Which Of The Following Statements About Capital Structure Are Correct

Imagine a seasoned sailor, carefully adjusting the sails of a ship. Each rope pulled, each angle adjusted, represents a decision about how to best harness the wind's power. Similarly, in the world of business, executives are constantly making crucial decisions about their company’s financial structure.

At the heart of these decisions lies the concept of capital structure – the specific mix of debt and equity a company uses to finance its operations. Understanding which statements about capital structure are correct is paramount for investors, managers, and anyone seeking to navigate the complex seas of corporate finance. This article will delve into the core principles, exploring the factors that influence capital structure decisions and debunking common misconceptions along the way.

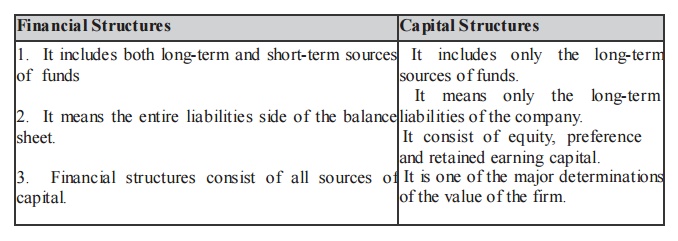

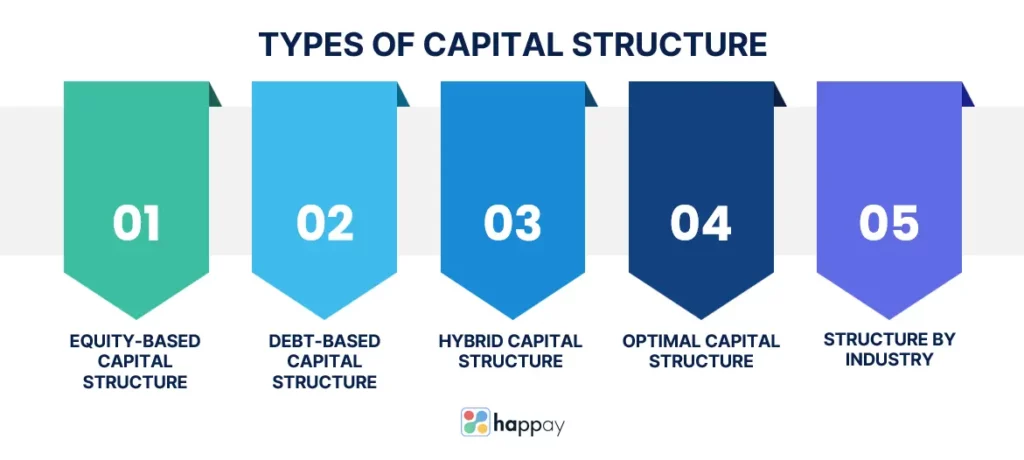

The Basics of Capital Structure

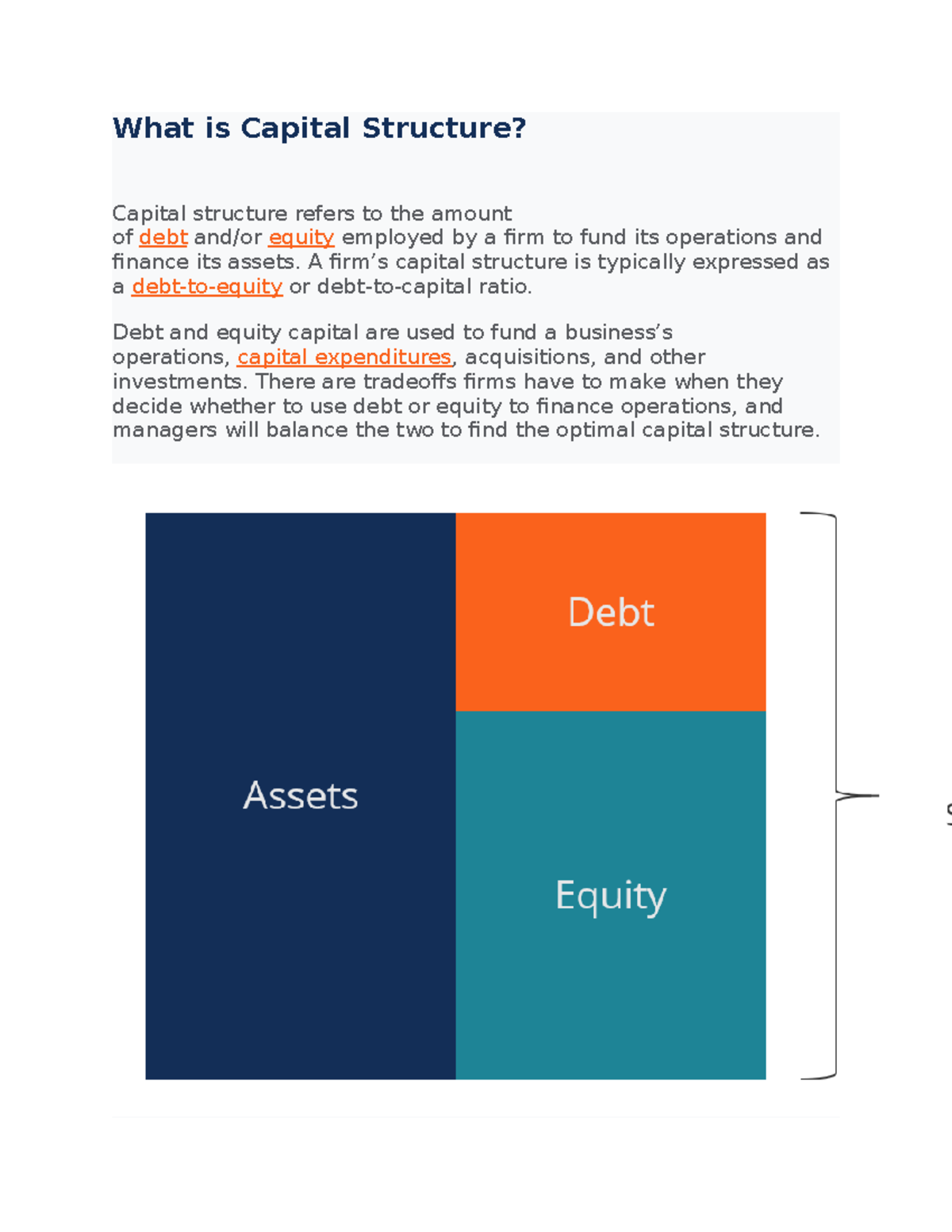

Simply put, capital structure refers to how a company funds its assets through a combination of debt and equity. Debt represents borrowed funds that must be repaid with interest, while equity represents ownership in the company.

