Operating Cash Flows Include Which Of The Following

Imagine strolling through a bustling marketplace, the air thick with the scent of spices and the sounds of vendors hawking their wares. Each transaction, each exchange of goods for cash, represents a tiny heartbeat in the flow of commerce. But what if you wanted to understand the overall health of this marketplace, to see if it's truly thriving? In the world of business, understanding operating cash flows is like taking the pulse of that marketplace – it tells you how well a company is generating cash from its core business activities.

At its core, operating cash flow is the lifeblood of any organization. It shows the amount of cash a company generates from its normal business operations. Understanding what constitutes operating cash flow is critical for investors, analysts, and even business owners to make sound financial decisions. But what exactly makes up this vital metric?

Decoding Operating Cash Flow

Operating cash flow (OCF) represents the cash a company generates from its regular business activities. It's the cash coming in and going out as a direct result of selling goods or services. Think of it as the financial engine that keeps the business running.

Unlike net income, which can be influenced by accounting practices and non-cash expenses, OCF offers a clearer picture of a company’s ability to generate cash. This makes it a crucial indicator of a company's financial health and sustainability.

The Direct Method

One way to calculate operating cash flow is the direct method. This approach tallies up all the actual cash inflows and outflows from operating activities.

Cash inflows primarily come from customer payments for goods or services. On the other hand, cash outflows include payments to suppliers, employees, and other operating expenses.

The difference between these inflows and outflows equals the net cash flow from operations, giving a clear and straightforward view of the cash generated from these core activities.

