How Does The Economy Affect Profit

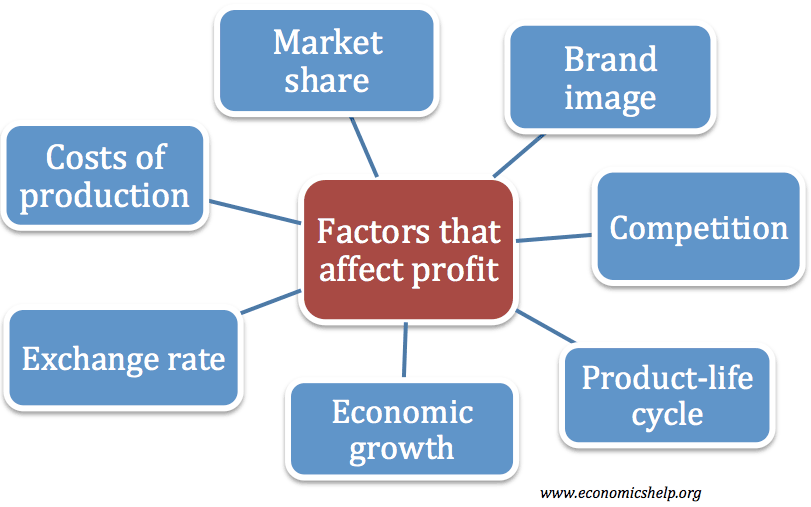

Profits are taking a hit! The volatile economy is directly impacting businesses, forcing them to adapt or face significant losses.

This article breaks down how economic shifts—inflation, interest rate hikes, and fluctuating consumer demand—are squeezing profit margins and what companies are doing to stay afloat.

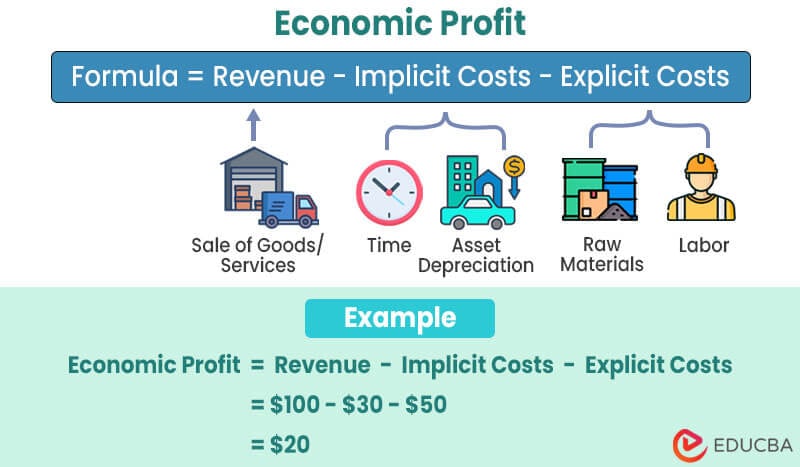

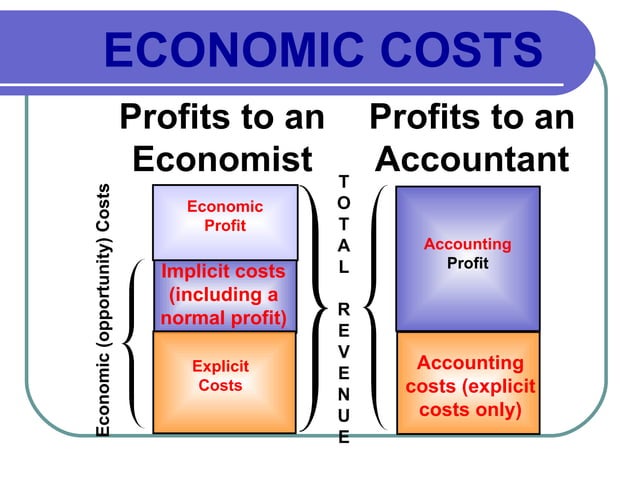

The Inflation Squeeze

Inflation continues to be a major headwind. The Consumer Price Index (CPI) rose by 3.4% in April, according to the Bureau of Labor Statistics, signaling persistent inflationary pressure.

This increase in the cost of goods and services forces businesses to raise prices, potentially alienating customers and reducing sales volume.

Companies are struggling to absorb these costs, leading to shrinking profit margins across various sectors.

