Tmus Stock Price April 18 2025

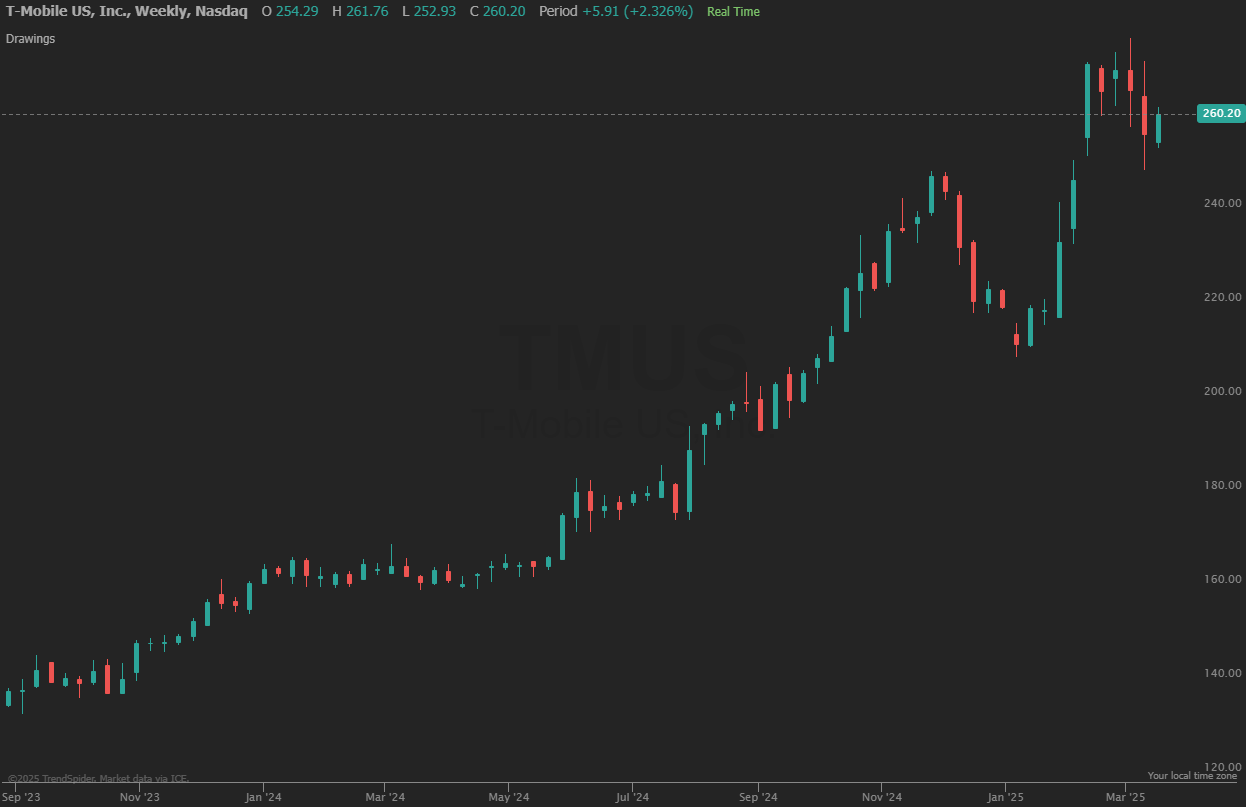

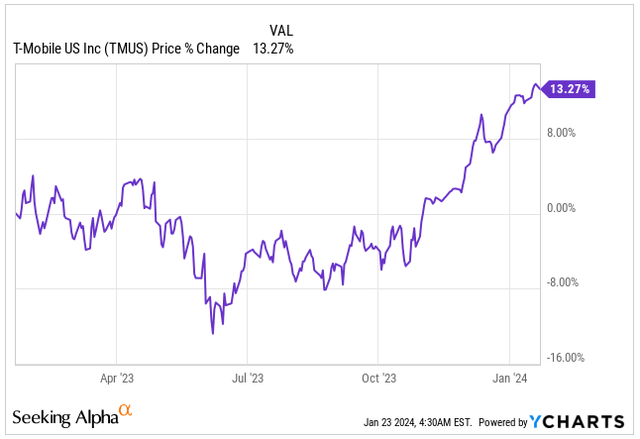

The rollercoaster ride that T-Mobile US, Inc. (TMUS) stock has been on took another dramatic turn today. Shares closed at $162.50 on April 18, 2025, marking a significant dip from the previous week's high. This volatility has investors and analysts scrambling to understand the forces at play in a rapidly evolving telecommunications landscape.