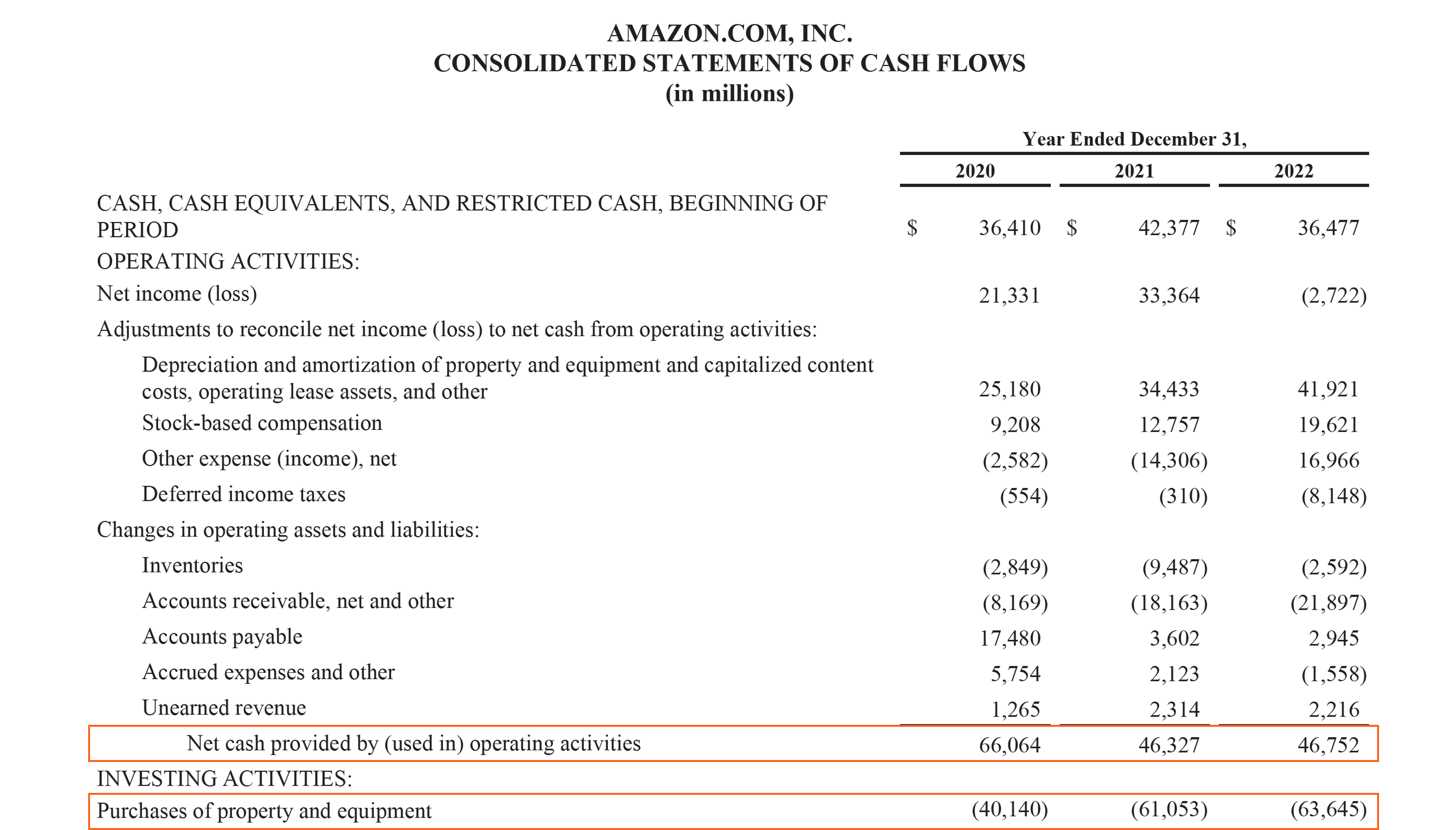

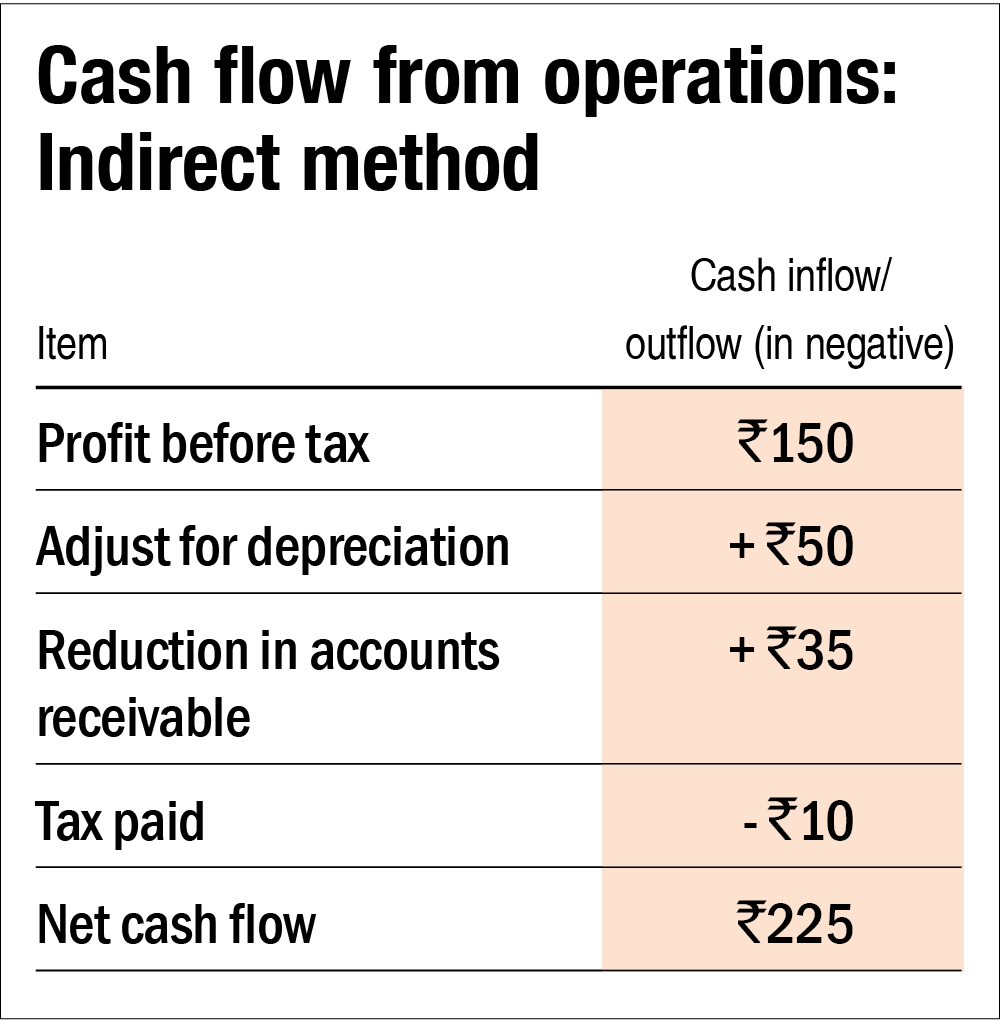

The Indirect Method

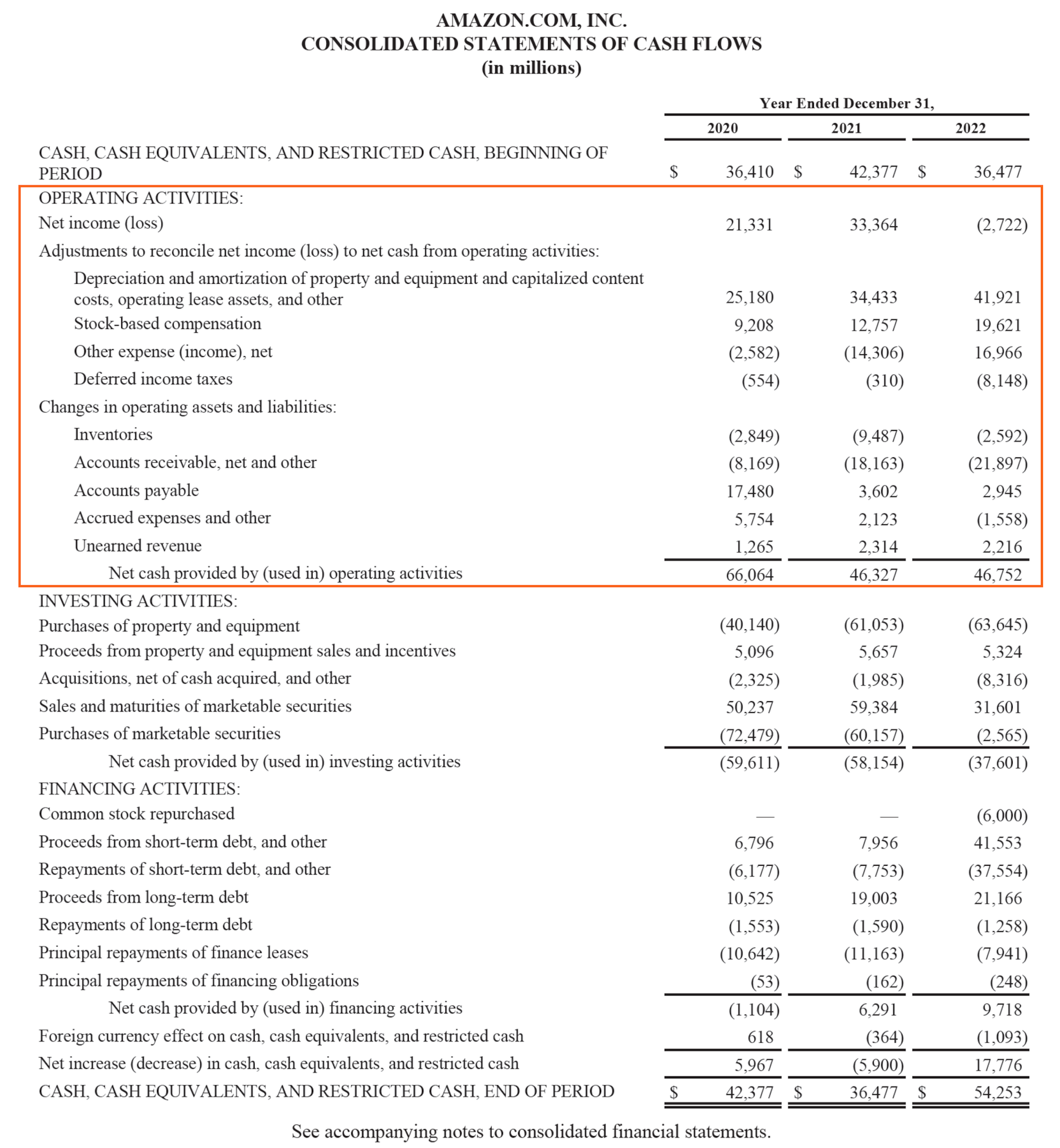

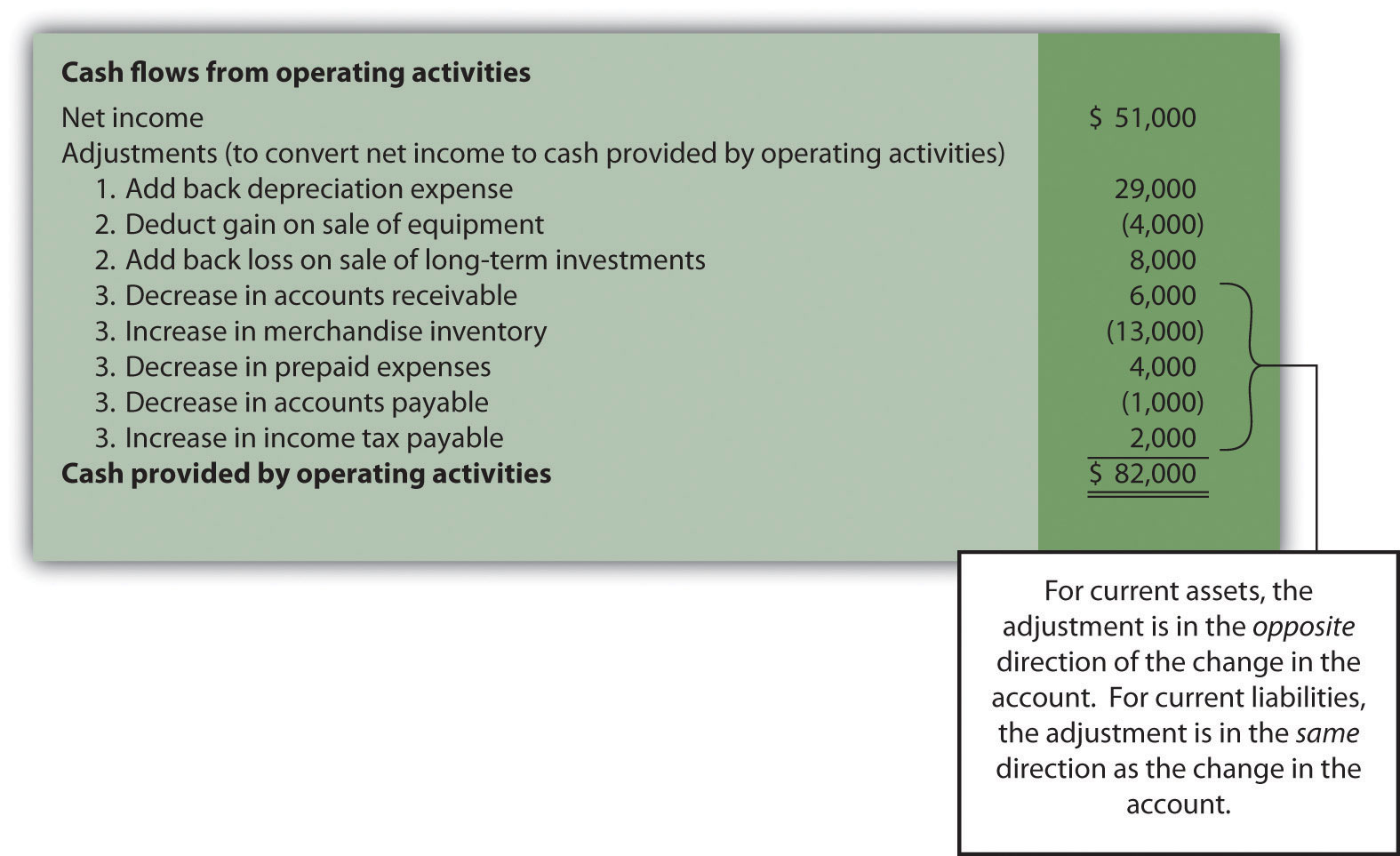

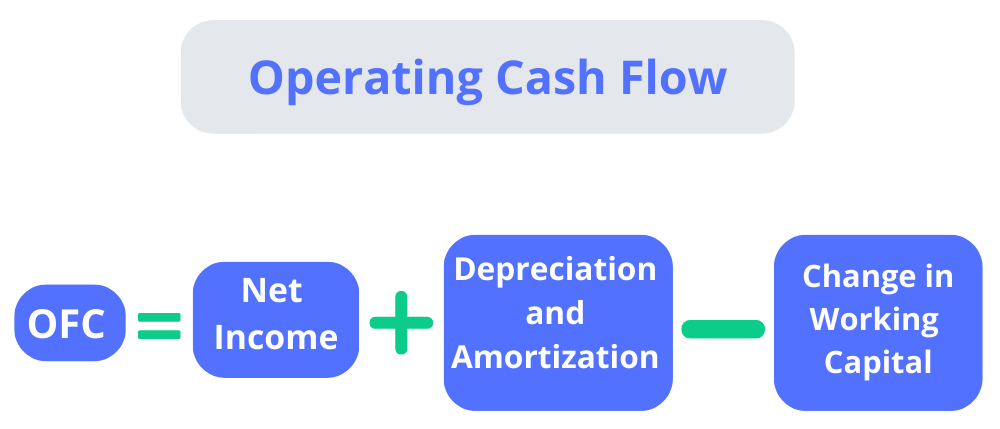

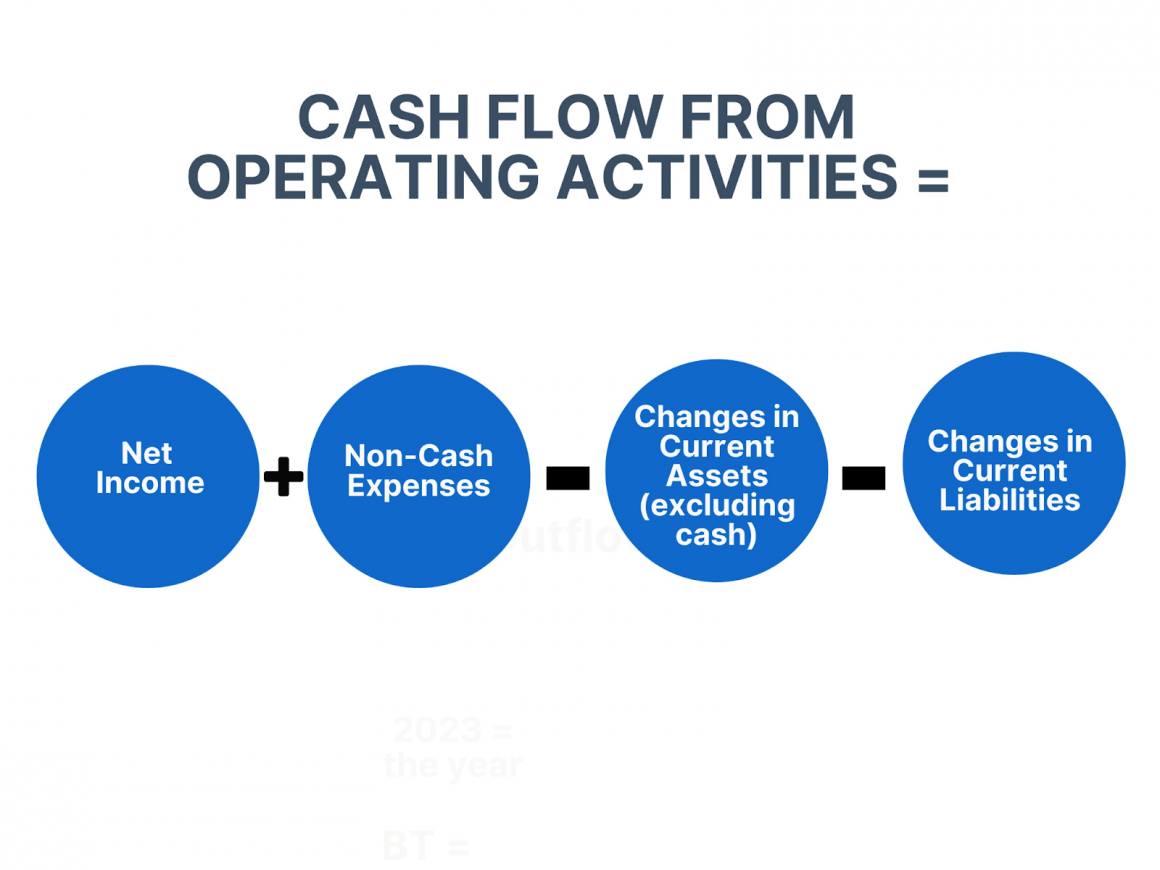

The more commonly used method is the indirect method. It starts with net income, found on the income statement, and adjusts it to account for non-cash items and changes in working capital.

Non-cash items, such as depreciation and amortization, are added back to net income because they reduced net income but didn't involve an actual outflow of cash. Changes in working capital accounts, like accounts receivable and accounts payable, are also considered.

Increases in accounts receivable (money owed to the company) are subtracted, as this indicates that sales have been made but cash hasn't yet been received. Conversely, increases in accounts payable (money owed by the company) are added, as this indicates that expenses have been incurred but not yet paid.

What's Included in Operating Cash Flows?

So, what exactly falls under the umbrella of operating cash flows? The key is to focus on the transactions directly related to the company's core business.

