Which Of The Following Appears On The Balance Sheet

Businesses face critical choices daily, and understanding financial statements is paramount. The question of what appears on a balance sheet is fundamental to assessing a company's financial health.

Decoding the Balance Sheet: Assets, Liabilities, and Equity

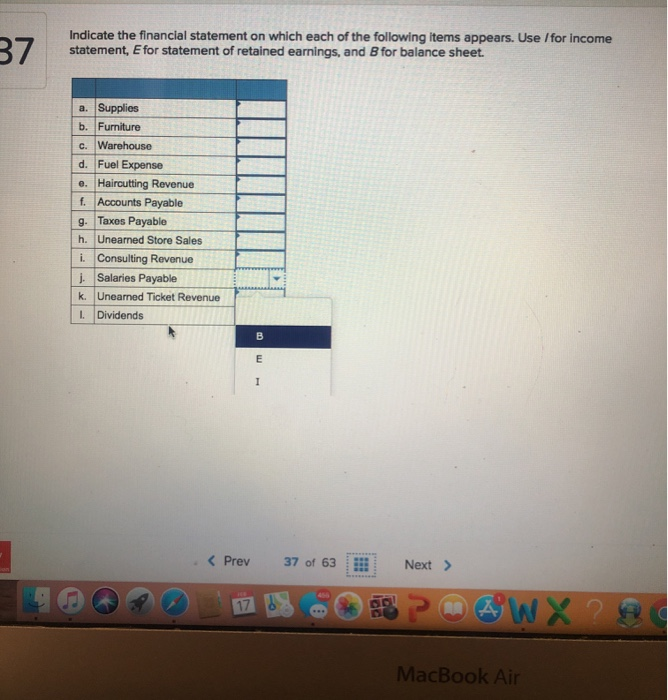

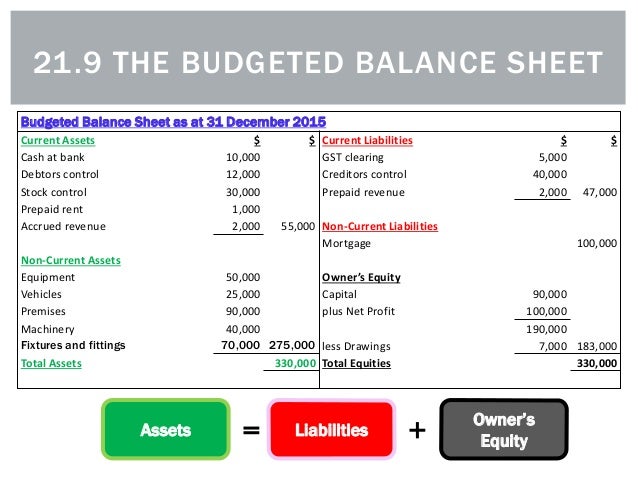

The balance sheet, a snapshot of a company's financial position at a specific point in time, operates under the basic accounting equation: Assets = Liabilities + Equity.

This equation dictates what elements are included and how they are categorized.

