A Common Measure Of Liquidity Is

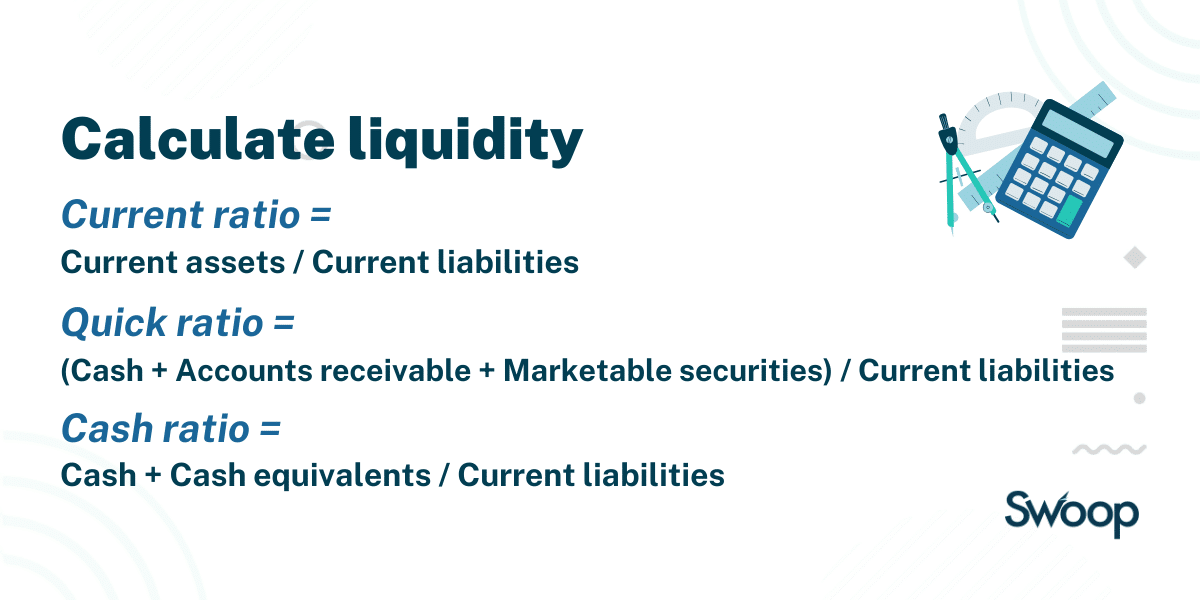

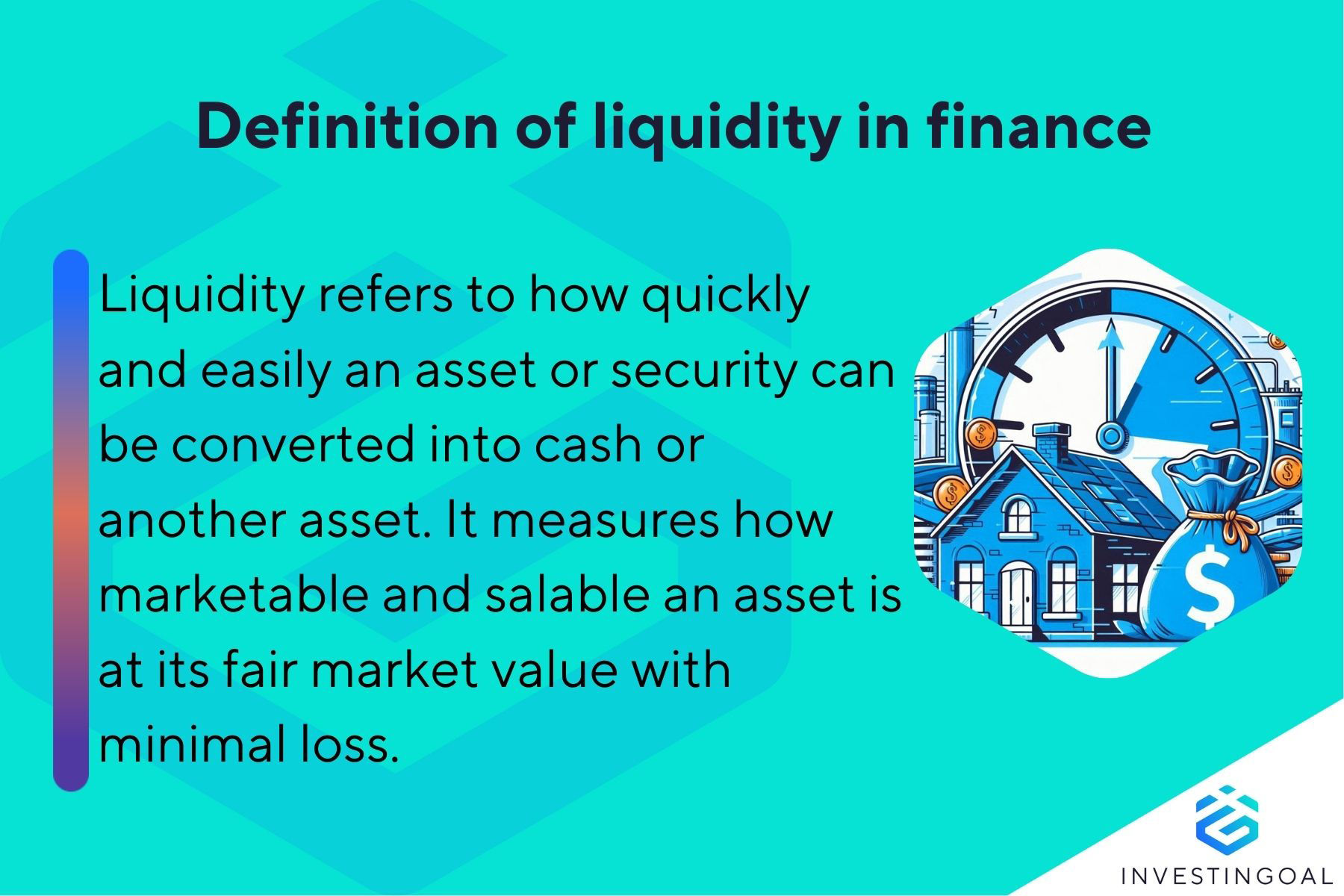

Liquidity, the ease with which an asset can be converted into cash, is the lifeblood of financial markets and businesses. Without sufficient liquidity, companies can struggle to meet their obligations, and markets can seize up. A key indicator closely watched by investors, analysts, and policymakers alike is the current ratio, a simple yet powerful tool for gauging short-term financial health.

