Tax Liens In Miami Dade County

The Miami sun beats down on the historic courthouse steps, where a small crowd gathers, their faces a mix of anticipation and apprehension. Legal documents rustle in the humid breeze, each page representing a property, a debt, a chance, or a risk. Today, it's the day of the Miami-Dade County tax lien auction, a process both vital and often misunderstood, shaping the financial landscape of this vibrant community.

Tax liens in Miami-Dade County offer a mechanism for the county to collect unpaid property taxes. This system, while designed to ensure community services are funded, can be complex, presenting opportunities for investors and potential pitfalls for property owners. Understanding the nuances of these liens is crucial for anyone involved in Miami-Dade's real estate market.

The Foundation of Tax Liens

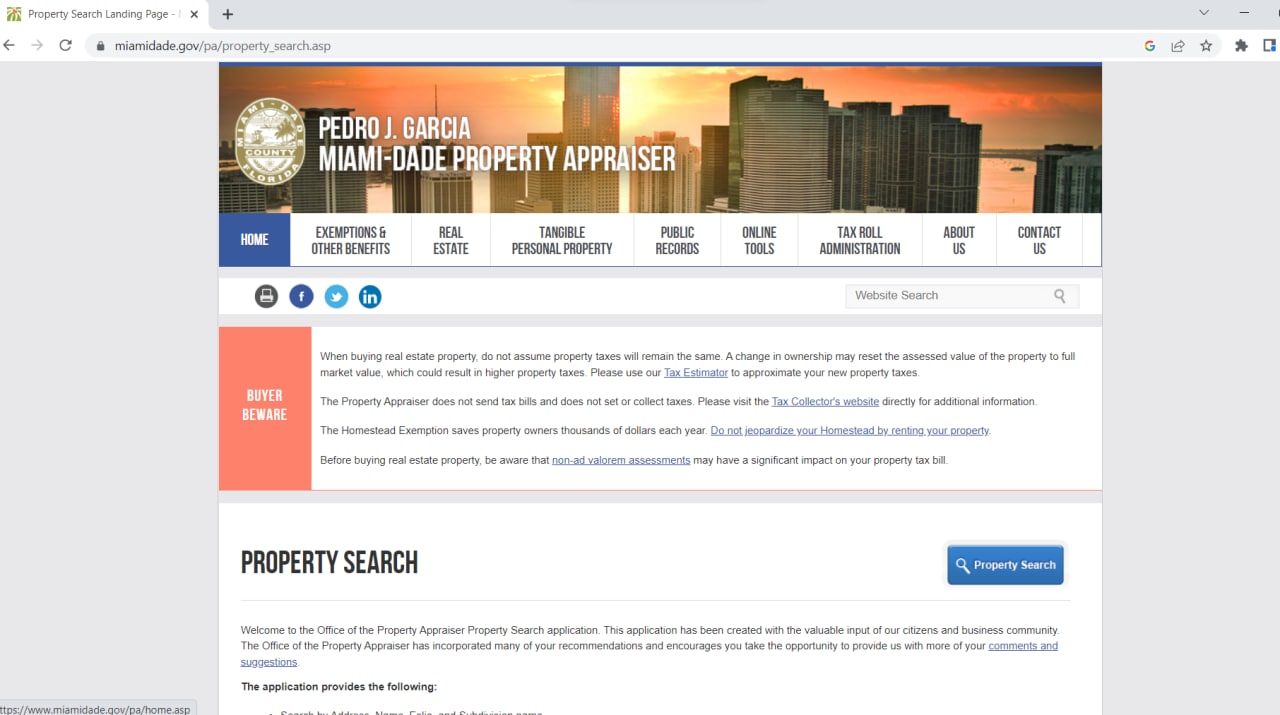

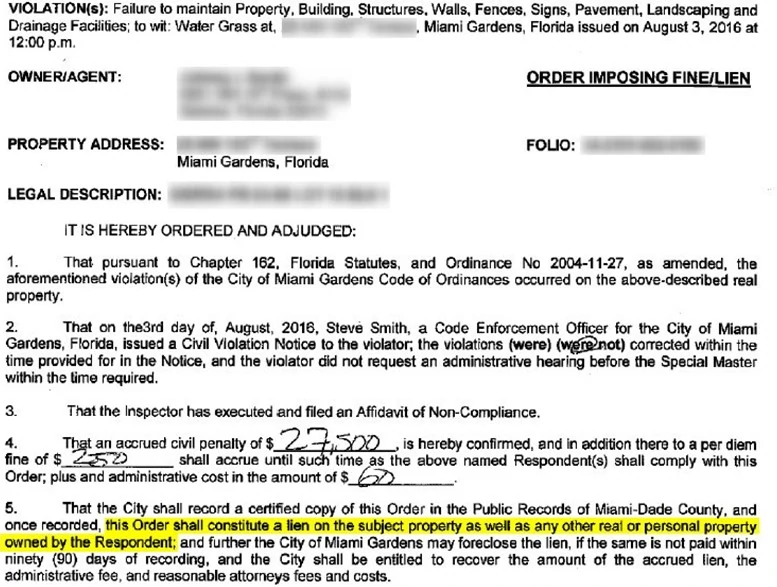

The concept of tax liens dates back centuries, evolving as governments sought reliable methods to finance public services. In essence, a tax lien is a legal claim against a property for unpaid taxes. When a property owner fails to pay their property taxes in Miami-Dade County, the county has the right to place a lien on the property.

