List The Four Phases Of The Business Cycle.

The economy is a constantly fluctuating system. Understanding its cycles is critical for businesses and individuals alike to make informed decisions.

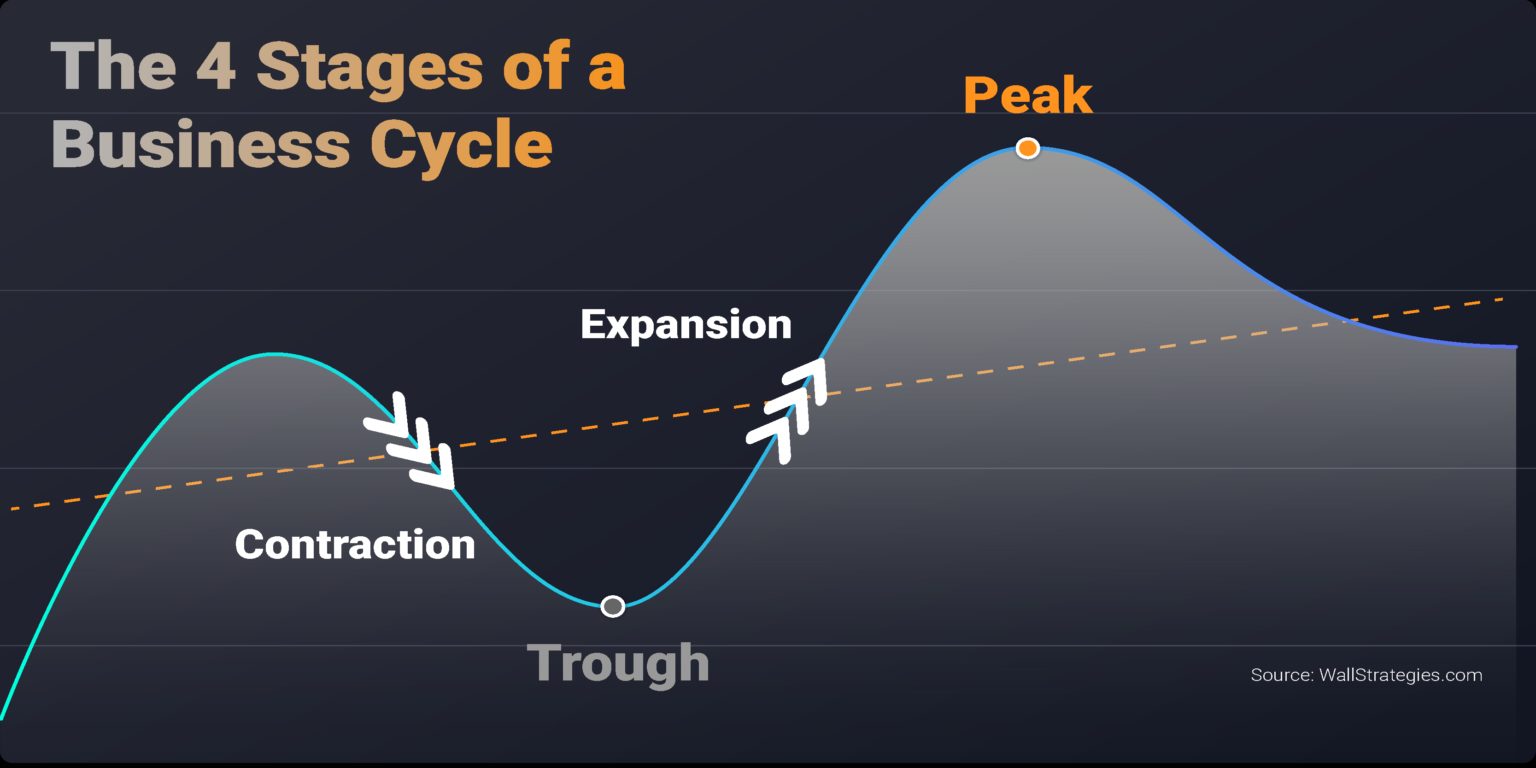

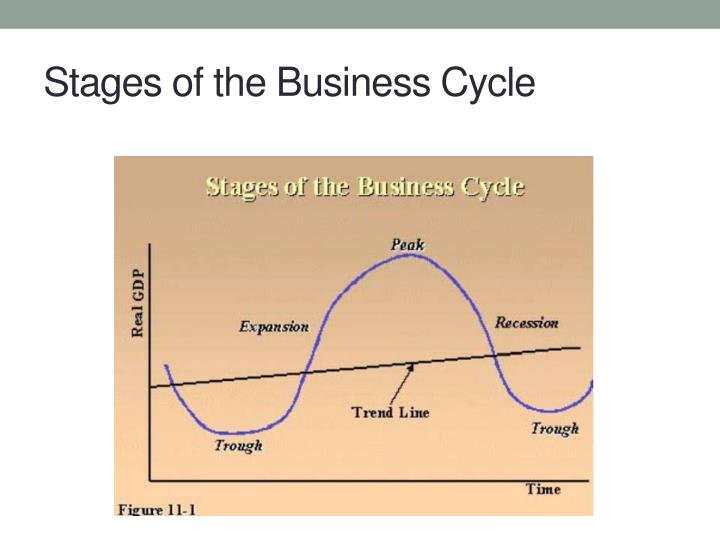

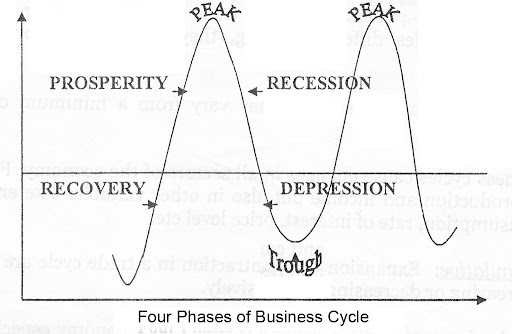

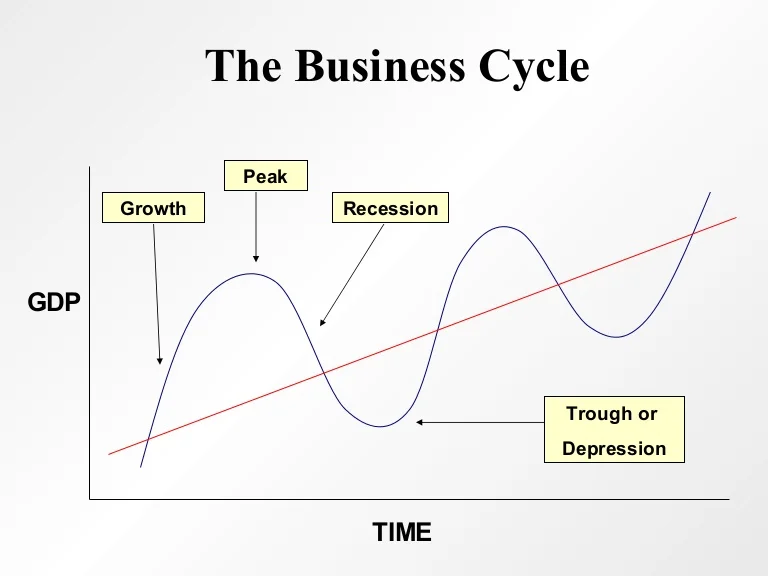

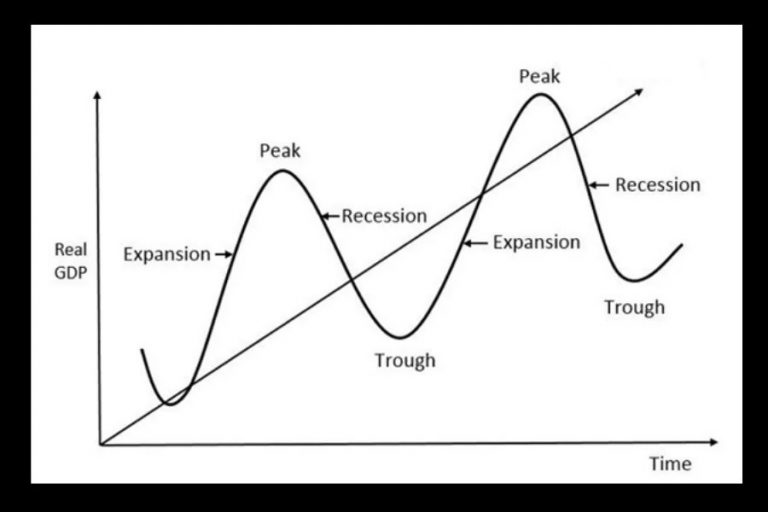

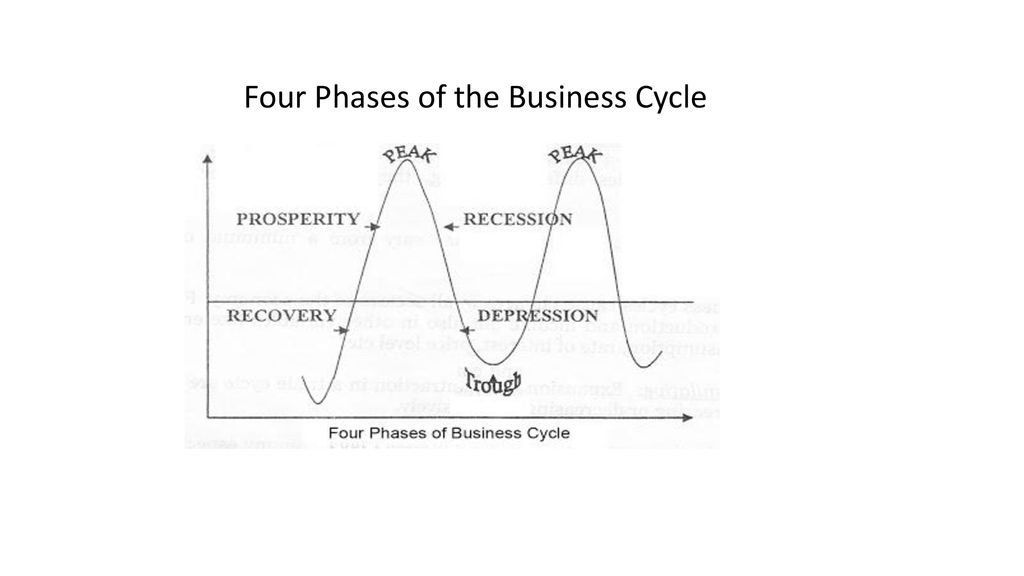

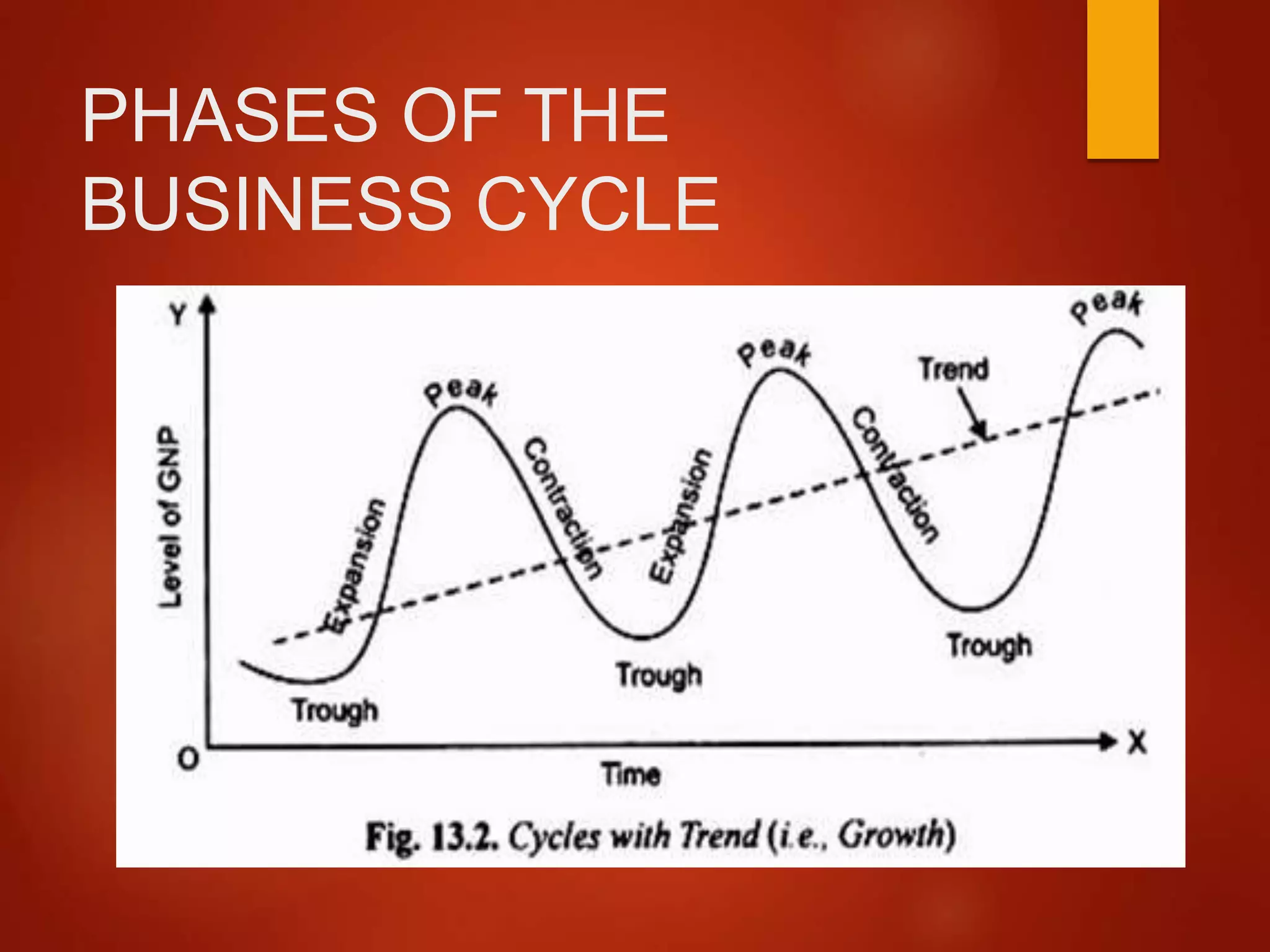

This article breaks down the four distinct phases of the business cycle: expansion, peak, contraction, and trough, providing a concise overview for navigating economic shifts.

Understanding the Business Cycle

The business cycle represents the periodic but irregular movement of economic activity, measured by indicators like GDP and employment. These cycles influence everything from investment strategies to hiring practices. Therefore, understanding them is paramount.

