Stocks Under $2 Dollars On Robinhood

Imagine scrolling through your phone on a sunny afternoon, a gentle breeze rustling the leaves outside your window. You open your Robinhood app, the gateway to a world of investment opportunities. But instead of focusing on the big names, you're drawn to a different corner: the realm of stocks trading under $2.00, a landscape ripe with potential and intrigue.

This article explores the world of penny stocks available on platforms like Robinhood, offering a balanced perspective on their allure and the risks they entail. We'll delve into why these stocks are attracting attention and what investors, particularly beginners, should consider before diving in.

Penny Stocks: A World of Possibilities (and Risks)

Penny stocks, often defined as stocks trading under $5.00, have always held a certain appeal. For investors with limited capital, they offer the chance to acquire a significant number of shares in a company. Robinhood, with its commission-free trading, has made these stocks even more accessible to a wider audience.

The potential for high returns is a major draw. A small increase in share price can translate to substantial percentage gains. Success stories, however rare, fuel the excitement, inspiring investors to search for the next big winner.

However, it's crucial to understand that these stocks come with significant risks. Many of the companies behind penny stocks are small, emerging businesses with unproven track records. This introduces substantial uncertainty.

The Risks Involved

Liquidity is a major concern. Penny stocks often have low trading volumes, making it difficult to buy or sell shares quickly without significantly affecting the price. This can trap investors who need to liquidate their positions.

Information asymmetry is another factor. These companies often have limited regulatory oversight and reporting requirements, meaning less information is available to investors. This lack of transparency makes it harder to evaluate the company's true value and potential.

Scams and manipulation are prevalent in the penny stock world. Pump-and-dump schemes, where fraudsters artificially inflate the price of a stock before selling their shares at a profit, leaving other investors with losses, are not uncommon.

According to a Securities and Exchange Commission (SEC) investor alert, “Fraudsters often spread false or misleading information about a company to create unwarranted investor demand, causing the price of the stock to increase temporarily. Then, the fraudsters sell their shares at a profit before the price falls sharply, leaving other investors with substantial losses.”

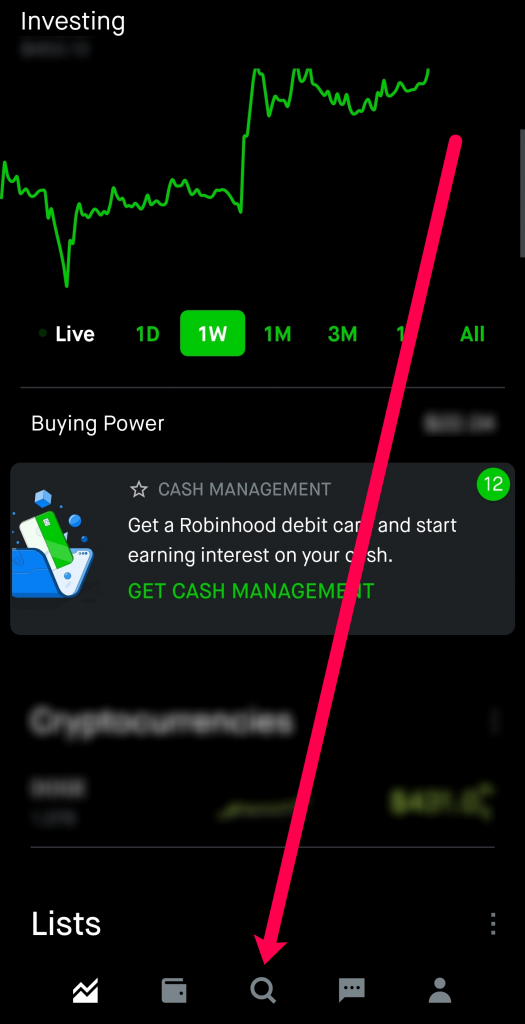

Robinhood and Penny Stocks

Robinhood's accessibility has amplified the reach of penny stocks. The ease of trading on the platform, coupled with the allure of quick profits, can lead inexperienced investors to make impulsive decisions without proper due diligence.

Robinhood, to its credit, provides risk disclosures and educational resources to its users. However, the responsibility ultimately lies with the individual investor to understand the risks involved.

It's also important to note that Robinhood has specific requirements for listing stocks on its platform, even penny stocks. These requirements aim to ensure a minimum level of legitimacy and trading volume.

Due Diligence is Key

Before investing in any penny stock, thorough research is essential. This includes carefully reviewing the company's financial statements, understanding its business model, and assessing the competitive landscape. Seek out independent sources of information and be wary of overly optimistic or promotional materials.

Consider the company's management team and their track record. Do they have experience in the industry? What are their qualifications?

Diversification is also crucial. Don't put all your eggs in one basket. Spread your investments across different asset classes to mitigate risk. Only invest what you can afford to lose.

"Investing in penny stocks can be incredibly risky, but it can also be potentially rewarding if you do your homework and understand the risks involved."

In conclusion, the world of stocks under $2.00 on platforms like Robinhood presents both opportunities and challenges. While the potential for high returns is enticing, the risks are equally significant. By approaching these investments with caution, conducting thorough due diligence, and understanding the potential pitfalls, investors can navigate this landscape more effectively.