The Value Of One Currency Expressed In Terms Of Another

Imagine yourself strolling through a bustling marketplace in Marrakech, the scent of spices hanging heavy in the air. A vendor offers you a vibrant, handwoven rug, its colors practically singing. But you're not sure if the price, quoted in Moroccan Dirhams, is a good deal. Suddenly, the concept of currency exchange rates becomes intensely personal, a bridge between your familiar world of dollars or euros and the exotic allure of this new place.

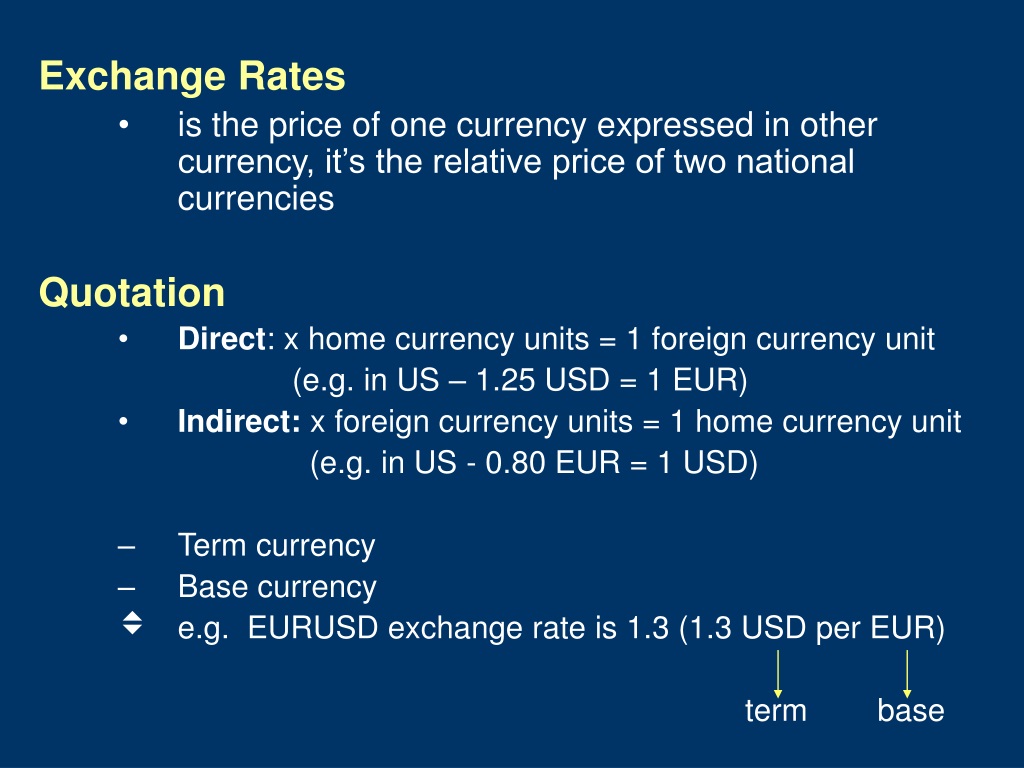

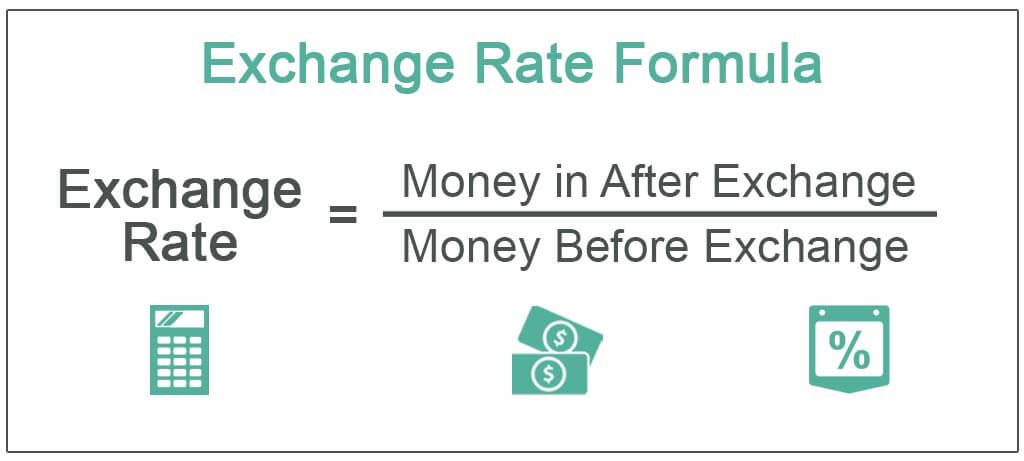

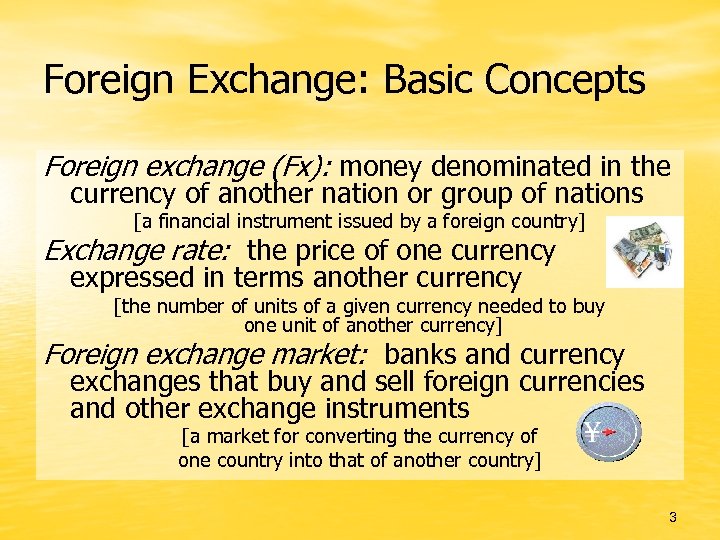

At its heart, the value of one currency expressed in terms of another, known as the exchange rate, is a fundamental concept that governs global commerce, investment, and even travel. Understanding this dynamic relationship unlocks insights into international economics and its impact on our daily lives.

The Story Behind the Numbers

The history of currency exchange is as old as trade itself. In ancient times, bartering was the norm, but the emergence of standardized currencies, like silver coins, simplified transactions between different regions. The need to determine the relative value of these currencies quickly became apparent.

