Does Checking Credit Score On Mint Lower It

Credit score concerns are swirling among Mint users. The crucial question: does checking your credit score on Mint actually lower it?

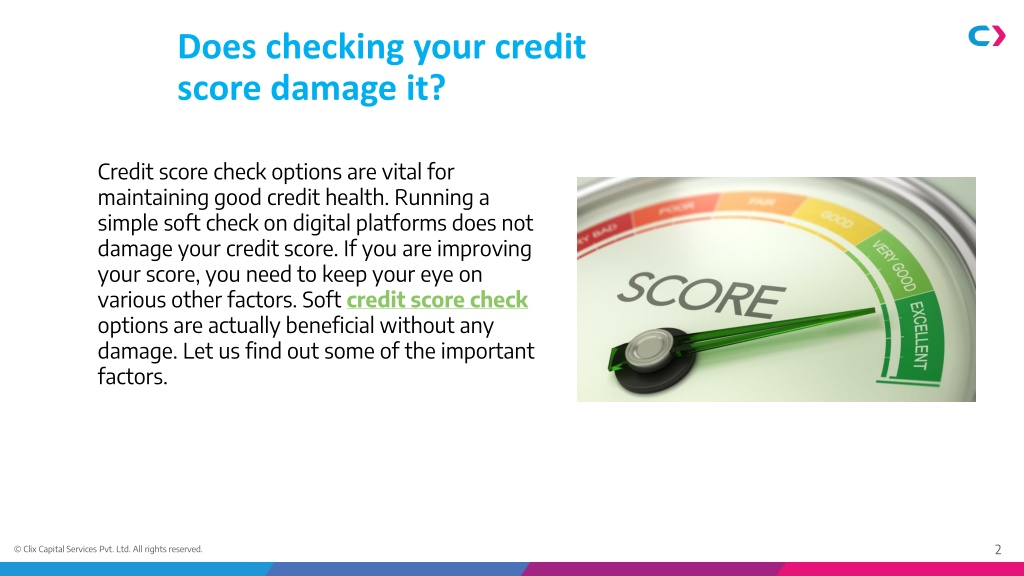

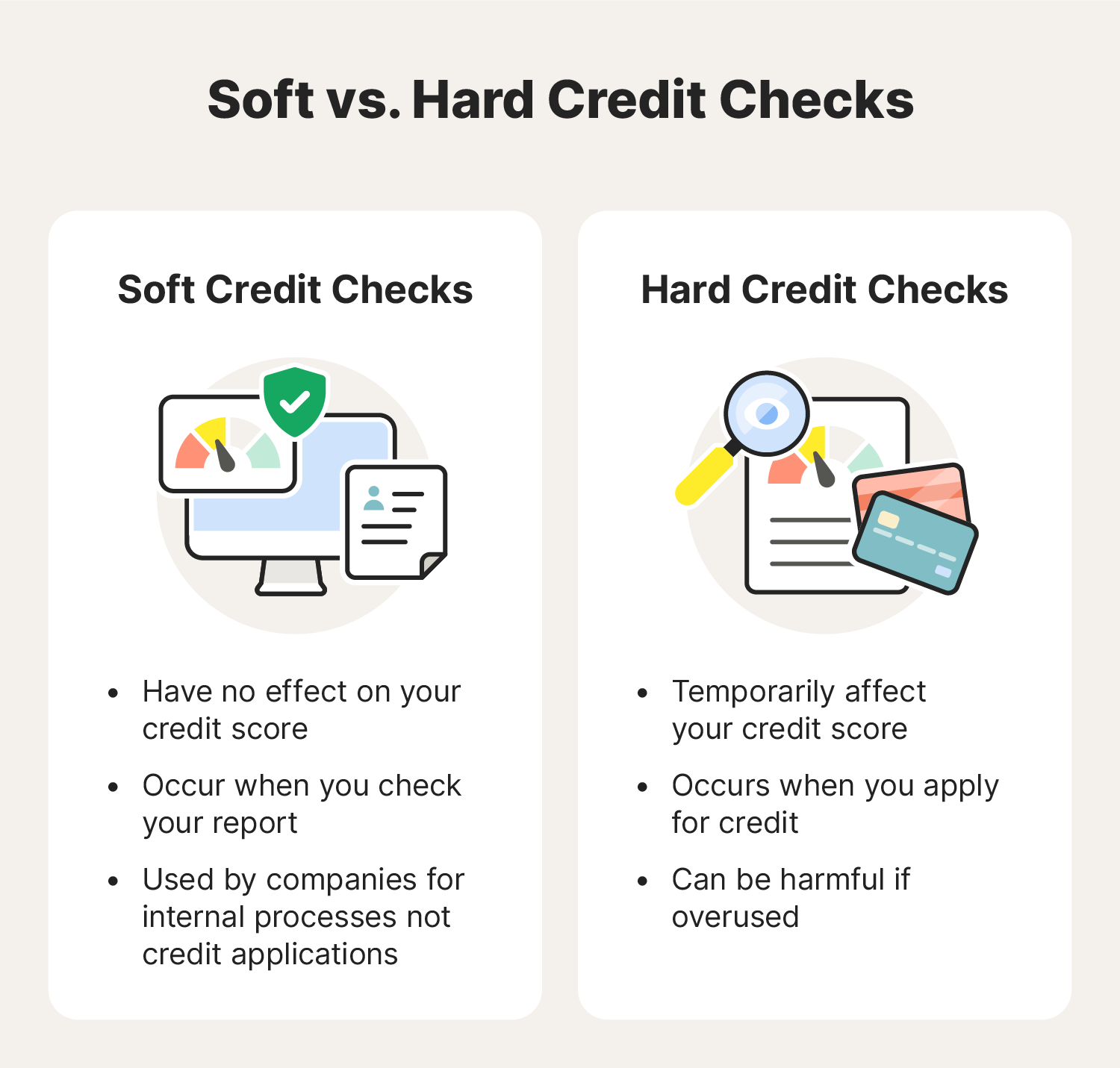

Here's the reality: checking your credit score through Mint or similar services will NOT negatively impact your score. This is because Mint uses a "soft inquiry", which is different from a "hard inquiry".

Soft vs. Hard Inquiries: The Key Difference

A soft inquiry occurs when you check your own credit score, or when lenders pre-approve you for offers. Soft inquiries are invisible to lenders and have zero impact on your credit score.

