Multiple Streams Of Income Examples

The pursuit of financial security is increasingly leading individuals to explore avenues beyond traditional employment. Diversifying income streams, once a strategy primarily for the wealthy, is now gaining traction among various demographics. This shift reflects a growing awareness of the vulnerabilities associated with relying solely on a single source of income.

The concept of multiple streams of income revolves around generating revenue from various sources, supplementing or even replacing a primary job. This article will explore several examples of how individuals are implementing this strategy, the benefits it offers, and the potential implications for the future of work.

Understanding Multiple Income Streams

At its core, building multiple income streams is about risk mitigation. Loss of a single income source can be devastating; diversification creates a safety net. This strategy can also allow individuals to pursue passions and build wealth more effectively.

Common Examples of Diversification

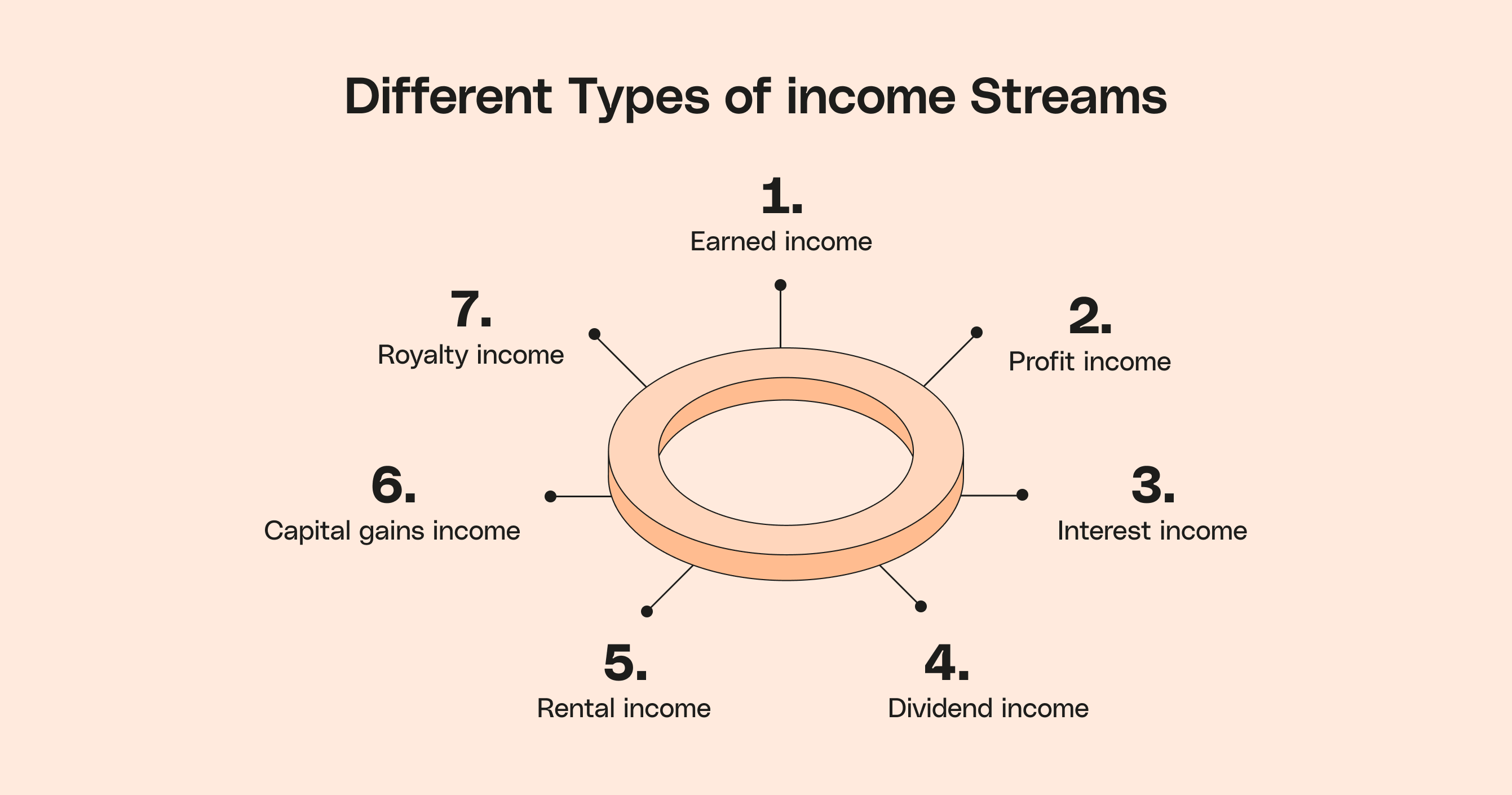

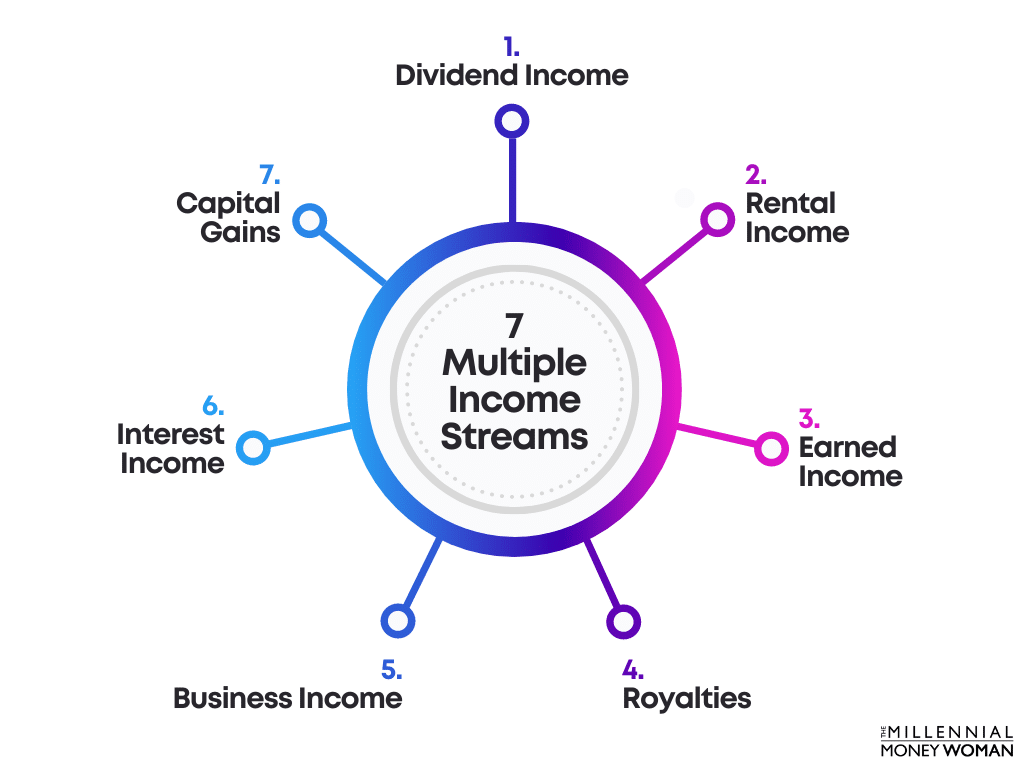

Real Estate Investing: Investing in rental properties is a well-established method for generating passive income. Landlords collect rent while potentially benefiting from property appreciation. This requires upfront capital and ongoing management.

Online Businesses: The digital landscape provides vast opportunities for creating income streams. Examples include blogging, affiliate marketing, and e-commerce. Low overhead and global reach are significant advantages, but success often requires significant effort in building an audience and marketing effectively.

Freelancing and Consulting: Leveraging existing skills to offer services on a contract basis is another popular approach. Freelancing platforms connect individuals with businesses seeking specific expertise. This offers flexibility, but income can be unpredictable.