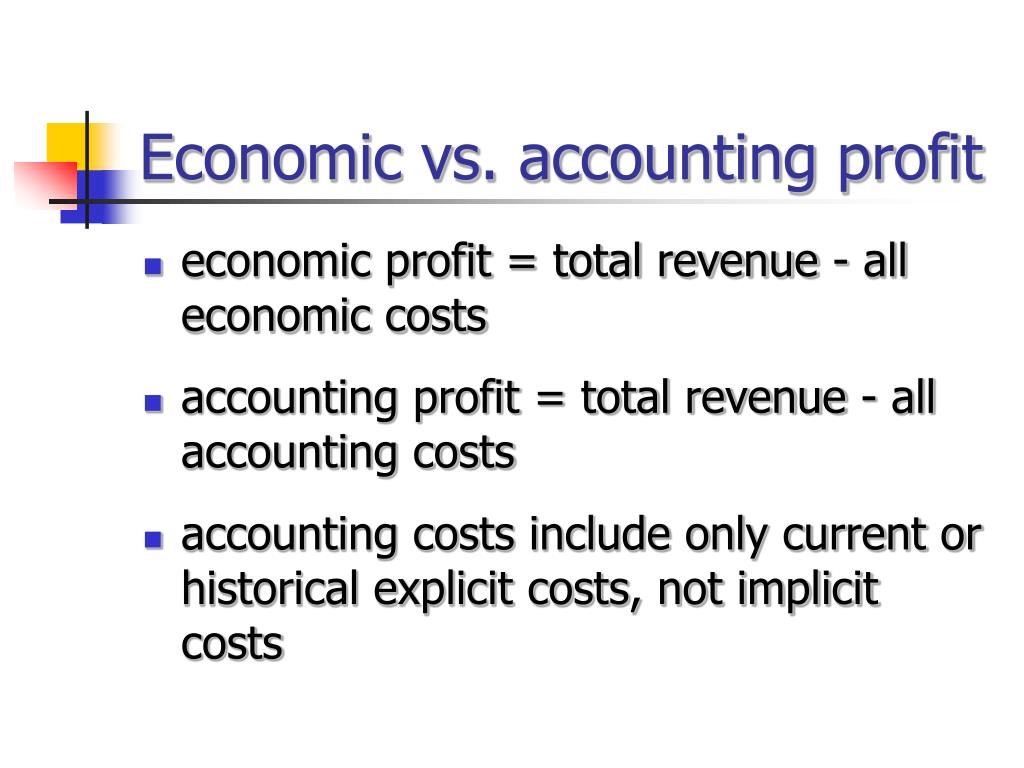

Interest Rate Impacts

The Federal Reserve's moves to combat inflation through interest rate hikes are also impacting profitability. Higher interest rates increase the cost of borrowing, making it more expensive for businesses to invest in expansion or manage existing debt.

A recent report from the National Federation of Independent Business (NFIB) shows that small businesses are particularly vulnerable, with a significant percentage citing interest rate increases as a major concern.

This increased financial burden directly cuts into profits, especially for companies reliant on credit.

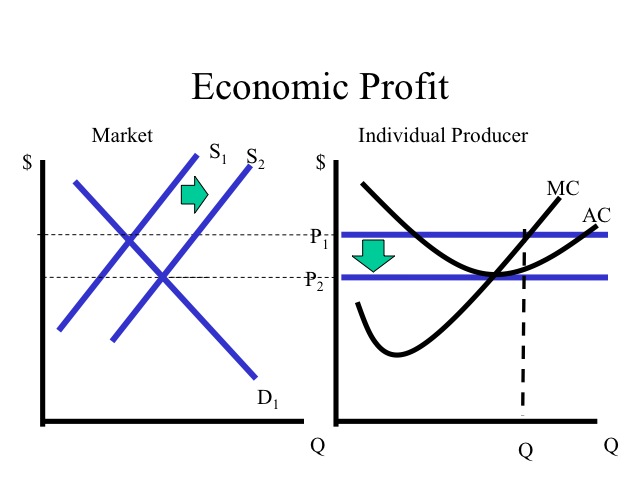

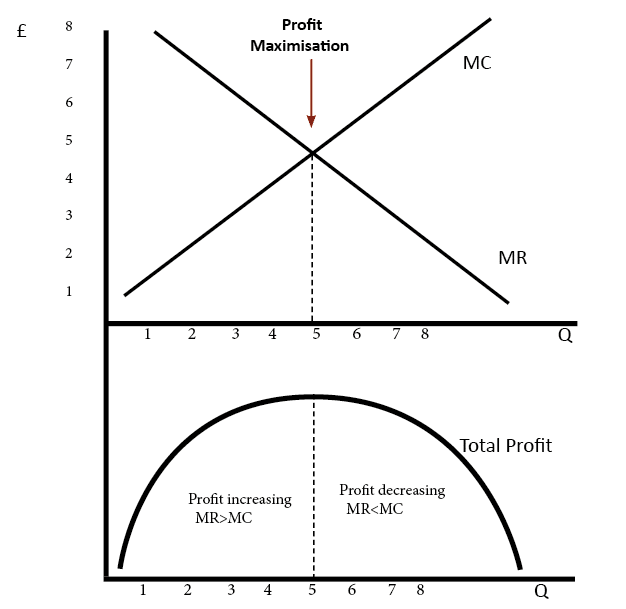

Demand Fluctuations

Consumer demand is proving unpredictable. While some sectors, like travel and leisure, are experiencing robust growth, others, such as retail, are facing headwinds due to reduced discretionary spending.

This uneven demand creates challenges for businesses trying to forecast sales and manage inventory. Overstocking or understocking can both negatively impact profitability.

Walmart, for example, recently reported mixed earnings, highlighting the difficulty of navigating the current demand landscape.

