The Stated Interest Rate Is The Interest Rate Expressed

Imagine strolling through a bustling marketplace, the air thick with the aroma of spices and the vibrant calls of vendors. Each merchant proudly displays their wares, prices clearly marked, promising a fair deal. But what if the price tag only told part of the story? In the world of finance, understanding the "stated interest rate" is like deciphering those market prices—it's the initial figure presented, but it's crucial to know if there are hidden costs or adjustments lurking beneath the surface.

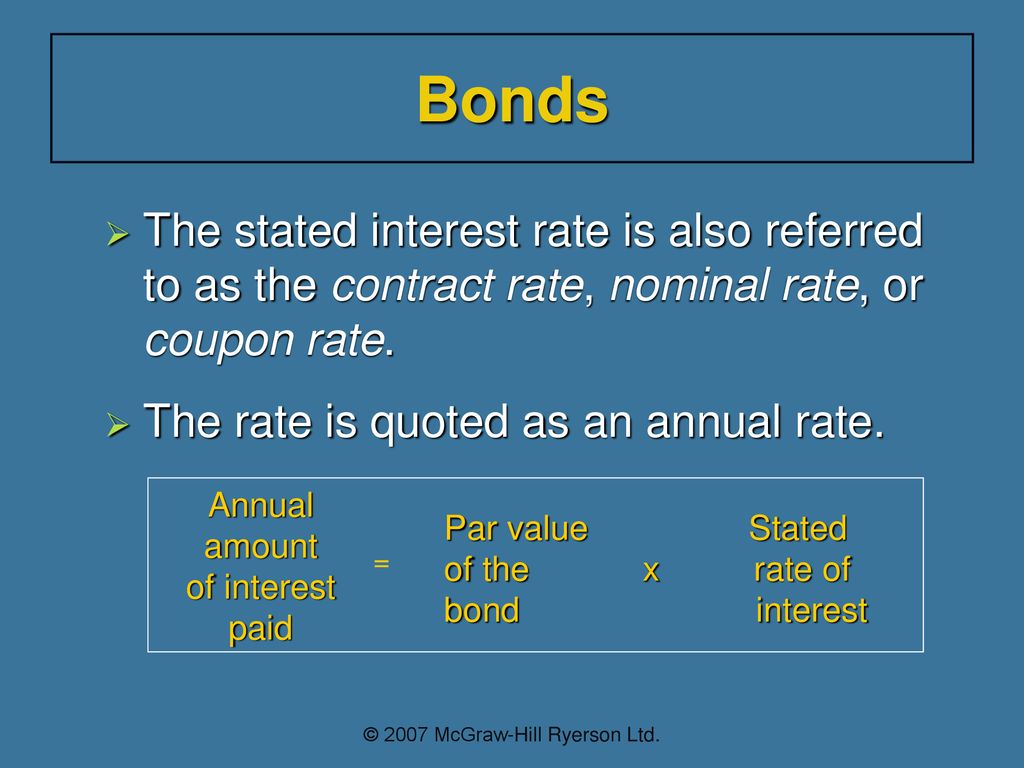

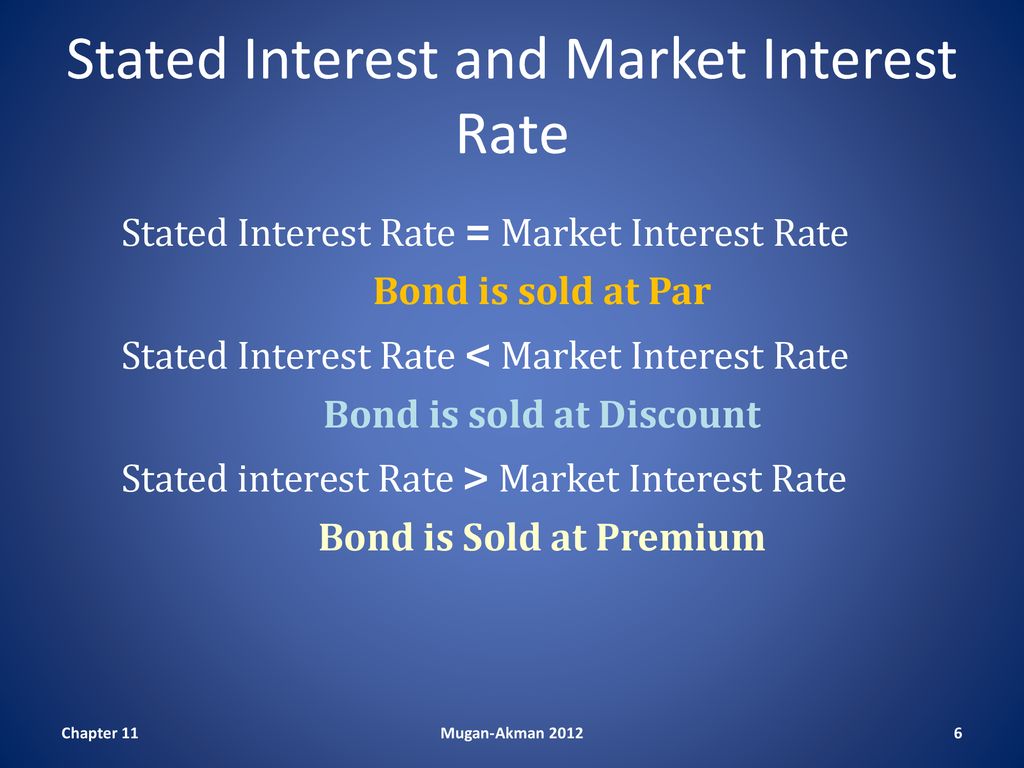

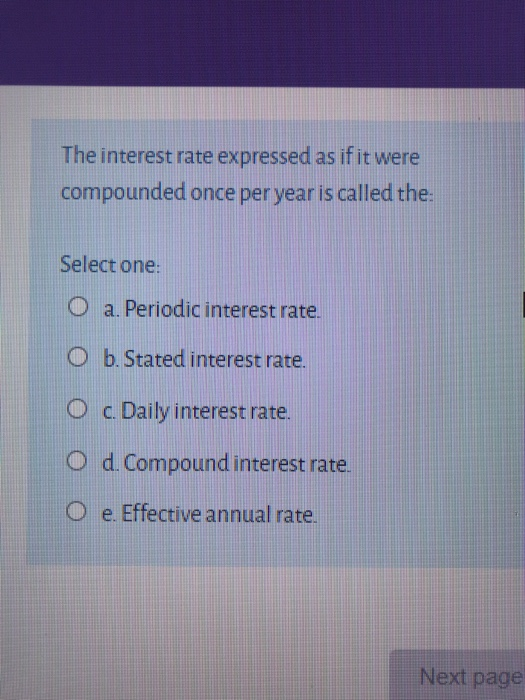

The stated interest rate, also known as the nominal interest rate, is the raw, unadjusted percentage advertised on a loan, savings account, or investment. It's the