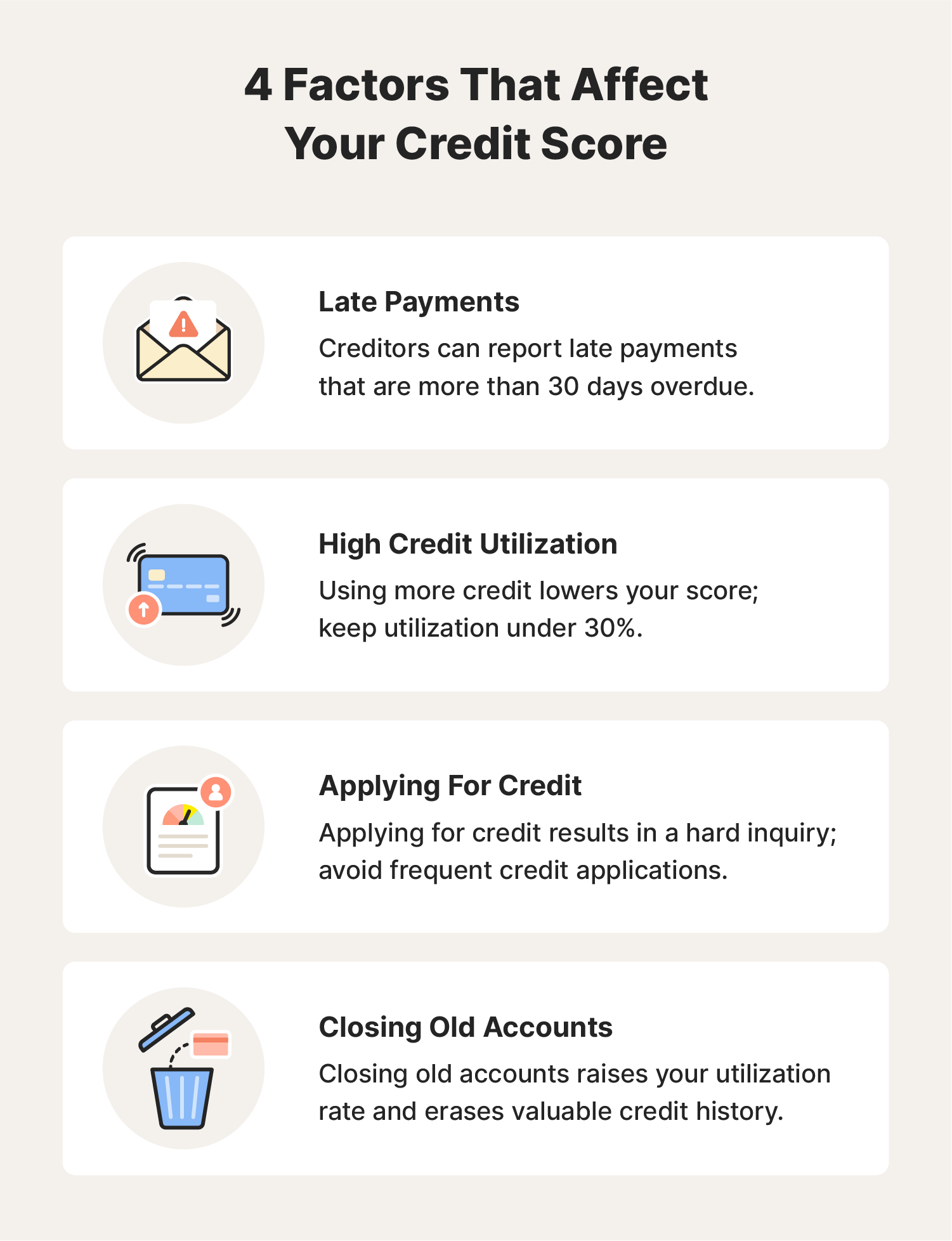

Hard inquiries, on the other hand, happen when you apply for credit – a credit card, a loan, etc. Lenders use these to assess your creditworthiness. Too many hard inquiries in a short period can lower your score, signaling to lenders that you may be a higher risk.

Mint's Role in Credit Monitoring

Mint provides a convenient way to track your credit score. The platform partners with credit bureaus like Equifax to provide score updates and credit report information.

According to Mint's own FAQs and help documentation, checking your score on their platform generates a soft inquiry. This process is specifically designed to be risk-free to your credit rating.

Data from credit reporting agencies confirms this practice. Major bureaus emphasize that self-monitoring of credit scores does not affect the score itself.

Why the Confusion?

The misconception likely stems from the general understanding that credit checks can impact your score. It's crucial to distinguish between the two types of inquiries to understand the true impact.

Furthermore, it's essential to review your credit report regularly from all three major bureaus (Equifax, Experian, and TransUnion) to identify and correct any errors that could negatively affect your score.

What To Do If You See Unexpected Score Changes

If you notice a drop in your credit score after checking it on Mint, it's unlikely that the check itself caused the change. Investigate other factors that could be at play.

These include: missed payments, high credit utilization (the amount of credit you're using compared to your credit limit), or newly opened accounts.

Also, review your credit report for any inaccuracies or fraudulent activity that could be negatively impacting your score. Report errors to the credit bureaus immediately.

The Verdict: Check Away!