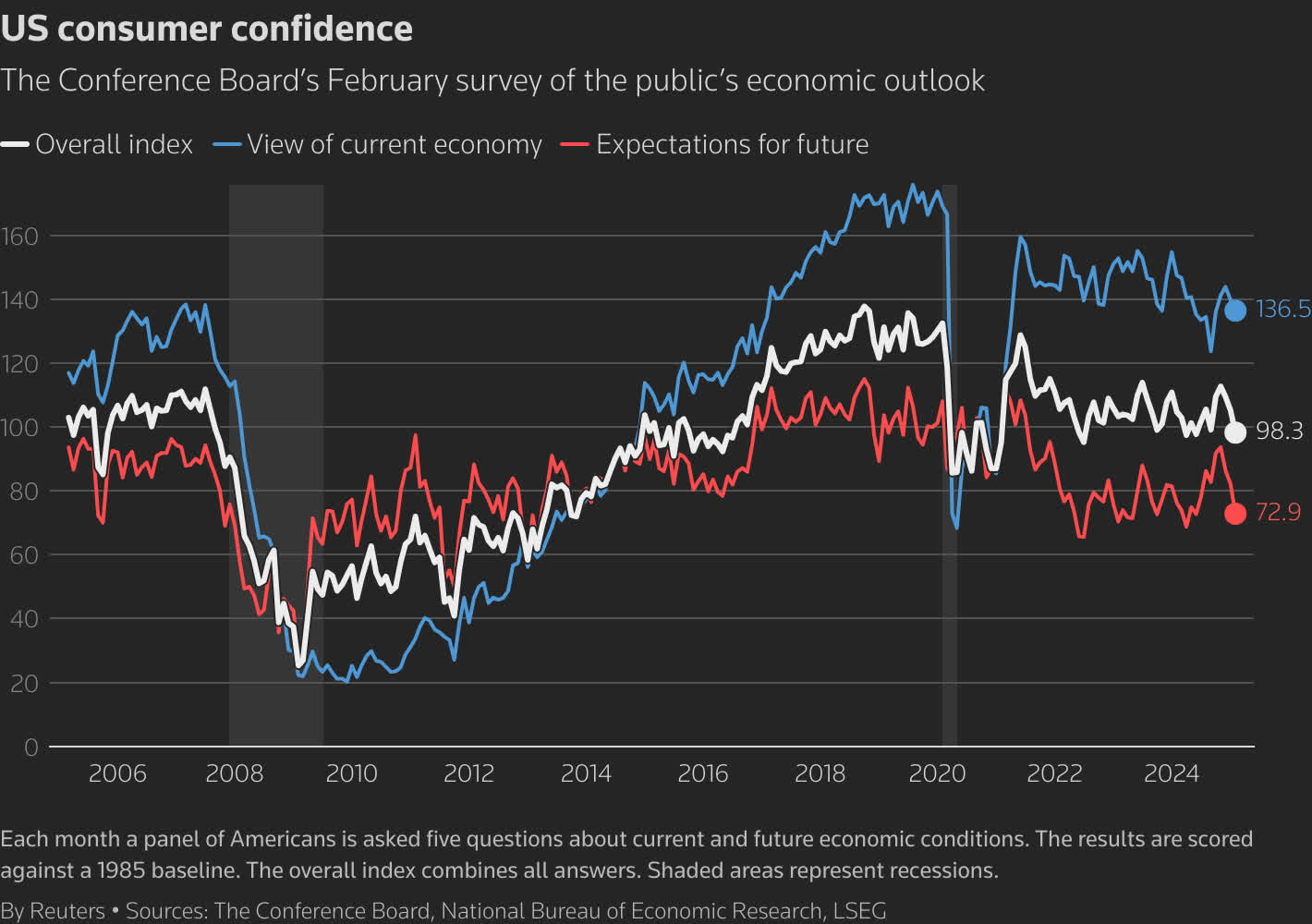

Today's closing price reflects a complex interplay of factors. These include competitive pressures from Verizon and AT&T, regulatory scrutiny regarding potential mergers, and the overall macroeconomic climate. The question on everyone's mind is whether this dip represents a temporary setback or a sign of deeper challenges for the Un-carrier.