Phase 1: Expansion

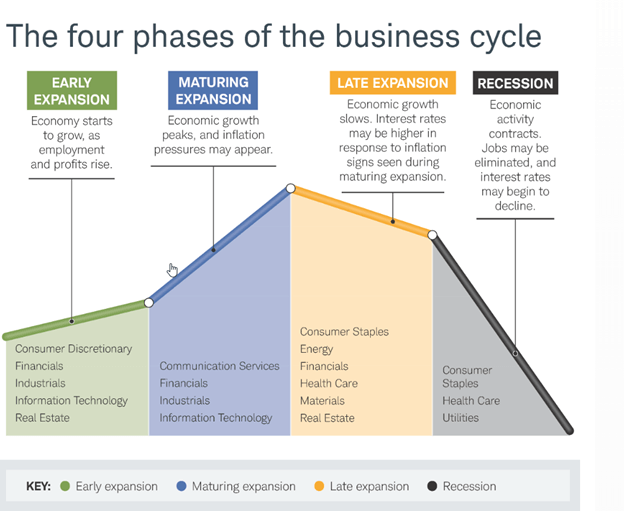

Expansion, also known as recovery, marks a period of economic growth. GDP rises, unemployment falls, and consumer spending increases.

Businesses invest, and new ventures emerge. For instance, from 2009 to 2020, the U.S. experienced an expansion phase following the Great Recession.

Phase 2: Peak

The peak represents the highest point of economic activity in the cycle. It's characterized by full employment, maximum output, and potential inflationary pressures.

At the peak, demand may outstrip supply, causing prices to rise. Think of late 2006 and early 2007, just before the housing market collapse.

Phase 3: Contraction

Contraction, often referred to as recession, is a period of economic decline. GDP falls, unemployment rises, and consumer spending decreases.

