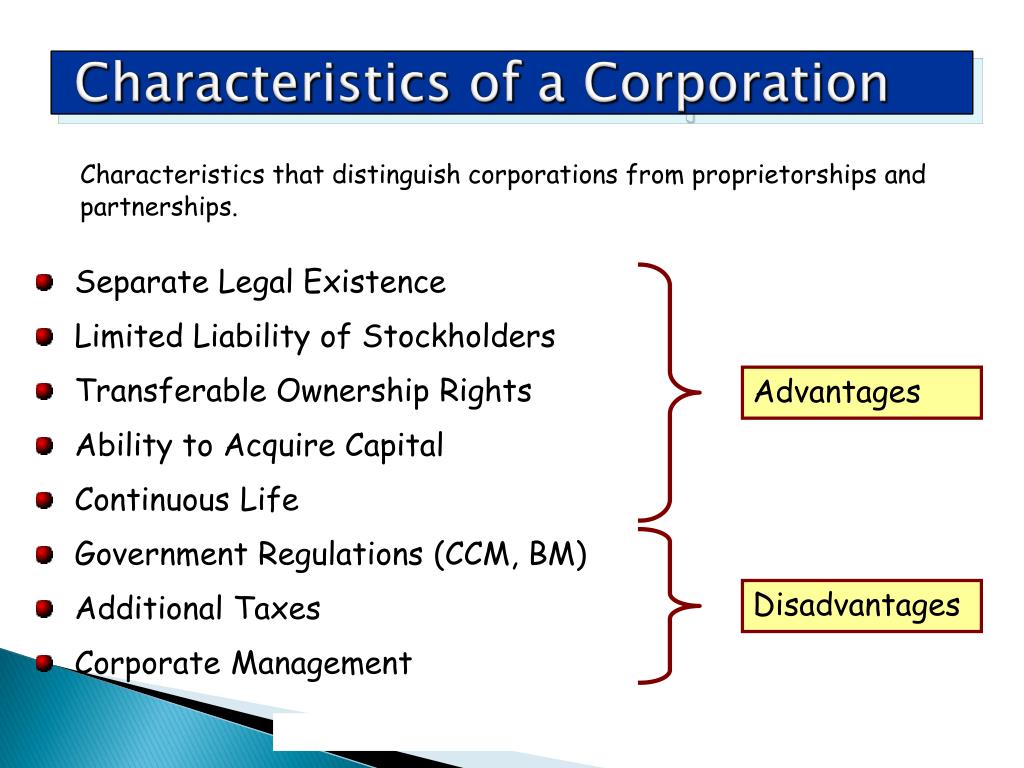

The Ability Of A Corporation To Obtain Capital Is

The lifeblood of any corporation, the ability to secure capital, is facing unprecedented pressures in today’s volatile economic landscape. From rising interest rates to geopolitical instability and shifting investor sentiment, businesses are navigating a complex web of challenges to fuel growth, innovation, and even simple survival.

This article delves into the multifaceted nature of a corporation's ability to obtain capital, examining the key factors influencing access to funding, the diverse sources available, and the potential implications for the global economy. Understanding these dynamics is crucial for investors, policymakers, and corporate leaders alike as they strive to navigate an increasingly uncertain future.

The Shifting Sands of Capital Markets

The landscape of capital acquisition is constantly evolving. What worked a decade ago may be obsolete today, requiring corporations to adapt and innovate their financial strategies. The Federal Reserve's interest rate hikes, aimed at curbing inflation, have significantly increased the cost of borrowing, impacting everything from corporate bonds to bank loans.

According to a recent report by Standard & Poor's, corporate debt defaults are projected to rise in the coming quarters. This trend reflects the growing strain on companies burdened with higher interest payments and potentially weakening revenue streams. The report highlights a particular vulnerability for smaller and mid-sized enterprises, which often lack the financial resilience of their larger counterparts.

Geopolitical risks also play a significant role. Uncertainty surrounding international trade, political instability in key regions, and escalating global tensions can all deter investors and make capital markets more risk-averse. This environment creates a challenging atmosphere for corporations seeking to expand internationally or invest in long-term projects.

