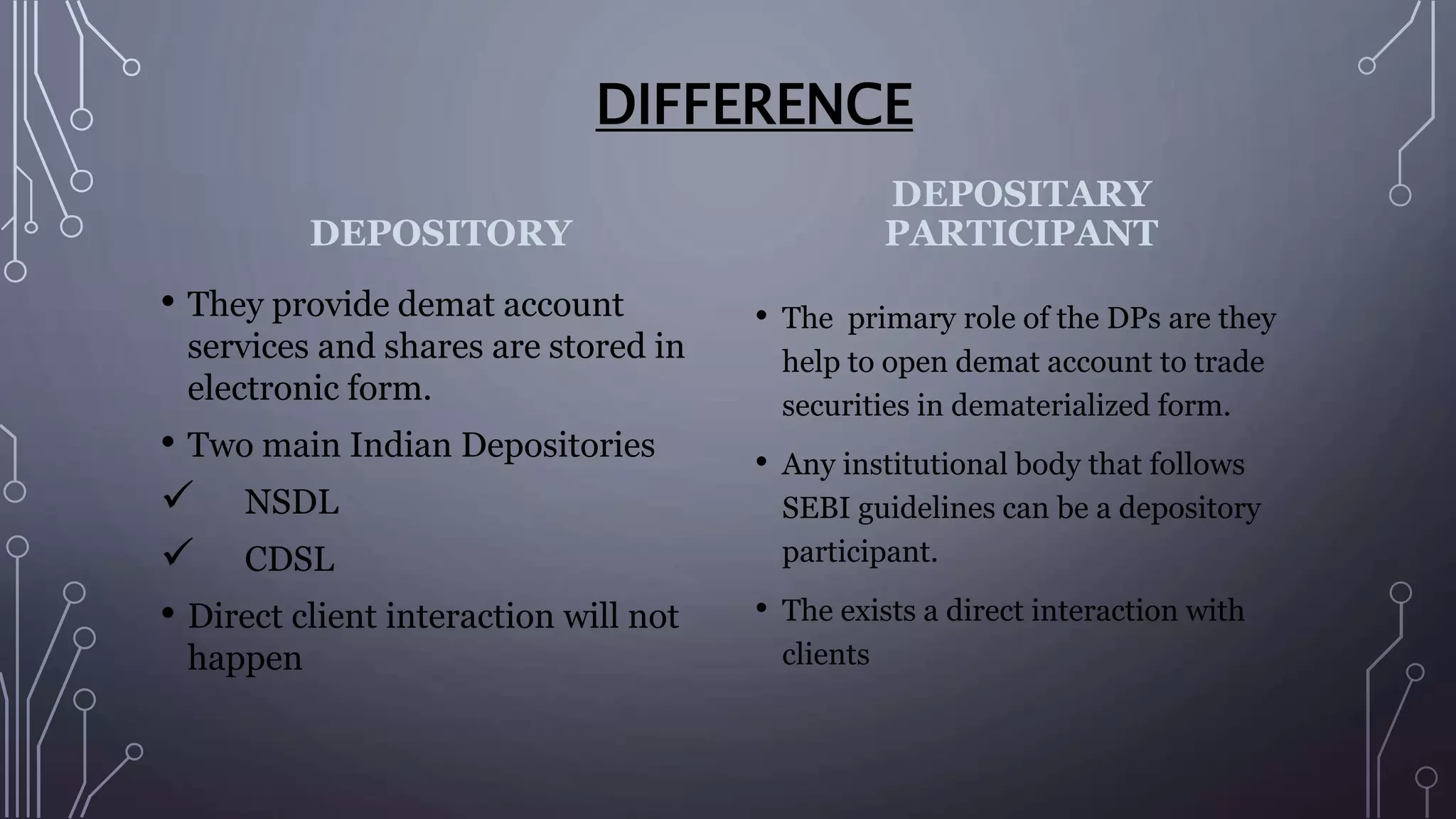

To fully appreciate Sharekhan's function, let's delve deeper into what it means to be a Depository Participant. Think of depositories like banks, but instead of holding money, they hold securities like shares, bonds, and mutual funds in a dematerialized, or electronic, format.