Fast forward to the modern era, and the system has become considerably more sophisticated. The Bretton Woods Agreement of 1944 established a fixed exchange rate system, pegging many currencies to the U.S. dollar, which was in turn convertible to gold. This system provided stability for a time, but ultimately proved unsustainable and collapsed in the early 1970s.

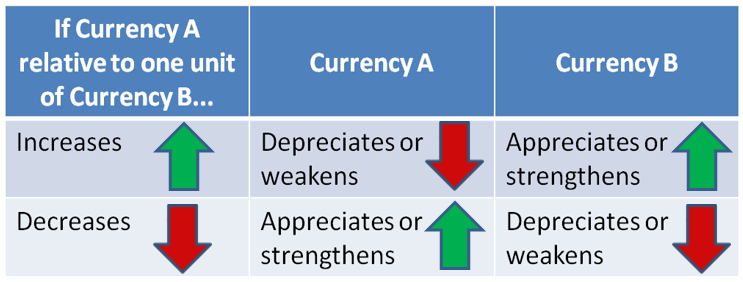

Today, most major currencies operate under a floating exchange rate regime. This means their value is determined by supply and demand in the foreign exchange (forex) market, a decentralized global marketplace where currencies are traded. Factors like economic growth, inflation, interest rates, and political stability all influence these supply and demand forces.

Factors at Play

Several key economic indicators drive currency valuations. Higher interest rates in a country, for example, tend to attract foreign investment, increasing demand for that country's currency and pushing its value up. Conversely, high inflation can erode a currency's purchasing power, leading to a decline in its exchange rate.

Economic growth plays a significant role. A booming economy often signals a stronger currency. Political stability is crucial; uncertainty or instability can deter foreign investment and weaken a currency.

