What Is The Best Company To Invest With

Imagine sitting on your porch swing, the gentle evening breeze carrying the scent of honeysuckle. You're not just enjoying the peace; you're also contemplating your financial future. Where should you entrust your hard-earned savings to help them grow and secure your dreams? The options seem endless, each promising prosperity, but which one truly delivers?

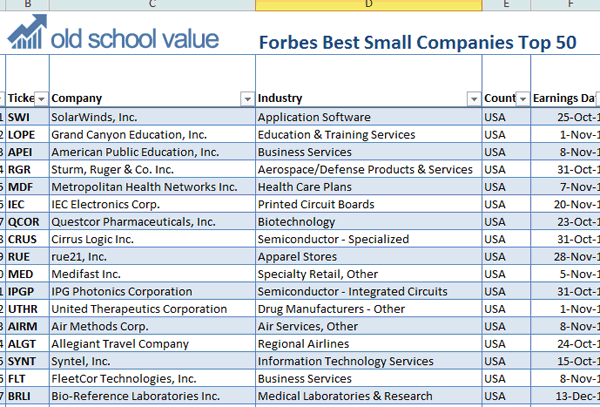

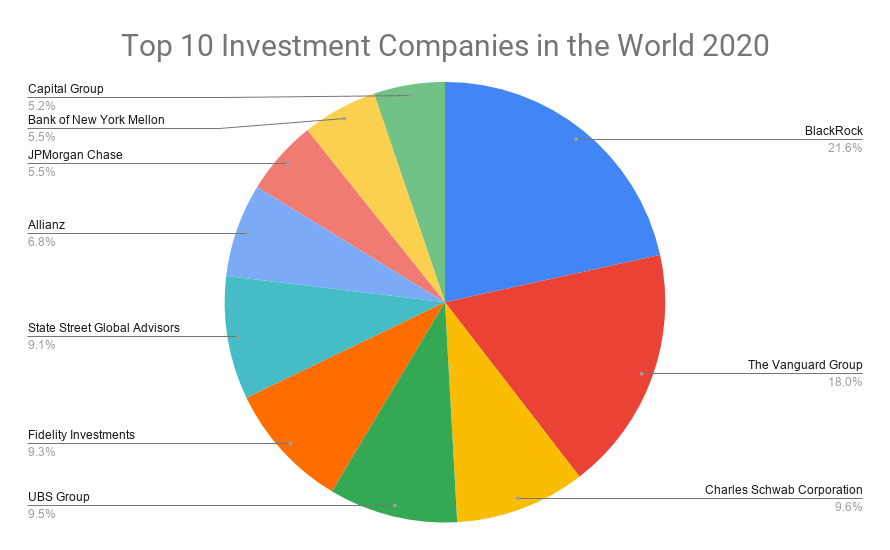

The quest for the "best" investment company is a deeply personal journey, with no one-size-fits-all answer. While giants like Vanguard, Fidelity, and Charles Schwab consistently rank high in investor satisfaction and assets under management, the ideal choice hinges on individual needs, risk tolerance, and investment goals. This article explores these leading contenders, examining their strengths and weaknesses to help you make an informed decision.

The Giants of Investing

Vanguard, founded by the late John Bogle, champions low-cost investing with its index funds and ETFs. Their philosophy centers around minimizing expenses to maximize returns for the average investor. This approach has resonated deeply, making them a powerhouse in the investment world.

Fidelity offers a broader range of services, including actively managed funds, brokerage accounts, and retirement planning tools. They cater to both seasoned investors and beginners, providing ample educational resources and customer support. Their zero-fee index funds have become increasingly popular.

Charles Schwab distinguishes itself with its robust trading platform and extensive research capabilities. They are a strong choice for active traders who want to stay informed about market trends. Like Fidelity, Schwab also offers a suite of banking services, streamlining financial management.

What Matters Most To You?

Before diving into specific companies, it’s crucial to define your investment priorities. Are you a beginner seeking a user-friendly platform with educational resources? Or an experienced trader looking for advanced tools and low trading fees?

Consider your risk tolerance. Are you comfortable with higher-risk investments for potentially higher returns, or do you prefer a more conservative approach? Answering these questions will narrow down your options considerably.