headline figure, the first number that grabs your attention. However, relying solely on this rate without considering other factors can lead to misinformed financial decisions, potentially costing you money in the long run.

Decoding the Stated Interest Rate

At its core, the stated interest rate is straightforward: it's the percentage of the principal that will be charged (for loans) or earned (for investments) over a specific period, typically a year. For instance, a loan with a stated interest rate of 5% means you'll pay 5% of the borrowed amount in interest annually.

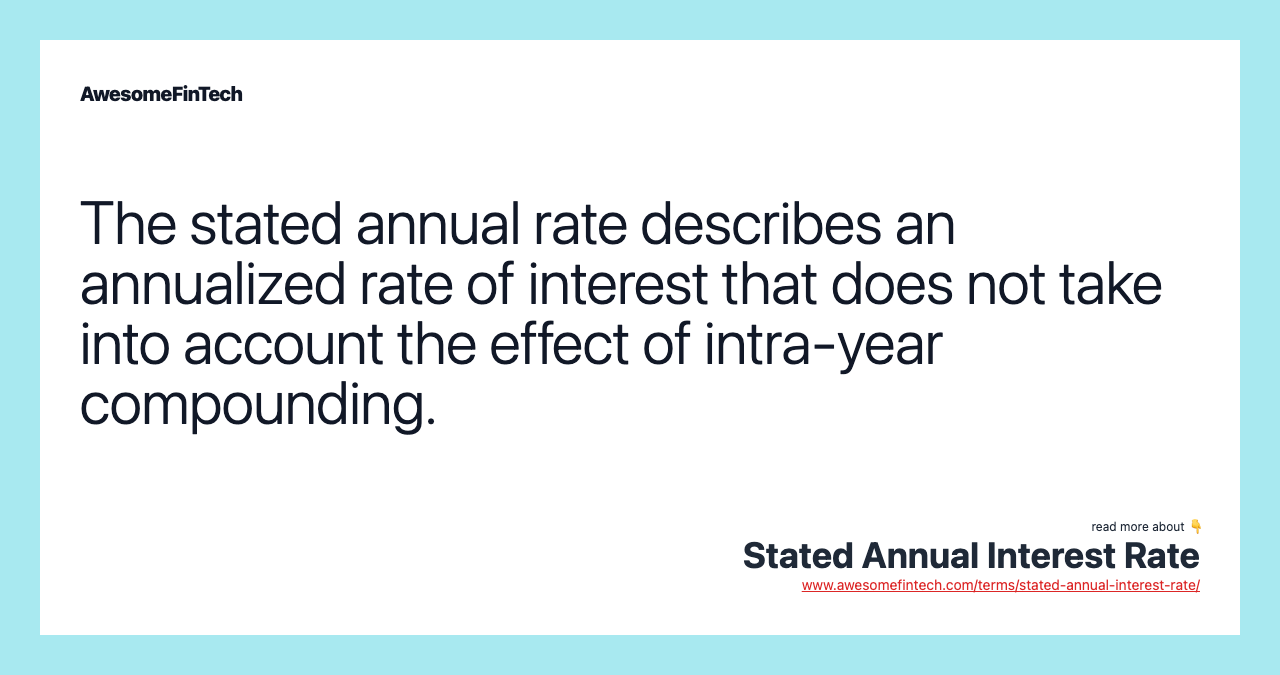

But here's the catch: the stated interest rate doesn't always reflect the true cost or return. It doesn't account for factors like compounding frequency, fees, or inflation, which can significantly impact the actual financial outcome.

