What Do I Need To Open A Franchise

Imagine the aroma of freshly brewed coffee mingling with the sweet scent of pastries, the friendly chatter of customers, and the satisfying click of the cash register. You envision yourself at the heart of it all, not just as a customer, but as the owner, the one steering the ship. The thought of owning a franchise, a proven business model with established brand recognition, dances in your head. But where do you even begin?

Franchising offers an enticing path to entrepreneurship, but it's not as simple as signing a contract and opening your doors. This article will guide you through the essential steps and considerations to determine if franchise ownership is the right fit for you, outlining the financial requirements, legal obligations, and personal attributes necessary to succeed.

Understanding the Franchise Landscape

Franchising is a business model where a franchisor grants a franchisee the right to operate a business using the franchisor’s brand name, trademarks, and operating system. Think of well-known names like McDonald's, Subway, or Anytime Fitness. These are all examples of successful franchise operations.

According to the International Franchise Association (IFA), franchising contributes significantly to the US economy. The IFA estimates that franchises support millions of jobs and generate hundreds of billions of dollars in economic output annually. This substantial contribution underscores the potential, but also the complexity, of this business model.

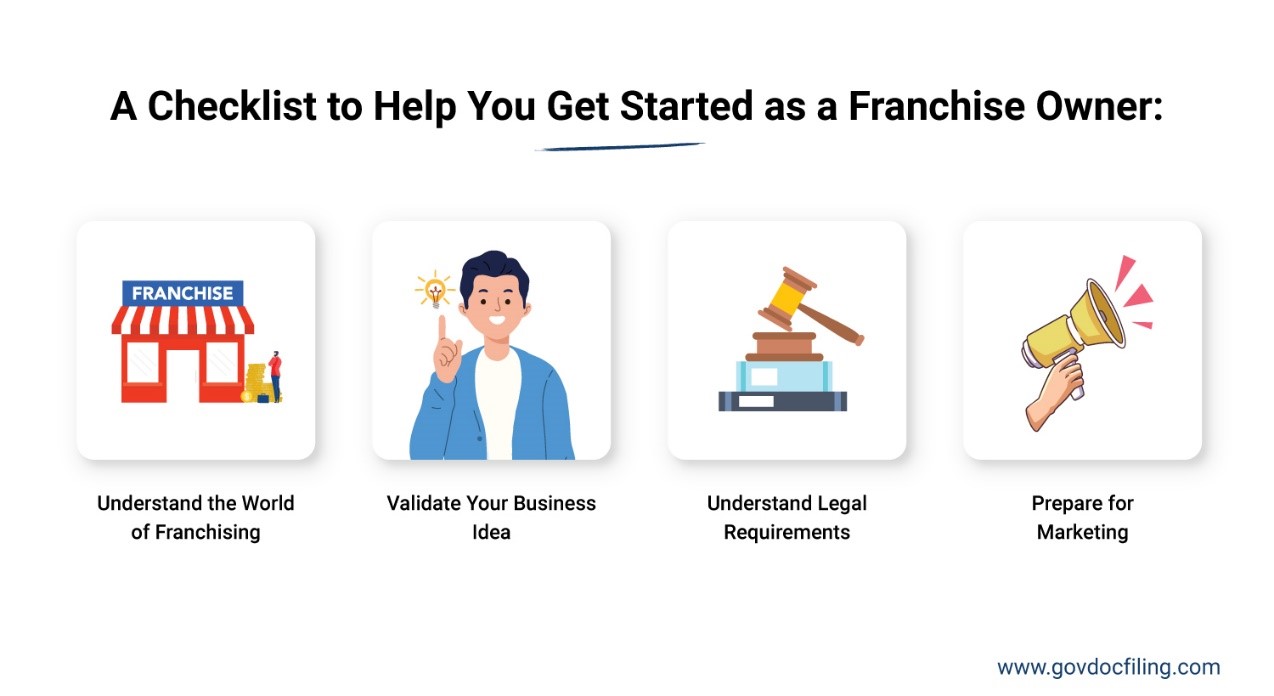

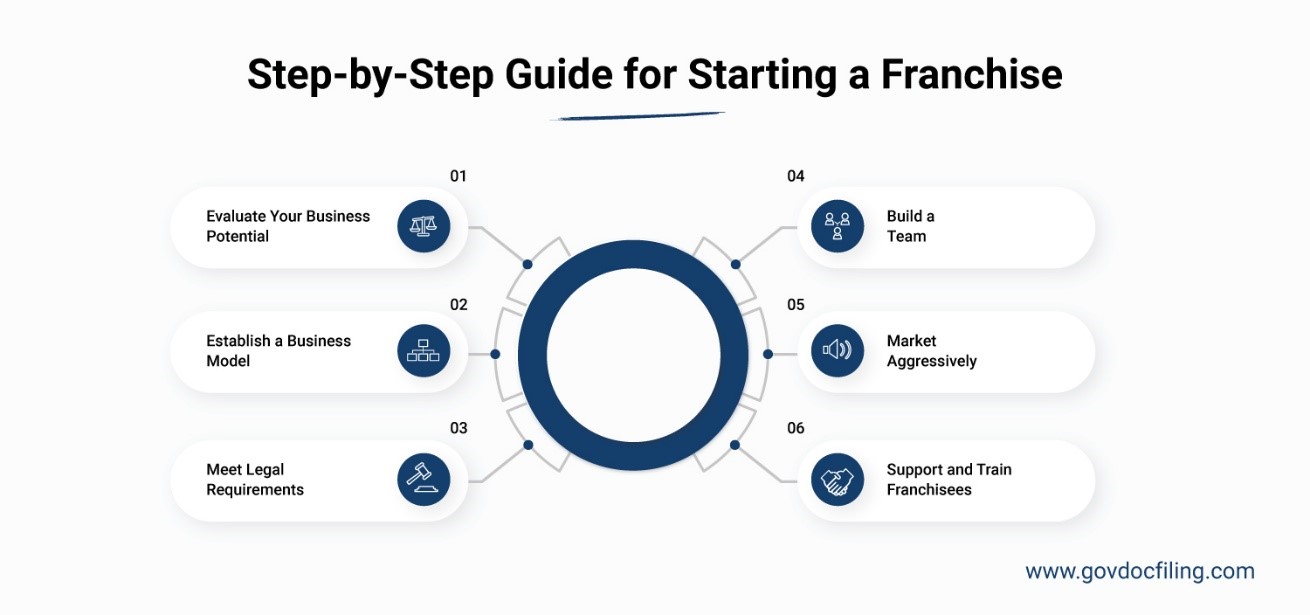

Essential Steps to Franchise Ownership

The journey to franchise ownership is a multi-stage process. Careful planning and due diligence are crucial.

Step 1: Self-Assessment and Research

Before diving into specific franchise opportunities, take some time for introspection. What are your passions, your skills, and your financial capabilities? Consider your risk tolerance and your preferred work-life balance.

Research various franchise industries, from food and beverage to retail and services. Identify sectors that align with your interests and capabilities. Start by visiting franchise directories and attending franchise expos.

Step 2: Financial Planning and Funding

Franchising requires a significant financial investment. This includes the initial franchise fee, startup costs (equipment, inventory, leasehold improvements), and working capital.

Explore various funding options, such as small business loans, personal savings, and investor financing. Consult with a financial advisor to develop a comprehensive financial plan. The Small Business Administration (SBA) often provides resources and loan guarantees for franchisees.

Step 3: Franchise Opportunity Evaluation

