S&p 500 Ex Magnificent 7 Etf

As investor focus increasingly zeroes in on the dominance of a handful of tech giants, a new exchange-traded fund (ETF) is emerging, offering a different route to S&P 500 exposure. This ETF aims to provide investors with a more diversified representation of the broader market by excluding the so-called “Magnificent Seven” stocks. The fund's launch reflects growing concerns about market concentration and the potential risks of over-reliance on a select few companies.

This article delves into the details of this new investment vehicle, its potential benefits, and the implications for investors seeking a different approach to accessing the S&P 500.

What is the S&P 500 Ex Magnificent 7 ETF?

The S&P 500 Ex Magnificent 7 ETF is designed to track the performance of the S&P 500 index, but with one crucial difference: it excludes the seven largest companies that have significantly driven market gains in recent years.

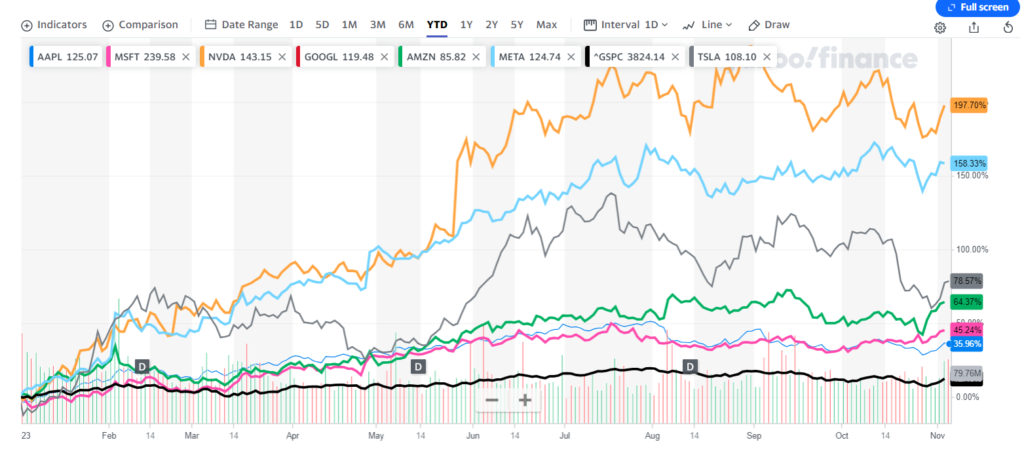

These companies, often referred to as the "Magnificent Seven," include Apple, Microsoft, Amazon, Alphabet (Google), NVIDIA, Meta Platforms (Facebook), and Tesla.

By removing these giants, the ETF aims to offer exposure to a broader range of companies within the S&P 500, potentially leading to different performance characteristics and reduced concentration risk.

Why Exclude the Magnificent Seven?