Think about the level of service you require. Do you prefer hands-on guidance from a financial advisor or are you comfortable managing your investments independently? Many companies offer both options, albeit at varying costs.

Digging Deeper: Fees, Services, and Reputation

Fees can significantly impact your investment returns over time. Vanguard is renowned for its rock-bottom expense ratios on its index funds. Fidelity and Charles Schwab have also made strides in reducing fees, offering zero-fee index funds to compete.

The quality of customer service is another important factor. J.D. Power consistently surveys investors about their experiences with different firms. Their data provides valuable insights into customer satisfaction levels.

Look beyond the marketing materials and research the company's reputation. Check for regulatory actions or customer complaints. A company with a clean track record inspires confidence.

“The investor's chief problem—and even his worst enemy—is likely to be himself.” - Benjamin Graham

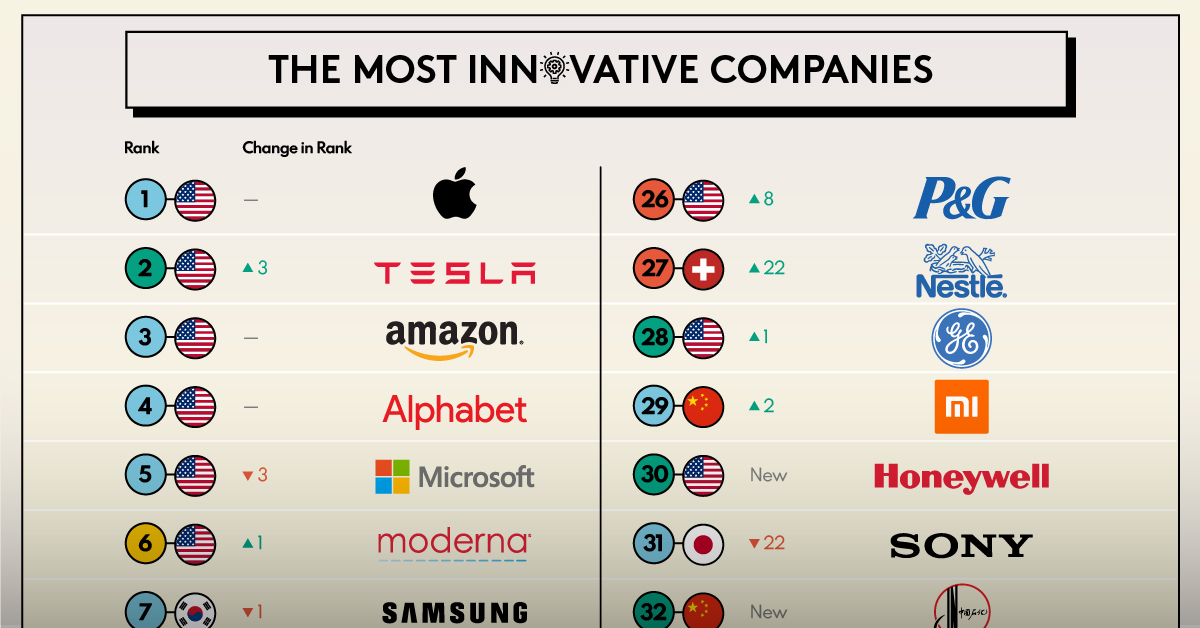

Beyond the major players, consider exploring smaller, specialized firms. Robo-advisors like Betterment and Wealthfront offer automated investment management at a low cost, appealing to tech-savvy investors. Boutique firms may specialize in specific investment strategies or industries.

The Long-Term Perspective

Investing is a marathon, not a sprint. Choose a company that aligns with your long-term goals and provides the support you need along the way. Don't chase short-term gains; focus on building a diversified portfolio that can weather market fluctuations.

Regularly review your investment strategy and make adjustments as needed. Your financial situation and goals may change over time. Staying proactive is key to achieving your financial objectives.

Ultimately, the "best" investment company is the one that empowers you to achieve your financial goals with confidence. Do your research, understand your needs, and choose wisely. Your future self will thank you.