Which Of The Following Statements Is Incorrect Regarding Treasury Regulations

Imagine yourself poring over stacks of documents, a weary accountant under the soft glow of a desk lamp. The air is thick with the scent of aged paper and the weight of responsibility. You’re tasked with deciphering the intricacies of tax law, specifically Treasury Regulations, and a single incorrect statement could lead to costly errors.

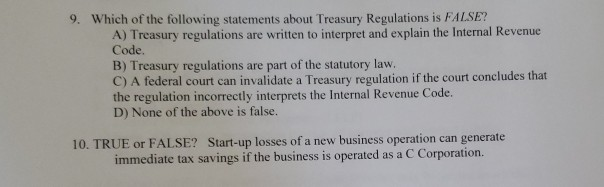

The quest to identify an incorrect statement about Treasury Regulations is a common, yet crucial, challenge for tax professionals. Treasury Regulations, issued by the Internal Revenue Service (IRS) and the Department of the Treasury, provide interpretations and guidance on the Internal Revenue Code. Understanding these regulations is essential for accurate tax compliance and planning.

The Foundation: What Are Treasury Regulations?

Treasury Regulations are essentially the rulebook for interpreting the Internal Revenue Code. They offer detailed explanations and examples, clarifying how the law should be applied in various situations. Without them, the Code would be a vague and often unworkable document.

These regulations carry significant legal weight, and taxpayers are generally expected to comply with them. They are categorized into different types, each with a specific level of authority and purpose.

Types of Treasury Regulations

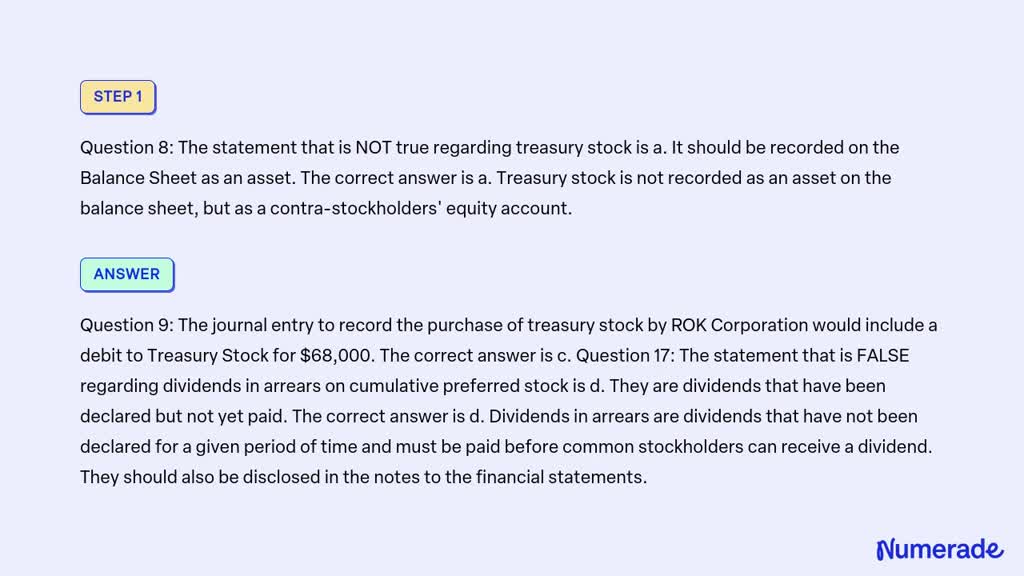

There are primarily three types of Treasury Regulations: proposed, temporary, and final. Each type represents a different stage in the regulation-making process and has varying degrees of authority.

Proposed Regulations are the initial drafts and don't have the force of law. They're released for public comment and feedback, allowing stakeholders to shape the final version.

Temporary Regulations are issued quickly to address immediate concerns or changes in the law. They have the force of law but expire after three years.

Final Regulations are the permanent interpretations of the Internal Revenue Code. They've gone through the public comment process and represent the IRS's official position on a particular issue.