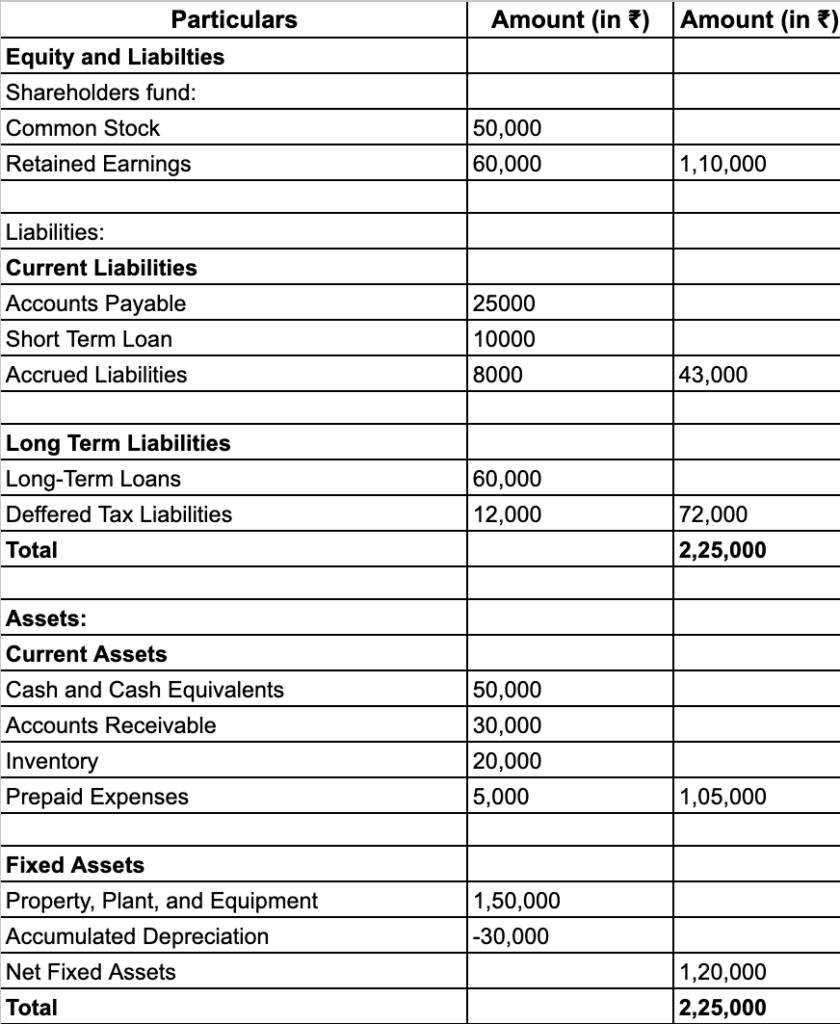

Assets: What a Company Owns

Assets represent what a company owns or is owed.

They are typically categorized as either current or non-current.

Current assets are those expected to be converted into cash or used up within one year.

Examples include cash and cash equivalents, accounts receivable (money owed by customers), inventory, and prepaid expenses.

Non-current assets have a life of more than one year.

They include property, plant, and equipment (PP&E), intangible assets like patents and trademarks, and long-term investments.