Businesses may reduce investment and lay off employees. For example, the 2008 financial crisis triggered a significant contraction, with the U.S. GDP dropping by 4.3% in 2009, according to the Bureau of Economic Analysis.

Phase 4: Trough

The trough is the lowest point of economic activity in the cycle. It marks the end of the contraction and the beginning of a new expansion.

Unemployment is typically high, and consumer confidence is low. Government intervention, such as fiscal stimulus, often plays a key role in initiating the next expansion.

Navigating the Phases: Key Considerations

Understanding these phases helps businesses and investors anticipate and adapt to changing economic conditions. During expansion, growth-oriented strategies are often favored.

Contraction calls for defensive measures, such as cost-cutting and preserving capital. Investors may shift towards more conservative assets. A diversified portfolio, with asset allocation tailored to the specific phase of the business cycle, may prove most beneficial.

The Role of Economic Indicators

Economic indicators provide valuable insights into the current phase of the business cycle. Leading indicators, like consumer confidence and housing permits, can signal future trends.

Coincident indicators, such as employment and industrial production, reflect current economic activity. Lagging indicators, like unemployment rate, confirm past trends.

Next Steps

Monitor economic indicators regularly to stay informed about the current phase of the business cycle. Adapt investment and business strategies accordingly.

Stay tuned for further updates and expert analysis on economic trends. Consult financial professionals for personalized guidance.

/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)

.png)