Sandia Laboratory Federal Credit Union Hours

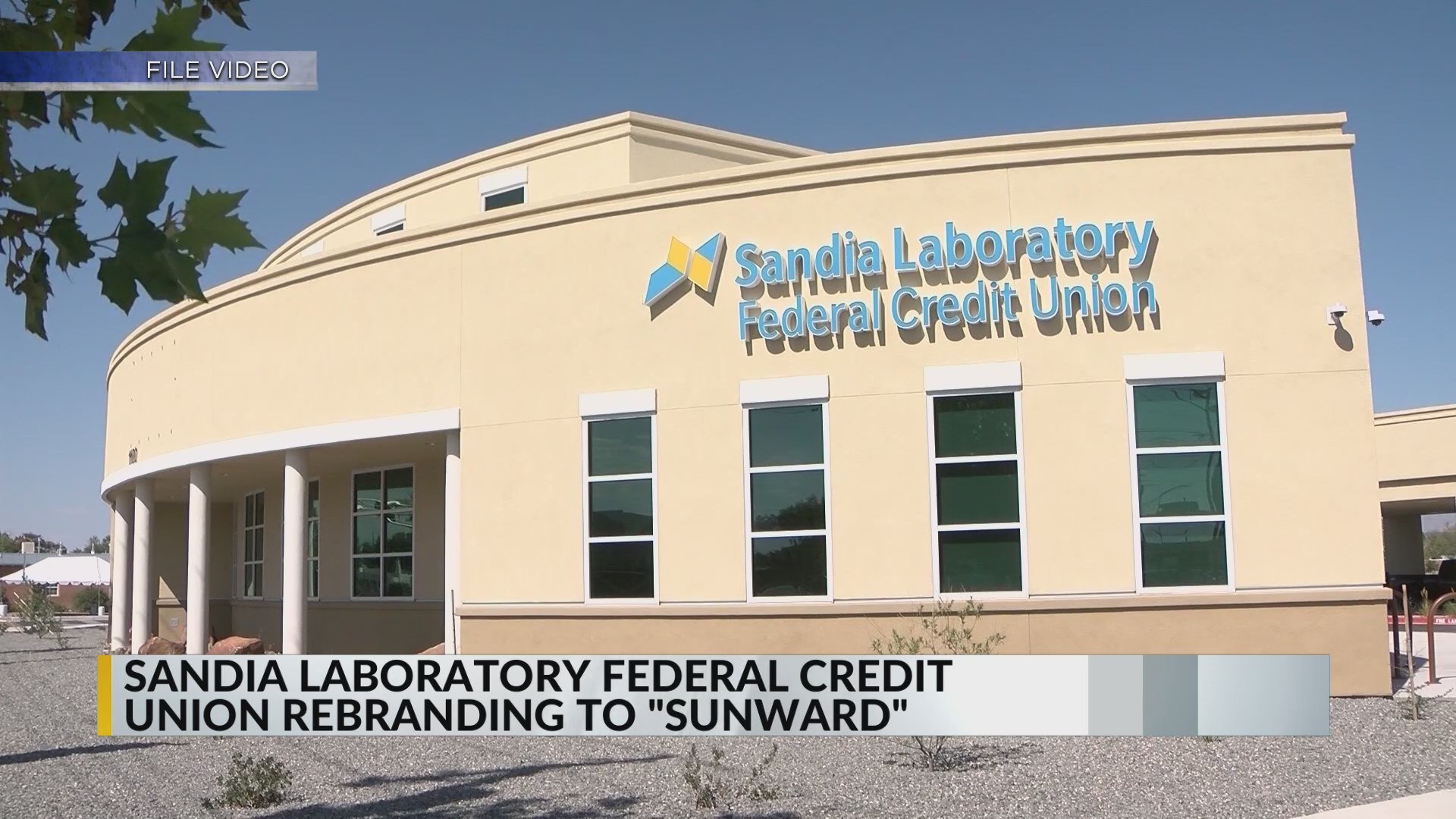

Sandia Laboratory Federal Credit Union (SLFCU), a major financial institution serving members in New Mexico and beyond, has announced adjustments to its branch hours across several locations. The changes, effective October 28, 2024, aim to optimize service delivery and reflect evolving member preferences, according to a press release issued by the credit union.

