Which Of The Following Creates A Deferred Tax Liability

Imagine a crisp autumn morning, sunlight filtering through the leaves as you settle down with a warm cup of coffee and the latest financial news. The stock market is buzzing, tax season is looming, and the complexities of corporate finance are swirling in the air like the falling leaves outside your window. Today, let's untangle one of those complexities: deferred tax liabilities and how they arise, which is crucial for understanding the financial health of any company.

At its heart, a deferred tax liability emerges when a company's accounting profit, calculated under accounting standards like GAAP or IFRS, differs from its taxable income, as determined by tax laws. The specific question we're addressing is: which accounting scenarios create this liability? Understanding the drivers behind deferred tax liabilities is essential for investors, accountants, and anyone seeking a clearer view of a company's financial future.

Understanding Deferred Tax Liabilities

Deferred tax liabilities aren't taxes owed today. They are taxes a company will likely owe in the future. These liabilities arise from temporary differences between the book value of an asset or liability and its tax base.

Think of it as a timing difference. Income or expenses are recognized at different times for accounting purposes versus tax purposes.

Common Scenarios Leading to Deferred Tax Liabilities

Several common situations trigger the creation of deferred tax liabilities. Here are some of the most prominent:

Accelerated Depreciation

Depreciation is the process of allocating the cost of an asset over its useful life. Companies often use accelerated depreciation methods (like double-declining balance) for tax purposes. This allows them to deduct a larger portion of the asset's cost in the early years of its life, reducing taxable income and, consequently, taxes in those years.

However, for accounting purposes, a company might use straight-line depreciation, which spreads the cost evenly over the asset's life. This creates a difference between the asset's book value (higher under straight-line) and its tax base (lower due to accelerated depreciation). This difference results in a deferred tax liability, because in future years, the company will have lower depreciation deductions for tax purposes than for accounting purposes, leading to higher taxable income and tax payments.

