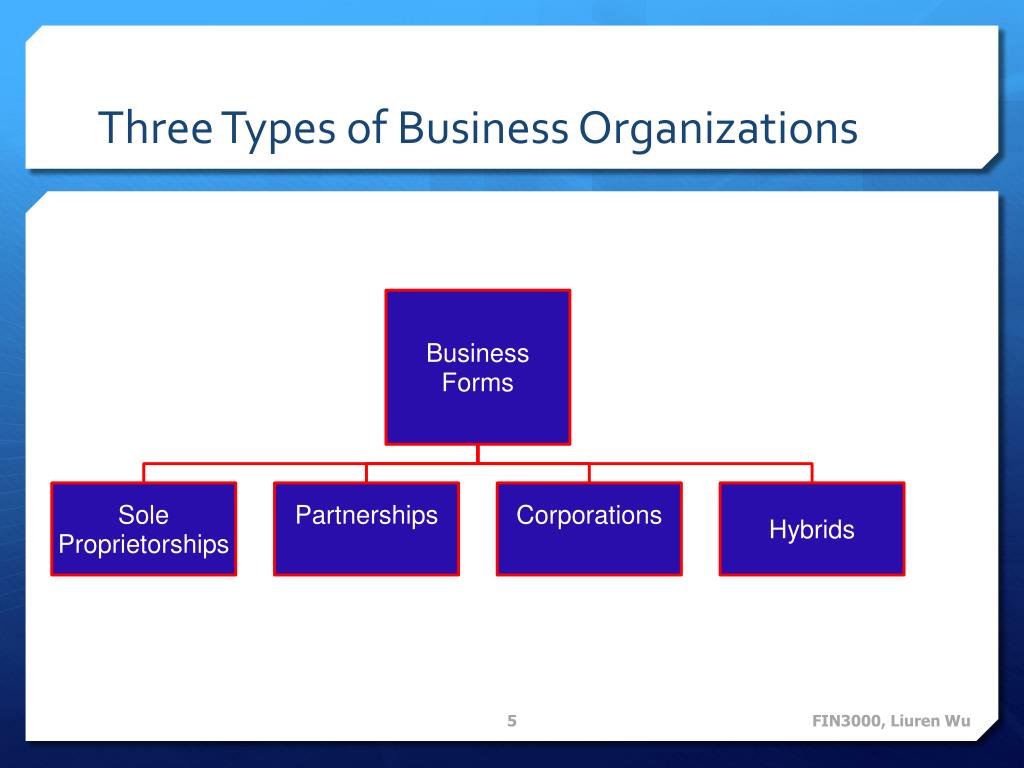

Three Types Of Business Organizations

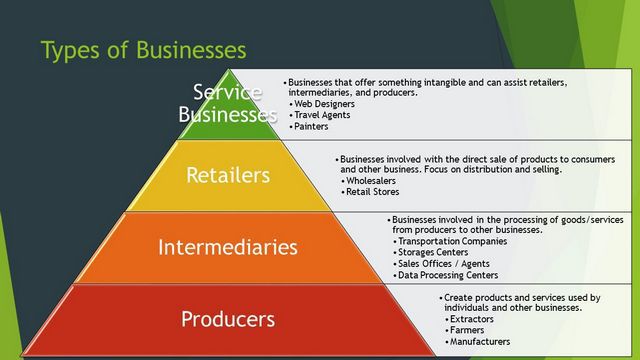

Choosing the right business structure is a fundamental decision for any entrepreneur, impacting everything from taxation to liability. Understanding the core differences between the primary types of business organizations is crucial for setting a company up for success. This article explores the characteristics of sole proprietorships, partnerships, and corporations, providing a clear overview of their advantages and disadvantages.

The type of business organization selected dictates legal and financial responsibilities. It influences how profits are distributed, how taxes are paid, and the extent to which the owner(s) are personally liable for business debts. This decision, therefore, should be made with careful consideration of both short-term and long-term goals.

