What Happens If I Quit Paying My Credit Cards

Imagine the weight of unopened envelopes sitting on your kitchen counter, each one a stark reminder of mounting credit card debt. The phone rings, an unknown number flashes across the screen, and your heart skips a beat. This scenario, unfortunately, is a reality for many Americans struggling with their finances.

Understanding the consequences of not paying your credit card bills is crucial for navigating financial hardships and making informed decisions. This article explores the ramifications of defaulting on credit card payments, offering insights into the potential damage to your credit score, the increasing debt burden, and the possible legal actions that may follow.

The Slippery Slope: Initial Missed Payments

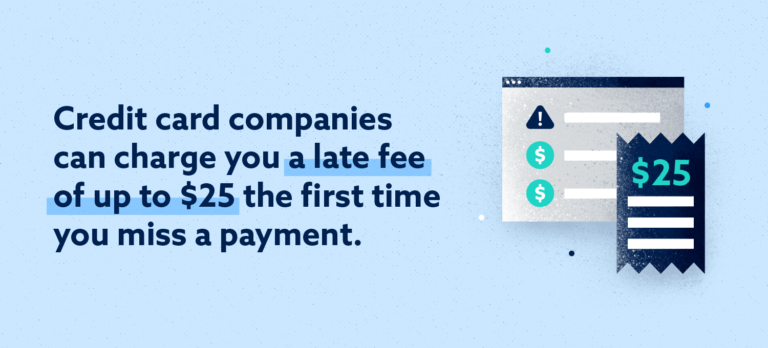

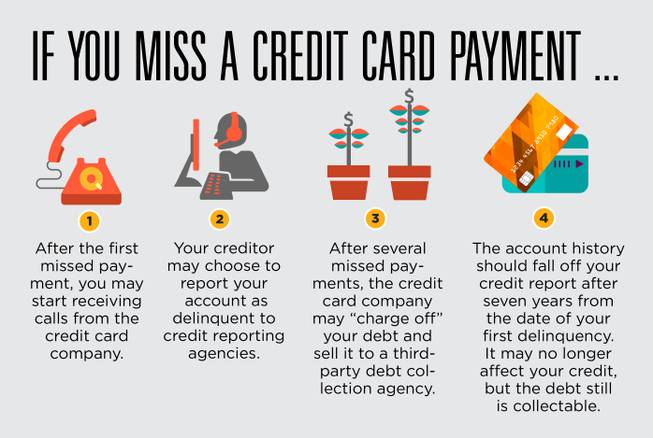

The journey from responsible credit card user to defaulter often begins with a single missed payment. Initially, you’ll likely face a late payment fee, which can range from $25 to $39 depending on your credit card agreement and the amount you owe. While seemingly small, these fees can quickly add up, compounding the problem.

Beyond the fees, your credit card company will likely report the missed payment to the major credit bureaus – Experian, Equifax, and TransUnion. This is a significant event that can negatively impact your credit score.

According to Experian, payment history is the most important factor in determining your credit score. A single missed payment can cause your score to drop, and the longer you delay, the more severe the impact.

The Escalating Consequences: Delinquency and Default

After 30 days of non-payment, your account becomes officially delinquent. Your credit card company will likely increase your interest rate to a penalty APR, which can be significantly higher than your regular rate.

This means you'll be charged more interest on your outstanding balance, further increasing your debt. The calls and letters from your credit card company will become more frequent and insistent.

At 90 days past due, the situation escalates further. Your credit card company may close your account, effectively terminating your credit line. This closure can further damage your credit score.

After 180 days of non-payment, your account is typically charged off. This doesn't mean you're off the hook. It simply means the credit card company has written off the debt as a loss for accounting purposes. You still owe the money.