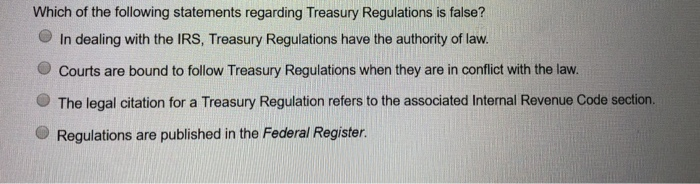

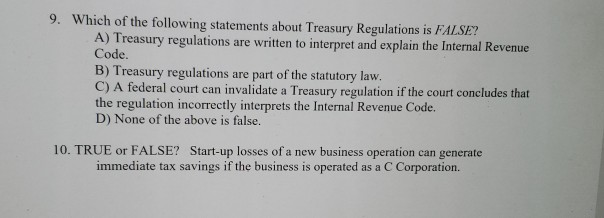

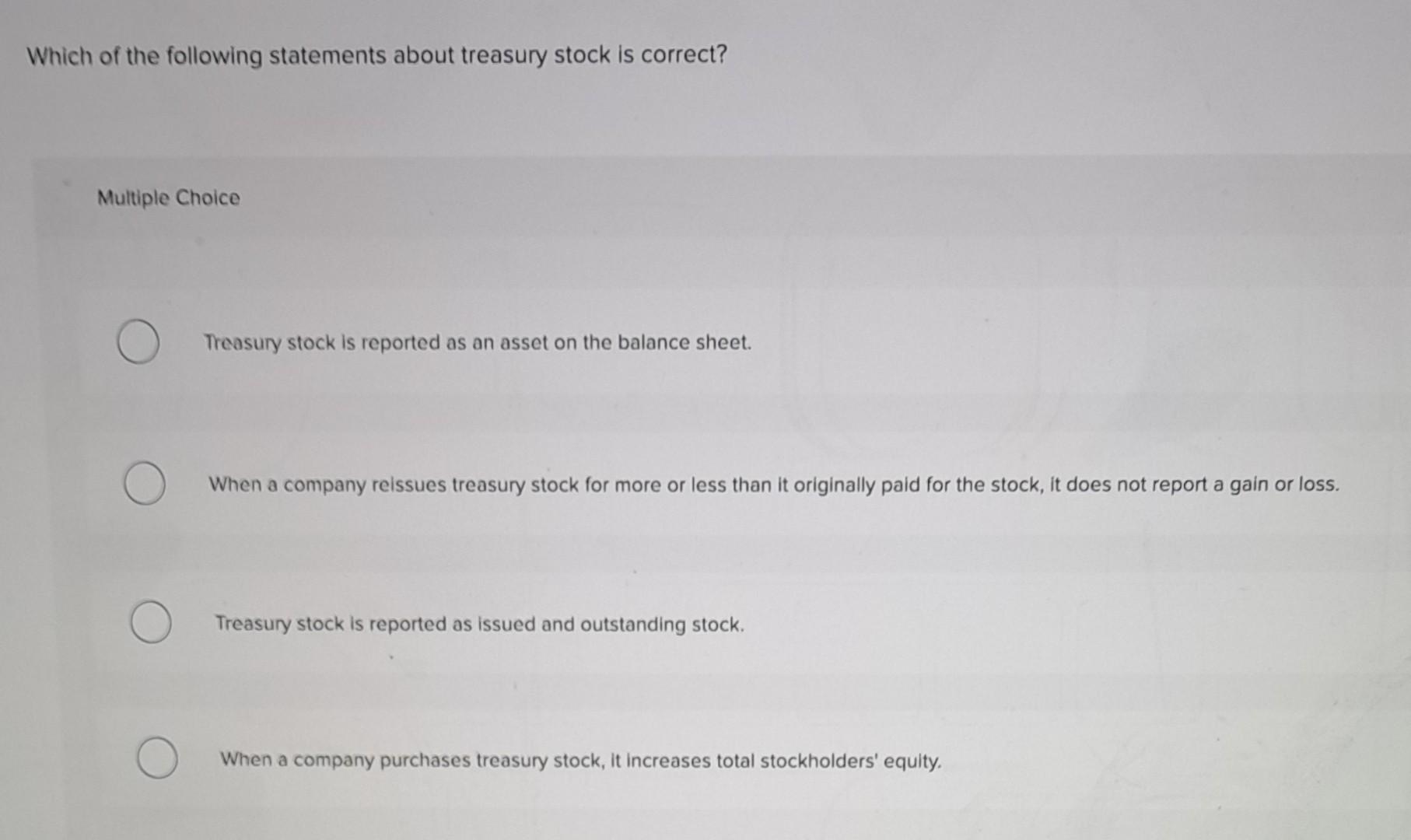

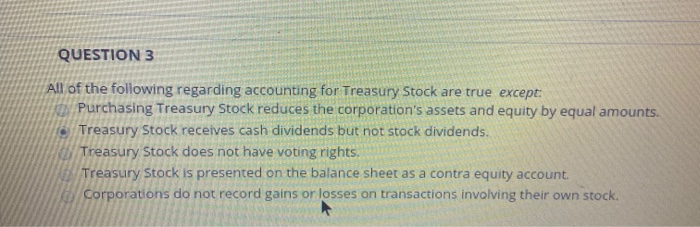

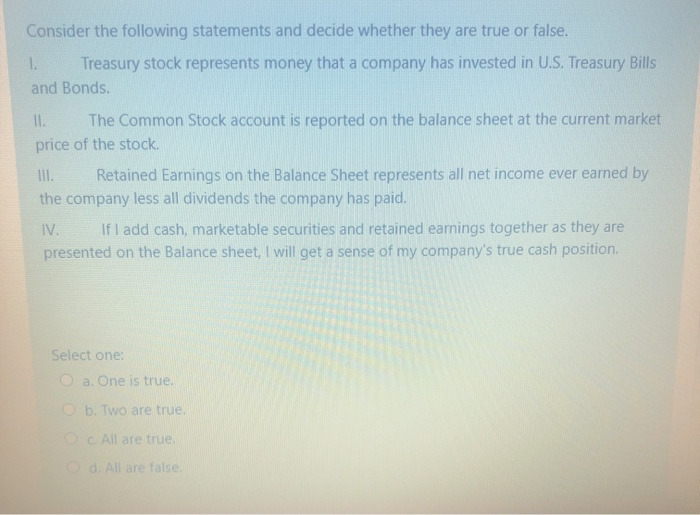

Key Aspects and Common Misconceptions

One common misconception is that all Treasury Regulations are equal in authority. This is incorrect; Final Regulations, especially those issued under the general authority of Section 7805 of the Internal Revenue Code, have less weight than those issued under a specific grant of authority from Congress.

Another misconception is that proposed regulations can be relied upon. While they provide insight into the IRS's thinking, they are subject to change and don't offer the same level of protection as final regulations.