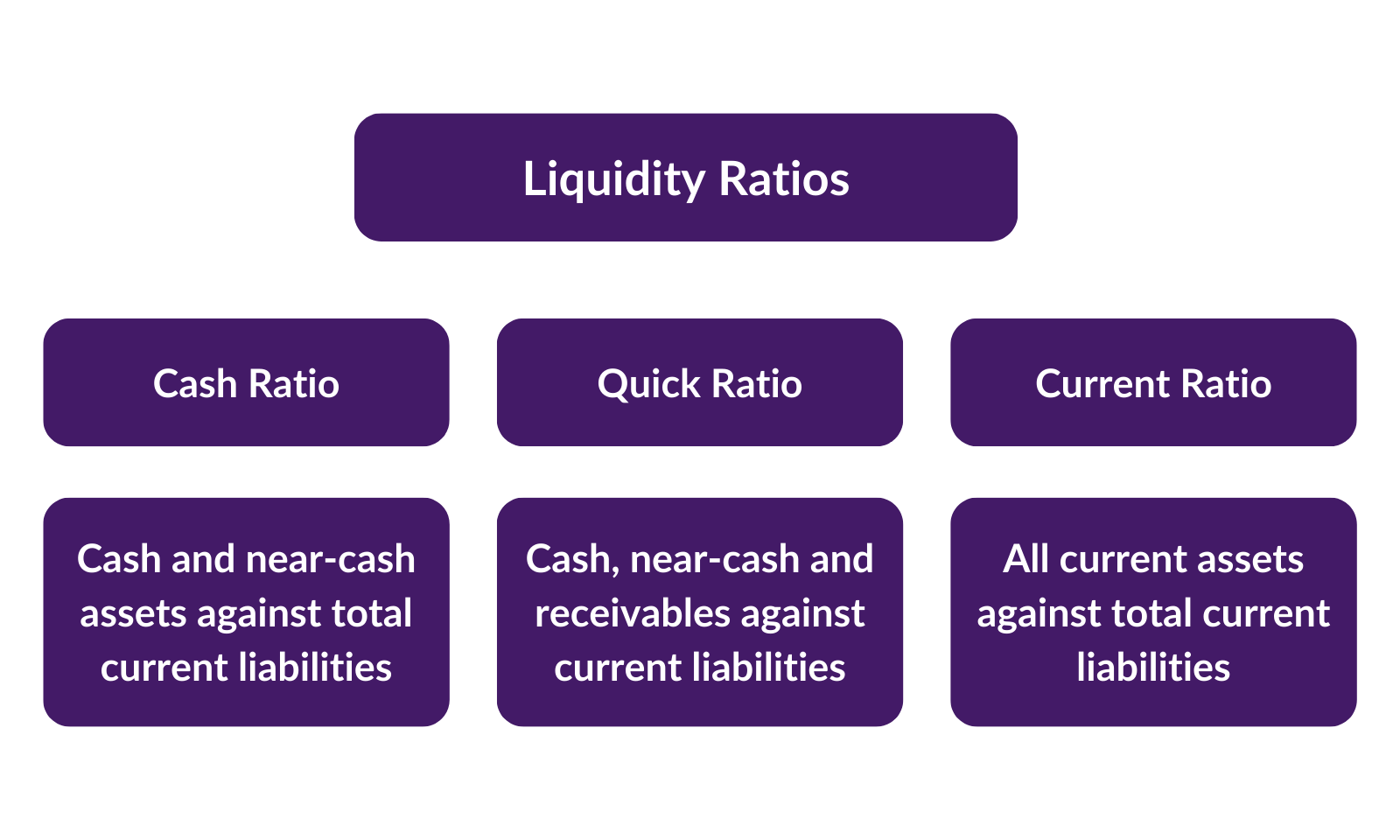

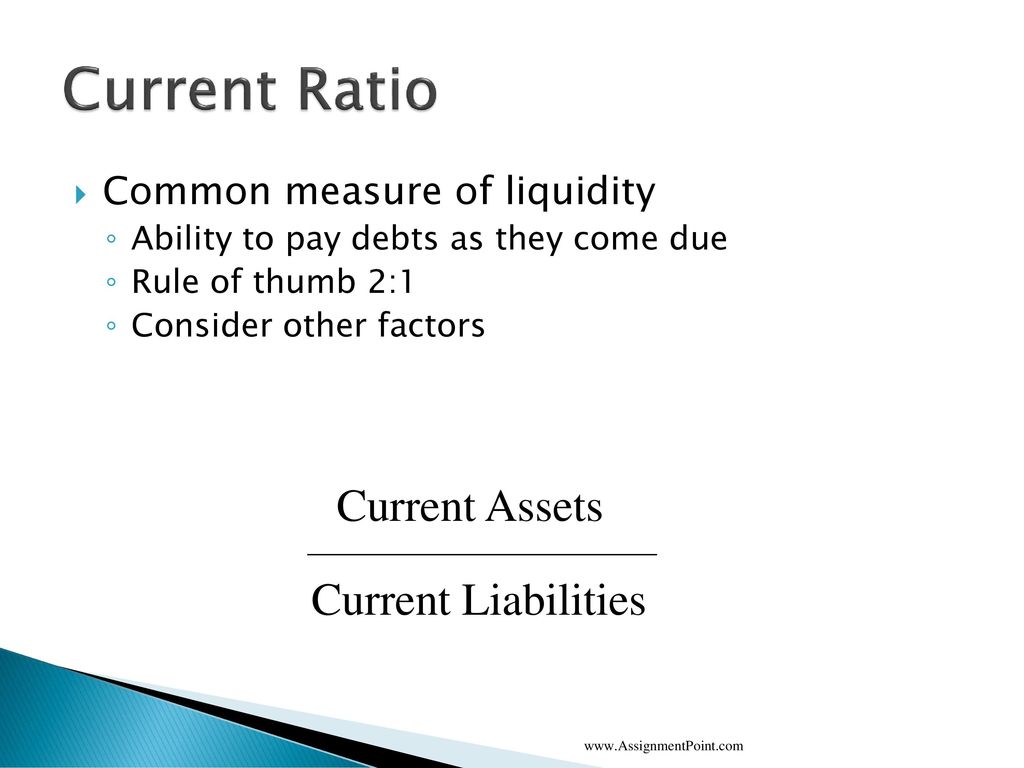

The current ratio is calculated by dividing a company's current assets by its current liabilities. This metric provides a snapshot of a company's ability to pay off its short-term debts with its short-term assets. A healthy current ratio is generally considered to be between 1.5 and 2, indicating a comfortable cushion for meeting financial obligations.

Understanding the Current Ratio

The current ratio is a fundamental part of financial statement analysis. It serves as a first-line defense in assessing a company's financial strength. A higher current ratio typically signals greater liquidity, suggesting the company is well-positioned to handle unexpected expenses or economic downturns.

Conversely, a very low current ratio (below 1) can raise red flags. It potentially indicates that the company might struggle to pay its bills on time, possibly leading to financial distress.

