Is Dollar General A Good Stock To Buy

Imagine driving down a quiet, sun-drenched highway, the endless cornfields blurring past. Suddenly, a familiar yellow sign pops into view: Dollar General. It's a beacon of affordable necessities, a place where communities often find solace in budget-friendly options. But beyond the welcoming facade, does this retail giant represent a sound investment opportunity?

The question on many investors' minds is whether Dollar General stock (DG) remains a worthwhile addition to their portfolios. While the company's expansion and focus on value resonate with consumers, several factors, including market saturation and evolving consumer behavior, warrant careful consideration before making a decision.

Dollar General: A Deep Dive

Founded in 1939 as J.L. Turner and Son, Dollar General has grown from a family business to a nationwide retail behemoth. Its core strategy revolves around offering a curated selection of essential products at low prices, primarily targeting rural and underserved communities. This approach has fueled significant growth, with thousands of stores dotting the American landscape.

Financial Performance: A Mixed Bag

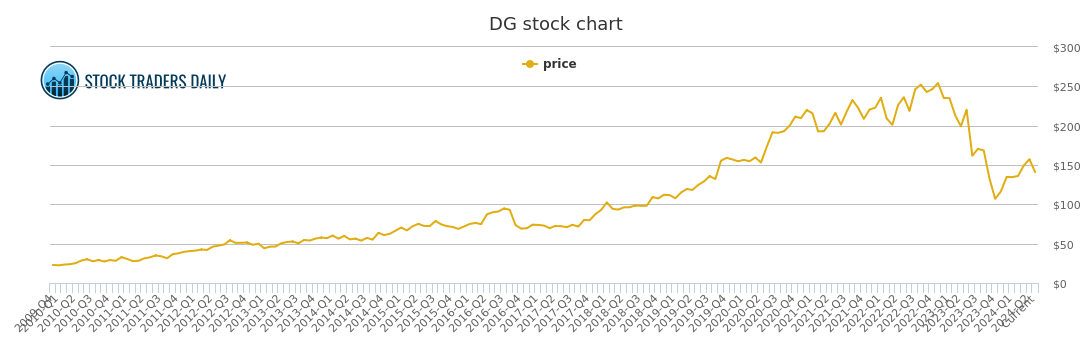

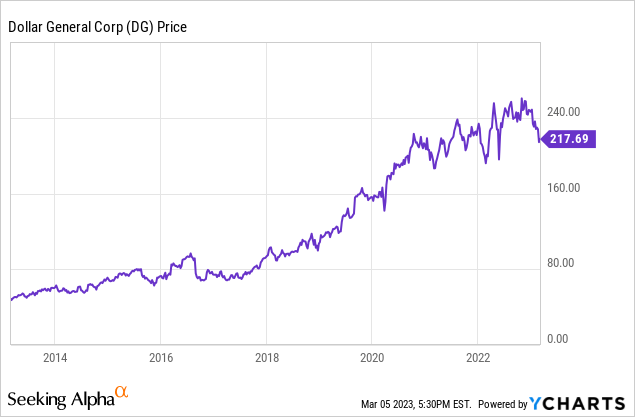

Recent financial reports paint a complex picture. While Dollar General continues to expand its store count, same-store sales growth has shown signs of slowing. This slowdown can be attributed to various factors, including increased competition from other discount retailers and shifting consumer spending habits.

According to the company's Q1 2024 report, net sales increased by 6.1%, but same-store sales decreased by 0.1%. This highlights a crucial point: opening new stores drives revenue, but attracting more business into each store is becoming more challenging.

"We are committed to delivering value and convenience to our customers,"stated Todd Vasos, the CEO of Dollar General, in a recent earnings call. But value and convenience alone might not be enough.

Expansion and Saturation

Dollar General's aggressive expansion strategy has been a key driver of its past success. However, concerns are growing about potential market saturation. With stores often located in close proximity to each other, the company risks cannibalizing its own sales.

Some analysts believe that Dollar General may be approaching a point where the benefits of opening new stores are outweighed by the negative impact on existing locations. This concern is validated by reports indicating a rise in "near-store cannibalization" which is now impacting long-term growth strategies.

Consumer Behavior and Economic Factors

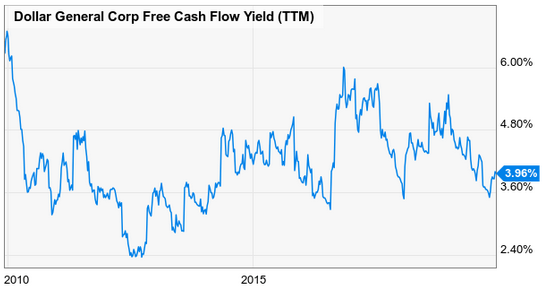

The current economic climate also plays a significant role. Inflation, while easing, continues to impact consumer spending. While Dollar General's value proposition is attractive during periods of economic uncertainty, consumers may also be drawn to online retailers or explore alternative discount options.

Moreover, changing consumer preferences for healthier food options and sustainable products could pose challenges for Dollar General, which primarily focuses on packaged goods and household essentials.

The Investment Perspective

So, is Dollar General a good stock to buy? The answer is nuanced. The company's proven business model and commitment to serving value-conscious consumers remain strengths. However, investors must carefully consider the challenges posed by market saturation, evolving consumer behavior, and the overall economic outlook.

Before investing, it's crucial to analyze Dollar General's financial statements, monitor its same-store sales performance, and assess its ability to adapt to changing consumer demands. Furthermore, investors should diversify their portfolios and not rely solely on a single stock for returns.

Conclusion

Driving away from that Dollar General on the highway, the question lingers. While the company offers a vital service to many communities, its stock performance isn't a simple equation. Prudent investors will weigh the opportunities against the risks before deciding whether to add Dollar General to their portfolios, remembering that a well-researched decision is always the best investment.