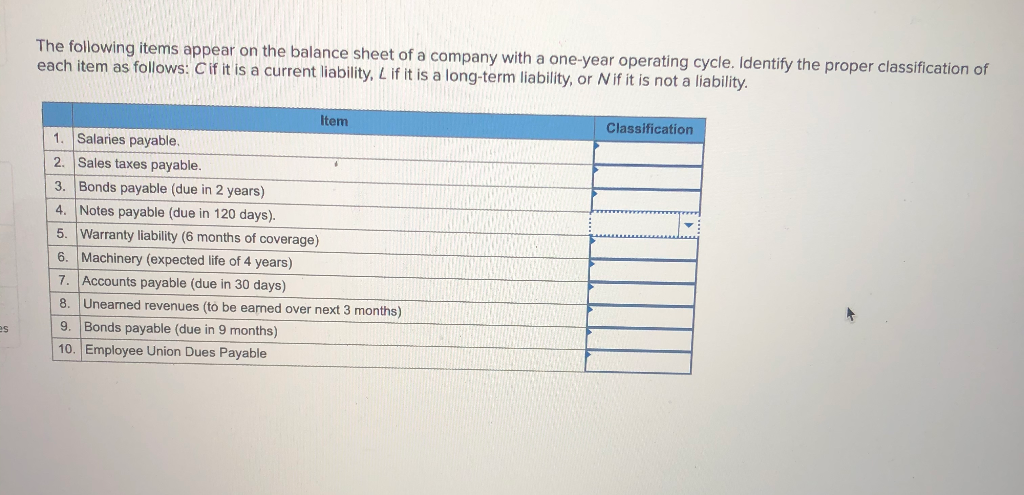

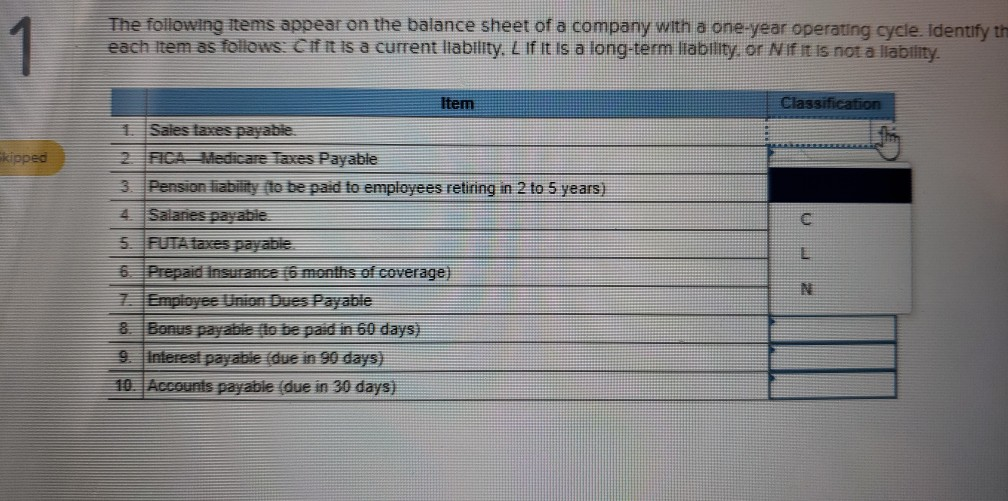

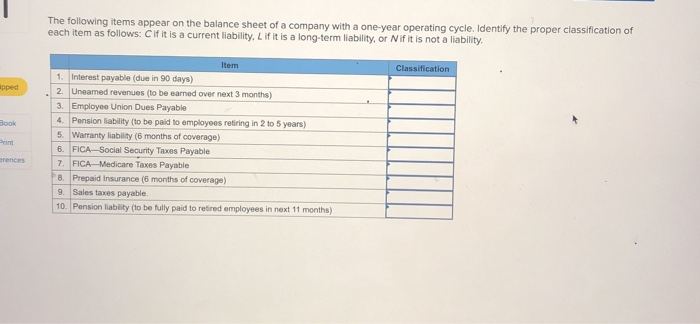

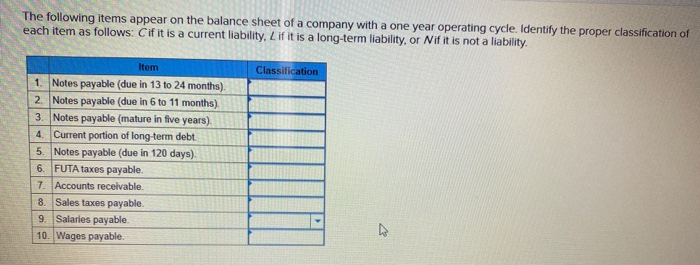

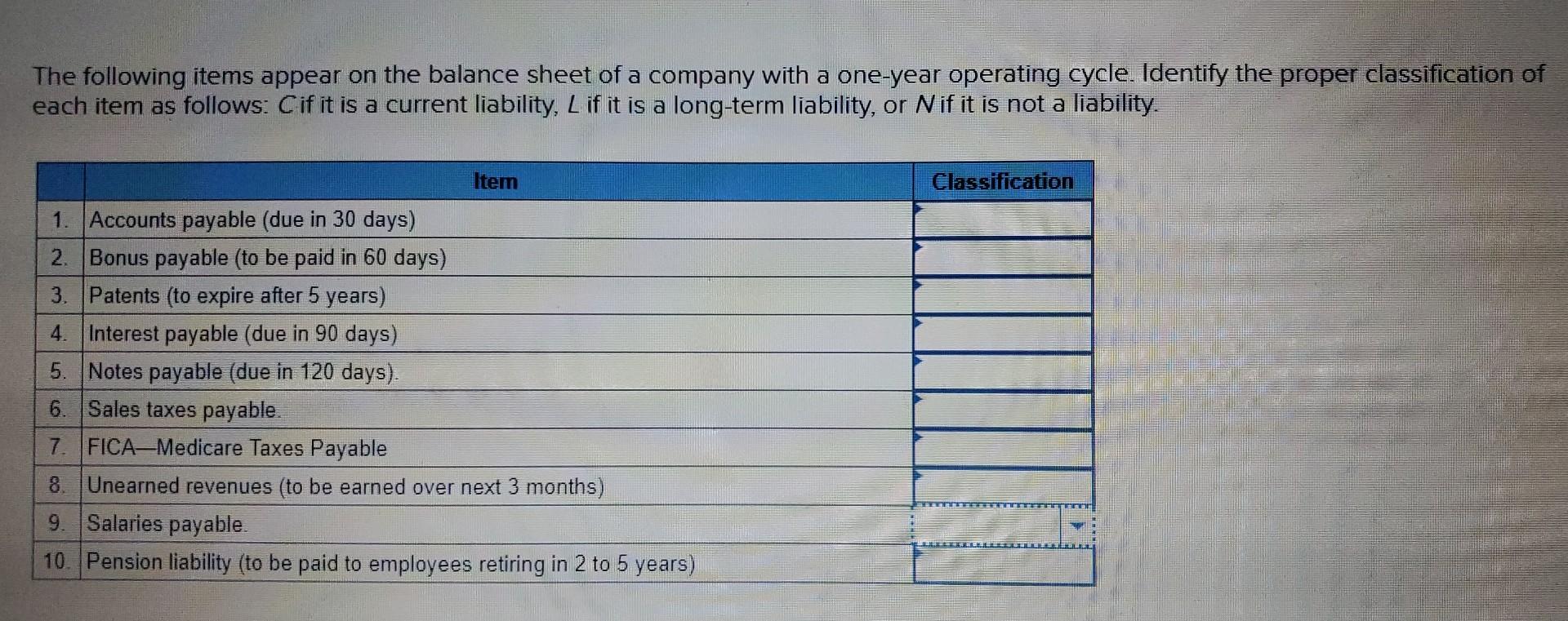

Liabilities: What a Company Owes

Liabilities represent what a company owes to others.

These are also categorized as current or non-current.

Current liabilities are obligations due within one year.

Examples include accounts payable (money owed to suppliers), salaries payable, short-term loans, and deferred revenue.

