Legal Fees For Small Business Startup

Imagine a cozy café, sunlight streaming through the window, the aroma of freshly brewed coffee filling the air. Sarah, a passionate baker, envisions this as her reality, her dream business. But amidst the excitement of choosing the perfect location and crafting delectable recipes, a daunting question lingers: How much will it cost to navigate the legal landscape of starting a small business?

For budding entrepreneurs like Sarah, understanding and managing legal fees is crucial for a successful launch. This article will explore the typical legal costs associated with starting a small business, offering insights and guidance to help navigate this often-overlooked aspect of entrepreneurship.

The Landscape of Legal Fees

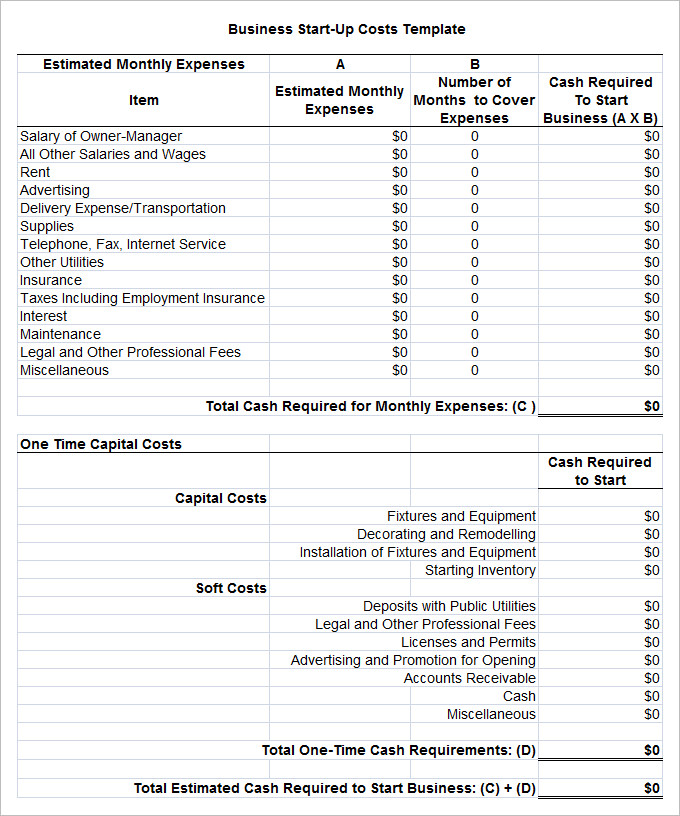

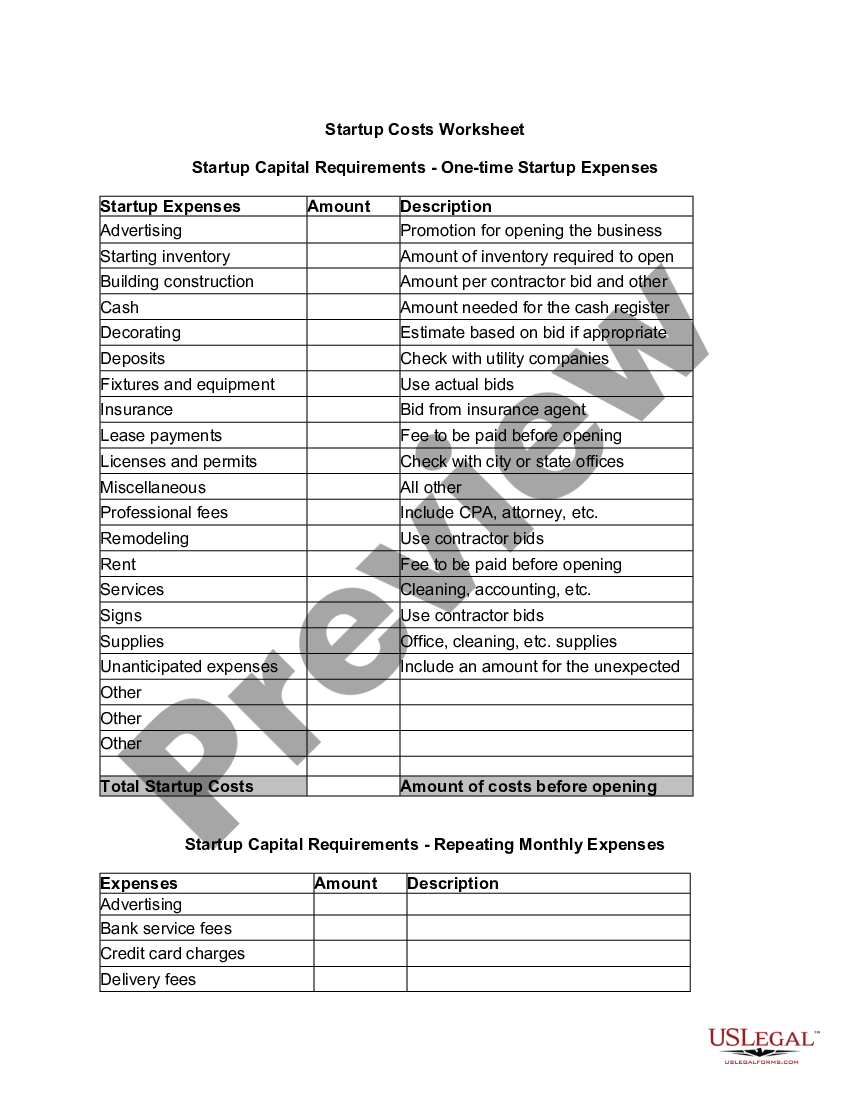

Starting a business involves a complex web of legal requirements, from choosing the right business structure to protecting intellectual property. Legal fees can quickly add up, potentially straining the already limited budget of a startup.

