Questions To Ask Before Buying A Small Business

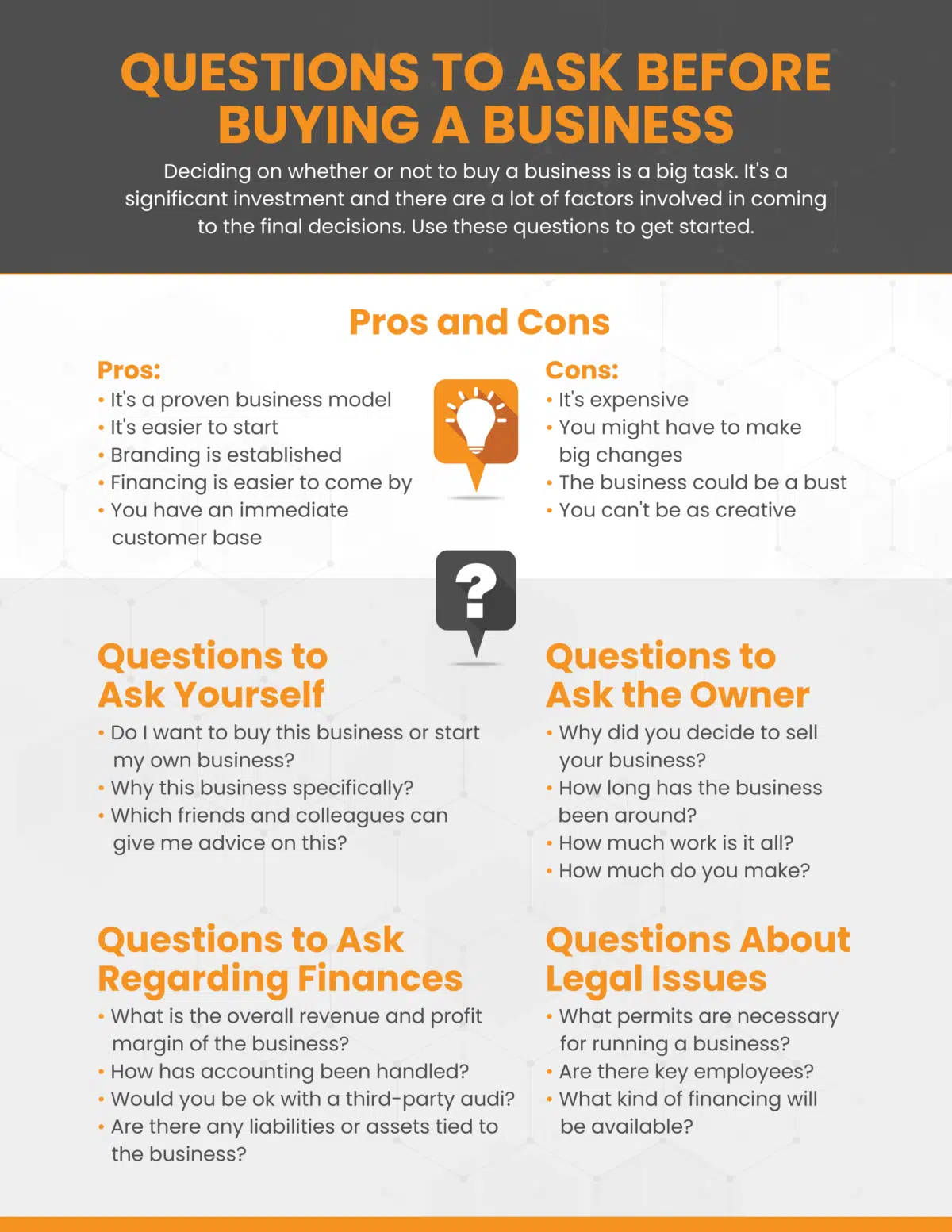

The allure of owning a small business is strong, promising independence and the potential for significant financial reward. Yet, the path to entrepreneurship is often paved with unforeseen challenges and risks. Failing to conduct thorough due diligence can quickly turn a dream into a financial nightmare.

