What Are The Four Stages Of The Business Cycle

The relentless rhythm of the economy impacts every business, every household, and every investment. Understanding the forces that drive its fluctuations is not just academic; it's crucial for navigating the complex financial landscape.

From boom to bust, these cyclical patterns, known as the business cycle, shape our financial realities.

The Business Cycle: A Comprehensive Overview

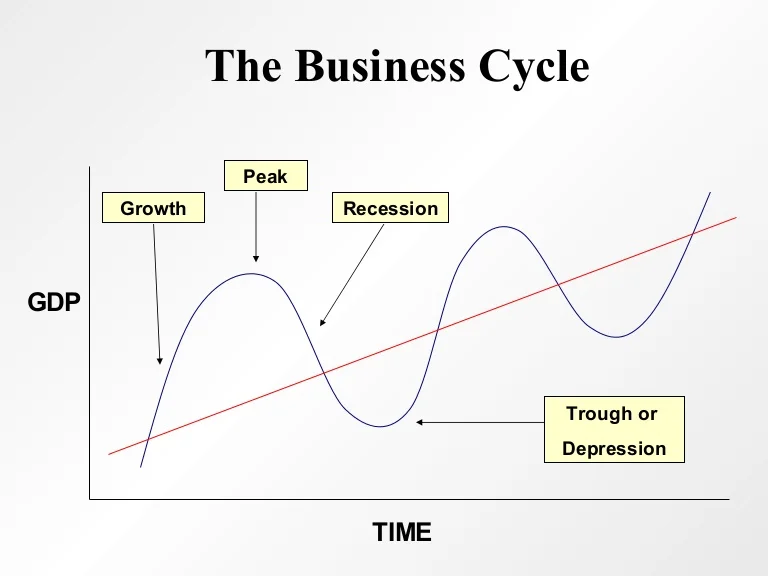

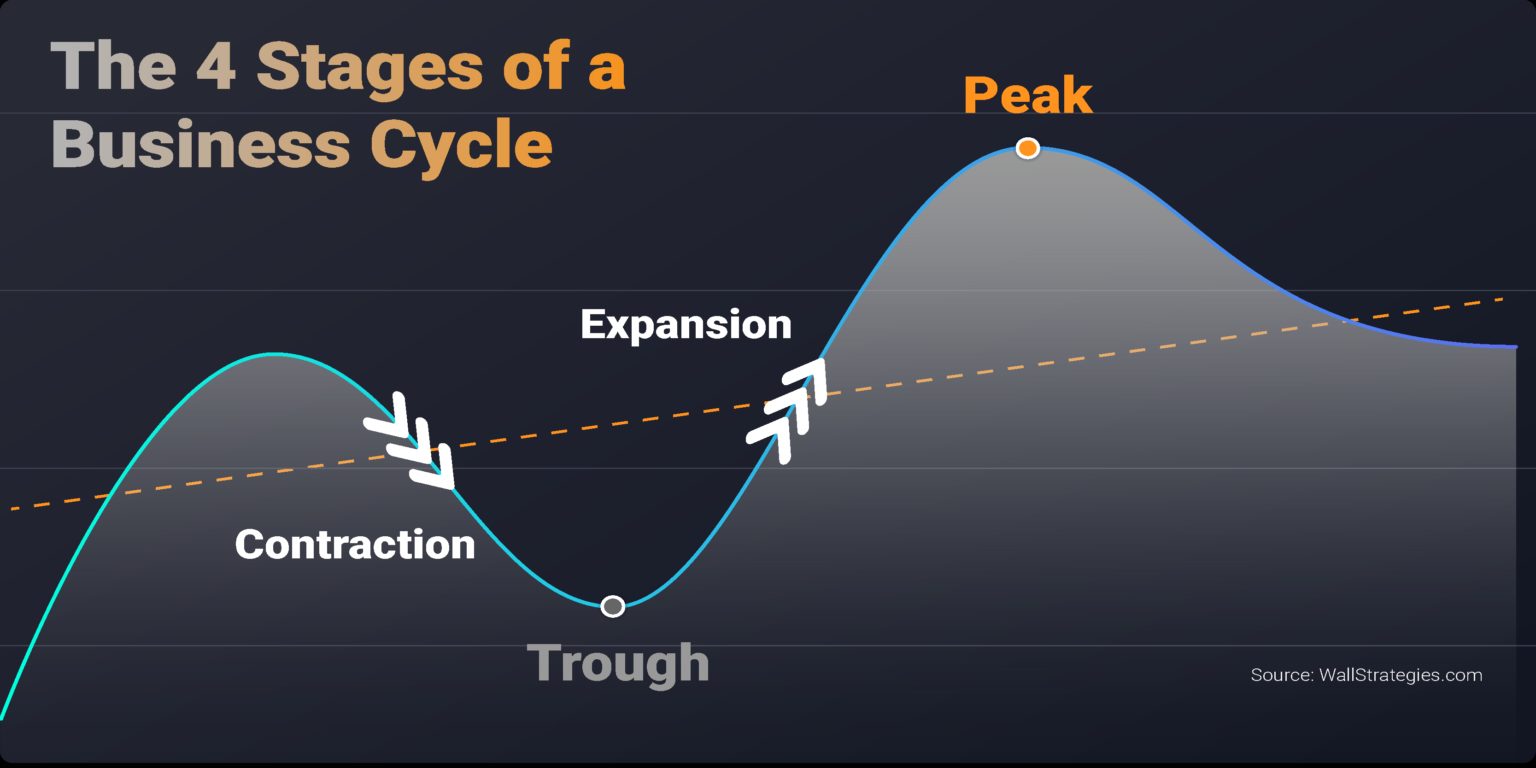

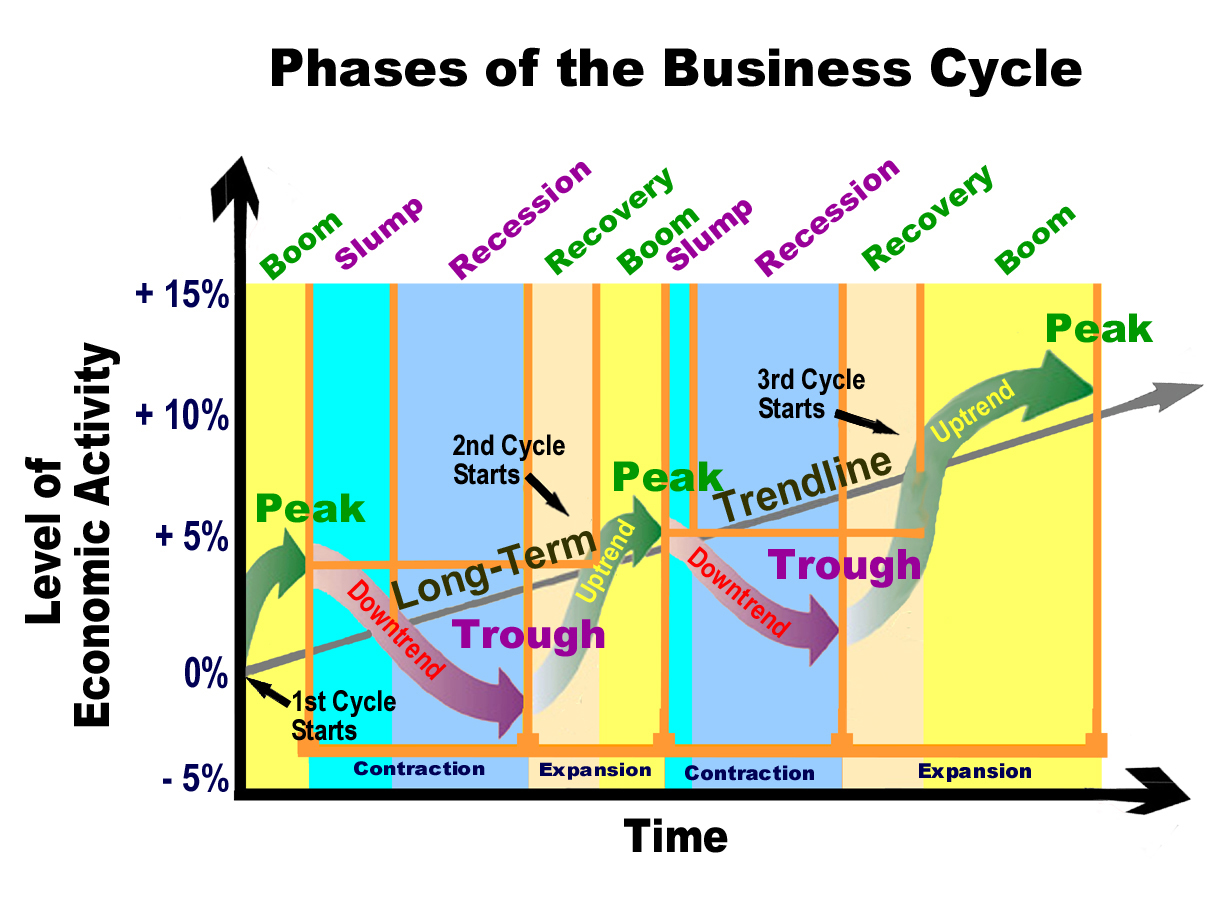

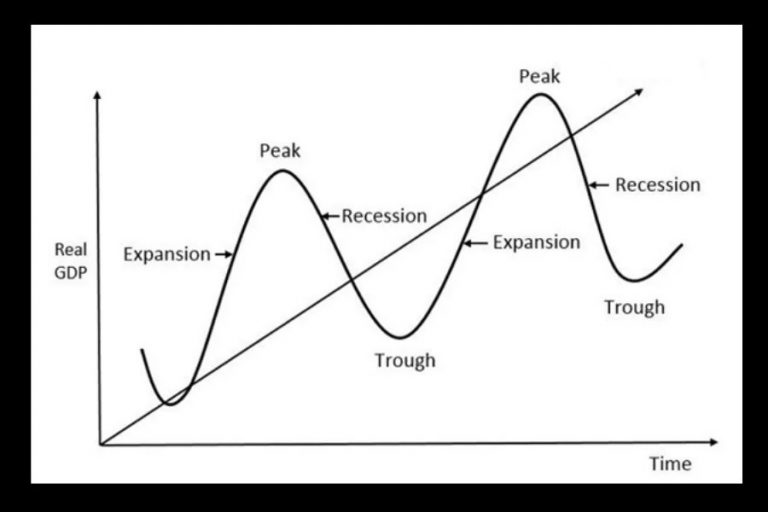