Several factors influence the overall cost, including the complexity of the business, the chosen legal structure (sole proprietorship, LLC, corporation), and the location of the business. The more complex the business, the higher the legal fees could be.

Choosing Your Business Structure

One of the first and most important legal decisions is selecting the appropriate business structure. According to the Small Business Administration (SBA), each structure has distinct legal and tax implications.

A sole proprietorship, the simplest form, typically incurs minimal legal fees. However, it offers no personal liability protection, which can be risky.

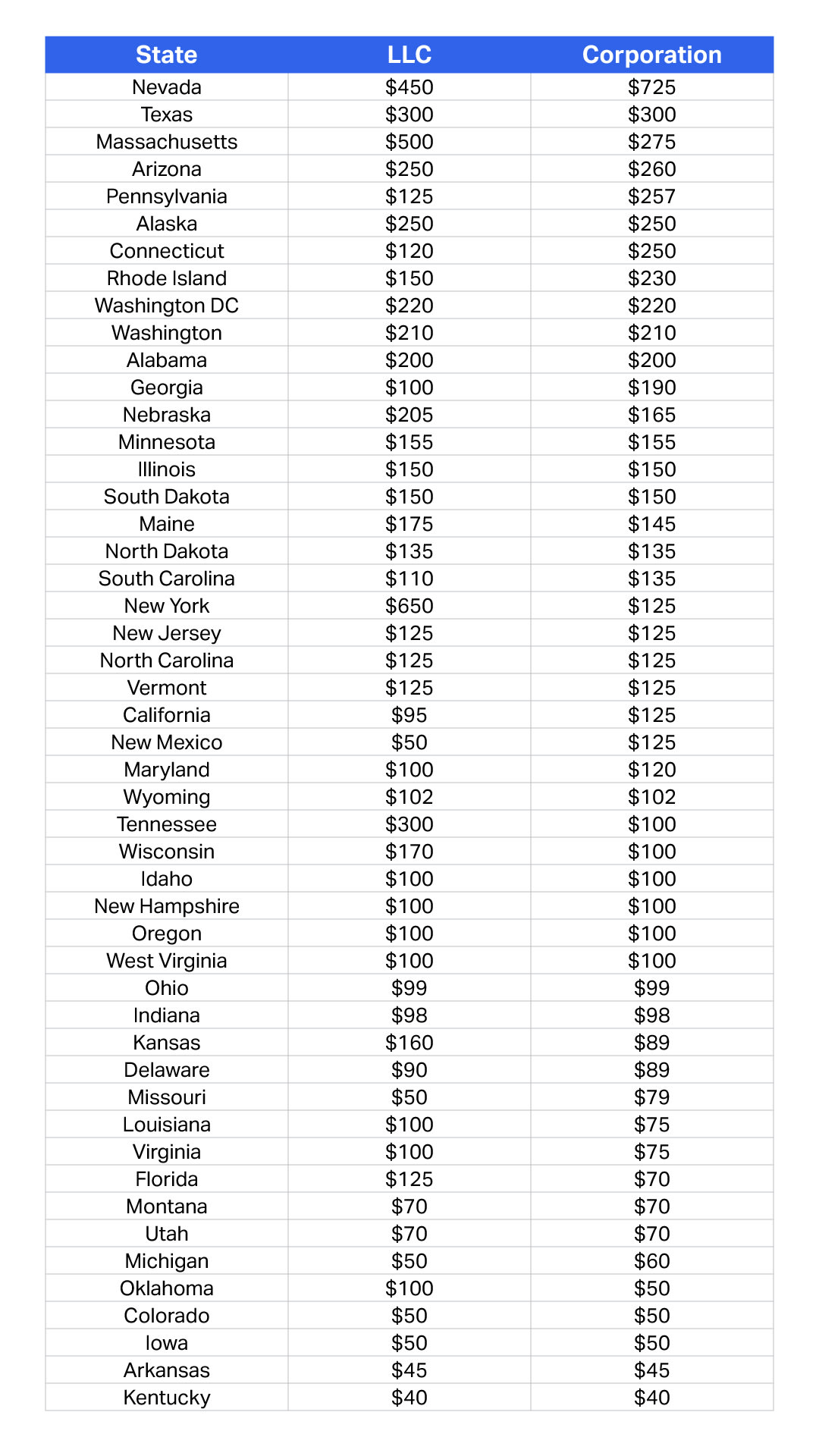

An LLC (Limited Liability Company) provides liability protection while maintaining relative simplicity. Forming an LLC usually involves filing articles of organization with the state, which may require legal assistance, typically costing between $500 and $2,000 depending on the state and complexity.

