Preventative Care Management Program Tax Credit

Taxpayers alert: A new tax credit designed to incentivize preventative care management is now available, offering potential savings for individuals investing in proactive health measures. This credit aims to alleviate the financial burden associated with preventative healthcare, encouraging early detection and management of potential health issues.

Preventative Care Management Program Tax Credit: Key Details

The Preventative Care Management Program Tax Credit, enacted on [Insert Date, e.g., January 1, 2024], allows eligible taxpayers to claim a credit for qualified expenses related to preventative healthcare services. The credit is intended to reduce healthcare costs and promote healthier lifestyles through early intervention and management.

Who is Eligible?

Eligibility extends to individuals and families who incur qualifying expenses for preventative care management programs. These programs must meet specific criteria, focusing on early detection, risk assessment, and personalized health management strategies.

Consult a tax professional or refer to IRS guidelines for comprehensive eligibility requirements and income limitations, if any.

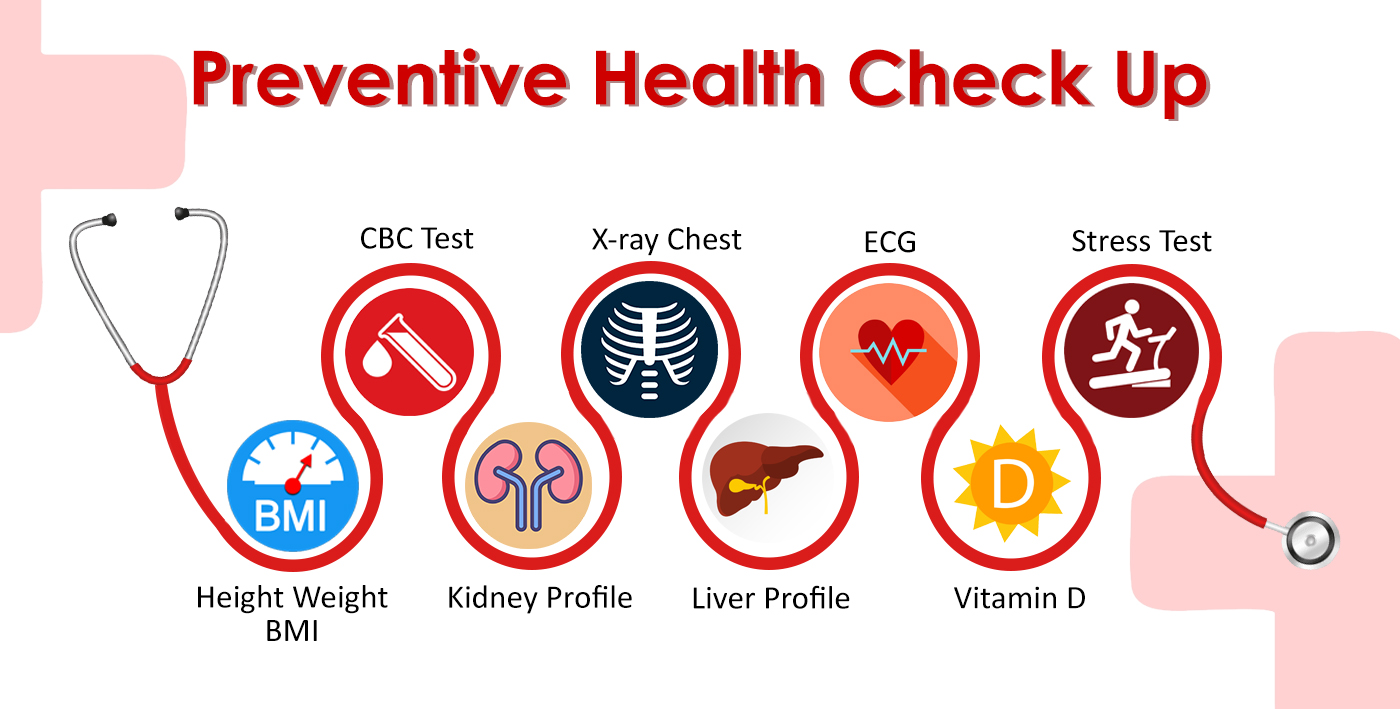

What Expenses Qualify?

Qualifying expenses include costs associated with approved preventative care management programs. This may encompass health risk assessments, personalized coaching, chronic disease management, and early detection screenings.

Review IRS guidelines for a detailed list of covered services and limitations. Keep detailed records and receipts for all qualified expenses.

Where to Claim the Credit?

The credit is claimed when filing your federal income tax return. Complete the designated form (e.g., Form 8962, Premium Tax Credit) and submit it with your return. Seek professional guidance from a certified tax advisor for personalized instructions.

When to Claim the Credit?

Claim the credit annually when filing your federal income tax return for the tax year in which the qualified expenses were incurred. Filing deadlines apply, typically April 15th, unless an extension is filed.

How Much is the Credit Worth?

The value of the credit varies depending on individual circumstances and qualified expenses. Consult IRS guidelines or a tax professional to determine the potential credit amount based on your specific situation.

Preliminary estimations suggest the credit could offset a significant portion of expenses, encouraging greater participation in preventative programs. Exact figures will depend on the taxpayer's individual profile.

Understanding Preventative Care Management Programs

These programs are designed to identify and manage potential health risks before they escalate into serious conditions. They often involve personalized health assessments, lifestyle coaching, and regular screenings. Early intervention can improve health outcomes and reduce overall healthcare costs.

According to the CDC, preventative care plays a crucial role in reducing the burden of chronic diseases.

Documenting Your Expenses

Maintain meticulous records of all expenses related to preventative care management programs. This includes receipts, invoices, and documentation from healthcare providers.

Accurate record-keeping is essential for claiming the credit and supporting your tax return in the event of an audit.

Consulting a Tax Professional

Tax laws can be complex, so it is advisable to consult a qualified tax professional for personalized guidance. They can assess your eligibility, determine the credit amount, and ensure proper filing.

A tax professional can also advise on maximizing your credit and avoiding potential errors.

Resources and Further Information

Visit the IRS website (www.irs.gov) for detailed information on the Preventative Care Management Program Tax Credit. Review relevant publications, forms, and instructions. Consider seeking guidance from a qualified tax professional or financial advisor.

Act now to take advantage of this opportunity to reduce your tax burden while investing in your health. Consult with healthcare and tax professionals to understand how this credit can benefit you and contribute to your overall well-being.

![Preventative Care Management Program Tax Credit [Infographic] The Impact of Preventative Care: A Visual Representation](https://greensensebilling.com/wp-content/uploads/2024/02/The-Impact-of-Preventative-Care-768x1024.jpg)