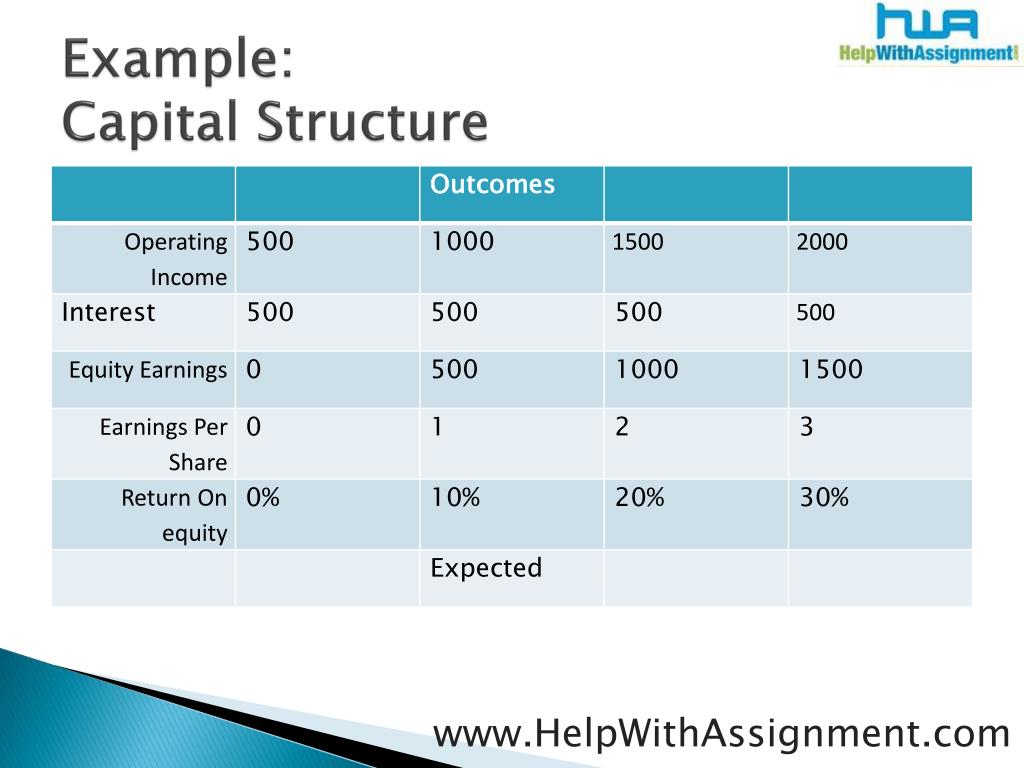

The ratio of debt to equity (D/E ratio) is a common metric used to assess a company's financial leverage. A higher D/E ratio generally indicates greater reliance on debt financing.

Debt vs. Equity: A Balancing Act

Both debt and equity have their advantages and disadvantages. Debt can be cheaper than equity due to the tax deductibility of interest payments, but it also increases financial risk because of the obligation to make fixed payments regardless of the company’s profitability.

Equity, on the other hand, doesn't require fixed payments but dilutes ownership and can be more expensive due to investors expecting a higher return. The optimal capital structure balances these competing factors.

Key Considerations in Capital Structure Decisions

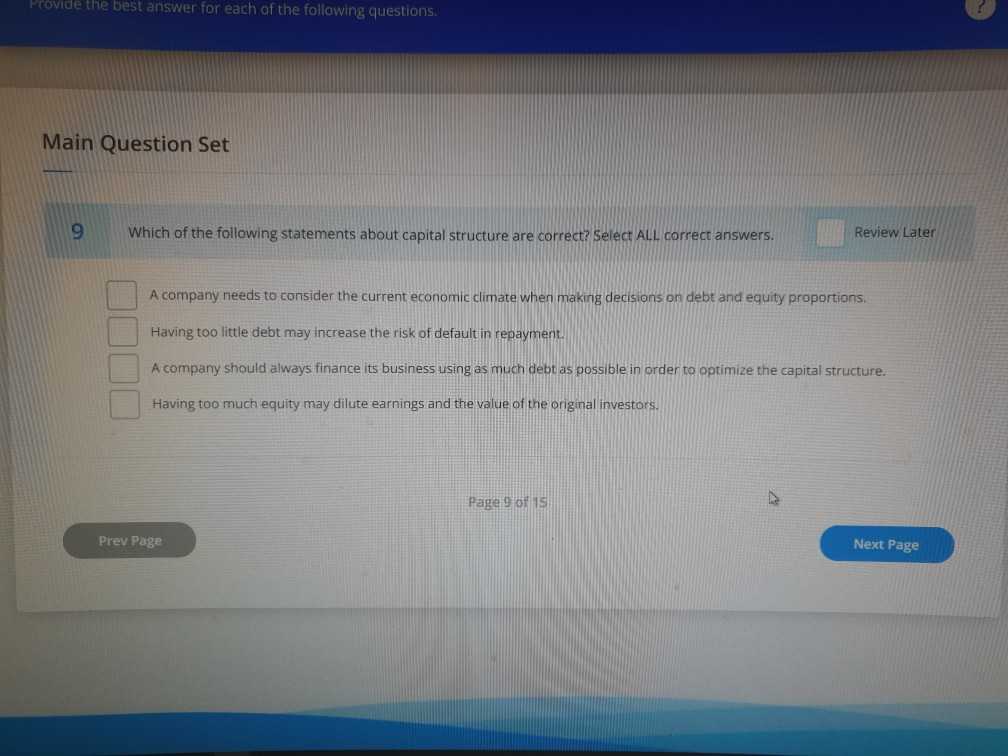

Numerous factors influence a company's capital structure decisions. These factors range from macroeconomic conditions to the specific characteristics of the firm itself.