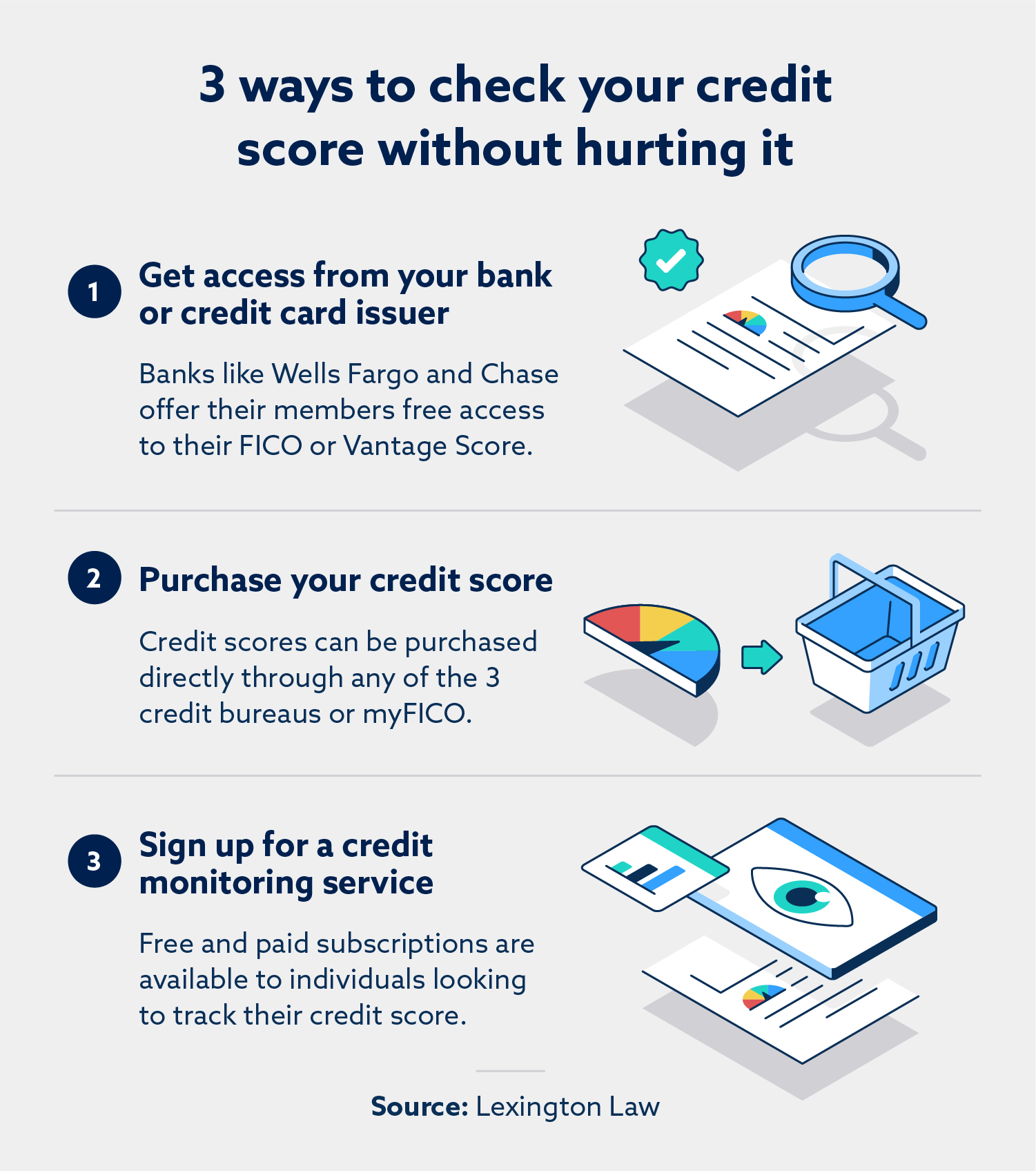

The takeaway is clear: regularly checking your credit score on Mint or other reputable credit monitoring services will not harm your score. It is, in fact, a responsible practice for maintaining good financial health.

Using Mint for credit monitoring can help you identify potential problems early. Consistent monitoring helps you take proactive steps to maintain and improve your creditworthiness.

Next Steps

Continue to monitor your credit score regularly using Mint or another preferred service. Focus on responsible credit management practices to improve your score over time.

Report any discrepancies found on your credit report immediately to the credit bureaus. Taking these steps will protect and improve your credit profile.

:max_bytes(150000):strip_icc()/credit-score-checking-d6115f7a65154cdcb80977341f5f2960.jpg)