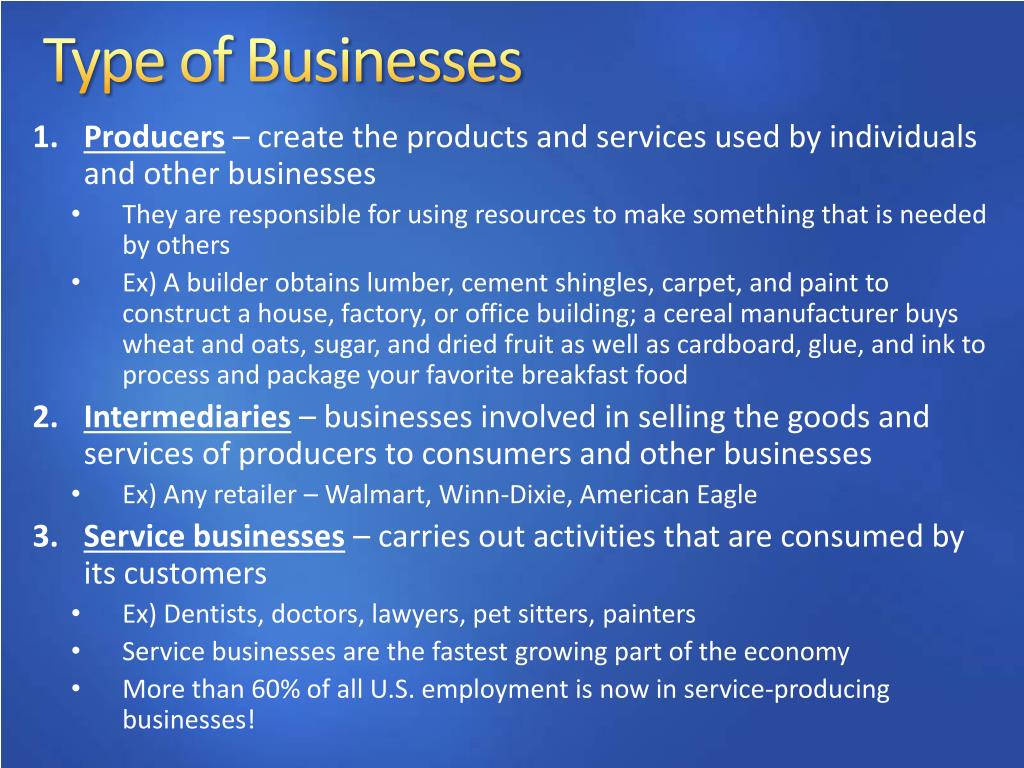

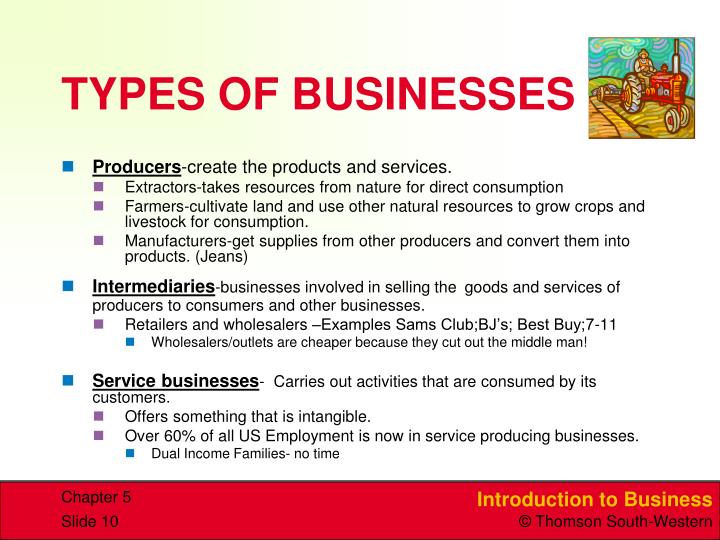

Sole Proprietorships: Simplicity and Direct Control

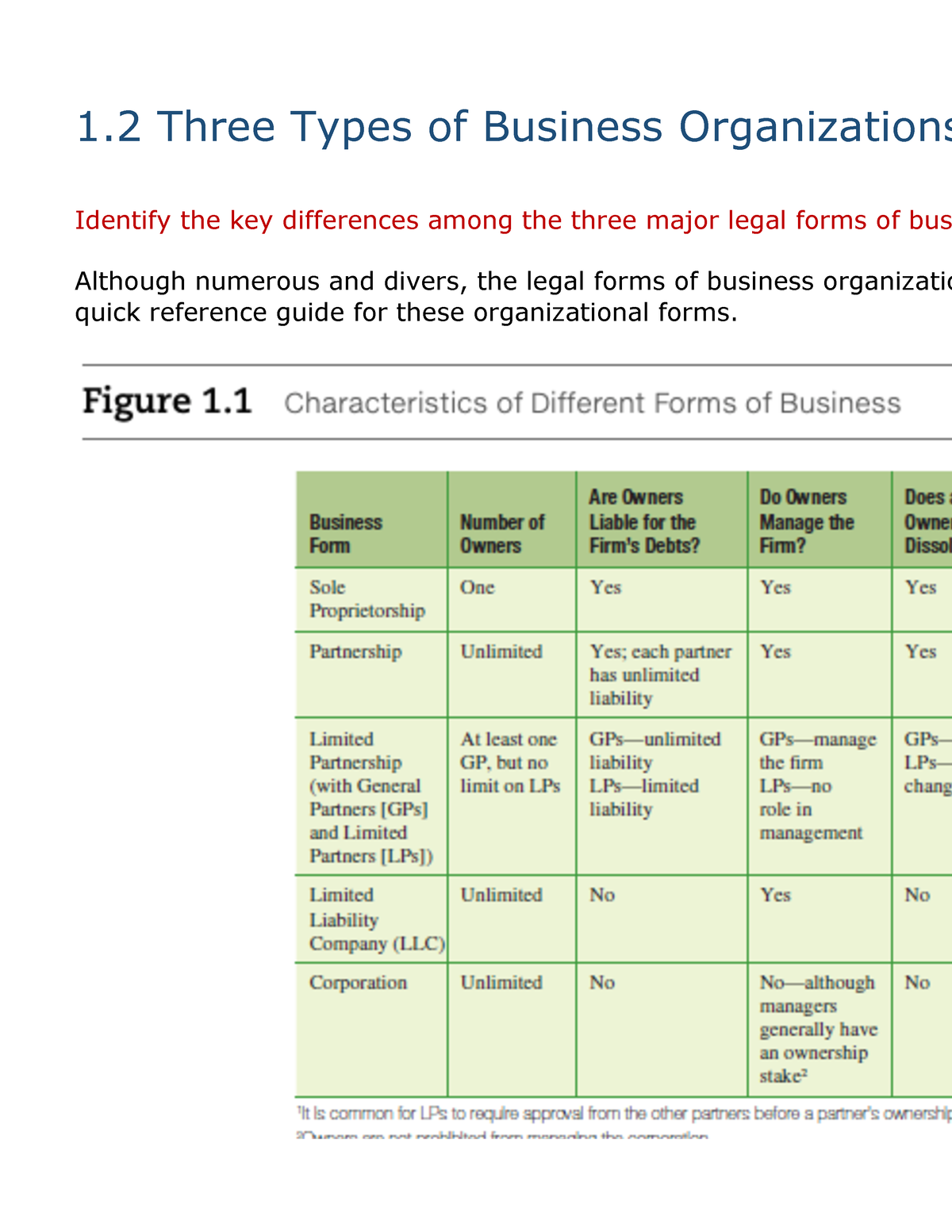

A sole proprietorship is the simplest form of business organization, owned and run by one person. The owner and the business are considered a single entity for tax and legal purposes. This means that the owner directly receives all profits but is also personally liable for all business debts and obligations.

The ease of setup is a major advantage. It usually requires minimal paperwork and low startup costs, making it attractive to independent contractors and freelancers. However, the personal liability aspect is a significant drawback.

The owner's personal assets are at risk if the business incurs debt or faces lawsuits. Additionally, raising capital can be challenging as sole proprietorships often rely on the owner's personal credit or loans.

Partnerships: Sharing Resources and Risks

A partnership involves two or more individuals who agree to share in the profits or losses of a business. Partnerships can be general or limited. In a general partnership, all partners share in the business's operational management and liability.

Limited partnerships have general partners with management responsibilities and unlimited liability, and limited partners with limited liability and typically no management authority. This structure allows for diverse skill sets and increased capital investment.

While partnerships offer the benefit of shared resources and expertise, they also come with the risk of disagreements and potential liability issues. For instance, in a general partnership, each partner can be held liable for the actions of the other partners.

A well-defined partnership agreement is essential to outline responsibilities, profit/loss sharing, and dispute resolution processes. This agreement helps to prevent conflicts and protect the interests of all partners.

Corporations: Limited Liability and Growth Potential