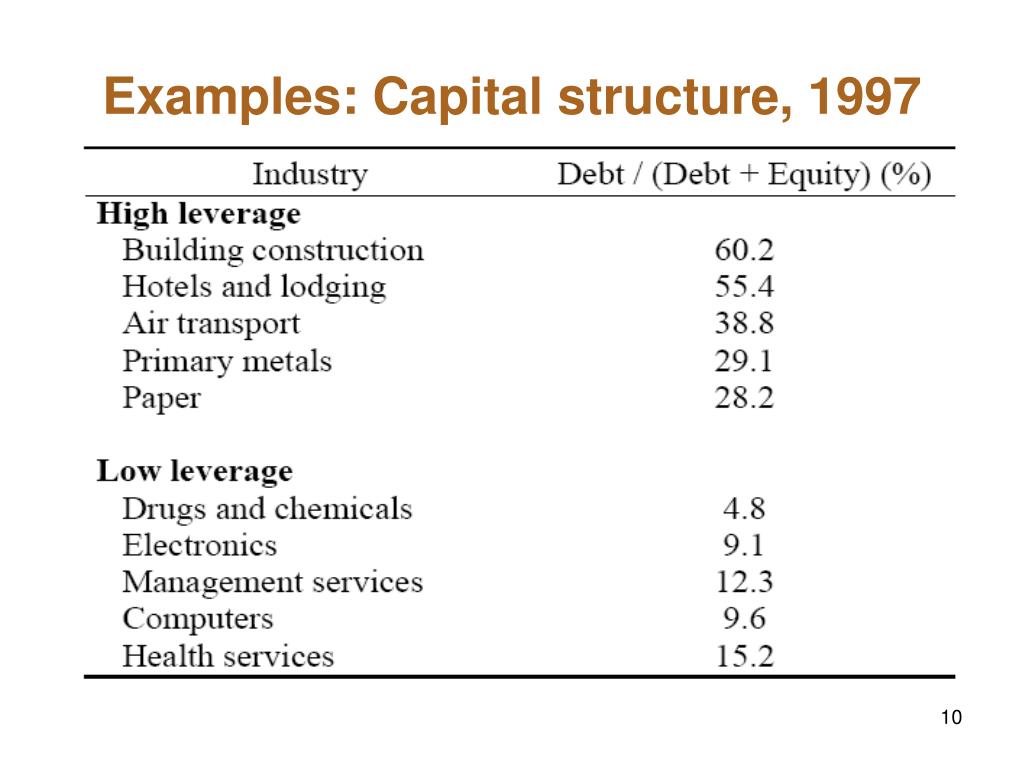

Industry Dynamics and Business Risk

Companies in stable industries with predictable cash flows can generally handle more debt. Businesses in volatile industries, like technology or pharmaceuticals, typically prefer a lower debt-to-equity ratio to cushion against unexpected downturns.

High operating leverage, which refers to a high proportion of fixed costs, can make a company more sensitive to changes in sales volume. Therefore, such companies might shy away from heavy debt burdens.

Tax Implications

As mentioned earlier, the tax deductibility of interest is a significant advantage of debt financing. This reduces the effective cost of debt and can make it an attractive option for profitable companies.

However, companies with low profitability or losses may not benefit significantly from this tax shield, potentially making equity a more sensible choice.

Financial Flexibility and Control

Excessive debt can limit a company's financial flexibility, making it difficult to respond to new opportunities or weather unexpected crises. Moreover, lenders may impose covenants that restrict the company's actions.

Issuing equity, while diluting ownership, provides greater flexibility and avoids the constraints associated with debt covenants. Companies must weigh the trade-offs between control and financial flexibility when determining their capital structure.