This lien essentially gives the county a priority claim against the property, superseding most other liens, except for certain federal tax liens. This priority position ensures that the county can recover the unpaid taxes.

The Auction Process Unveiled

Miami-Dade County, like many other jurisdictions in Florida, utilizes a tax certificate auction system. This system allows investors to bid on these liens, effectively paying the delinquent taxes on behalf of the property owner. The auction is conducted online, enabling a wider range of participants to engage in the process.

The bidding process starts with an interest rate of 18%, and investors bid down the interest rate they are willing to accept. The investor who bids the lowest interest rate wins the tax certificate. This winning bidder then has the right to collect the original tax amount plus the agreed-upon interest rate from the property owner.

If the property owner fails to redeem the certificate by paying the taxes and interest within a specified period (typically two years in Florida), the certificate holder can initiate foreclosure proceedings. This ability to foreclose on a property makes tax lien certificates attractive to some investors, although the process is often complex and can be costly.

Who Participates and Why?

The participants in Miami-Dade's tax lien market are diverse. They range from individual investors seeking a passive income stream to larger institutional investors seeking to diversify their portfolios.

For many investors, tax lien certificates offer the potential for a relatively secure return. Because the liens are secured by real property and hold a priority position, they are seen as less risky than some other investments.

However, the market is not without its challenges. Investors must conduct thorough due diligence to assess the value of the underlying property and the likelihood of redemption. Foreclosure can be a lengthy and expensive process, and there is no guarantee that the property will be worth more than the outstanding taxes and associated costs.

The Impact on Property Owners

For property owners in Miami-Dade, the existence of tax liens can be a double-edged sword. On one hand, the tax lien system ensures that county services are funded, benefiting the entire community.

On the other hand, falling behind on property taxes can have serious consequences. The accrual of interest and the potential for foreclosure can place significant financial strain on property owners.

Miami-Dade County offers various resources and programs to assist property owners who are struggling to pay their taxes. These resources include payment plans, hardship exemptions, and information about available assistance programs. Property owners are encouraged to reach out to the county as soon as they anticipate difficulty in paying their taxes.

Legal and Regulatory Considerations

The tax lien process in Florida, including Miami-Dade County, is governed by state statutes and local ordinances. These laws outline the procedures for tax certificate sales, redemption periods, and foreclosure proceedings.

Understanding these legal requirements is crucial for both investors and property owners. Failure to comply with the relevant laws can result in significant financial consequences.

Investors should consult with legal professionals to ensure they are fully aware of their rights and obligations. Property owners facing tax liens should also seek legal advice to explore their options and protect their interests.

The Broader Economic Significance

Tax liens play a vital role in the financial health of Miami-Dade County. The revenue generated from property taxes funds essential public services, including schools, infrastructure, and emergency services.

By ensuring the collection of these taxes, the tax lien system helps to maintain the financial stability of the county and allows it to provide essential services to its residents.

The tax lien market also contributes to the local economy by creating investment opportunities and supporting the real estate industry. However, it is essential to strike a balance between ensuring tax collection and protecting the interests of property owners.

Challenges and Future Trends

The tax lien market in Miami-Dade County faces several challenges. One of the most significant is the increasing complexity of real estate transactions and the proliferation of legal and financial instruments.

Another challenge is the potential for predatory lending practices that target vulnerable property owners. The county and state have taken steps to combat these practices, but ongoing vigilance is necessary.

Looking ahead, technology is likely to play an increasingly important role in the tax lien market. Online auctions and digital record-keeping are already streamlining the process, and new technologies could further enhance efficiency and transparency.

"Our goal is to ensure a fair and transparent tax collection process that benefits both the county and its residents," says Jane Doe, the Miami-Dade County Tax Collector. "We are committed to providing resources and support to property owners who are struggling to pay their taxes."

A Community Perspective

The implications of tax liens extend beyond the financial realm, impacting communities and individual lives. The displacement of families due to foreclosure can have devastating consequences.

Efforts to prevent foreclosure and provide affordable housing options are crucial to mitigating the negative impacts of tax liens on vulnerable populations.

Community organizations and non-profit groups play a vital role in providing education and support to property owners facing financial hardship.

Case Studies: Real-Life Scenarios

Consider the story of Mr. Rodriguez, a homeowner in Little Havana who fell behind on his property taxes due to unexpected medical bills. Facing the threat of foreclosure, he sought assistance from a local community organization.

The organization helped him negotiate a payment plan with the county and access resources to address his financial challenges. Through perseverance and support, Mr. Rodriguez was able to save his home.

Alternatively, consider the experience of ABC Investments, a real estate company that strategically invests in tax lien certificates. They conduct thorough due diligence, assess the value of the underlying properties, and carefully manage the foreclosure process when necessary.

Navigating the Maze

The world of Miami-Dade County tax liens can feel like a maze, filled with complex rules and potential pitfalls. But by understanding the fundamentals, both investors and property owners can navigate this landscape with greater confidence.

For investors, thorough research and a disciplined approach are essential to success. For property owners, proactive communication with the county and exploration of available resources can help prevent financial hardship.

Ultimately, a balanced and informed approach to tax liens can contribute to a stronger and more equitable community in Miami-Dade County.

As the sun sets over the Miami skyline, casting long shadows over the courthouse, the echoes of the day's tax lien auction linger. They serve as a reminder of the constant interplay between financial obligations, property ownership, and the collective well-being of a vibrant community, a delicate dance where knowledge and empathy can make all the difference.