What Is 20 Percent Of 1600

The question “What is 20 percent of 1600?” has been unexpectedly trending online, sparking discussions across various platforms and highlighting a renewed interest in basic mathematical concepts. The query's simple nature belies its relevance in everyday financial calculations and decision-making processes.

At its core, the answer to this question is 320. However, the online surge in interest reveals a broader need for accessible and easily understandable explanations of percentage calculations, particularly in the context of discounts, taxes, and financial planning.

The Calculation: A Simple Explanation

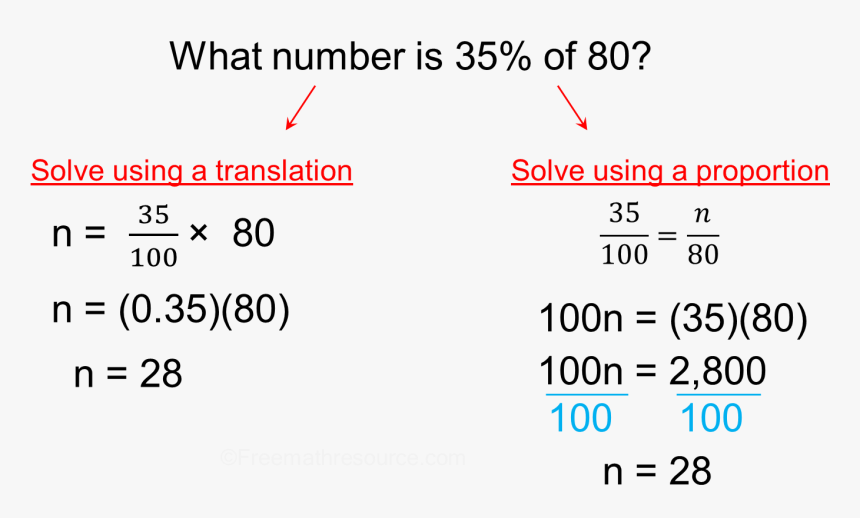

Calculating percentages is a fundamental mathematical skill. To find 20 percent of 1600, you can multiply 1600 by 0.20 (the decimal equivalent of 20 percent).

Mathematically, this is expressed as: 1600 * 0.20 = 320.

Therefore, 20 percent of 1600 is 320.

Why The Sudden Interest?

The reasons behind the sudden online interest are varied. Some speculate that it could be linked to recent online shopping trends where discounts are frequently expressed in percentages.

Others believe it might be due to educational content gaining traction or even a simple case of algorithmic amplification on social media platforms.

It’s difficult to pinpoint a single cause, but the effect is a widespread conversation about basic mathematical principles.

The Role of Online Shopping and Discounts

Online retailers frequently offer discounts expressed as percentages. Understanding how to calculate these discounts quickly is crucial for consumers to make informed purchasing decisions.

Knowing that 20 percent of a $1600 item is $320 allows shoppers to immediately assess the actual savings and compare deals effectively.

This practical application makes percentage calculations a valuable skill in today's digital economy.

Educational Initiatives and Online Learning

Many online educational platforms and resources focus on reinforcing basic mathematical concepts. These initiatives often use real-world examples to make learning more engaging and relevant.

The trending question could be a byproduct of these educational efforts, as more people seek quick and easy answers to common mathematical problems.

Furthermore, the Khan Academy and similar organizations offer free resources covering percentage calculations, potentially contributing to the increased interest.

The Significance of Understanding Percentages

Understanding percentages is essential for various aspects of daily life. From calculating tips at restaurants to understanding interest rates on loans, percentages play a vital role in financial literacy.

A lack of understanding can lead to poor financial decisions and vulnerability to deceptive marketing practices.

Therefore, reinforcing these skills is crucial for empowering individuals to make informed choices.

"A strong grasp of basic mathematics, including percentages, is fundamental to navigating the complexities of modern financial life," stated Dr. Anya Sharma, a financial literacy expert. "It allows individuals to confidently assess deals, manage their finances, and avoid potential pitfalls."

Beyond the Calculation: Real-World Applications

The relevance of this simple calculation extends beyond online shopping. It applies to understanding taxes, budgeting, and investment returns.

For example, if someone invests $1600 and experiences a 20 percent gain, they would have earned $320. Similarly, understanding how to calculate 20 percent of their income can help individuals budget effectively for savings or expenses.

These practical applications underscore the importance of mathematical literacy in everyday life.

The unexpectedly trending question "What is 20 percent of 1600?" serves as a reminder of the importance of basic mathematical skills in everyday life. While the calculation itself is straightforward, the renewed interest highlights a broader need for accessible and understandable explanations of financial concepts. As online shopping and financial transactions become increasingly prevalent, a strong grasp of percentages will continue to be a vital asset for individuals and society as a whole. This simple question underscores the importance of continuous learning and reinforcing foundational mathematical concepts for a more financially literate population.

![What Is 20 Percent Of 1600 What is 5 Percent of 20000? = 1000 [With 2 Solutions]](https://timehackhero.com/wp-content/uploads/2024/01/What-is-5-Percent-of-20000-1000-With-2-Solutions.png)