Investors cannot directly interact with these depositories. This is where DPs such as Sharekhan come into the picture, acting as an access point. They provide services like opening demat accounts, facilitating the transfer of securities, and providing statements of holdings.

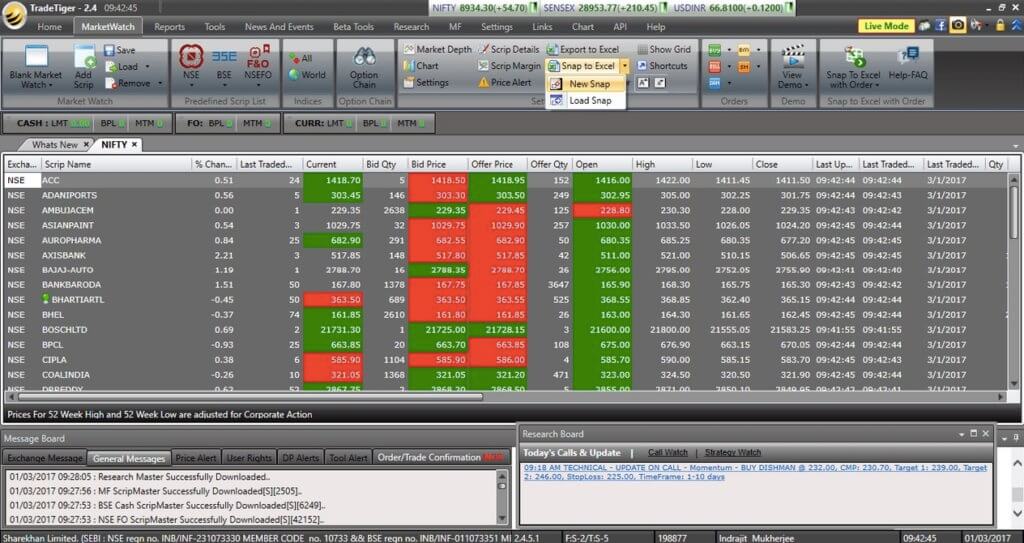

Sharekhan, a well-known name in the Indian broking industry, has been serving investors for many years. They enable individuals to participate in the stock market by providing a platform to buy, sell, and hold securities electronically. They offer a range of services, including online trading, research reports, and investment advisory, leveraging their DP status to ensure seamless transactions.

Significance for Investors

The role of a DP is far from trivial. It is instrumental in ensuring the safety and efficiency of the stock market. Without DPs like Sharekhan, the entire process of buying and selling shares would be significantly more cumbersome and risky.

Consider the alternative: physically handling share certificates, dealing with paperwork, and facing the potential for loss or theft. The dematerialization process, facilitated by DPs, eliminates these concerns, making investing accessible and secure.

By holding securities in electronic form, DPs contribute to faster settlement cycles and reduced transaction costs. This efficiency benefits both investors and the overall market, promoting greater participation and liquidity.

Sharekhan's Contribution to the Market

As a prominent Depository Participant, Sharekhan plays a significant role in broadening access to the Indian stock market. Their extensive network and online platform allow individuals from all corners of the country to participate in wealth creation.

Beyond simply facilitating transactions, Sharekhan also provides educational resources and investment advisory services. These resources empower investors to make informed decisions, contributing to a more sophisticated and resilient market.

"We strive to empower our clients with the knowledge and tools they need to achieve their financial goals," Sharekhan spokesperson once stated, emphasizing their commitment to investor education.

Furthermore, Sharekhan's adherence to regulatory guidelines ensures the safety and integrity of the market. They are subject to strict oversight by SEBI (Securities and Exchange Board of India), ensuring they meet the highest standards of compliance.

The Future of Depository Services

The role of Depository Participants is only set to grow in importance as the Indian stock market continues to evolve. With increasing participation from retail investors and the rise of fintech, DPs will need to adapt and innovate to meet the changing needs of the market.

Expect to see further advancements in technology, such as blockchain and artificial intelligence, being integrated into depository services. These innovations will likely lead to even greater efficiency, transparency, and security in the market.

Ultimately, the success of the Indian stock market hinges on the strength and reliability of its infrastructure. Depository Participants like Sharekhan are a vital component of this infrastructure, ensuring that investments are safe, accessible, and contribute to the overall growth of the economy.