Before signing on the dotted line, prospective buyers must ask the right questions and carefully analyze the answers. This article will explore crucial inquiries that can help potential owners navigate the complexities of acquiring a small business, ensuring a more informed and successful transition.

Financial Health and Performance

A deep dive into the financial records is paramount. Request at least three to five years of financial statements, including profit and loss statements, balance sheets, and cash flow statements. Analyze these documents for trends, inconsistencies, and potential red flags.

"Understanding the true financial performance of the business is critical," says Maria Sanchez, a certified public accountant specializing in small business acquisitions. "Don't just rely on the seller's word. Verify the information with independent audits and professional assessments."

Key Questions to Ask:

- What is the business's average gross revenue and net profit over the past 3-5 years?

- What are the key cost drivers and are they sustainable?

- Are there any outstanding debts, loans, or liens against the business?

- What is the company's current cash flow situation?

- Have there been any significant changes in accounting practices?

Operational Considerations

Beyond the numbers, understanding the day-to-day operations is equally vital. Investigate the business's processes, systems, and infrastructure to identify potential areas for improvement or concern. Meet with key employees to gauge their experience, loyalty, and potential for retention.

Operational efficiency directly impacts profitability. Therefore, a thorough assessment of the business's current operational state is crucial for forecasting future performance.

Key Questions to Ask:

- What are the business's core operational processes?

- What technology and systems are in place?

- Who are the key employees and what are their roles?

- What are the business's current inventory levels and management practices?

- Are there any existing contracts with suppliers, vendors, or customers?

Legal and Regulatory Compliance

Ensure the business is operating in full compliance with all applicable laws and regulations. Conduct a thorough legal review to identify any potential liabilities, lawsuits, or regulatory issues. This includes environmental regulations, labor laws, and industry-specific licensing requirements.

"Ignoring legal compliance can lead to significant fines and legal battles," warns David Lee, a business attorney specializing in mergers and acquisitions. "A comprehensive legal review is a non-negotiable step in the due diligence process."

Key Questions to Ask:

- Are there any pending lawsuits or legal claims against the business?

- Is the business compliant with all applicable environmental regulations?

- Are all employees properly classified and paid according to labor laws?

- Does the business have all the necessary licenses and permits?

- Are there any outstanding tax liabilities?

Market Analysis and Competition

Evaluate the business's position within its market and assess the competitive landscape. Understand the target market, customer demographics, and market trends. Identify key competitors and analyze their strengths and weaknesses.

A strong market position and competitive advantage are essential for long-term success. Analyze the business's marketing strategies and customer acquisition costs.

Key Questions to Ask:

- What is the size and growth rate of the target market?

- Who are the key competitors and what are their market shares?

- What are the business's strengths and weaknesses compared to its competitors?

- What are the current market trends and how are they impacting the business?

- What is the business's customer acquisition cost and customer retention rate?

Transition and Future Outlook

Negotiate a clear and comprehensive transition plan with the seller. Determine the level of support and training that will be provided to ensure a smooth handover. Develop a strategic plan for the future of the business, including goals, objectives, and key performance indicators.

"A successful transition is crucial for maintaining customer relationships and employee morale," emphasizes Sarah Kim, a business consultant specializing in post-acquisition integration. "Communicate openly and transparently with all stakeholders throughout the process."

Key Questions to Ask:

- What is the seller's plan for transitioning the business to new ownership?

- What level of support and training will the seller provide?

- What are the key challenges and opportunities facing the business in the future?

- What are the new owner's goals and objectives for the business?

- How will the new owner communicate with employees, customers, and suppliers during the transition?

Acquiring a small business is a significant investment that demands careful consideration and thorough due diligence. By asking the right questions and seeking expert advice, potential buyers can significantly increase their chances of a successful and rewarding entrepreneurial journey. Remember, informed decisions are the cornerstone of sound business ownership.

![Questions To Ask Before Buying A Small Business 3 questions to ask before buying a business [infographic]](https://blog.jpabusiness.com.au/hs-fs/hubfs/3. Infographics and cheat sheets/3 questions to ask yourself before buying a business.png?width=300&name=3 questions to ask yourself before buying a business.png)