The Origins and Evolution of Interest Rates

The concept of interest rates dates back to ancient civilizations, where lending and borrowing were commonplace. Early forms of interest were often tied to agricultural cycles, with lenders charging a fee for providing seeds or tools to farmers.

Over time, interest rates became more formalized, evolving alongside the development of banking systems and financial markets. The stated interest rate emerged as a standardized way to communicate the cost of borrowing or the return on investment.

However, as financial instruments became more complex, it became clear that the stated interest rate alone was insufficient to provide a complete picture of the financial implications.

The Significance of Understanding the Stated Rate

Why is it so important to grasp the nuances of the stated interest rate? Because it's the foundation upon which all other interest rate calculations are built. Understanding its limitations empowers you to make informed decisions.

For example, consider two loans with the same stated interest rate but different compounding frequencies. Loan A compounds annually, while Loan B compounds monthly. Even though the stated rates are identical, Loan B will ultimately cost you more due to the more frequent compounding.

Furthermore, the stated interest rate doesn't account for inflation. A 5% interest rate might seem appealing, but if inflation is running at 3%, your real return is only 2%. This is where the concept of the real interest rate comes into play, which adjusts the stated rate for inflation.

Beyond the Headline: Unveiling the True Cost

Several factors can influence the true cost of borrowing or the real return on investment beyond the stated interest rate.

Compounding Frequency

Compounding refers to the process of earning interest on interest. The more frequently interest is compounded, the higher the effective interest rate will be.

For instance, a credit card with a stated interest rate of 18% compounded monthly has a higher effective annual percentage rate (APR) than a loan with the same stated rate compounded annually. The APR is a more comprehensive measure that includes the effects of compounding.

The formula to calculate the effective annual rate (EAR) is: EAR = (1 + (stated rate/number of compounding periods))^number of compounding periods - 1.

Fees and Charges

Many loans and investments come with associated fees, such as origination fees, closing costs, or account maintenance fees. These fees can significantly increase the overall cost of borrowing or reduce the net return on investment.

Always carefully review the fine print to identify any hidden fees. Don't be afraid to ask lenders or financial advisors to provide a complete breakdown of all costs involved.

Ignoring these fees can lead to a rude awakening when you realize the true cost is far higher than the stated interest rate initially suggested.

Inflation

Inflation erodes the purchasing power of money over time. A stated interest rate that doesn't keep pace with inflation can result in a negative real return, meaning your investment is actually losing value.

To calculate the real interest rate, subtract the inflation rate from the stated interest rate. For example, if the stated interest rate is 6% and the inflation rate is 2%, the real interest rate is 4%.

Monitoring inflation is crucial for making informed investment decisions and ensuring your money grows faster than the rate at which it's losing value.

Making Informed Financial Decisions

So, how can you use this knowledge to your advantage? By being a savvy consumer and asking the right questions.

Compare APRs, Not Just Stated Rates

When comparing loans or credit cards, focus on the APR (Annual Percentage Rate) rather than just the stated interest rate. The APR includes the effects of compounding and fees, providing a more accurate reflection of the total cost.

Lenders are legally required to disclose the APR before you agree to a loan. Take the time to carefully compare APRs from different lenders to find the best deal.

A lower APR translates to lower overall borrowing costs.

Ask About All Fees and Charges

Don't hesitate to ask lenders or financial advisors to provide a complete breakdown of all fees and charges associated with a loan or investment.

Understand what each fee covers and how it impacts the overall cost. Negotiate fees whenever possible, especially if you have a strong credit history or a long-standing relationship with the financial institution.

Transparency is key to making informed decisions.

Consider the Real Interest Rate

When evaluating investments, factor in the inflation rate to determine the real interest rate. This will give you a more realistic picture of your investment's potential to generate wealth.

Choose investments that offer a real interest rate that meets your financial goals and risk tolerance. Diversify your portfolio to protect against inflation and other economic uncertainties.

A positive real interest rate is essential for long-term financial success.

In the end, understanding the stated interest rate is about more than just numbers; it's about empowering yourself to make informed financial decisions. It's about looking beyond the initial price tag and uncovering the true cost or potential return. As you navigate the financial marketplace, remember to be curious, ask questions, and always seek the full picture. By doing so, you can ensure that your financial choices align with your goals and lead you toward a brighter, more secure future. Like a savvy shopper in that bustling marketplace, you'll be able to identify the best values and make confident choices.

:max_bytes(150000):strip_icc()/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg)

/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg)

+NOMINAL+I%25:+interest+rate+expressed+in+terms+of+annual+amounts+currently+charged+for+interest%3B+not+adjusted+for+inflation..jpg)