Trading In Newly Issued Securities Takes Place In The

Trading in newly issued securities, often occurring in the grey market, presents both opportunities and risks demanding immediate attention from investors and regulators.

This pre-market activity, while technically outside formal exchanges, offers an early glimpse into market sentiment but necessitates careful navigation due to increased volatility and potential for manipulation.

The Grey Market Unveiled

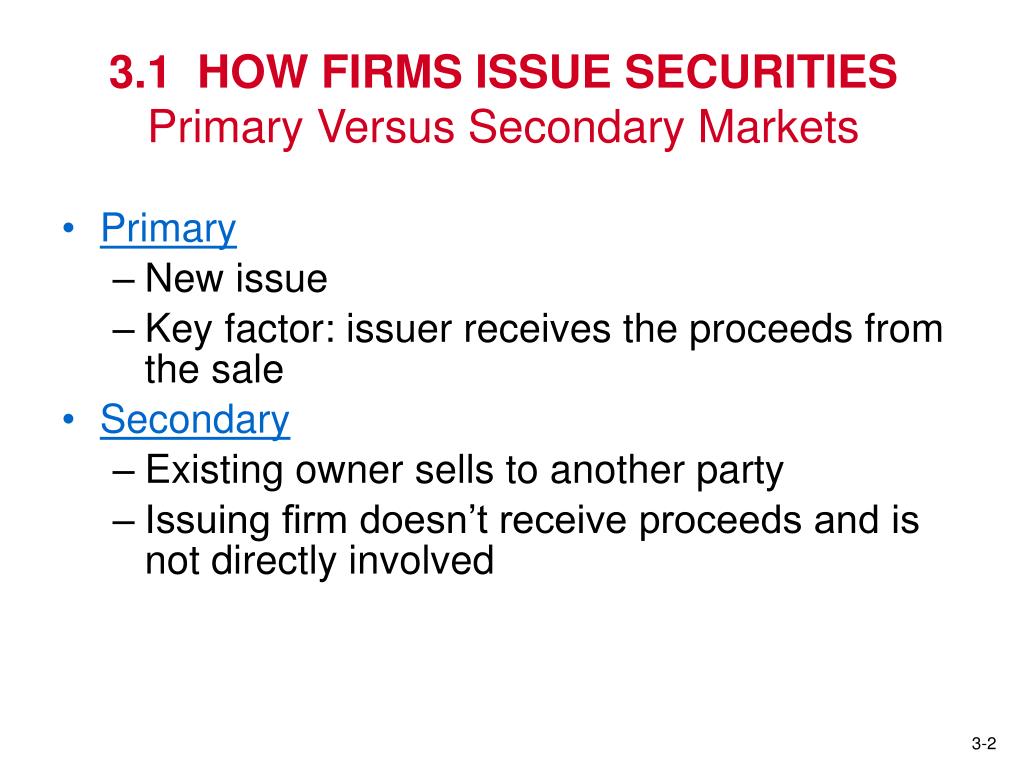

The grey market is where trading of new securities begins *before* they are officially listed on an exchange. This trading can start immediately after the initial public offering (IPO) price is set.

It’s a largely unregulated, over-the-counter (OTC) environment where investors buy and sell shares based on anticipated demand and perceived value.

This pre-listing trading activity is not sanctioned or monitored by the official exchanges, introducing elements of risk not present in regulated markets.

Who Participates?

A mix of institutional investors, high-net-worth individuals, and sophisticated traders actively engage in grey market trading.

These participants often possess a high-risk tolerance and seek to capitalize on potential price discrepancies between the IPO price and perceived market value.