Once you've identified potential franchises, conduct thorough due diligence. Request and carefully review the Franchise Disclosure Document (FDD). This document contains critical information about the franchise system, including financial performance representations, legal obligations, and franchisee contact information.

Speak with existing franchisees to gain firsthand insights into their experiences. Ask about the challenges and rewards of operating the franchise. A key part of the FDD is Item 19, which discloses financial performance representations (if any) that can give you an idea of potential revenue and expenses.

Step 4: Legal Review and Contract Negotiation

Engage a qualified franchise attorney to review the franchise agreement. This agreement is a legally binding contract that outlines the rights and responsibilities of both the franchisor and the franchisee.

Your attorney can help you understand the legal implications of the agreement and negotiate favorable terms. Do not sign the agreement without seeking legal counsel.

Step 5: Training and Launch

After signing the franchise agreement, you will typically undergo extensive training provided by the franchisor. This training covers all aspects of operating the business, from customer service to inventory management.

Follow the franchisor's guidelines and utilize their support system. A successful launch is crucial for long-term success.

Key Considerations for Success

Beyond the steps outlined above, certain personal attributes and operational strategies contribute to franchise success.

Strong leadership skills, a commitment to customer service, and a willingness to follow the franchisor's system are essential. Building a strong team and managing your finances effectively are also crucial.

Remember that franchising is not a passive investment. It requires hard work, dedication, and a willingness to learn and adapt. The support of the franchisor and the strength of the brand are valuable assets, but ultimately, your success depends on your own efforts.

The Rewards of Franchise Ownership

While franchising demands hard work and dedication, the rewards can be substantial. You'll have the opportunity to build a successful business with a proven model and a recognizable brand.

The potential for financial independence and the satisfaction of being your own boss are significant motivators. By carefully evaluating your options and committing to the process, you can turn your entrepreneurial dreams into a reality.

Owning a franchise is a journey, not a destination. It's about building something lasting, contributing to your community, and achieving your personal and professional goals. So, take that first step, do your research, and embrace the exciting world of franchising.

/requirements-to-open-a-mcdonald-s-franchise-1350970-Final-5c890d0446e0fb00012c67a3.png)