Strategies for Survival

Businesses are employing various strategies to protect their profit margins. Cost-cutting measures are widespread, with companies streamlining operations and reducing headcount.

Some businesses are investing in technology to improve efficiency and reduce labor costs. Others are focusing on value engineering, seeking ways to reduce the cost of goods without sacrificing quality.

Price optimization is also becoming increasingly common, with companies using data analytics to identify the optimal pricing strategies to maximize revenue.

The Labor Market

The tight labor market adds another layer of complexity. While unemployment remains relatively low, finding and retaining skilled workers is challenging, driving up labor costs.

Companies are offering higher wages and benefits to attract and retain employees, further impacting profitability.

This labor cost inflation is particularly pronounced in sectors like hospitality and healthcare.

Looking Ahead

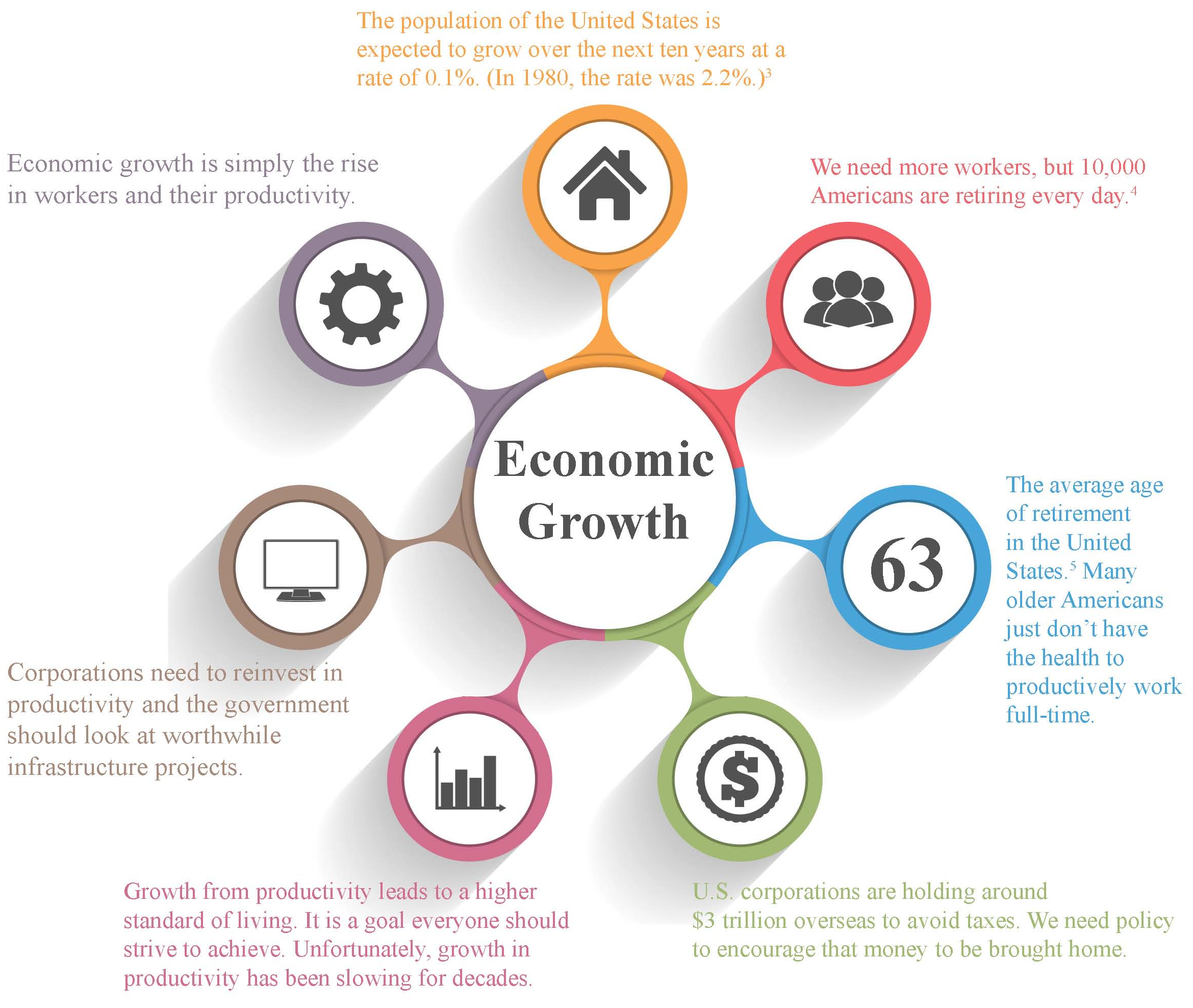

The economic outlook remains uncertain. Experts at the International Monetary Fund (IMF) are projecting moderate global growth, but also warning of potential risks from geopolitical tensions and further inflationary pressures.

Businesses need to remain agile and proactive, closely monitoring economic indicators and adapting their strategies accordingly.

The coming months will be crucial in determining which businesses can weather the storm and maintain profitability in the face of these challenges.