Here are some of the most common items included:

- Cash Receipts from Sales: This is the most obvious component – the cash received from customers for goods sold or services rendered.

- Cash Payments to Suppliers: This includes payments made to suppliers for the raw materials, inventory, and other goods needed to produce and sell the company's products.

- Cash Payments to Employees: Wages, salaries, and benefits paid to employees directly involved in the operation of the business are included here.

- Cash Payments for Operating Expenses: This encompasses a wide range of expenses necessary to run the business, such as rent, utilities, marketing, and administrative costs.

- Interest Payments: Although sometimes debated, interest payments are generally considered part of operating activities.

- Income Tax Payments: Similarly, payments for income taxes are also typically included in operating cash flows.

What's Excluded from Operating Cash Flows?

It's equally important to understand what's *not* included in operating cash flows. Certain cash flows fall under different categories: investing and financing activities.

Investing activities involve the purchase and sale of long-term assets, such as property, plant, and equipment (PP&E). These are not part of the day-to-day operations of the business.

Financing activities relate to how the company is funded. This includes activities like borrowing money, issuing stock, and paying dividends. These are separate from the core operations.

Examples of Excluded Items

Here are some specific examples of items excluded from operating cash flows:

- Purchase of Equipment: This is an investing activity, as it involves acquiring a long-term asset.

- Sale of Land: Similarly, selling land is an investing activity.

- Issuance of Stock: Raising capital through the sale of stock is a financing activity.

- Repurchase of Stock: Buying back company stock is also a financing activity.

- Payment of Dividends: Distributing profits to shareholders through dividends is a financing activity.

The Significance of Operating Cash Flow

Understanding operating cash flow is crucial for several reasons. It provides insights into a company's financial health and performance that other metrics might miss.

Financial Health: A consistently positive OCF indicates that the company is generating enough cash from its core business to cover its operating expenses. This is a sign of a healthy, sustainable business.

Debt Repayment: Strong OCF enables a company to service its debt obligations more easily. This reduces the risk of financial distress.

Investment Opportunities: A healthy OCF provides the company with the flexibility to invest in future growth opportunities, such as new product development, expansion into new markets, or acquisitions.

Dividend Payments: Consistent dividend payments depend on a company’s ability to generate strong OCF. This attracts and retains investors.

According to the Securities and Exchange Commission (SEC), understanding a company's cash flow statement, including operating cash flow, is a key aspect of assessing its financial performance.

Analyzing Operating Cash Flow

Simply looking at the absolute value of OCF isn't enough. It's important to analyze it in relation to other financial metrics and over time.

OCF Margin: Dividing OCF by revenue provides the OCF margin. This helps understand the profitability and efficiency of the business. A higher margin indicates that the company is generating more cash per dollar of revenue.

Free Cash Flow: Subtracting capital expenditures (investments in PP&E) from OCF yields free cash flow (FCF). This represents the cash available to the company after making necessary investments to maintain its operations.

Trend Analysis: Comparing OCF over several periods can reveal important trends. A consistent increase in OCF indicates a strengthening business, while a decline might signal potential problems.

Real-World Examples

Consider two hypothetical companies: TechCo and RetailCorp. TechCo, a software company, consistently generates strong OCF due to its high profit margins and efficient operations.

This allows TechCo to invest heavily in research and development, fueling further innovation and growth. RetailCorp, on the other hand, operates in a highly competitive industry with lower margins.

Its OCF is more volatile and sensitive to economic conditions. It faces challenges in generating sufficient cash to fund its operations and expansion plans. These examples illustrate the practical implications of strong versus weak OCF.

The Investor's Perspective

For investors, OCF is a critical metric for evaluating investment opportunities. A company with a strong and consistent OCF is generally considered a more attractive investment.

This indicates that the company is financially stable and capable of generating returns. In contrast, a company with a weak or declining OCF may be a riskier investment.

It might struggle to meet its financial obligations and generate value for shareholders. Before investing, review the cash flow statement, particularly operating cash flow.

Conclusion

In the complex world of finance, understanding the nuances of operating cash flow is paramount. It provides a clear and vital perspective on a company’s ability to generate cash from its core business operations.

By understanding what's included and excluded from this metric, stakeholders can gain valuable insights into a company's financial health, sustainability, and growth potential. So, next time you analyze a company’s financials, remember that operating cash flow is more than just a number – it's the heartbeat of the business.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)