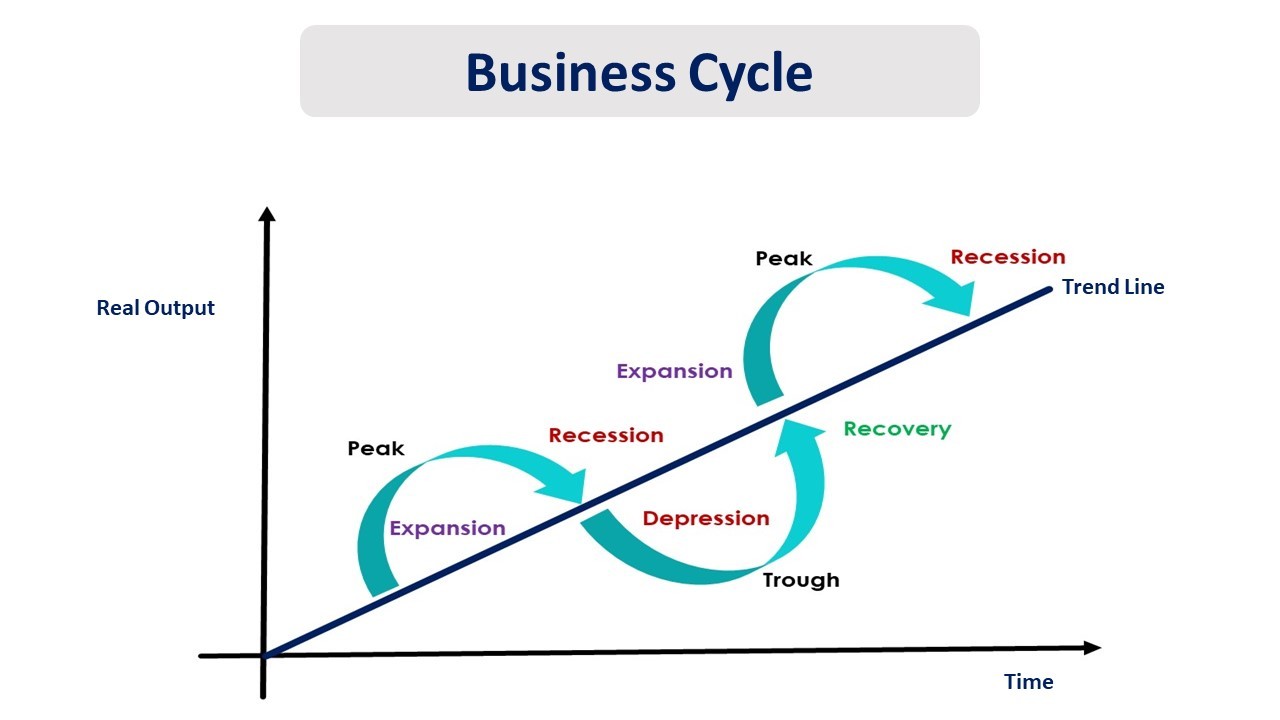

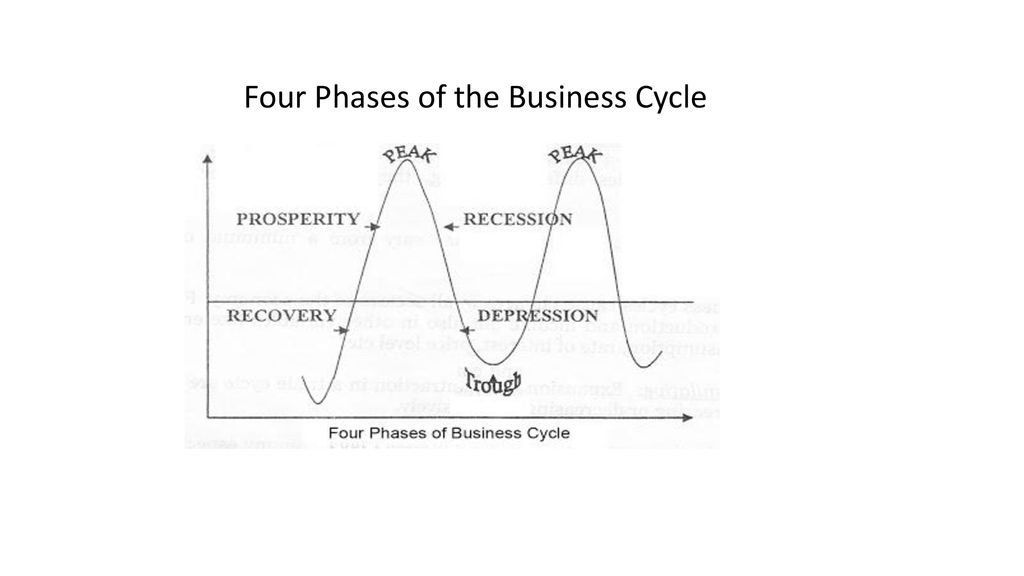

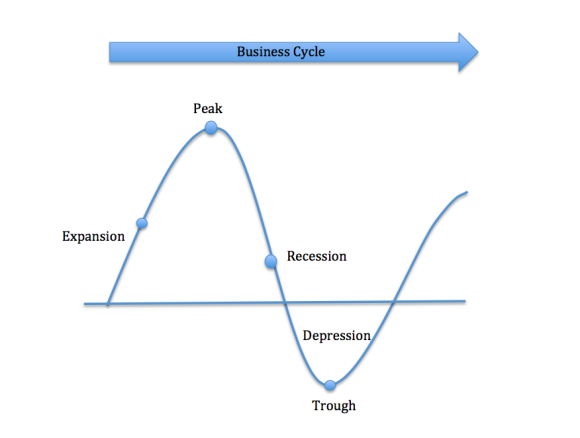

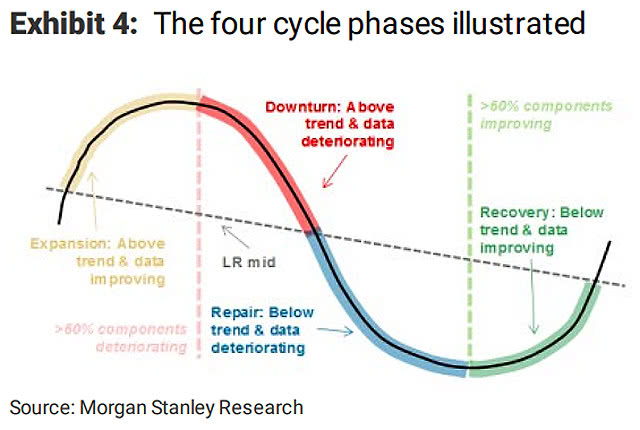

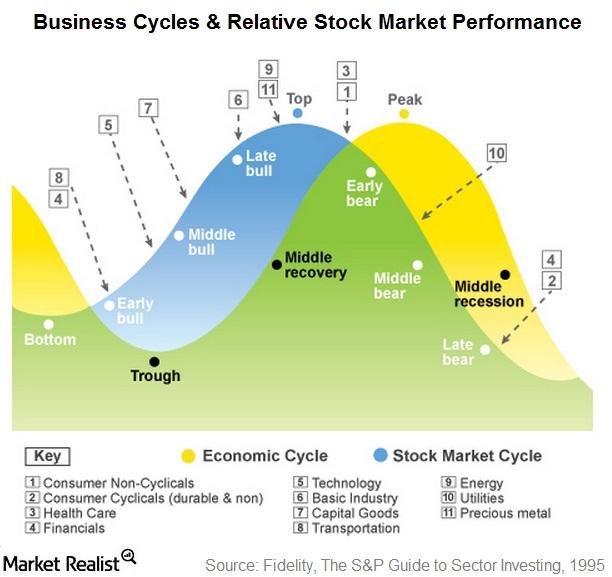

This article delves into the four distinct stages of the business cycle: expansion, peak, contraction (or recession), and trough. We will examine the characteristics of each stage, backed by economic data and insights from leading financial institutions, providing a clear framework for understanding the current economic climate and anticipating future trends.