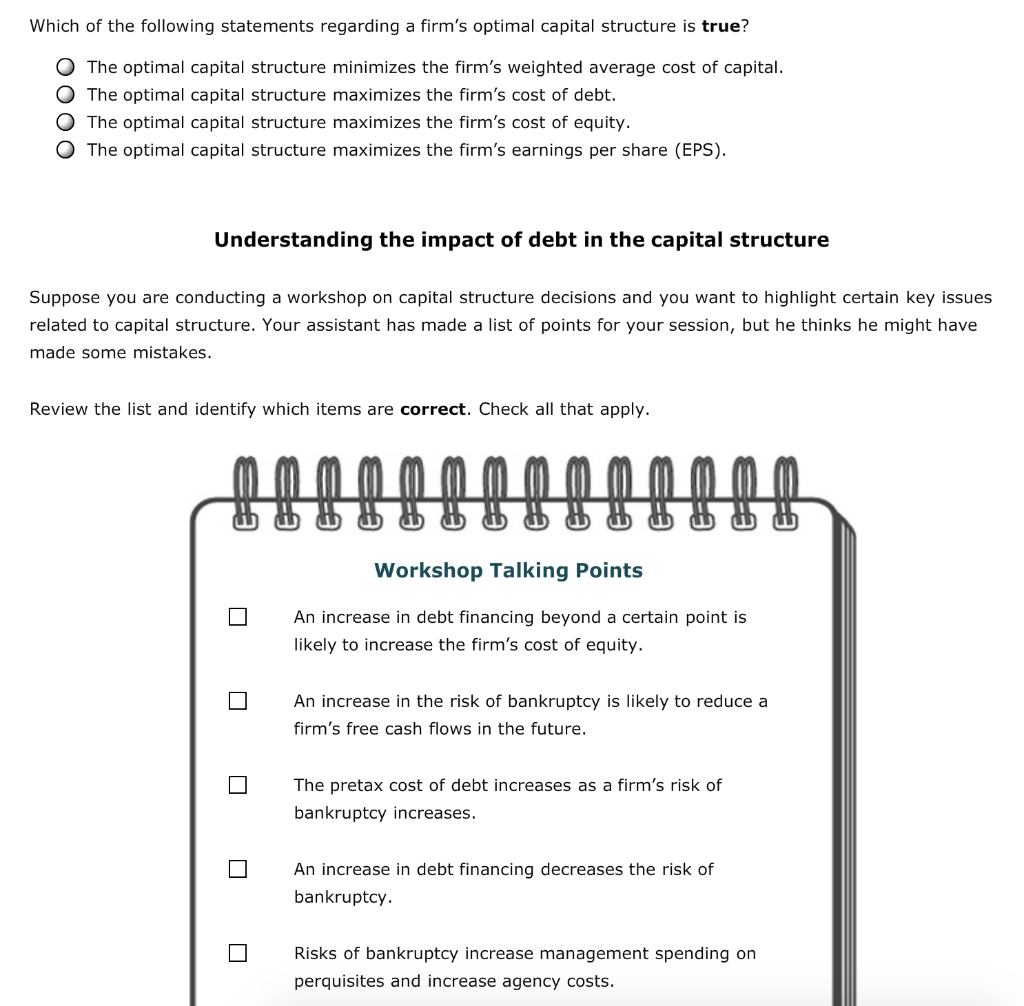

Common Statements about Capital Structure: Which are Correct?

Let's examine some common statements about capital structure and clarify their accuracy, based on well-established principles and empirical evidence.