The Components of the Ratio

Current assets include cash, marketable securities, accounts receivable, and inventory – resources expected to be converted into cash within one year. Current liabilities encompass accounts payable, short-term debt, and other obligations due within the same timeframe. The balance between these two elements is what the current ratio reflects.

Accounts receivable, representing money owed to the company by its customers, are considered current assets only if they are expected to be collected within a year. Similarly, inventory is included if it is expected to be sold during that period.

Current liabilities might include wages payable, taxes payable, and the current portion of long-term debt.

Why the Current Ratio Matters

The current ratio is significant for a variety of stakeholders. Investors use it to evaluate the risk associated with investing in a company. Creditors use it to assess a company's creditworthiness.

Management uses it to monitor the company's financial health and make informed decisions. Regulators may also use it to oversee compliance with financial regulations.

Quote from a financial analyst:

"The current ratio, while simple, provides a crucial first look into a company's ability to manage its short-term obligations. It's a critical tool for anyone assessing financial health."

Factors Affecting the Current Ratio

Numerous factors can influence a company's current ratio. These include industry norms, business cycles, and management decisions. A company's inventory turnover rate, for example, can significantly impact the current ratio. A slow-moving inventory can tie up capital and depress the ratio.

Seasonal fluctuations can also affect the ratio, particularly for businesses with cyclical sales patterns. Retailers, for instance, may see their current ratio increase during peak shopping seasons and decrease afterwards.

Changes in a company’s credit policy can also influence its current ratio, since it affects accounts receivable.

Limitations of the Current Ratio

While the current ratio is a valuable tool, it is not without its limitations. It is a static measure, providing a snapshot at a specific point in time and not considering the ongoing dynamics of a business.

Moreover, the current ratio does not assess the quality of current assets. Some assets, such as obsolete inventory or uncollectible accounts receivable, may be included in the calculation but are unlikely to be converted into cash.

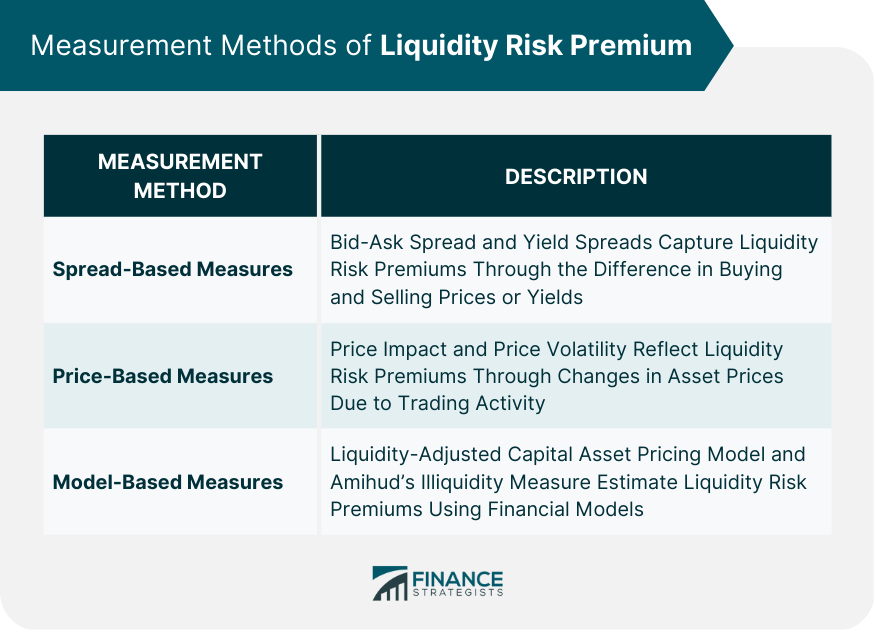

It's crucial to consider other financial ratios and industry benchmarks when evaluating a company's liquidity.

Real-World Examples

Consider two hypothetical companies: Company A has current assets of $5 million and current liabilities of $2.5 million, resulting in a current ratio of 2. Company B has current assets of $3 million and current liabilities of $2 million, giving it a current ratio of 1.5.

Company A appears to be in a stronger financial position, with ample liquid assets to cover its short-term debts. Company B, while still generally considered healthy, has less of a buffer.

However, without further context, it would be too early to jump to conclusions.

Conclusion

The current ratio is a vital metric for assessing a company's liquidity and short-term financial health. Though it offers a valuable perspective, it should be used in conjunction with other financial ratios and qualitative factors. By understanding the current ratio, stakeholders can make more informed decisions and better navigate the complexities of the financial landscape.