Importance Of Budgeting In An Organization

Businesses face immediate financial peril without meticulous budgeting. Resources dwindle, opportunities vanish, and stability crumbles if financial planning is neglected.

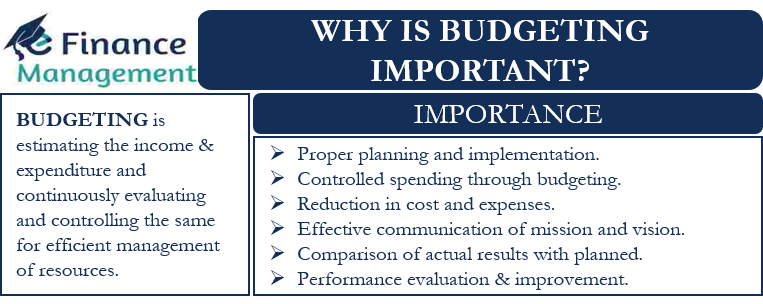

This article underscores the critical role of budgeting in ensuring organizational survival and growth, detailing its impact on resource allocation, strategic decision-making, and overall financial health. We are focusing on the *crucial* aspect of **financial discipline**.

Resource Allocation: Where the Money Goes

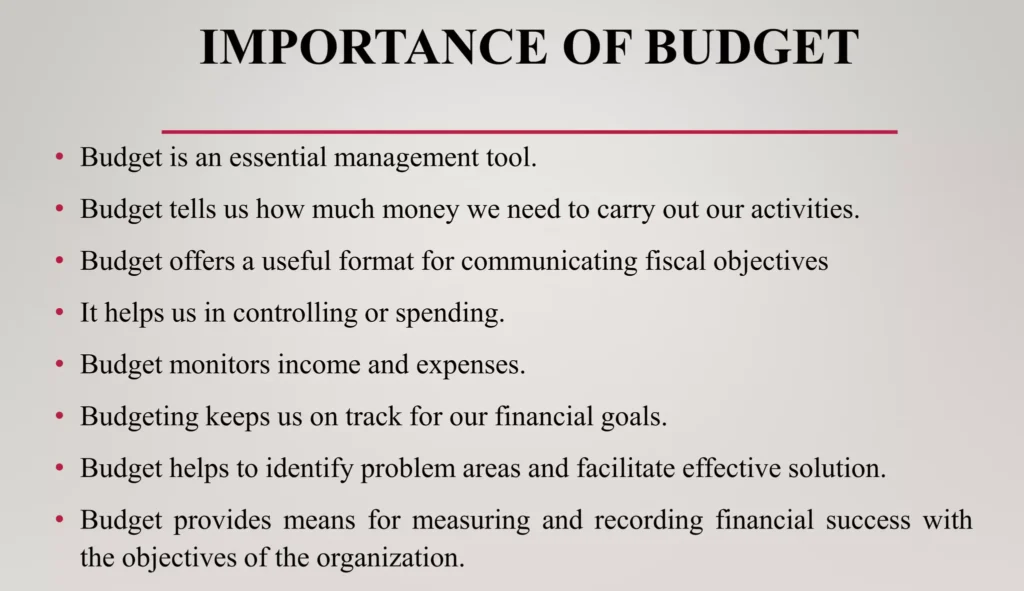

Effective budgeting dictates where every dollar is spent. It forces organizations to prioritize essential activities and avoid wasteful expenditures.

Without a budget, departments often overspend, leading to deficits and jeopardizing the entire company's financial stability.

Prioritization is Key

A well-crafted budget allows leaders to allocate resources to the most impactful areas. This includes research and development, marketing initiatives, and essential infrastructure upgrades.

Strategic investments become clear when viewed through the lens of a comprehensive budget.

Strategic Decision-Making: Informed Choices

Budgeting provides the data necessary for making informed strategic decisions. Leaders can assess the potential return on investment for various projects and initiatives.

Decisions become less guesswork and more driven by *data-backed projections*.

Market Adaptability

With proper financial insights, organizations can quickly adapt to changing market conditions. They can redirect funds to capitalize on emerging opportunities or mitigate potential threats.

According to a recent study by Deloitte, companies with robust budgeting processes are 30% more likely to achieve their financial goals.

Financial Health: Stability and Growth

Budgeting is the cornerstone of financial health. It provides a roadmap for achieving financial stability and sustainable growth.

Organizations can accurately track income and expenses, ensuring they remain profitable and solvent.

Investor Confidence

A transparent and well-managed budget fosters investor confidence. It demonstrates financial responsibility and attracts potential investments.

Investors are more likely to entrust their capital to organizations that show they are able to keep careful track of the money.

According to the Association for Financial Professionals (AFP), more than 75% of CFOs believe budgeting is essential for ensuring long-term organizational success.

Specifically, the AFP emphasizes that budgeting provides a framework for performance measurement. It allows companies to set targets and track progress towards achieving those targets.

The How-To: Implementing a Budget

Implementing a budget is a multi-step process. This starts with a careful assessment of current financial performance and projected future earnings.

From there, each department contributes to the development of the budget. These contributions should consider its operational needs and strategic objectives.

Continuous Monitoring

A budget is not a static document; it requires continuous monitoring and adjustment. Regular reviews are essential to ensure it remains aligned with organizational goals and market realities.

Using financial software and analytics tools is essential for *tracking performance* and spotting discrepancies.

Next Steps

Organizations that neglect budgeting face certain financial repercussions. Immediate action is required to avoid negative outcomes.

Consulting with financial experts, implementing appropriate software, and establishing a culture of financial discipline are crucial steps. The time to act is now.