It’s also wrong to assume that the IRS is bound by its own regulations in all cases. The IRS can amend or revoke regulations, although this process typically involves public notice and comment.

Furthermore, it’s incorrect to believe that all Treasury Regulations address complex issues. Some regulations clarify simple aspects of the tax law, ensuring consistency in application.

"Understanding the nuances of Treasury Regulations is paramount for anyone navigating the complexities of tax law," says Sarah Miller, a tax attorney with over 20 years of experience. "A single misinterpretation can have significant financial consequences."

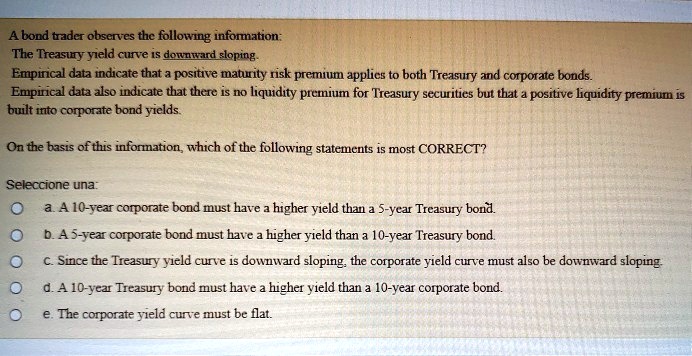

Navigating the Regulation-Making Process

The process of creating Treasury Regulations is a transparent one, designed to ensure fairness and accuracy. It begins with the IRS identifying a need for clarification or guidance on a particular section of the Internal Revenue Code.