Creating and Selling Digital Products: Developing and selling digital products such as online courses, ebooks, or software applications can provide a scalable income stream. Once created, these products can be sold repeatedly with minimal additional effort. Effective marketing is crucial for success.

Investing in Stocks and Bonds: Although it carries risk, investing in the stock market can generate passive income through dividends and capital appreciation. Diversifying investments across different asset classes can help to mitigate risk. Professional advice is often recommended, especially for beginners.

The Impact and Considerations

The rise of multiple income streams is partly fueled by the gig economy and the increasing availability of online resources. These factors have lowered the barriers to entry for aspiring entrepreneurs. However, managing multiple income streams requires dedication, time management, and a solid understanding of personal finances.

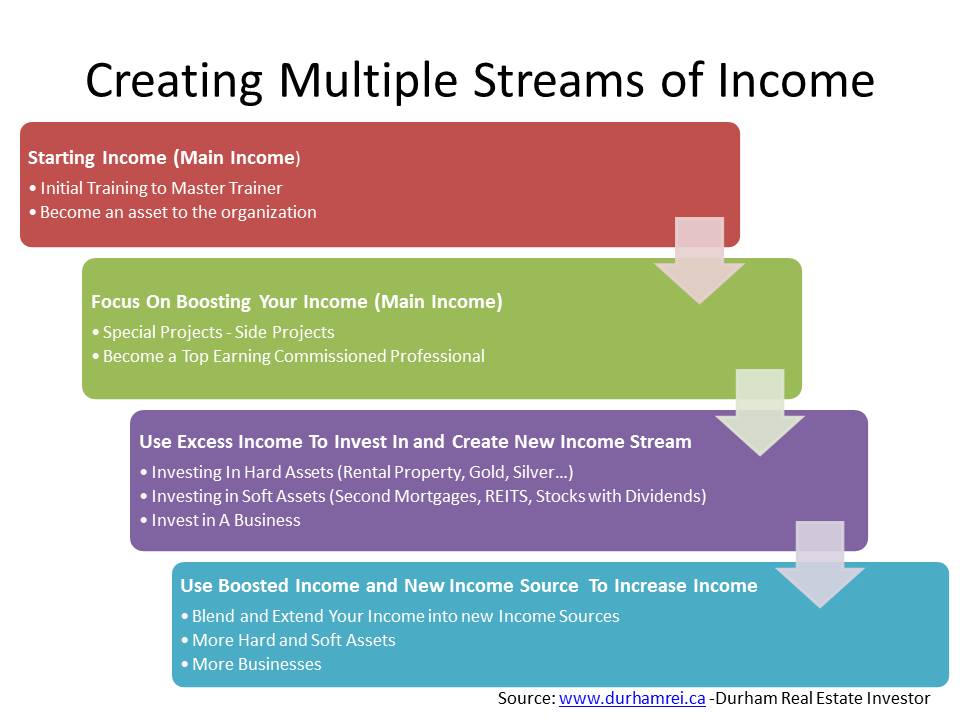

Financial experts often advise individuals to start small and gradually build additional income streams. Overextending oneself can lead to burnout and decreased productivity. Thorough research and planning are essential for long-term success.

"Building multiple streams of income can offer financial freedom and security, but it requires discipline and a strategic approach," says Jane Doe, a financial advisor at Acme Investments. "It's important to assess your skills, interests, and resources before diving in."

The Future of Work

The trend toward multiple income streams is likely to continue as the nature of work evolves. Remote work, technological advancements, and a growing desire for flexibility are contributing to this shift. The traditional model of a single employer may become increasingly obsolete.

For businesses, this trend presents both challenges and opportunities. Companies may need to adapt their hiring practices to attract and retain talent who are also pursuing other ventures. At the same time, access to a wider pool of skilled individuals through freelancing platforms can be advantageous.

Ultimately, the decision to pursue multiple income streams is a personal one. However, understanding the various options and potential benefits can empower individuals to take control of their financial futures. As the economy continues to change, diversification may become an increasingly important strategy for achieving long-term financial security.