This restructuring of operational hours marks a significant shift for SLFCU, impacting both its members and employees. Understanding the motivations behind these changes and their potential consequences is crucial for those who rely on SLFCU's services.

The move raises questions about the future of brick-and-mortar banking in an increasingly digital world and sets a precedent that other credit unions may consider following.

Key Details of the Hour Adjustments

The new branch hours will vary depending on the location. Several branches will see a reduction in weekday hours, while others will experience changes to their Saturday schedules. SLFCU has stated that these adjustments are based on careful analysis of member traffic patterns and transaction volumes.

Specific changes include earlier closing times at several branches during the week and the elimination of Saturday hours at select locations with lower weekend traffic. The credit union emphasizes that these decisions were not made lightly and are intended to enhance overall efficiency.

Members are encouraged to visit the SLFCU website or contact their local branch for detailed information regarding the specific hours of operation at their preferred location. SLFCU has also launched a communication campaign to inform members about the changes.

Impact on Members

The most immediate impact will be felt by members who regularly visit branches during the affected hours. Some members may need to adjust their schedules or explore alternative banking options.

SLFCU is encouraging members to utilize its online and mobile banking platforms for transactions and services. These platforms offer 24/7 access to accounts and a wide range of banking functions.

However, some members, particularly those who prefer in-person interactions or require more complex services, may find the reduced hours inconvenient. The credit union is working to address these concerns through enhanced online support and extended call center hours.

Reasons Behind the Changes

SLFCU cites several factors driving the decision to adjust branch hours. These include the increasing popularity of online and mobile banking, a desire to optimize staffing levels, and a commitment to improving operational efficiency.

According to data from the Credit Union National Association (CUNA), digital banking adoption has surged in recent years, with a significant percentage of members now preferring to conduct transactions online. This trend has led many financial institutions to re-evaluate their branch strategies.

By reducing branch hours, SLFCU aims to allocate resources more effectively and invest in technology and services that meet the evolving needs of its members. The credit union also emphasized the importance of ensuring employee well-being and work-life balance.

SLFCU's Response to Concerns

SLFCU acknowledges that the changes may raise concerns among some members. The credit union is committed to providing support and assistance to those affected.

In addition to enhanced online and mobile banking support, SLFCU is offering personalized assistance to members who need help transitioning to digital channels. Branch staff are also available to answer questions and provide guidance.

“We understand that these changes may require some adjustments for our members, and we are committed to making the transition as smooth as possible,” said Jane Doe, SLFCU’s Vice President of Member Services, in a statement. "We are confident that these adjustments will ultimately allow us to serve our members more effectively."

The Broader Trend

SLFCU's decision reflects a broader trend within the financial industry. Many banks and credit unions are reassessing their branch networks and adjusting their hours of operation in response to changing consumer behavior.

The rise of fintech companies and the increasing accessibility of online banking services have fundamentally altered the way people manage their finances. As a result, traditional brick-and-mortar branches are becoming less central to the banking experience.

The move underscores the ongoing evolution of the financial landscape and the need for institutions to adapt to the digital age. Financial institutions are increasingly trying to balance the benefits of in-person services with the cost-effectiveness of digital solutions.

The Future of Branch Banking

While the future of branch banking remains uncertain, it is clear that branches will continue to play a role in the financial ecosystem. However, their function may evolve to focus more on providing advisory services and handling complex transactions.

Financial institutions are experimenting with different branch formats, such as smaller, more technologically advanced locations, and branches located within retail stores. The goal is to create a more convenient and engaging banking experience for members.

SLFCU's adjustments to its branch hours represent a proactive step towards adapting to these changes. The credit union's success will depend on its ability to effectively communicate with members and provide seamless access to its services through both physical and digital channels.

SLFCU remains a vital financial institution, and its success hinges on adapting to the evolving needs of its members in an increasingly digital world. Only time will tell how this shift will impact its members and the broader community it serves.