Software For Small Business Accounting

Small business owners, often juggling multiple responsibilities, are increasingly turning to specialized accounting software to streamline their financial operations. These tools offer a range of features designed to simplify bookkeeping, manage invoices, track expenses, and generate financial reports. This shift reflects a growing recognition of the importance of accurate financial management for business success.

The adoption of these digital solutions is not merely a trend; it's a strategic move with potential to transform how small businesses operate and compete. These platforms promise to boost efficiency, improve accuracy, and provide valuable insights for informed decision-making. What are the key benefits, who stands to gain the most, where is this adoption most prevalent, when did this trend accelerate, why is it happening, and how does it impact the broader economic landscape? This article seeks to answer these questions.

Benefits of Accounting Software for Small Businesses

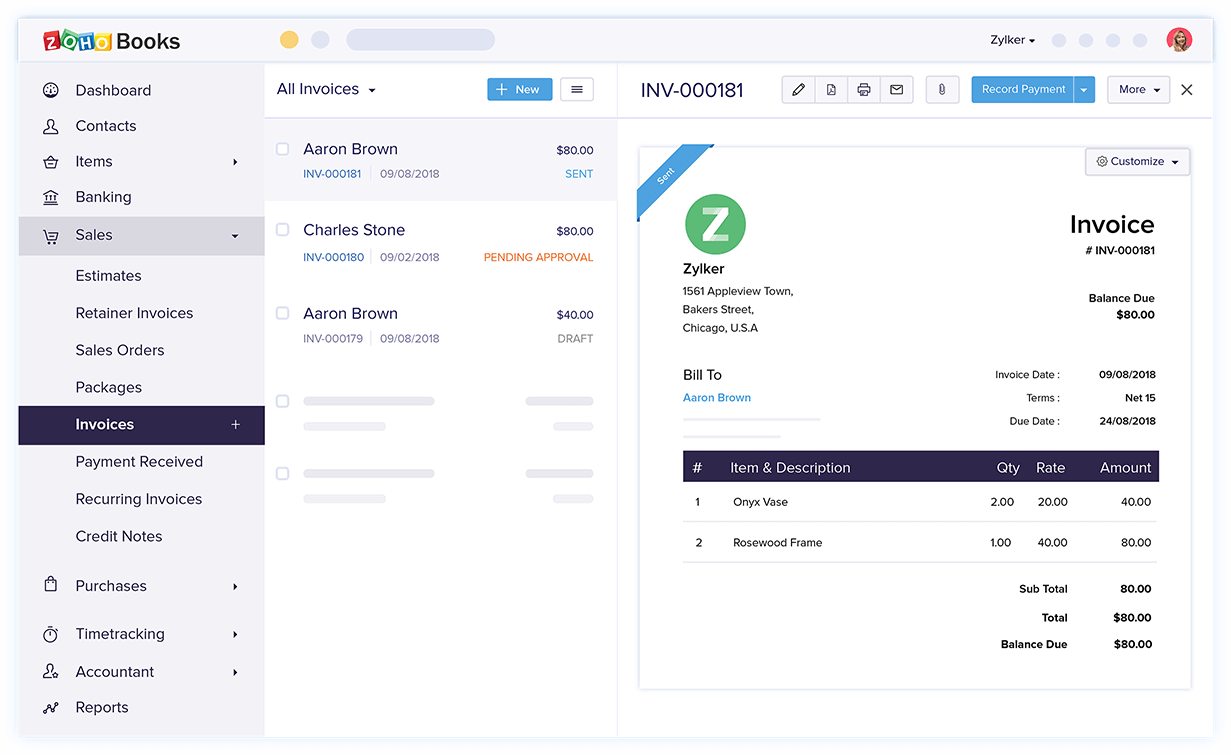

Accounting software offers a multitude of advantages for small businesses. One of the most significant is automation, which reduces manual data entry and minimizes the risk of human error.

Automated processes, such as bank reconciliation and invoice generation, save time and free up business owners to focus on core activities. According to a recent study by Gartner, businesses using accounting software reported a 25% reduction in time spent on bookkeeping tasks.