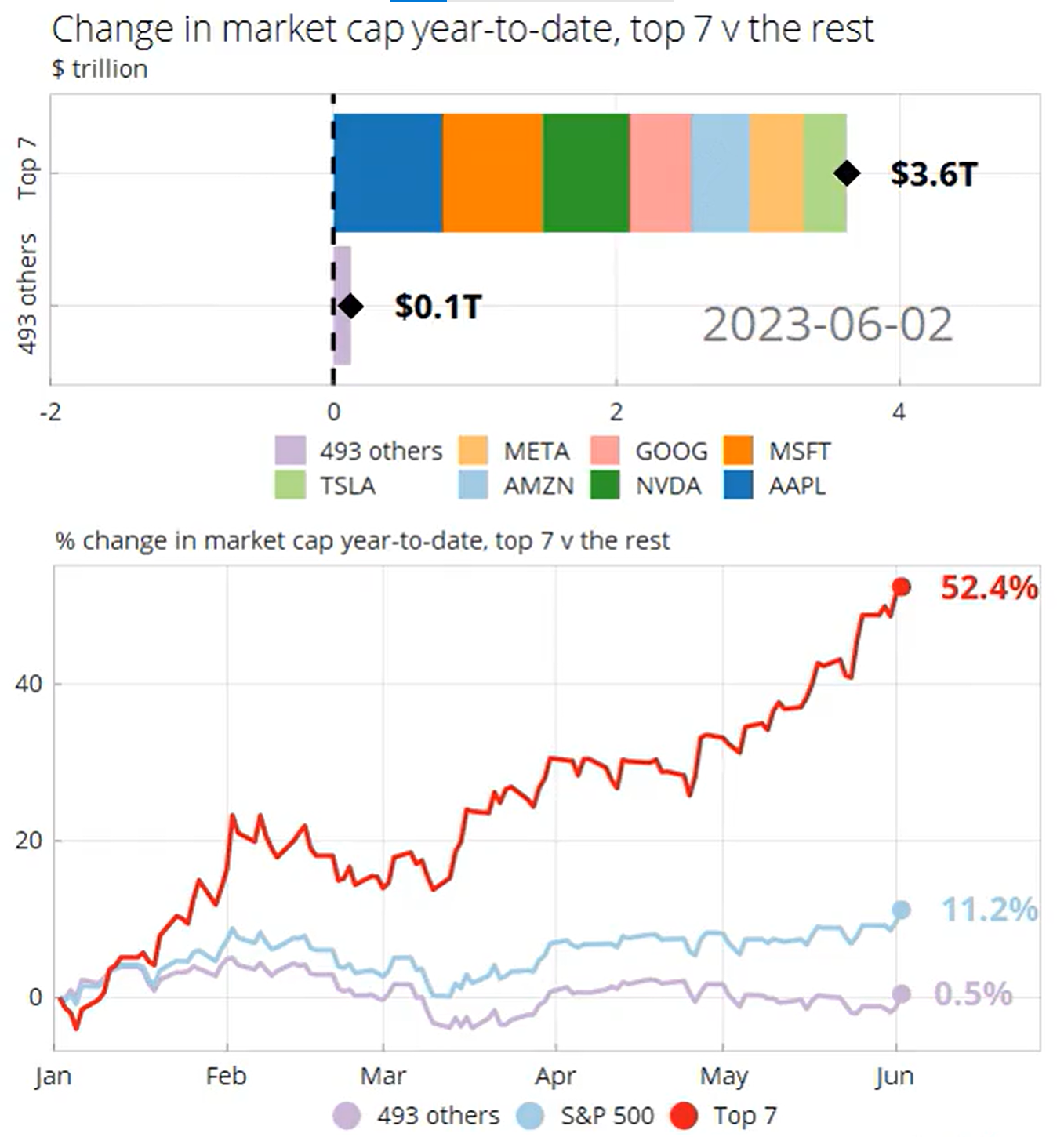

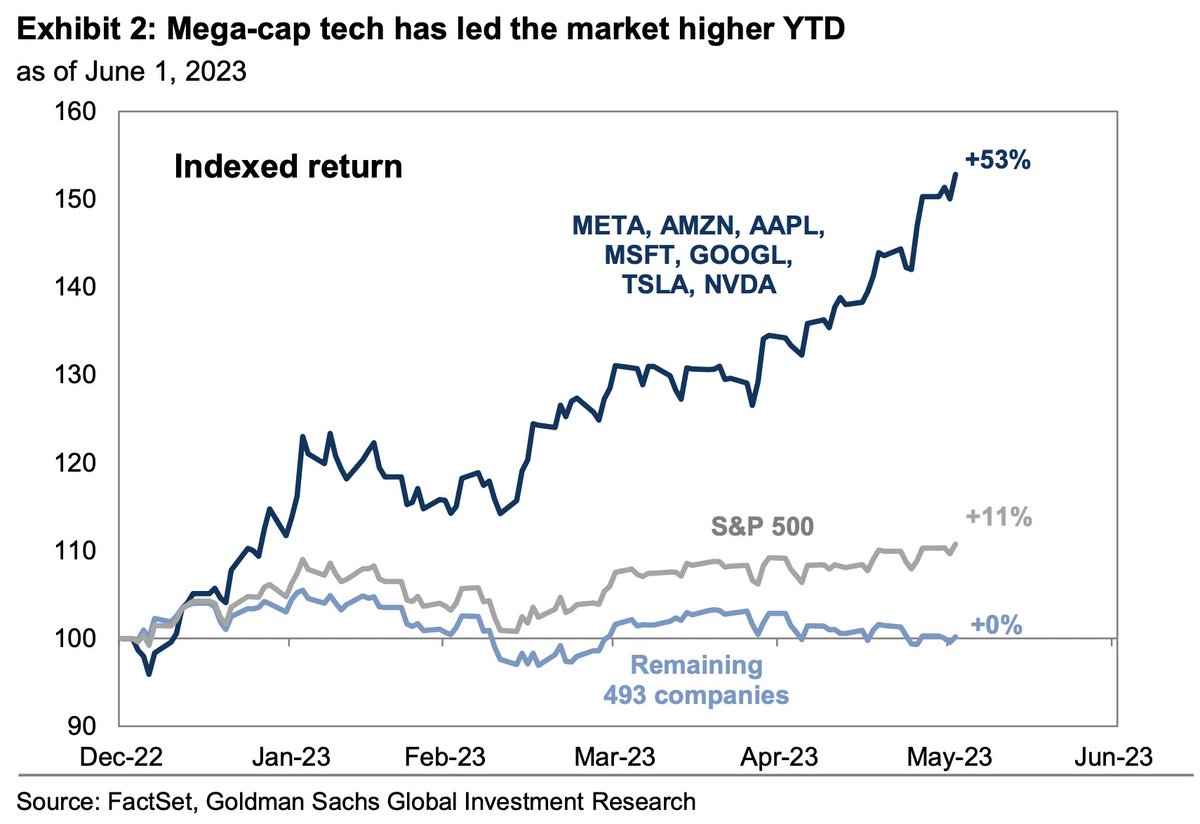

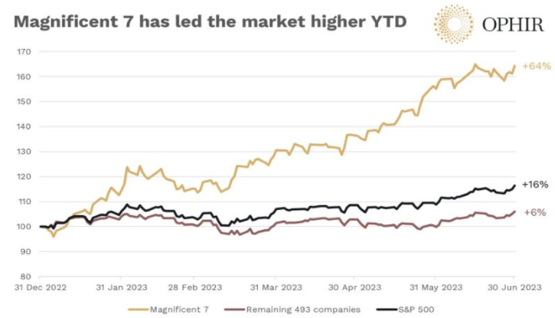

The rationale behind excluding these seven companies stems from concerns about market concentration. The Magnificent Seven have become such a significant portion of the S&P 500 that their individual performance can disproportionately influence the overall index return.

Some investors worry that this concentration creates a vulnerability. If any of these companies face significant headwinds, the entire S&P 500 could be negatively impacted to a greater extent than if the index were more evenly distributed.

Furthermore, proponents of the ex-Magnificent Seven approach argue that it can lead to a more accurate representation of the overall health of the U.S. economy, as it reduces the skew caused by the exceptional performance of a few dominant tech companies.

Potential Benefits of the ETF

One of the primary benefits touted is greater diversification. By excluding the Magnificent Seven, the ETF provides exposure to a wider range of sectors and companies within the S&P 500.

This can potentially reduce volatility and lower the risk associated with being heavily invested in a small number of high-growth companies. It may also appeal to investors who believe that the Magnificent Seven are overvalued or have limited future growth potential compared to other companies in the index.

The ETF might also offer an opportunity to invest in companies that have been overshadowed by the dominance of the Magnificent Seven. This could potentially lead to higher returns if these "underdog" companies outperform expectations.