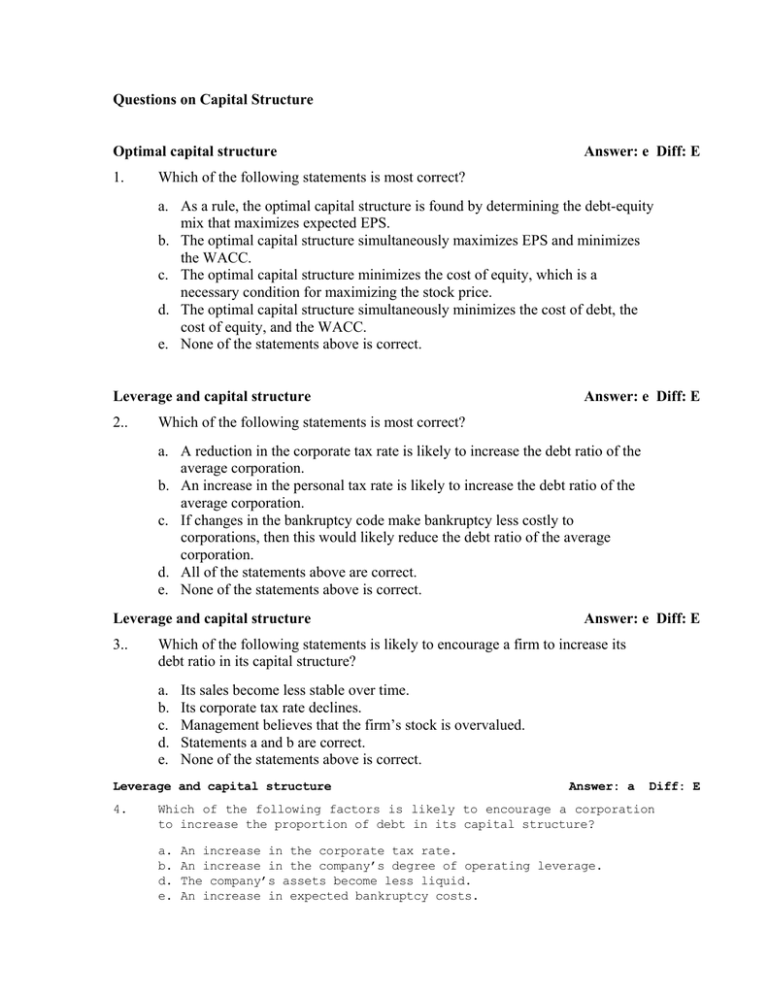

"The optimal capital structure is always the one with the lowest cost of capital."

This statement is largely true, but needs nuance. The weighted average cost of capital (WACC) considers the cost of both debt and equity, weighted by their respective proportions in the capital structure. A lower WACC generally indicates a more efficient capital structure.

However, minimizing WACC is not the sole objective. Companies must also consider factors like financial risk, flexibility, and the potential impact on shareholder value.

"Increasing debt always increases firm value."

This statement is incorrect. While debt can initially increase firm value due to the tax shield, excessive debt can lead to financial distress and ultimately decrease value. The relationship between debt and firm value is typically represented by a "U-shaped" curve.

This means that there is an optimal level of debt, beyond which the costs of financial distress outweigh the benefits of the tax shield, leading to a decline in firm value. Bankruptcy costs can significantly reduce firm value.

"Equity is always the safest form of financing."

While equity does not carry the same fixed payment obligations as debt, it isn't necessarily always the safest form of financing. Equity can be more expensive than debt due to the higher required return demanded by equity investors.

Furthermore, issuing too much equity can dilute ownership and potentially lower earnings per share, impacting shareholder returns negatively. A balanced approach is generally preferred.

"Capital structure decisions have no impact on a company's stock price."

This statement is demonstrably false. Capital structure decisions directly impact a company’s risk profile, profitability, and overall financial health, all of which influence investor perceptions and, consequently, stock prices. Changes in capital structure can send signals to the market.

For instance, a large debt issuance might be interpreted negatively if it suggests the company is struggling to generate cash flow, whereas a stock repurchase financed by debt might be viewed favorably if it signals management's confidence in future prospects.