Market Overview and Initial Reactions

The broader market showed mixed performance today, with the NASDAQ experiencing modest gains while the S&P 500 remained relatively flat. This lack of a clear market trend further complicates the analysis of T-Mobile's specific stock movement. Initial reactions from market analysts have been cautious, with many suggesting a "wait-and-see" approach.

Several analysts point to T-Mobile's upcoming earnings call as a critical event that could provide much-needed clarity. Investor sentiment seems to be shifting towards a more risk-averse position. This sentiment is driven by uncertainties surrounding capital expenditure related to network upgrades.

Competitive Landscape and Industry Trends

The telecom industry remains fiercely competitive, with each of the major players vying for market share. Verizon and AT&T have been aggressively promoting their 5G offerings, putting pressure on T-Mobile to maintain its competitive edge. These aggressive promotions include bundled services and discounts aimed at attracting and retaining customers.

The race to deploy and expand 5G infrastructure continues to be a key driver of investment and competition. Furthermore, industry observers are closely watching the potential impact of emerging technologies like 6G on long-term strategies. T-Mobile's investment in new technologies remains strong, but analysts are assessing whether the Return On Investment is reasonable.

Regulatory Environment and Potential Mergers

Regulatory oversight remains a significant factor for T-Mobile and the entire telecom industry. Any potential merger or acquisition could face intense scrutiny from the Federal Communications Commission (FCC) and the Department of Justice (DOJ). Concerns about market consolidation and potential anti-competitive practices are consistently present.

Rumors of potential partnerships and acquisitions have swirled in the past. These rumors contribute to market speculation and stock price fluctuations. Any future regulatory decisions could have profound implications for T-Mobile's growth trajectory.

Financial Performance and Key Metrics

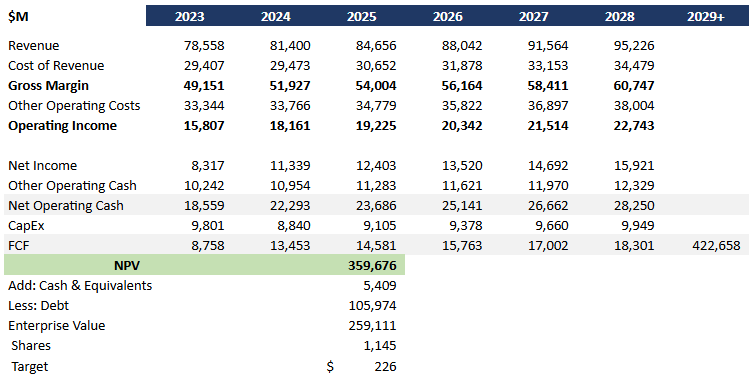

T-Mobile's most recent quarterly report showed strong subscriber growth, but profitability figures fell short of some analysts' expectations. This discrepancy raised questions about the company's ability to maintain profitability while simultaneously investing heavily in network infrastructure. Key metrics like Average Revenue Per User (ARPU) are being closely monitored.

The company's debt load remains a concern for some investors. T-Mobile acquired a large debt following the merger with Sprint. The company's ability to manage this debt while funding its expansion plans will be crucial in the coming years.

Analyst Ratings and Price Targets

Analyst ratings for T-Mobile stock are currently mixed, with a blend of "buy," "hold," and "sell" recommendations. Price targets range from $150 to $200, reflecting the uncertainty surrounding the company's future performance. Several analysts have recently revised their price targets downward, citing concerns about competition and profitability.

These revisions reflect a cautious outlook and underscore the need for T-Mobile to demonstrate strong execution. It is paramount for the company to demonstrate financial discipline in its capital expenditure. The overall forecast for the telecom sector remains positive, but T-Mobile's individual performance is subject to its own unique challenges.

Forward-Looking Considerations

Looking ahead, T-Mobile's success will depend on its ability to effectively compete in the evolving telecom landscape. Innovation and strategic partnerships are likely to play a key role in maintaining its competitive edge. The company's commitment to technological advancements could lead to long-term success.

Ultimately, the stock price trajectory will be determined by a combination of factors. These include strong financial performance, effective competition, and a favorable regulatory environment. Investors should carefully weigh these factors before making any investment decisions regarding T-Mobile stock.

The upcoming earnings call is pivotal, and could offer valuable insights into the company's strategy and financial health. In a climate of uncertainty, it is crucial to maintain an informed and measured perspective on the telecommunications market.