Trade balances are also important. A country with a large trade surplus (exporting more than it imports) is likely to see increased demand for its currency, as foreign buyers need it to purchase its goods and services. All these factors intertwine, creating a complex web of influence on currency values.

The Significance of Exchange Rates

Exchange rates have far-reaching consequences, affecting everything from the price of imported goods to the profitability of multinational corporations. For consumers, a weaker domestic currency means imported products become more expensive, potentially leading to inflation. However, it can also make exports more competitive, boosting domestic industries.

Businesses engaged in international trade are acutely aware of exchange rate fluctuations. A favorable exchange rate can significantly increase profits, while an unfavorable one can erode margins. Multinational companies often use hedging strategies to mitigate the risks associated with currency volatility.

For travelers, exchange rates directly impact the cost of their trips. A strong domestic currency means you can purchase more goods and services in a foreign country, making your vacation more affordable. A weak currency, on the other hand, can make travel more expensive.

Beyond the Bottom Line

The impact extends beyond simple economics. Consider the geopolitical implications. Currency manipulation, where a country deliberately weakens its currency to gain a trade advantage, can strain international relations. The perception of a currency's strength or weakness can also reflect a country's overall standing in the world.

Exchange rates also play a crucial role in international investment decisions. Investors often seek out countries with strong currencies and stable economies, as this can lead to higher returns on their investments. The value of one currency relative to another is thus a key factor in attracting foreign capital.

Central banks often intervene in the forex market to influence exchange rates. They might buy or sell their own currency to stabilize its value or achieve specific economic goals. These interventions can have a significant impact, particularly in countries with smaller economies.

Navigating the World of Currency

Understanding currency exchange rates is no longer the sole domain of economists and financial professionals. In an increasingly globalized world, this knowledge is valuable for anyone who travels, shops online, or invests internationally. There are various resources available to help individuals stay informed.

Many websites and apps provide real-time exchange rate data. Reputable financial news outlets offer analysis of currency movements and the factors driving them. Consulting with a financial advisor can also provide personalized guidance.

Moreover, having a basic understanding of economic principles can significantly enhance your ability to interpret currency trends. Learning about inflation, interest rates, and trade balances can provide valuable context for understanding why currencies fluctuate. Education is key to navigating this complex landscape.

Consider the experience of Maria Rodriguez, a small business owner who imports coffee beans from Colombia. She diligently monitors the exchange rate between the U.S. dollar and the Colombian Peso. "Understanding the exchange rate is essential for managing my costs and pricing my products competitively," she explains. "It directly impacts my bottom line."

A Continually Evolving Landscape

The world of currency exchange is constantly evolving. New technologies, such as cryptocurrencies, are introducing new dynamics and challenges to the traditional system. Geopolitical events, like trade wars or political upheavals, can trigger rapid and significant currency fluctuations.

As the global economy becomes increasingly interconnected, the importance of understanding currency exchange rates will only continue to grow. Staying informed and adapting to these changes will be crucial for individuals and businesses alike.

In conclusion, the value of one currency expressed in terms of another is more than just a number on a screen. It's a reflection of economic forces, political realities, and the interconnectedness of our globalized world. By understanding this dynamic relationship, we can gain a deeper appreciation for the complexities of international economics and its impact on our lives.

+currency+expressed+in+terms+of+another+currency..jpg)

+placed+on+a+good+or+service.+It+is+usually+expressed+in+monetary+terms..jpg)

![The Value Of One Currency Expressed In Terms Of Another [Class 12 Economics] What is Currency and Foreign Exchange Rate?](https://d1avenlh0i1xmr.cloudfront.net/large/8edf8bb9-5c2e-4a3a-9c36-1a5ab04ee5d8/do-all-countries-have-same-currency---teachoo.jpg)

![The Value Of One Currency Expressed In Terms Of Another [Class 12 Economics] What is Currency and Foreign Exchange Rate?](https://d1avenlh0i1xmr.cloudfront.net/da17eac8-e77a-4d00-8d5d-7e0c3448d782/what-is-currency---teachoo.jpg)