A corporation is a more complex business structure, considered a separate legal entity from its owners, the shareholders. This separation provides limited liability for the shareholders, meaning their personal assets are protected from business debts and lawsuits.

Corporations can raise capital more easily through the sale of stock. They are also able to continue operating even if there are changes in ownership. However, corporations face more stringent regulatory requirements and are subject to double taxation – profits are taxed at the corporate level, and then again when distributed to shareholders as dividends.

Corporations are typically classified as either S corporations or C corporations. S corporations allow profits and losses to be passed through directly to the owners' personal income without being subject to corporate tax rates. C corporations are subject to corporate income tax.

The choice between these structures depends on factors like tax planning and the desire to reinvest profits into the business. Forming a corporation involves considerable paperwork and ongoing compliance costs.

Conclusion: Choosing the Right Structure

Selecting the optimal business structure depends on various factors, including the owner's risk tolerance, financial goals, and the nature of the business. Carefully evaluating the advantages and disadvantages of each option is essential for long-term success.

Entrepreneurs should consult with legal and financial professionals to determine the most appropriate business structure for their specific circumstances. This consultation can help navigate the complexities of each option and ensure compliance with all relevant regulations.

The decision is not always permanent; businesses can restructure as they grow and evolve. Regular review and adaptation can help businesses stay aligned with their objectives and optimize their operational efficiency.

![Three Types Of Business Organizations Types of Business Organizations [INFOGRAPHIC]](https://image.slidesharecdn.com/businessorganizations-140508131724-phpapp02/95/types-of-business-organizations-infographic-1-638.jpg?cb=1399555252)