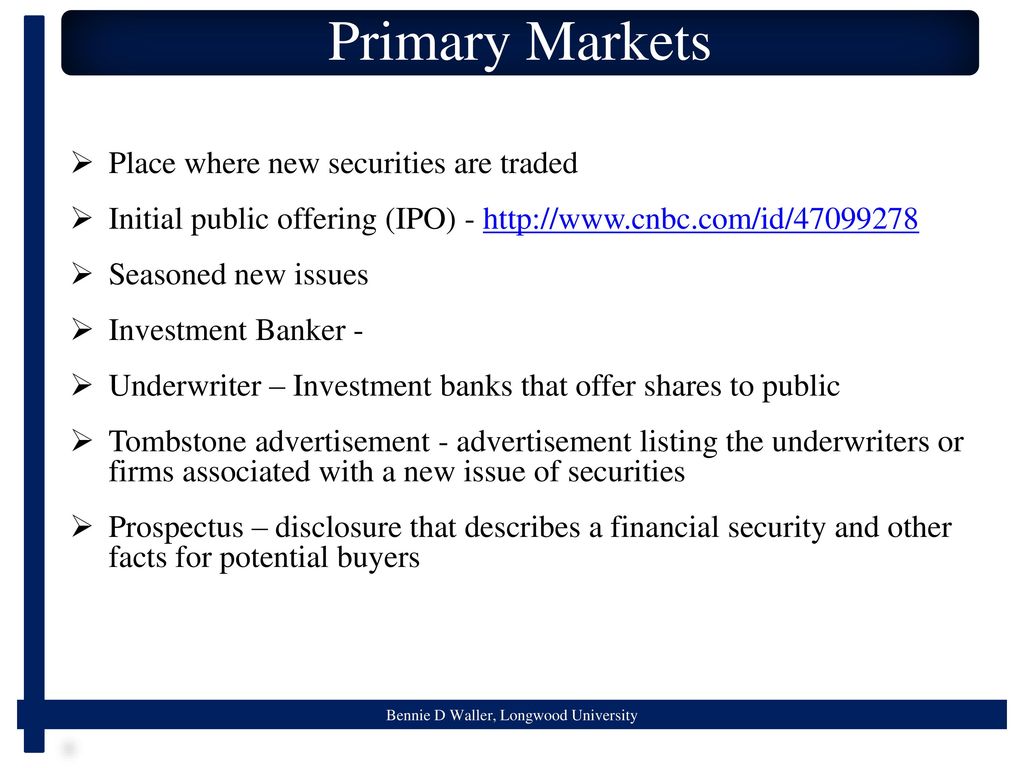

Brokers specializing in OTC transactions facilitate these trades, connecting buyers and sellers outside the traditional exchange framework.

What is Traded?

Newly issued stocks, bonds, and other securities are typically traded in the grey market. This includes securities from IPOs, spin-offs, and other corporate actions.

The focus is on securities that have yet to begin trading on a major exchange, presenting a unique opportunity for early access.

The lack of standardized reporting and regulation adds to the complexity and potential risk of these transactions.

Where Does This Happen?

Grey market trading primarily takes place through specialized brokers and OTC trading platforms. These platforms are often outside the direct oversight of regulatory bodies like the SEC in the US.

It is a decentralized network of buyers and sellers, making it difficult to track and monitor comprehensively.

Geographically, these trades occur globally, wherever there's demand for newly issued securities before their official listing.

When Does Trading Occur?

Trading begins immediately following the announcement of the IPO price and extends until the security is officially listed on a stock exchange.

The timeframe is often brief, lasting from a few hours to a few days, making swift decision-making crucial.

Volatility is heightened during this period, making it critical for traders to be aware of the risks involved.

How Does it Work?

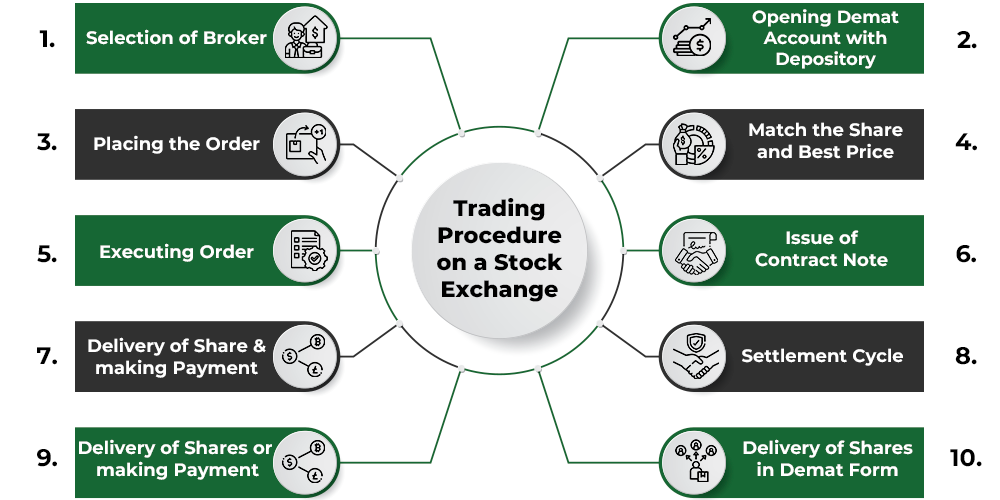

Transactions in the grey market are typically facilitated through negotiated agreements between buyers and sellers. Brokers act as intermediaries, matching orders and executing trades.

Settlement procedures can vary depending on the agreement between the parties involved, which can introduce delays and uncertainties compared to regulated exchanges.

Price discovery is largely driven by supply and demand, as there is no central limit order book to provide real-time price transparency.

Risks and Rewards

Grey market trading offers the potential for early profits if the security performs well upon listing. However, significant risks are involved.

Price volatility is extremely high, and prices can fluctuate dramatically based on market sentiment and limited information.

Lack of regulation and transparency increases the risk of manipulation, fraud, and information asymmetry.

Regulatory Scrutiny

Regulators are increasingly scrutinizing grey market activity due to concerns about investor protection and market integrity.

Increased surveillance and enforcement actions are being implemented to address potential abuses and ensure fair trading practices.

Investors should be cautious and conduct thorough due diligence before participating in grey market trading.

Looking Ahead

The future of grey market trading hinges on the balance between fostering market efficiency and safeguarding investors.

Ongoing regulatory developments and technological advancements will continue to shape the landscape of pre-market trading activity.

Investors are urged to stay informed about regulatory changes and exercise caution when engaging in the trading of newly issued securities.

+markets.jpg)