Non-current liabilities are obligations due in more than one year.

These include long-term debt, deferred tax liabilities, and lease obligations.

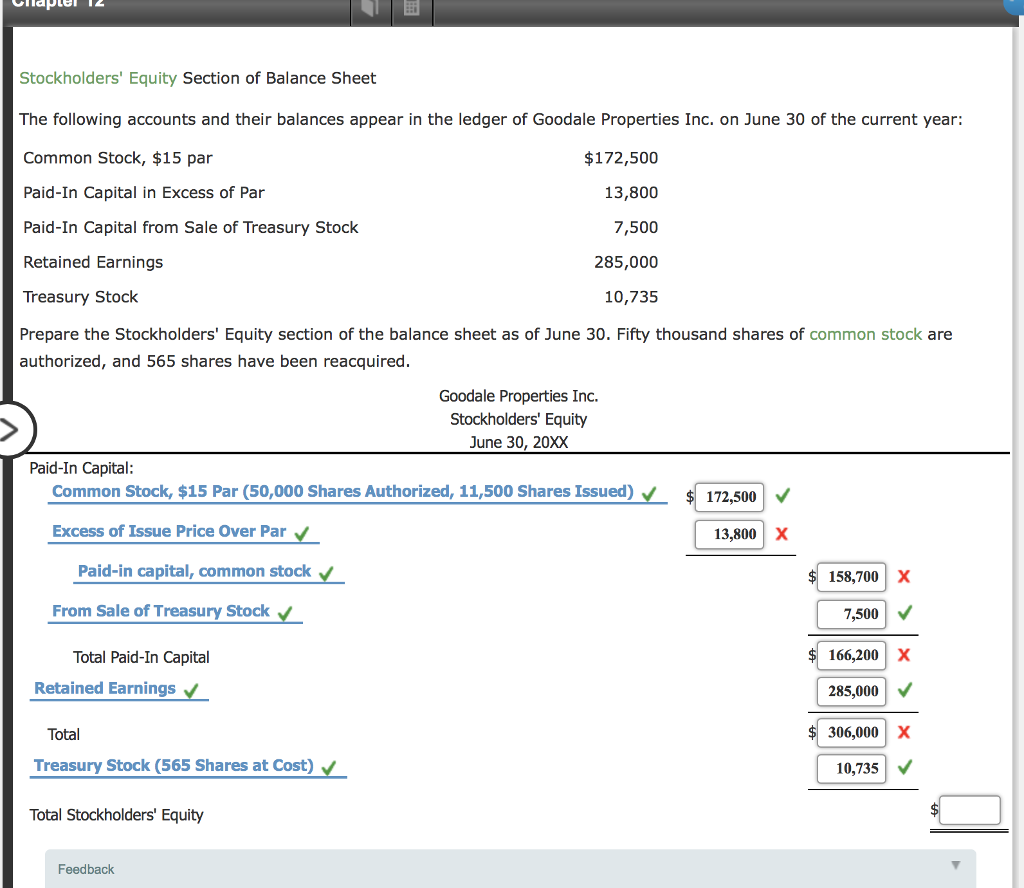

Equity: The Owners' Stake

Equity represents the owners' stake in the company.

It's the residual interest in the assets of the entity after deducting liabilities.

Common components include common stock, retained earnings (accumulated profits not distributed as dividends), and additional paid-in capital.

Items NOT on the Balance Sheet

It's equally important to understand what doesn't appear on a balance sheet.

While potentially significant to a company's future, certain items aren't directly reflected in the asset, liability, and equity framework.

Contingent liabilities, potential obligations dependent on future events, are generally disclosed in the footnotes to the financial statements, not on the balance sheet itself, unless their occurrence is probable and the amount can be reasonably estimated.

A highly skilled workforce, while a valuable asset, isn't typically recorded on the balance sheet due to the difficulty in assigning a monetary value and the lack of ownership.

Similarly, a company's reputation or brand image, though critical to success, is not directly reflected unless it's been acquired and recorded as goodwill.

The Importance of Accurate Representation

Accurate representation of these items on the balance sheet is crucial for informed decision-making by investors, creditors, and management.

The balance sheet provides a foundation for understanding a company's solvency, liquidity, and financial stability.

Therefore, adhering to accounting standards and ensuring proper categorization is paramount.

Ongoing Developments and Next Steps

Accounting standards are constantly evolving, with updates and revisions issued by bodies like the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB).

Companies must stay informed about these changes to ensure their balance sheets comply with the latest requirements.

Furthermore, ongoing analysis of the balance sheet is essential to identify potential risks and opportunities and to make strategic adjustments to improve financial performance.

![Which Of The Following Appears On The Balance Sheet [Solved] Common categories of a classified balance | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/04/660a5f0c399e9_724660a5f0c361ff.jpg)