Collection Agencies and Legal Action

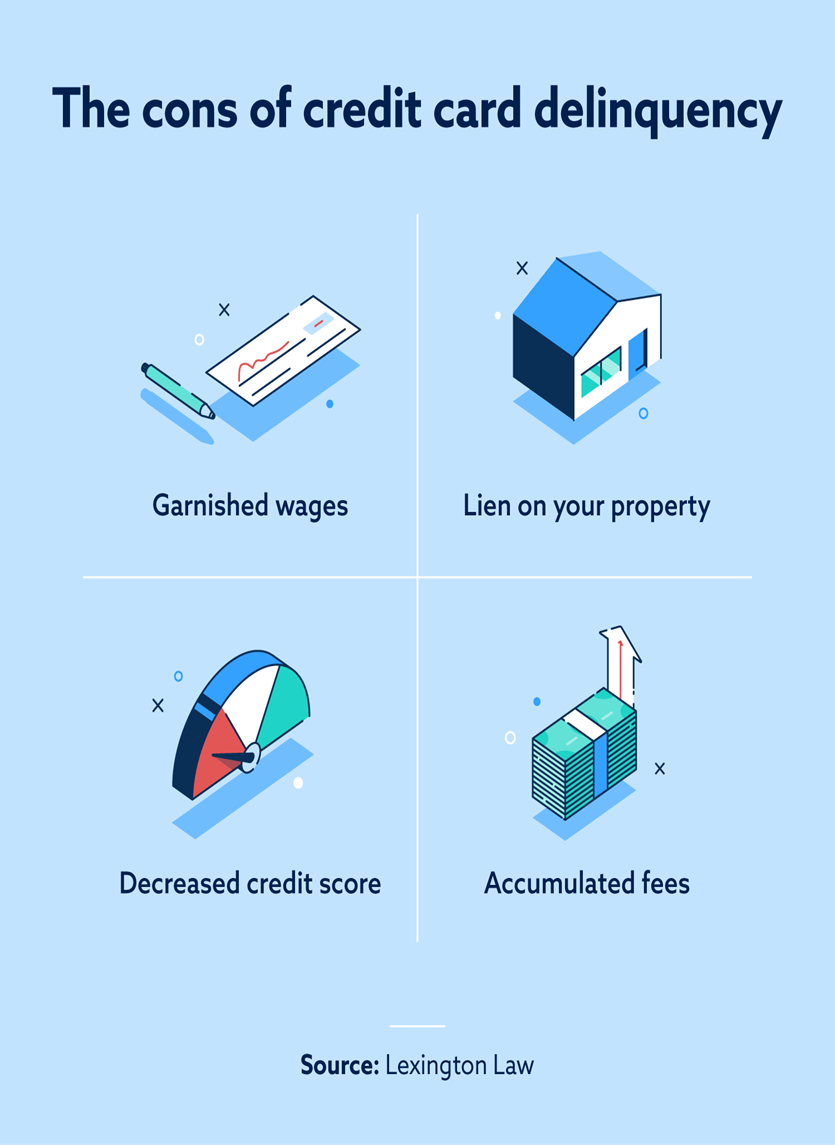

Once your account is charged off, the credit card company may sell your debt to a collection agency. These agencies are known for their aggressive tactics in pursuing payment.

They may call you frequently, send threatening letters, and even attempt to garnish your wages. In some cases, the credit card company or collection agency may file a lawsuit against you to recover the debt.

If they win the lawsuit, they can obtain a court order to garnish your wages or seize your assets. According to the Consumer Financial Protection Bureau (CFPB), it's crucial to understand your rights when dealing with debt collectors. You have the right to request validation of the debt and dispute its accuracy.

Long-Term Implications: Credit Score Damage and Financial Hardship

The impact of defaulting on credit card payments can last for years. A negative entry on your credit report, such as a charge-off or collection account, can remain for up to seven years.

This can make it difficult to obtain new credit, rent an apartment, or even get a job, as many employers check credit reports as part of their hiring process. The higher interest rates you'll face due to a damaged credit score will also make it more expensive to borrow money in the future.

Furthermore, the stress and anxiety associated with debt can take a toll on your mental and physical health. Financial hardship can strain relationships and lead to feelings of isolation and hopelessness.

Seeking Help and Finding Solutions

If you're struggling to keep up with your credit card payments, it's important to seek help as soon as possible. There are several resources available to assist you, including credit counseling agencies, debt management programs, and bankruptcy attorneys.

A credit counselor can help you create a budget, negotiate with your creditors, and develop a debt repayment plan. Debt management programs can consolidate your debts and lower your interest rates. Bankruptcy should be considered a last resort, but it can provide a fresh start for those who are overwhelmed by debt.

Remember, you are not alone. Millions of people face financial challenges every year. Seeking help and taking proactive steps to address your debt can help you regain control of your finances and build a brighter future.

The weight of those unopened envelopes can feel crushing, but understanding the consequences and actively seeking solutions is the first step towards lightening the load. Take a deep breath, reach out, and begin your journey towards financial recovery. Your future self will thank you.