Potential Risks and Considerations

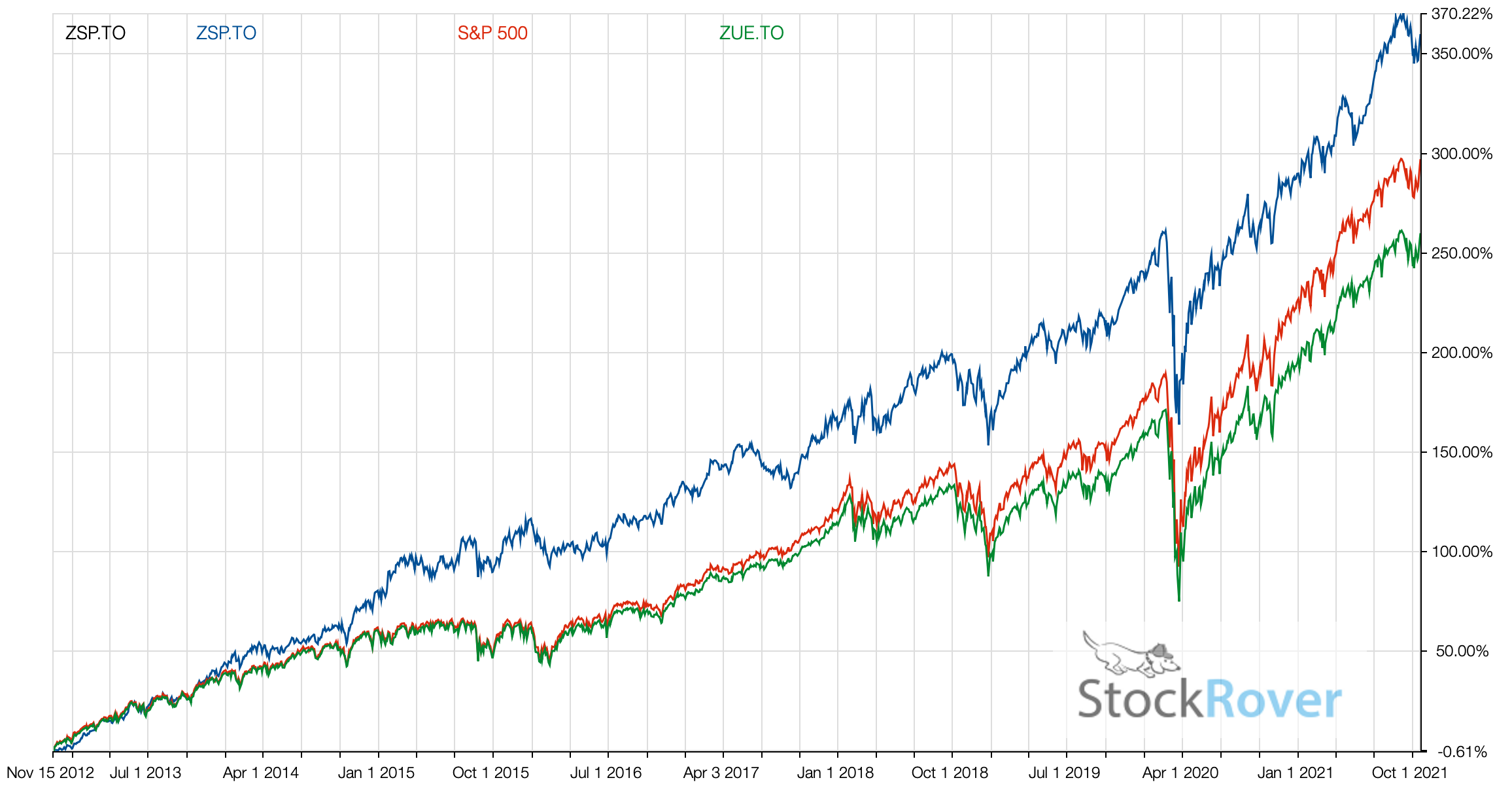

It's important to acknowledge the potential risks. The Magnificent Seven have consistently outperformed the broader market in recent years, and excluding them could lead to underperformance if this trend continues.

Investors should carefully consider their investment goals and risk tolerance before investing in an ex-Magnificent Seven ETF. It is vital to understand that excluding these companies can significantly alter the ETF's performance characteristics.

Expense ratios, tracking error, and liquidity are also crucial factors to evaluate before investing.

Impact on Investors and the Market

The introduction of an S&P 500 Ex Magnificent 7 ETF signals a growing awareness of market concentration and a desire for more diversified investment options. It caters to investors who are concerned about the dominance of a few companies and seek a broader representation of the U.S. economy.

The long-term impact on the market remains to be seen. However, the ETF's emergence is a testament to the evolving needs of investors and the ongoing debate about the optimal way to access the S&P 500.

The success of the ETF will likely depend on various factors, including the future performance of the Magnificent Seven relative to the rest of the market, investor sentiment, and overall economic conditions.