Corporations, particularly S corporations and C corporations, offer the strongest liability protection but require more complex legal documentation and compliance. Legal fees for incorporating can range from $1,000 to $5,000 or more, particularly if you require assistance setting up initial bylaws and shareholder agreements.

Protecting Your Intellectual Property

Protecting your brand and unique creations is paramount. This might involve trademarking your business name and logo, or copyrighting original content.

Trademark searches and registration can cost anywhere from $500 to $2,000 per mark, depending on the complexity of the search and the attorney's fees. Copyright registration is generally less expensive, but it's still essential for protecting your original works, costing from $55 to $85 when filed online.

"Protecting your intellectual property is an investment in the future of your business," says Jane Doe, a small business attorney.

Contracts and Agreements

Businesses rely on contracts for various purposes, from vendor agreements to employment contracts. Having well-drafted contracts is crucial for preventing disputes and protecting your interests.

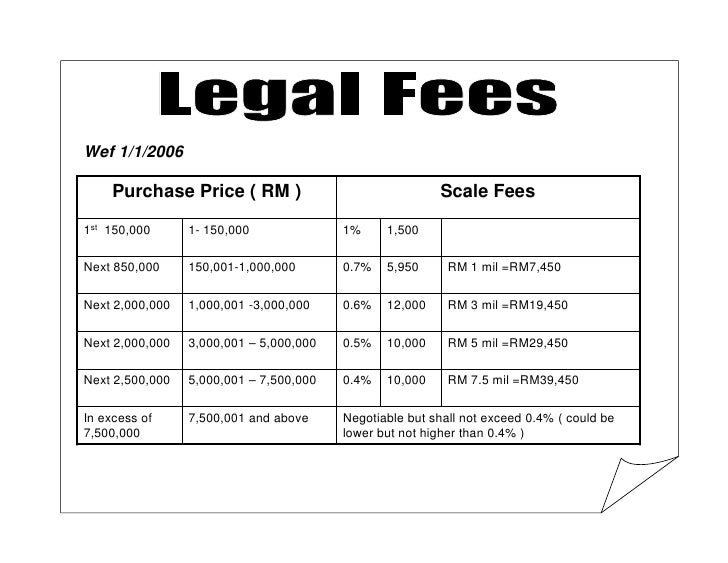

The cost of contract drafting varies depending on the complexity of the agreement. A simple contract might cost a few hundred dollars, while more complex agreements, such as partnership agreements or commercial lease agreements, can cost several thousand dollars.

Other Potential Legal Costs

Beyond the initial setup, businesses may encounter other legal needs, such as lease negotiations, regulatory compliance, and potential litigation. It’s prudent to set aside a budget for unexpected legal expenses.

For example, navigating zoning regulations or obtaining necessary permits can require legal expertise and associated fees.

Strategies for Managing Legal Fees

While legal fees are unavoidable, there are strategies to manage them effectively. Thorough research and planning can minimize costs without compromising on legal protection.

Consider using online legal services for basic tasks, such as forming an LLC or drafting simple contracts. However, for complex legal matters, such as intellectual property protection or contract disputes, it's best to consult with an experienced attorney.

Obtain quotes from multiple attorneys before making a decision. Be transparent about your budget and ask for a clear breakdown of fees.

Focus on preventative measures, such as ensuring contracts are well-drafted and complying with all applicable regulations. These steps can help you avoid costly legal disputes in the future.

The Value of Legal Guidance

While the prospect of legal fees can seem daunting, remember that investing in sound legal advice is an investment in your business's long-term success. A knowledgeable attorney can guide you through the legal complexities, ensuring you are protected and compliant.

For Sarah, the aspiring café owner, understanding and budgeting for these legal fees is crucial. By carefully considering her options and seeking appropriate legal guidance, she can confidently navigate the legal landscape and focus on realizing her dream of creating a thriving café.

Starting a small business is an exciting journey, and with careful planning and the right legal support, entrepreneurs can build a solid foundation for success. The initial investment may seem daunting, but the peace of mind and security that comes with proper legal protection are invaluable.

![Legal Fees For Small Business Startup [Infographic] Small Business Startup Costs – Canada Small Business](https://www.canadastartups.org/wp-content/uploads/2017/07/startupbuddy.com_.png)