What Percentage Should You Pay Yourself From Your Business

Small business owners face a critical decision: How much to pay themselves? The answer significantly impacts both personal finances and the business's health.

Determining a fair salary as a business owner is crucial for financial stability and business growth. Neglecting this aspect can lead to personal financial strain or underinvestment in the company. This article dissects key factors and industry recommendations for owner compensation.

Understanding the Basics

There's no one-size-fits-all percentage. Several factors influence the appropriate owner's draw, including profitability, industry standards, and personal needs.

Profitability is paramount. The business must generate sufficient revenue to cover operating expenses, reinvestment, and owner compensation.

According to a 2023 survey by the National Federation of Independent Business (NFIB), profitability remains a top concern for small business owners, impacting their ability to increase wages, including their own.

Industry Benchmarks

Researching industry benchmarks offers valuable insight. Resources like Salary.com and industry-specific associations provide salary ranges for comparable roles.

For example, a restaurant owner might consult the National Restaurant Association for data on average salaries for restaurant managers in their region.

Benchmarking against peers helps determine a competitive and sustainable salary.

The "Pay Yourself First" Mentality - With Caveats

While the "pay yourself first" principle encourages financial discipline, it needs context. It doesn't mean taking a large salary at the expense of the business.

It means prioritizing a reasonable and consistent draw. A 2024 report by Guideline highlights that consistently taking a draw, even a smaller one, can improve personal financial planning.

It also establishes a precedent for proper financial management.

Calculating Your Fair Share

A common approach involves calculating a replacement salary. What would you earn if you held a similar position at another company?

This provides a baseline. Adjustments can be made based on the business's financial performance and personal circumstances.

Consider using a combination of salary surveys and expert consultation to establish a realistic figure.

Prioritizing Business Needs

Business needs should always come first. Reinvestment in marketing, equipment, and employee training is crucial for long-term growth.

Cash flow management is also vital. Ensure sufficient cash reserves to cover unexpected expenses or economic downturns.

Sacrificing business needs for personal gain can ultimately jeopardize the entire enterprise. The Small Business Administration (SBA) emphasizes prudent financial planning for sustained success.

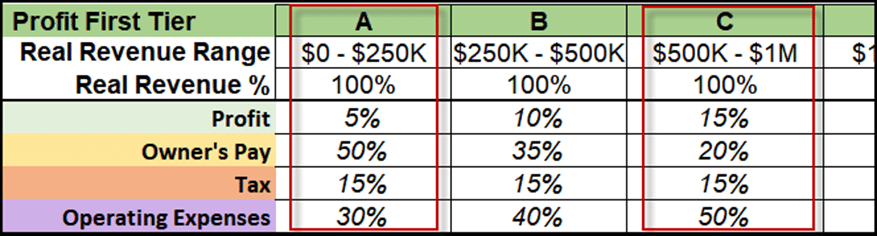

The Percentage Myth

Focusing solely on a percentage can be misleading. A percentage of a small profit is vastly different from a percentage of a substantial one.

Instead, prioritize a fixed salary or draw amount. This provides predictability for both personal and business finances.

Consider supplementing with bonuses during periods of high profitability, but base these on clearly defined metrics.

Tax Implications

Owner compensation impacts taxes. Different business structures (sole proprietorship, LLC, S-corp) have varying tax implications.

Consult with a tax professional to understand the optimal structure and salary strategy. Strategies may involve a combination of salary and owner distributions.

Proper tax planning can minimize tax liabilities and maximize after-tax income. The IRS provides resources for small business owners on tax compliance.

Next Steps

Begin by assessing your business's financial health. Analyze revenue, expenses, and profit margins.

Research industry benchmarks for comparable roles. Consult with a financial advisor or accountant to develop a personalized compensation strategy.

Regularly review and adjust your salary as your business evolves to ensure both personal and business needs are met.

+Paying+Yourself.png)