Ways To Raise Money For A Business

Starting a business often requires significant capital, and entrepreneurs explore various avenues to secure funding. From traditional loans to innovative crowdfunding campaigns, the options are diverse and cater to different needs and circumstances.

This article examines key strategies for raising money for a business, focusing on their mechanics, benefits, and potential drawbacks. Understanding these options is crucial for aspiring and existing business owners seeking financial stability and growth.

Traditional Funding Sources

Bank Loans

Securing a bank loan remains a common approach. Banks assess credit history, business plans, and collateral to determine loan eligibility and interest rates.

The Small Business Administration (SBA) often guarantees loans, reducing risk for lenders and making it easier for small businesses to qualify. This is often a more secure option that some of the other methods described below.

However, loan applications can be lengthy, and repayment terms can be demanding.

Venture Capital

Venture capital (VC) firms invest in high-growth potential startups in exchange for equity. VC funding often comes with mentorship and strategic guidance.

This option provides substantial capital but dilutes ownership and subjects the business to investor influence.

VCs typically expect a significant return on their investment, leading to pressure for rapid growth and profitability.

Angel Investors

Angel investors are individuals with high net worth who invest their own money in early-stage businesses. They often provide smaller investments than VC firms but can be more flexible and accessible.

Like VCs, angel investors receive equity in exchange for their investment.

Finding the right angel investor who understands your business and industry is crucial for a successful partnership.

Alternative Funding Methods

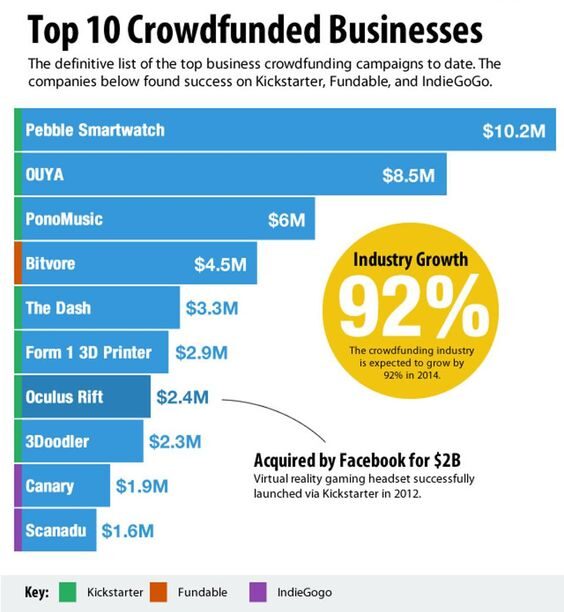

Crowdfunding

Crowdfunding platforms like Kickstarter and Indiegogo allow businesses to raise money from a large number of individuals, typically in exchange for rewards or equity.

This method can be effective for raising awareness and building a customer base. According to a 2023 report by Statista, the global crowdfunding market is projected to reach $39.8 billion by 2027.

However, successful crowdfunding campaigns require extensive marketing and a compelling pitch.

Bootstrapping

Bootstrapping involves funding a business with personal savings and revenue generated by the business itself.

This method allows entrepreneurs to maintain full control and avoid debt.

However, growth can be slower, and resources may be limited in the early stages.

Grants

Government agencies and private foundations offer grants to businesses that meet specific criteria. Grants do not need to be repaid, making them an attractive funding source.

The application process can be competitive and time-consuming.

"Securing a grant often requires a detailed proposal and strong alignment with the grantor's mission," says Dr. Anya Sharma, a business grant consultant.

Examples of grant programs include those offered by the National Institutes of Health (NIH) for biomedical research and the Department of Energy for clean energy initiatives.

Microloans

Microloans are small loans, typically under $50,000, offered by specialized lenders to entrepreneurs and small businesses. Accion and Kiva are prominent microloan providers.

These loans can be particularly helpful for businesses that do not qualify for traditional bank loans.

Interest rates on microloans can be higher than those on traditional loans.

Choosing the right funding method depends on the business's stage, industry, and financial needs. Carefully evaluating the pros and cons of each option is essential for securing the necessary capital while maintaining control and minimizing financial risk.