Diverse Avenues for Securing Funding

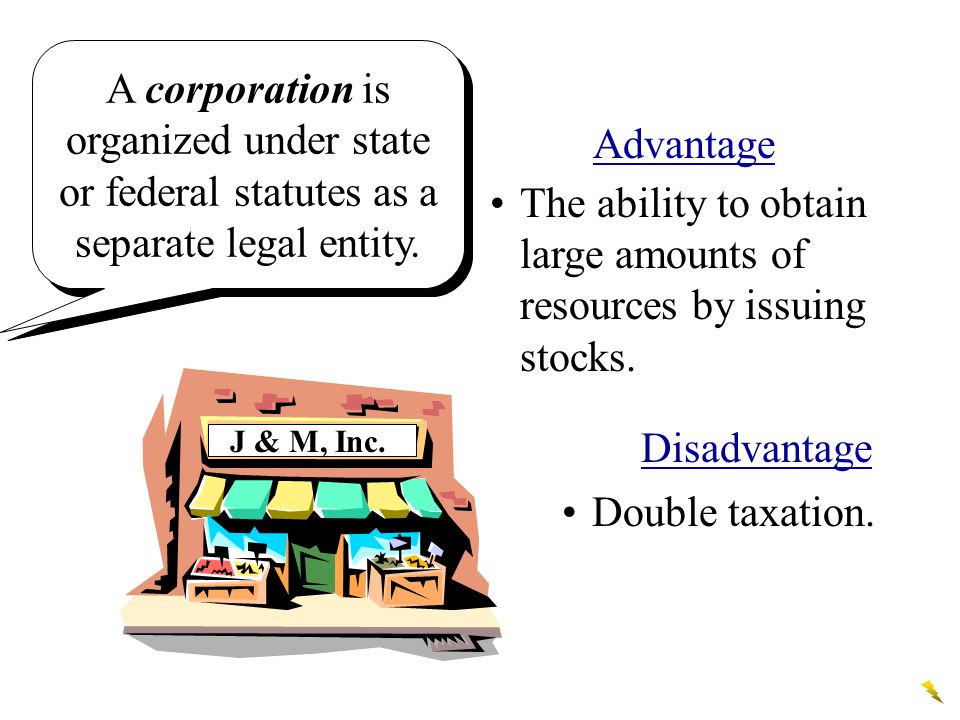

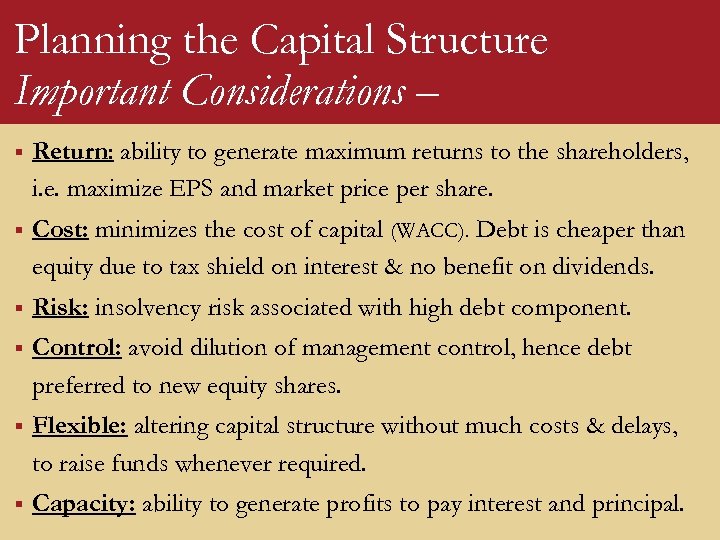

Corporations have various options available to them when seeking capital. These options range from traditional sources like debt financing and equity offerings to more innovative approaches such as venture capital and private equity.

Debt Financing: A Double-Edged Sword

Debt financing, typically in the form of corporate bonds or bank loans, remains a popular method for raising capital. It allows companies to retain ownership and control, but it also creates a legal obligation to repay the borrowed funds with interest. With interest rates on the rise, the attractiveness of debt financing is waning for some.

Bank of America recently released a statement cautioning businesses to carefully assess their debt capacity. The statement recommends avoiding excessive borrowing and exploring alternative funding sources when possible. They also highlighted the importance of maintaining strong credit ratings.

Equity Offerings: Diluting Ownership

Issuing equity, such as stocks, is another common method for raising capital. It allows companies to access funds without incurring debt, but it also dilutes the ownership stake of existing shareholders. This can be a particularly sensitive issue for privately held companies considering going public.

Venture Capital and Private Equity: High Risk, High Reward

Venture capital (VC) and private equity (PE) firms provide funding to companies with high growth potential. VC typically focuses on early-stage startups, while PE invests in more established businesses. These sources of capital often come with stringent terms and expectations, requiring companies to cede some degree of control to investors.

"The VC and PE landscape is shifting. Investors are becoming more selective, prioritizing companies with proven business models and strong management teams," said John Smith, a partner at a leading VC firm.

Alternative Financing Options: Embracing Innovation

Newer financing options are emerging, including crowdfunding, peer-to-peer lending, and revenue-based financing. These methods offer alternative pathways for companies to access capital, often bypassing traditional financial institutions.

The Impact on Economic Growth

A corporation's ability to obtain capital has far-reaching implications for economic growth. Companies that can access funding are better positioned to invest in research and development, expand their operations, and create jobs. Conversely, limited access to capital can stifle innovation and hinder economic progress.

The current economic climate presents a mixed bag. While some industries are thriving and attracting significant investment, others are struggling to survive. The ability of companies to adapt and innovate their financial strategies will be crucial in determining their long-term success.

The World Bank has warned that a tightening of global financial conditions could significantly slow economic growth in developing countries. These nations often rely heavily on foreign investment, which can be particularly sensitive to fluctuations in global capital markets.

Looking Ahead: Navigating Uncertainty

The future of capital acquisition remains uncertain. Several factors will likely shape the landscape in the years to come, including technological advancements, evolving regulatory frameworks, and shifting investor preferences.

Companies that can demonstrate strong financial discipline, adapt to changing market conditions, and embrace innovative financing solutions will be best positioned to thrive. The ability to access capital is not just about securing funding; it's about building a sustainable and resilient business that can weather any storm.

In conclusion, the ability of a corporation to obtain capital is a dynamic and complex issue with far-reaching implications. Understanding the forces at play and adapting to the evolving landscape is crucial for ensuring long-term success and contributing to a healthy global economy.

:max_bytes(150000):strip_icc()/CapitalStructureV3-98bd3c154a524492a52170b854cc0b82.jpg)