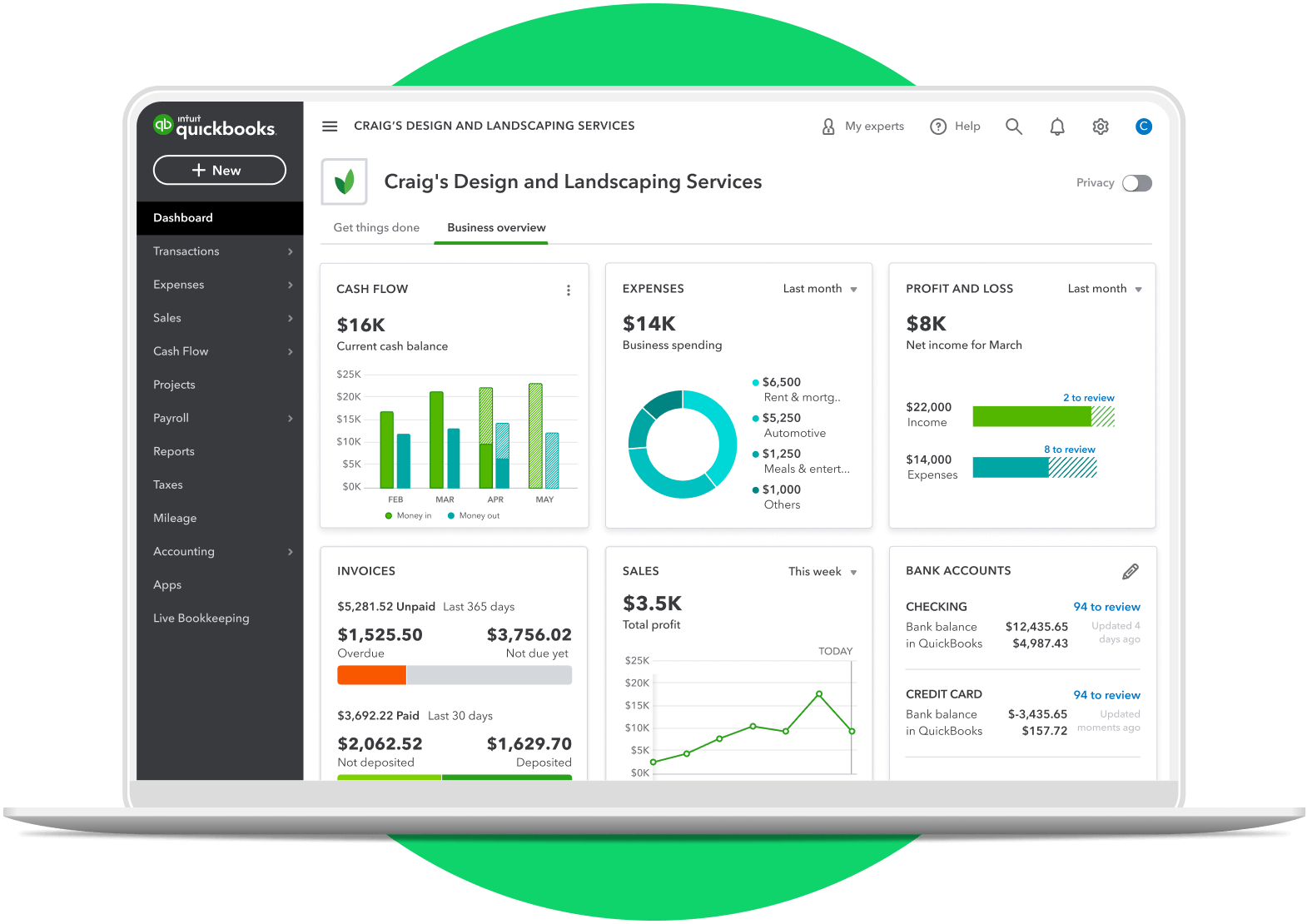

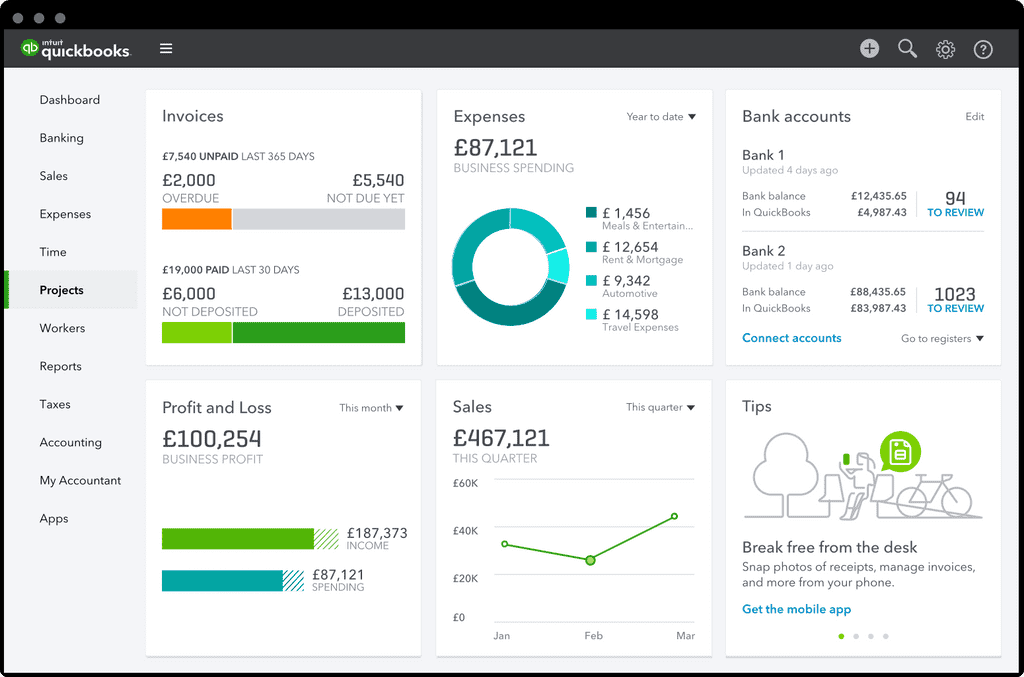

Another key benefit is improved financial visibility. These platforms provide real-time insights into a company's financial health, allowing owners to track key metrics like cash flow, profitability, and expenses.

This data can be used to make better-informed decisions about pricing, investments, and resource allocation. Furthermore, accounting software typically offers features that facilitate compliance with tax regulations.

Key Players and Market Trends

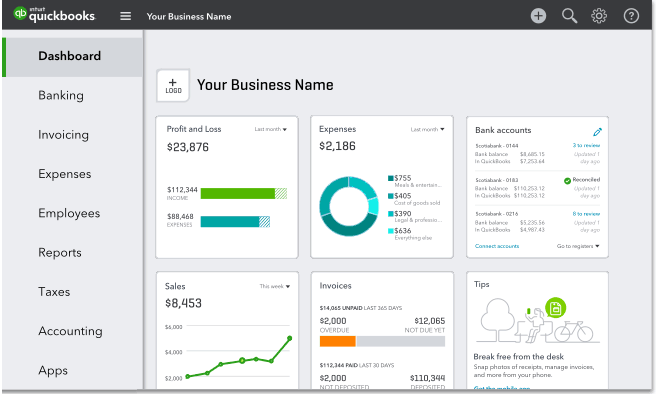

The market for small business accounting software is dominated by several major players. Popular options include QuickBooks, Xero, and Zoho Books, each offering a range of plans and features to suit different business needs.

These companies are constantly innovating, adding new features and integrating with other business applications to enhance user experience. The trend towards cloud-based accounting solutions is particularly noteworthy.

Cloud-based platforms offer several advantages over traditional desktop software. These include accessibility from anywhere with an internet connection, automatic data backups, and seamless collaboration among team members.

The increasing adoption of mobile devices is also driving innovation in the accounting software market. Many providers now offer mobile apps that allow business owners to manage their finances on the go.

Challenges and Considerations

Despite the many benefits, implementing accounting software can present challenges for some small businesses. One common concern is the cost of the software and related services.

While some free or low-cost options are available, these may not offer all the features needed by a growing business. Another challenge is the learning curve associated with new software.

Business owners may need to invest time in training themselves and their staff on how to use the platform effectively. Data security is also a crucial consideration.

It's essential to choose a reputable provider with robust security measures to protect sensitive financial information. Choosing the wrong software can lead to frustration and inefficiencies.