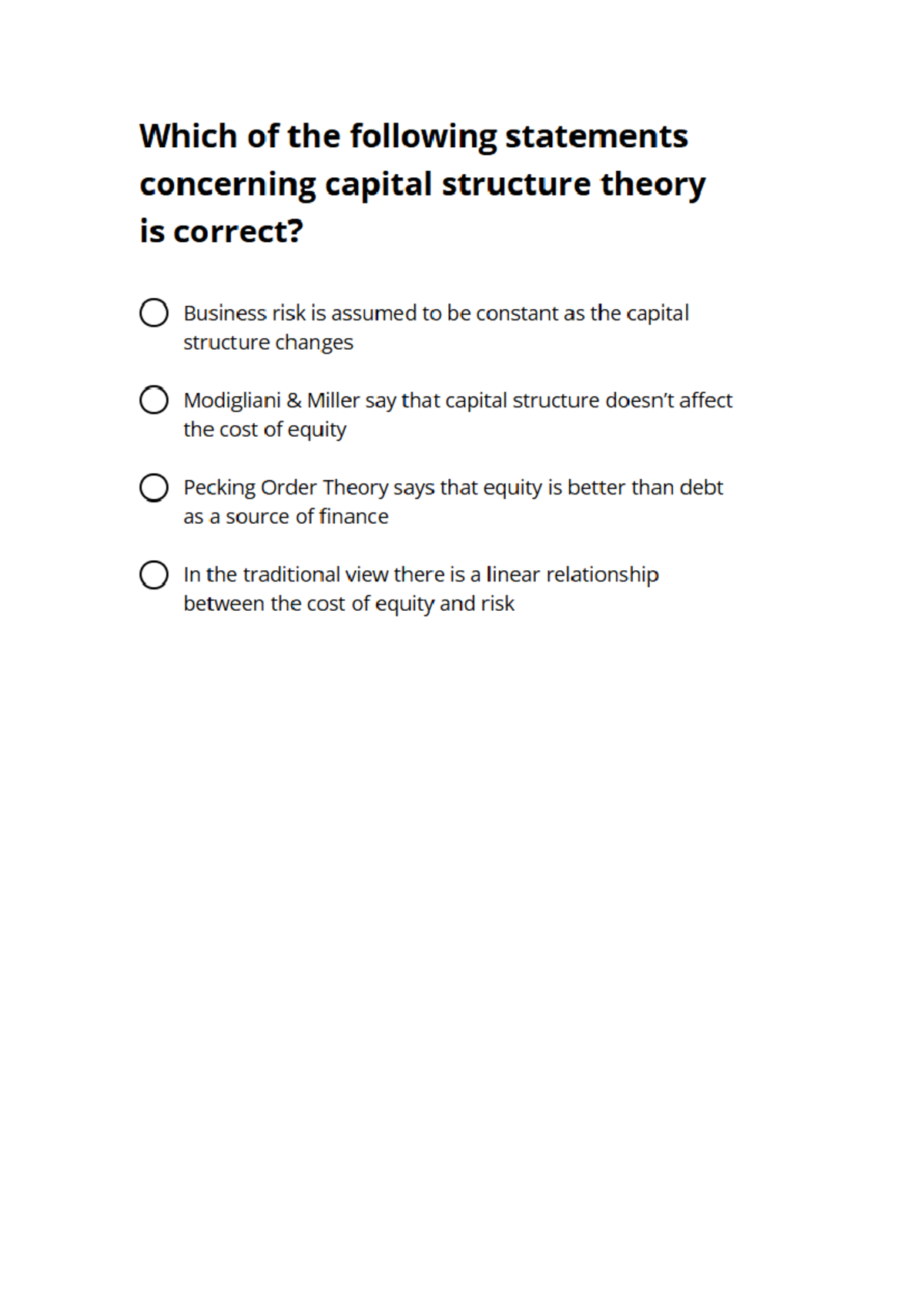

"Modigliani-Miller theorem proves that in a perfect world, capital structure doesn't matter."

This statement is partially correct. The Modigliani-Miller theorem, in its original form, states that in a world with no taxes, no bankruptcy costs, and perfect information, a company's value is independent of its capital structure. However, the real world isn't perfect.

The theorem serves as a useful benchmark, highlighting the importance of factors like taxes, bankruptcy costs, and agency costs, which do influence capital structure decisions in practice. These imperfections give relevance to capital structure decisions.

The Ever-Evolving Landscape

Capital structure decisions are not static; they must adapt to changing market conditions and evolving business strategies. A company's optimal capital structure may change over time as it grows, enters new markets, or faces new challenges.

Managers must regularly reassess their capital structure to ensure it remains aligned with their long-term goals and maximizes shareholder value. They must always consider the balance between risk and return.

Conclusion: Charting the Course to Financial Stability

In conclusion, understanding the nuances of capital structure is essential for making sound financial decisions. Navigating the complexities of debt and equity requires careful consideration of various factors, including industry dynamics, tax implications, and financial flexibility.

While there is no one-size-fits-all solution, a well-defined capital structure strategy can significantly contribute to a company's long-term success and its ability to weather the inevitable storms of the business world. By understanding these principles, business leaders can effectively steer their companies toward financial stability and growth.