We'll explore how these stages influence key economic indicators and discuss the factors that contribute to transitions between them.

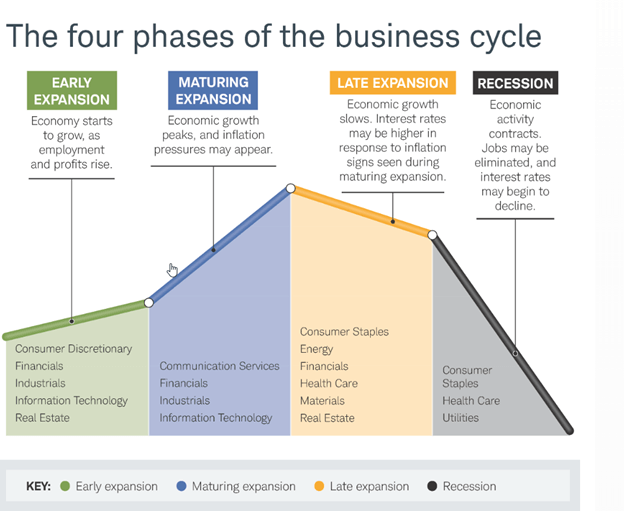

Stage 1: Expansion

The expansion phase is characterized by sustained economic growth. Businesses experience increased sales and profits, leading to job creation and lower unemployment rates.

Consumer confidence rises, fueling increased spending and investment. According to data from the Bureau of Economic Analysis (BEA), during expansionary periods, Gross Domestic Product (GDP) typically grows at an accelerated pace.

Interest rates often remain relatively low to encourage borrowing and investment, although central banks may gradually increase them to manage inflation.

Stage 2: Peak

The peak represents the highest point of economic activity in the business cycle. At this stage, the economy is operating at or near full capacity, with minimal unemployment and maximum output.

However, inflationary pressures begin to build as demand outstrips supply. Businesses may struggle to find qualified workers, leading to wage increases and further price hikes.

The Federal Reserve often responds by raising interest rates to curb inflation, which can eventually slow down economic growth.

Stage 3: Contraction (Recession)

The contraction phase, often referred to as a recession, is marked by a decline in economic activity. GDP falls for two consecutive quarters, according to the widely accepted definition.

Businesses experience declining sales and profits, leading to layoffs and rising unemployment. Consumer confidence plummets, resulting in reduced spending and investment.

The Bureau of Labor Statistics (BLS) tracks unemployment rates, a key indicator of the contraction phase, which typically increase significantly during recessions.

The National Bureau of Economic Research (NBER) officially declares recessions, analyzing a range of economic indicators to determine the start and end dates.

Stage 4: Trough

The trough represents the lowest point of economic activity in the business cycle. It marks the end of the contraction phase and the beginning of the next expansion.

At the trough, economic indicators are at their lowest levels. Businesses may have significantly reduced production and employment.

However, this phase also sets the stage for recovery. As interest rates remain low and government stimulus measures take effect, businesses and consumers begin to regain confidence.

Inventory levels are depleted, creating demand for new production. The International Monetary Fund (IMF) often monitors global economic troughs, providing guidance on policy responses.

Factors Influencing the Business Cycle

Numerous factors can influence the length and severity of each stage in the business cycle. These include monetary policy decisions by central banks, fiscal policy measures implemented by governments, technological innovations, and global economic events.

For example, a sudden increase in oil prices can trigger a contraction, while a breakthrough innovation can fuel an expansion. Consumer sentiment, driven by factors like political stability and confidence in the future, also plays a significant role.

The Future of the Business Cycle

Predicting the future of the business cycle is notoriously difficult. However, by carefully monitoring economic indicators, analyzing historical trends, and understanding the underlying forces driving economic activity, it is possible to make informed judgments about the likely direction of the economy.

Currently, economists hold diverse views on the near-term economic outlook. Some predict a potential slowdown due to rising interest rates and persistent inflation, while others foresee continued growth driven by strong consumer spending and technological advancements.

Ultimately, the business cycle is an inherent part of the economic landscape. Understanding its dynamics is essential for investors, businesses, and policymakers alike to make sound decisions and navigate the ever-changing economic climate.

/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)

.png)

:max_bytes(150000):strip_icc()/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)