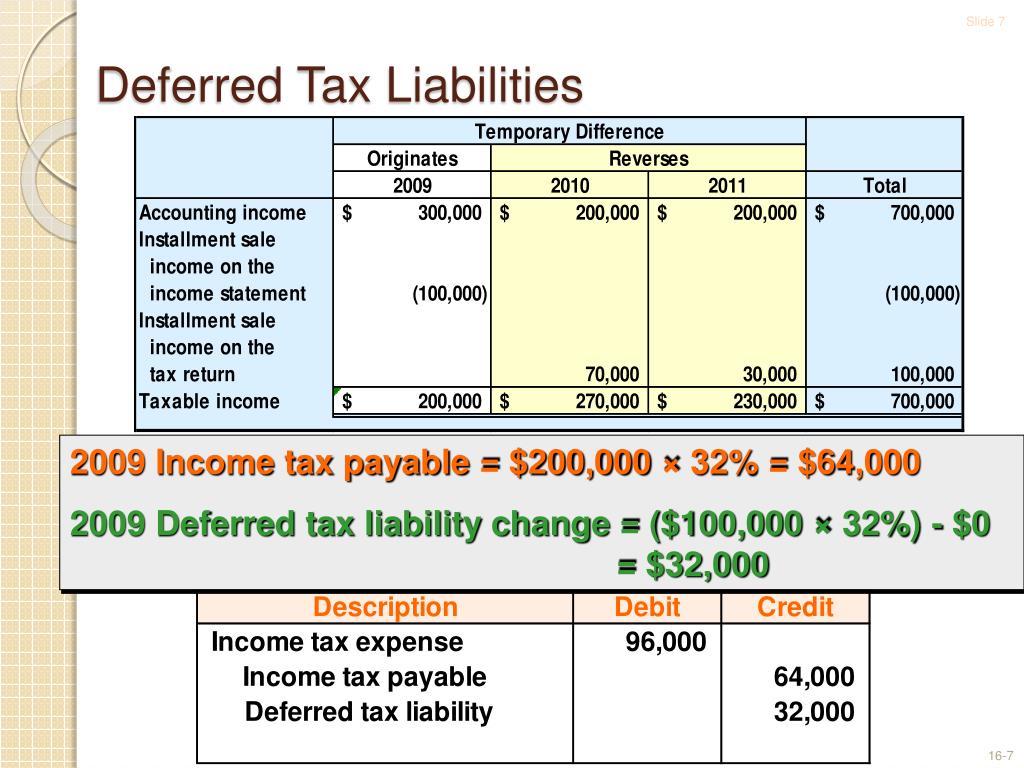

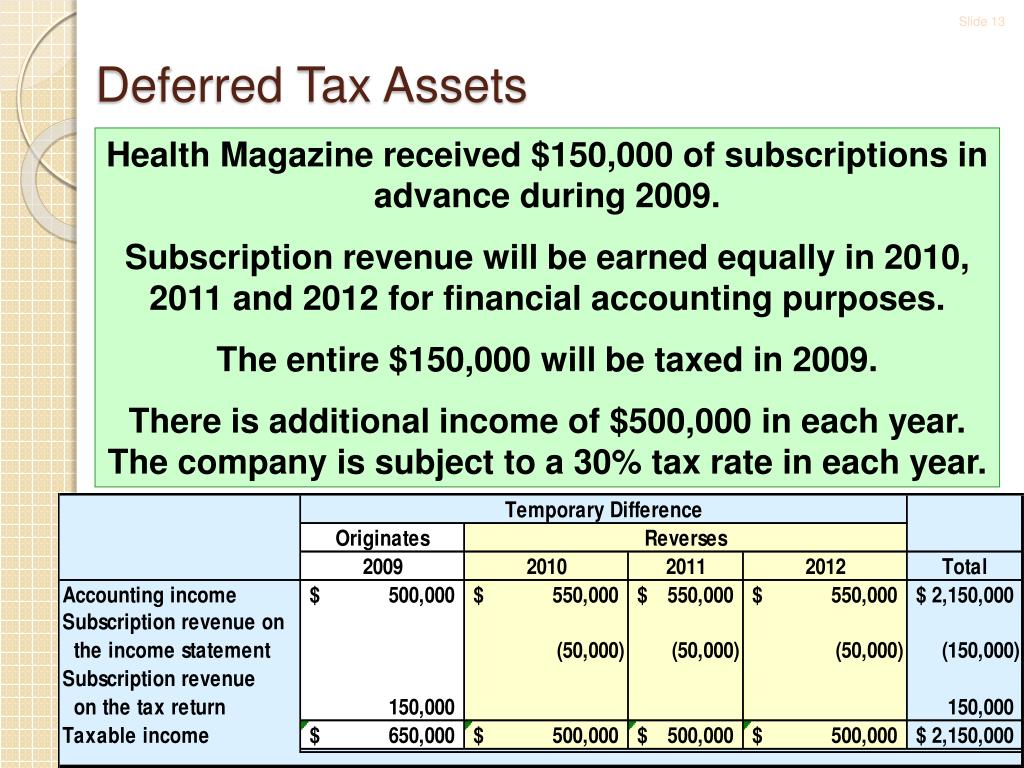

Installment Sales

Sometimes companies recognize revenue from sales over time, especially if they receive payments in installments. For accounting purposes, the entire revenue might be recognized immediately if the criteria for revenue recognition are met.

However, for tax purposes, the company might only recognize revenue as it receives cash payments. This difference in timing creates a deferred tax liability, as the company will eventually have to pay taxes on the remaining portion of the revenue recognized earlier for accounting purposes.

Unrealized Gains on Investments

Companies frequently hold investments, such as stocks or bonds. If the value of these investments increases, the company recognizes an unrealized gain for accounting purposes (especially under fair value accounting).

However, these gains are not taxed until the investment is actually sold. This difference creates a deferred tax liability, reflecting the tax that will be due when the gain is realized through the sale of the investment.

Prepaid Expenses

Prepaid expenses, such as insurance premiums, are paid in advance but the benefit is received over time. For accounting purposes, the expense is recognized gradually over the period the benefit covers.

For tax purposes, however, the expense might be immediately deductible. This creates a timing difference, leading to a deferred tax liability when the expense is recognized for accounting purposes in the future, but no further tax deduction is available.

The Importance of Deferred Tax Liabilities

Understanding deferred tax liabilities is vital for several reasons. For investors, these liabilities provide insight into a company's future tax obligations and can affect its profitability and cash flow. A large deferred tax liability might suggest that a company has been aggressively using tax strategies that will eventually catch up to them.

For accountants, accurately calculating and reporting deferred tax liabilities is crucial for complying with accounting standards and presenting a true and fair view of the company's financial position. It also helps in tax planning to mitigate future tax burdens.

For management, understanding the nature and magnitude of these liabilities can inform strategic decisions related to investments, financing, and overall business operations. Effective management of deferred tax liabilities can contribute to improved financial performance and shareholder value.

Example: Illustrating Accelerated Depreciation

Let's say ABC Corp purchases a machine for $100,000 with a useful life of 5 years. For tax purposes, they use double-declining balance depreciation. For accounting purposes, they use straight-line depreciation.

In the first year, under double-declining balance, the depreciation expense is $40,000 (2/5 * $100,000). Under straight-line, it's $20,000 ($100,000 / 5). The difference of $20,000 creates a temporary difference. If the tax rate is 25%, the deferred tax liability created is $5,000 (25% * $20,000).

This means ABC Corp effectively owes an additional $5,000 in taxes in future years because they claimed a larger depreciation expense upfront. This is a simplified example, but it illustrates the core concept.

Disclosures and Analysis

Companies are required to disclose their deferred tax assets and liabilities in their financial statements, usually within the notes to the financial statements. Investors and analysts should scrutinize these disclosures to understand the underlying reasons for the deferred tax items.

Changes in deferred tax liabilities can also provide valuable information about a company's tax planning strategies and future tax obligations. For example, a significant increase in deferred tax liabilities might signal that the company is engaging in aggressive tax avoidance strategies, which could be viewed negatively by investors if these strategies are deemed unsustainable or risky.

Conclusion

Deferred tax liabilities are an inherent part of corporate finance, arising from the different rules governing financial accounting and taxation. Recognizing which accounting scenarios create these liabilities – such as accelerated depreciation, installment sales, unrealized gains, and prepaid expenses – is essential for making informed financial decisions.

By understanding the nuances of deferred tax liabilities, investors and stakeholders gain a deeper appreciation for a company’s financial health, long-term prospects, and overall strategic direction. As the economic landscape continues to evolve, a solid grasp of these concepts will become even more crucial for navigating the complexities of the business world with confidence.