Next, the IRS drafts proposed regulations and publishes them in the Federal Register. This initiates a period of public comment, where individuals and organizations can submit their feedback.

After reviewing the comments, the IRS may revise the proposed regulations before issuing them as temporary or final regulations. This process ensures that regulations are well-considered and reflect the needs of taxpayers.

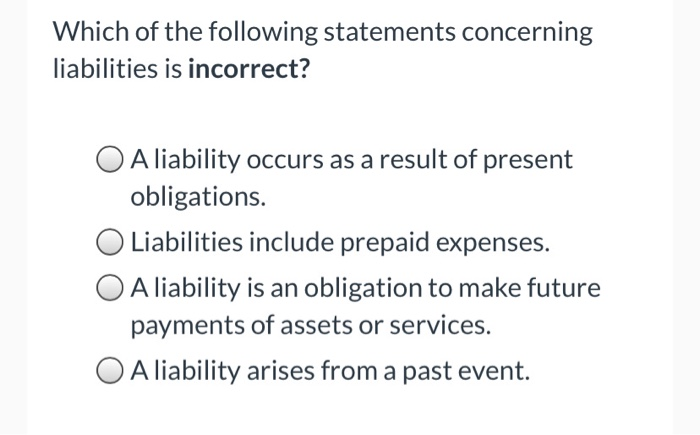

Why This Matters: The Significance of Accuracy

The accuracy of statements concerning Treasury Regulations is critical for several reasons. For taxpayers, it ensures compliance with the law and avoids penalties. For tax professionals, it safeguards their reputation and protects their clients' interests.

Inaccurate information can lead to misinterpretations, incorrect tax filings, and potential legal challenges. This is especially true in complex areas of tax law, such as international taxation or estate planning.

Staying up-to-date on the latest developments in Treasury Regulations is an ongoing responsibility for anyone involved in taxation. Continuous learning and professional development are essential for maintaining accuracy and providing sound advice.

Resources for Further Exploration

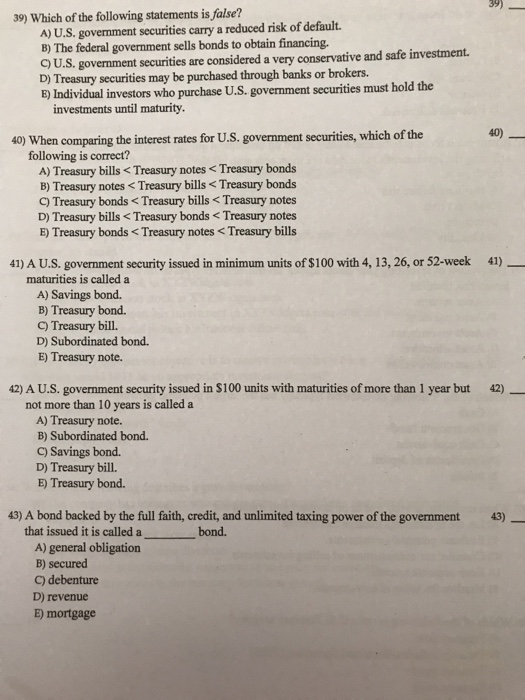

The IRS website is the primary source for Treasury Regulations and related guidance. The Federal Register publishes proposed and final regulations, providing a record of the regulation-making process.

Professional organizations, such as the American Institute of Certified Public Accountants (AICPA), offer resources and training on tax law and regulations. Tax research databases, like CCH Intelliconnect and Thomson Reuters Checkpoint, provide comprehensive access to regulations and related materials.

By utilizing these resources, individuals and organizations can enhance their understanding of Treasury Regulations and ensure compliance with the law.

Concluding Thoughts: A Commitment to Clarity

The world of Treasury Regulations can seem daunting, but it's a vital component of a fair and functioning tax system. Approaching the subject with diligence, a commitment to accuracy, and a willingness to learn can make all the difference.

Remember that Treasury Regulations are intended to clarify the law, not obscure it. By understanding their purpose and navigating them carefully, you can successfully navigate the complexities of taxation.

So, the next time you encounter a statement about Treasury Regulations, take a moment to verify its accuracy. Your diligence will be rewarded with greater confidence and peace of mind.