Impact on the Broader Economy

The widespread adoption of accounting software has the potential to boost economic growth. By improving efficiency and reducing costs, these tools can help small businesses become more competitive.

The streamlined processes can also contribute to a more vibrant and dynamic business environment. Access to accurate financial data also empowers small businesses to secure loans and attract investors.

This, in turn, can fuel innovation and job creation. The long-term impact on employment is a subject of ongoing debate, with some arguing that automation could lead to job displacement.

Human Interest Angle: A Local Bakery's Story

"Sweet Surrender," a local bakery, struggled to keep up with its bookkeeping using spreadsheets. Owner, Sarah Miller, spent hours each week reconciling accounts, leaving little time for recipe development or customer service.

After implementing accounting software, Sarah gained real-time insights into her inventory costs and profit margins. This helped her make informed decisions about pricing and menu offerings, leading to a 15% increase in revenue within six months.

"I can finally focus on what I love – baking – and less on the tedious paperwork," Sarah said. This story illustrates the positive impact of accounting software on individual businesses and the people behind them.

Conclusion

Accounting software is rapidly transforming the landscape of small business finance. By automating tasks, improving financial visibility, and facilitating compliance, these tools empower business owners to make better decisions and achieve greater success.

While challenges remain, the benefits of adopting accounting software are clear. As technology continues to evolve, these solutions will likely become even more sophisticated and accessible, further driving their adoption among small businesses.

The impact on the broader economy could be significant, with increased efficiency and competitiveness contributing to sustainable growth. Businesses need to carefully evaluate their needs and choose the right platform to reap the full benefits of this technology.